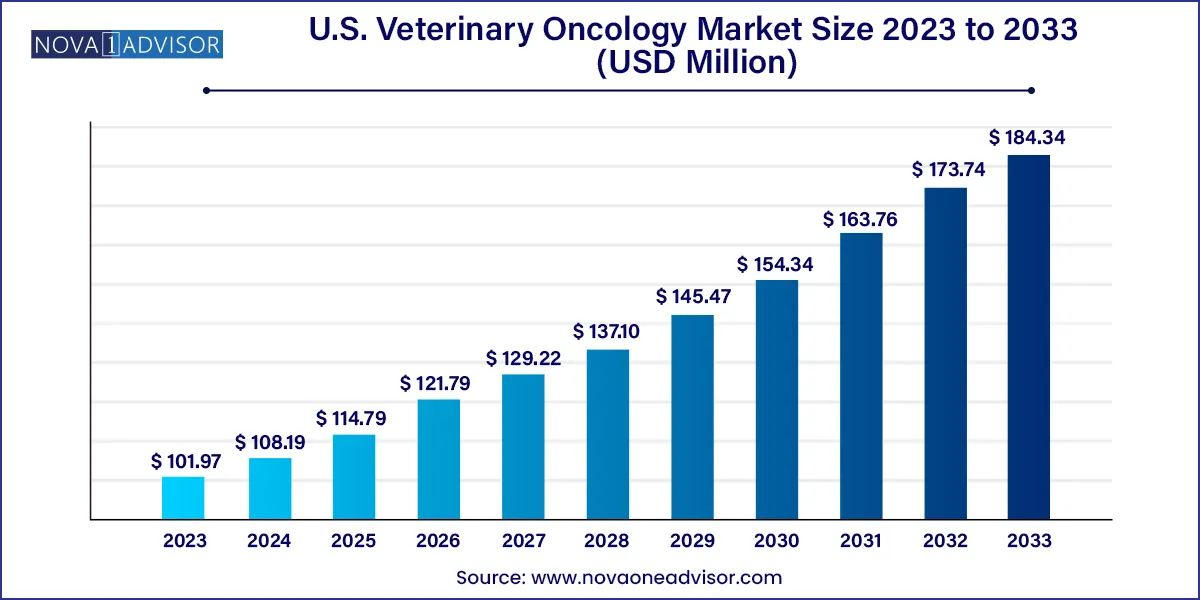

The U.S. veterinary oncology market size was exhibited at USD 101.97 million in 2023 and is projected to hit around USD 184.34 million by 2033, growing at a CAGR of 6.1% during the forecast period 2024 to 2033.

The U.S. veterinary oncology market is undergoing a pivotal transformation driven by increased awareness of pet health, advancements in veterinary medicine, and the growing emotional connection between owners and their companion animals. As cancer continues to be a leading cause of death in dogs and cats, demand for sophisticated oncology treatments has grown exponentially. Pet owners are increasingly willing to pursue complex diagnostics and therapies for their animals, reflecting broader societal trends toward humanization of pets and the prioritization of animal well-being.

Veterinary oncology encompasses multiple treatment approaches including surgery, radiology, chemotherapy, and immunotherapy, which are increasingly being customized based on tumor type and animal species. Advances in diagnostics such as cytology, biopsy techniques, imaging, and genomics are enabling early detection and tailored therapy, improving both survival rates and quality of life. Private veterinary hospitals, academic centers, and specialty practices have begun to adopt oncological standards akin to human healthcare, further elevating the level of care provided.

While historically limited by availability and cost, veterinary oncology services have become more accessible through insurance coverage, financing plans, and the proliferation of veterinary oncologists across the U.S. The rise of corporate veterinary chains and collaborations between human and animal pharmaceutical companies are also contributing to a more dynamic and rapidly expanding oncology ecosystem for animals.

| Report Coverage | Details |

| Market Size in 2024 | USD 108.19 Million |

| Market Size by 2033 | USD 184.34 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.1% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Therapy, animal type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Boehringer Ingelheim International GmbH; Elanco; Zoetis; PetCure Oncology; Accuray Incorporated; Varian Medical System, Inc; Morphogenesis, Inc.; Karyopharm Therapeutics, Inc.; Regeneus Ltd.; One Health |

A key driver in the U.S. veterinary oncology market is the rising rate of pet ownership coupled with a willingness to invest in their health. According to the American Pet Products Association, over 66% of U.S. households now own pets, with a significant share considering their animals as family members. This cultural shift has translated into higher veterinary spending, especially for chronic and terminal illnesses like cancer.

