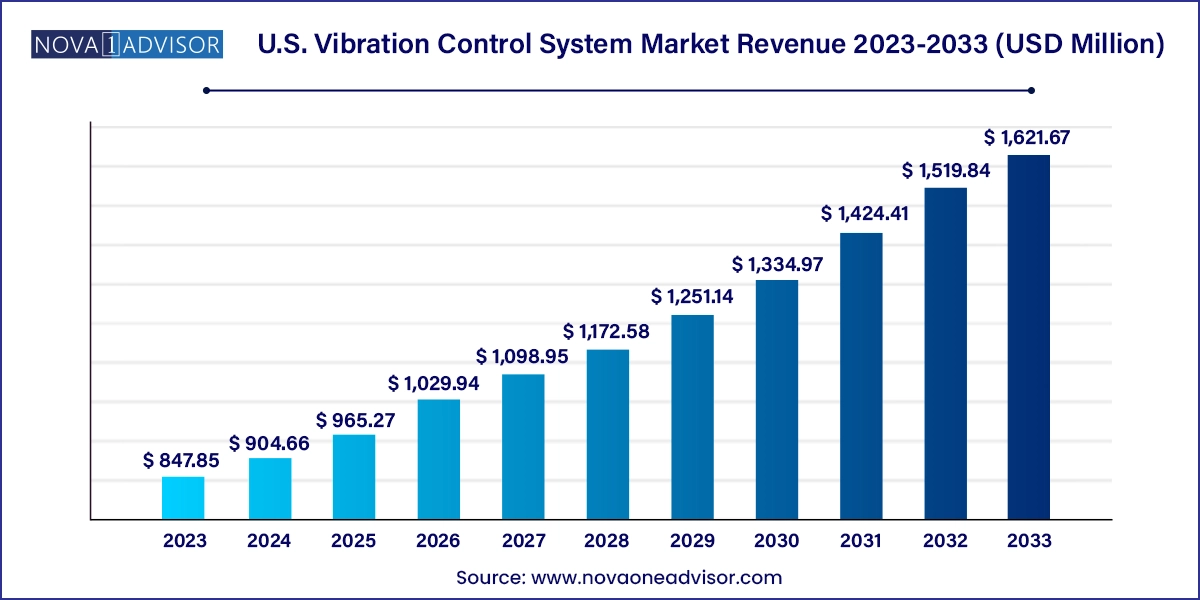

The U.S. vibration control system market size was exhibited at USD 847.85 million in 2023 and is projected to hit around USD 1,621.67 million by 2033, growing at a CAGR of 6.7% during the forecast period 2024 to 2033.

The U.S. vibration control system market serves as a critical enabler of performance, longevity, safety, and comfort across a wide array of industries—including automotive, aerospace, manufacturing, healthcare, and energy. These systems are engineered to mitigate unwanted oscillations, shocks, and noise that arise from dynamic mechanical processes, thereby enhancing the structural integrity and operational efficiency of both stationary and moving systems.

Vibration control systems play a pivotal role in extending machinery life, reducing noise pollution, improving worker safety, and preserving the quality of sensitive products and equipment. As the U.S. economy embraces Industry 4.0 and the electrification of mobility, the relevance of precision damping and isolation technologies has grown exponentially.

Advancements in sensor integration, smart materials, and adaptive control systems are reshaping traditional vibration management approaches. Companies are increasingly moving toward solutions that not only dampen vibration but also use real-time monitoring to optimize machine behavior dynamically. Given the complex operating environments in defense aircraft, offshore oil rigs, EVs, and medical imaging equipment, vibration control solutions are no longer considered optional but rather a strategic imperative.

From robust isolators under a military jet’s fuselage to anti-vibration mounts in an electric vehicle’s chassis, the U.S. vibration control system market continues to be shaped by technology, safety mandates, and sector-specific performance demands.

Integration of Smart Sensors and Predictive Maintenance Tools: Real-time vibration analysis and machine learning algorithms enable proactive maintenance and early fault detection.

Increased Use of Elastomeric and Composite Materials: Lightweight and highly durable polymers are replacing metals in mounts and isolators for weight-sensitive industries like aerospace.

Electrification of Mobility: EVs require customized vibration solutions due to different torque dynamics, battery insulation needs, and low NVH thresholds.

Customized Damping in Medical Equipment: Demand is rising for ultra-precise vibration isolation in MRI machines, robotic surgery systems, and lab diagnostics equipment.

Vibration Control in Data Centers and Semiconductor Facilities: Advanced anti-vibration solutions are used to protect sensitive computing and fabrication equipment from micro-vibrations.

Growth of Tuned Mass Dampers in Skyscrapers and Infrastructure: High-rise buildings and bridges in seismic or high-wind zones are incorporating vibration mitigation as a core structural component.

Automated Manufacturing Systems Driving Noise and Vibration Engineering (NVH): Robotics, CNC machines, and conveyors are being equipped with isolating pads and tuned mounts to meet OSHA standards.

| Report Coverage | Details |

| Market Size in 2024 | USD 904.66 Million |

| Market Size by 2033 | USD 1,621.67 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.7% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | System Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Fabreeka; Isolation Technology; Kinetics Noise Control, Inc; PARKER HANNIFIN CORP; Sentek Dynamics Inc.; VMC Group; LMCURBS; Mason Industries Inc; MicroMetl Corporation; Hutchinson |

A central driver of growth in the U.S. vibration control system market is the increasing electrification and automation of vehicles and industrial systems. Electric vehicles (EVs), unlike internal combustion engine (ICE) vehicles, produce fewer mechanical vibrations but amplify high-frequency disturbances due to the characteristics of electric motors and battery units. This has necessitated the development of new vibration damping