Veterinary oncology, once considered niche or experimental, is now a central focus for many pet owners. The market has responded with state-of-the-art treatment centers, clinical trials for animal drugs, and broader pharmaceutical investment in animal oncology. For instance, novel drugs for treating mast cell tumors in dogs have received fast-track FDA approvals under the Center for Veterinary Medicine, signaling regulatory support and growing innovation in the space.

Despite growth, the U.S. veterinary oncology market faces a significant restraint: the high cost of advanced oncology treatments, which are not always feasible for all pet owners. Treatments such as stereotactic radiation therapy or monoclonal antibody infusions can cost thousands of dollars, with ongoing follow-ups further raising expenses. While insurance uptake is growing, it remains limited compared to the human market, leading many pet owners to make difficult decisions regarding treatment.

Additionally, specialized oncology services are predominantly concentrated in urban centers or associated with veterinary teaching hospitals. This geographic disparity limits access for pets in rural or underserved regions. The shortage of board-certified veterinary oncologists also exacerbates this challenge. As a result, despite demand, certain pet populations remain underserved, hindering full market potential.

A promising opportunity lies in the expansion of targeted therapies and immuno-oncology for veterinary applications. Inspired by success in human oncology, these therapies are being adapted for animals with encouraging results. Drugs targeting specific cancer pathways, tumor antigens, or immune checkpoints are showing efficacy in pets, particularly in conditions like canine lymphoma and feline mammary tumors.

For example, monoclonal antibody therapies have emerged as a valuable tool in targeting cancer cells while minimizing damage to healthy tissues. Pharmaceutical companies are also exploring vaccine-based immunotherapy, where cancer vaccines stimulate the animal’s immune system to recognize and combat tumor cells. The integration of genomics and companion diagnostics further enhances personalization, paving the way for a new era in veterinary cancer care.

Surgery dominated the U.S. veterinary oncology market as the most widely adopted treatment modality. Surgical removal of tumors remains the first-line intervention for many localized cancers, particularly in canine patients. With advancements in veterinary surgical techniques, such as laparoscopic tumor resections and robotic assistance, outcomes have improved significantly. Veterinary surgeons are also employing margin assessment and intraoperative imaging to maximize surgical efficacy. In cancers such as mast cell tumors or mammary carcinomas, timely surgical excision offers the best prognosis, contributing to surgery’s leading position in the therapy segment.

Radiology is expected to be the fastest-growing segment, particularly modalities like stereotactic radiation therapy (SRT) and CyberKnife. These techniques allow for precise targeting of tumors with minimal damage to surrounding tissues, making them suitable for complex or inoperable cancers. Gamma Knife and LINAC are gaining adoption in referral centers and academic hospitals, offering new hope for brain and spinal tumors. The adoption of radiology is also supported by technological innovations and growing awareness among pet owners about non-invasive cancer management options.

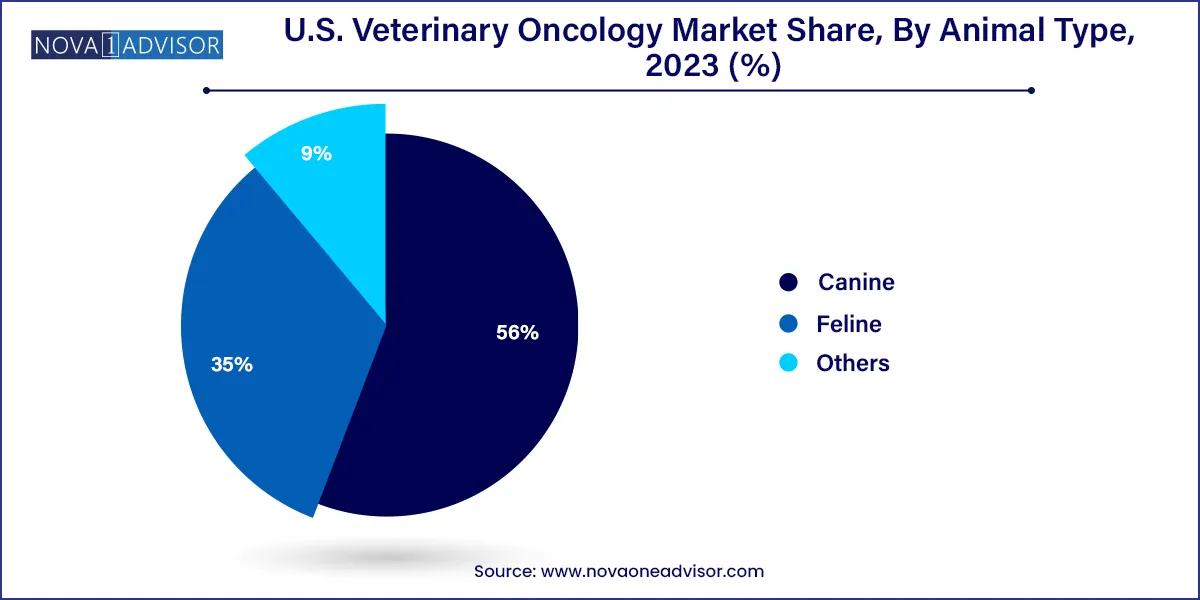

Canine segment dominates the U.S. veterinary oncology market, driven by high pet dog ownership and greater susceptibility to cancers such as lymphoma, mast cell tumors, and osteosarcomas. Dogs also benefit from better clinical protocols and pharmaceutical options tailored to their physiology. The availability of canine-specific chemotherapeutics and diagnostic biomarkers makes oncology care more accessible and effective. Clinics across the U.S. report that over 60% of their oncology caseload comprises canine patients, underscoring the segment’s dominance.

Feline oncology is emerging as the fastest-growing segment**, albeit from a smaller base. Cats are increasingly diagnosed with cancers like squamous cell carcinoma and mammary gland tumors, especially in older, unspayed females. Historically underdiagnosed due to subtle symptoms and challenges in examination, feline cancers are now being identified more accurately thanks to improved imaging and screening protocols. Additionally, educational campaigns by veterinary associations are raising awareness among cat owners, encouraging early detection and treatment.

In the U.S., the veterinary oncology landscape is marked by geographic and institutional diversity. Major metropolitan areas such as New York, Los Angeles, and Chicago host advanced veterinary oncology centers equipped with radiation therapy suites, imaging labs, and specialist teams. Academic institutions like the University of Pennsylvania, Colorado State University, and UC Davis are at the forefront of research, offering experimental treatments and training the next generation of veterinary oncologists.

However, suburban and rural areas face gaps in access, highlighting disparities in service availability. State veterinary boards and private foundations are increasingly funding mobile clinics and tele-oncology consultations to bridge this gap. Furthermore, the FDA’s Center for Veterinary Medicine continues to support innovation through fast-track approvals and conditional licenses for cancer therapies tailored to companion animals

Elanco Animal Health (February 2025): Initiated a clinical trial for a novel monoclonal antibody therapy targeting mast cell tumors in dogs, expected to conclude in Q4 2025.

Zoetis Inc. (January 2025): Launched a new oncology diagnostics panel for companion animals using next-gen sequencing.

Ethos Veterinary Health (December 2024): Opened a new state-of-the-art veterinary oncology center in Texas with integrated radiology and surgical units.

PetCure Oncology (November 2024): Expanded its network by partnering with five new veterinary clinics to offer stereotactic radiation therapy.

Morris Animal Foundation (October 2024): Announced a $2 million research grant for studies focused on feline cancer biology and treatment development.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. veterinary oncology market.

Therapy

Animal Type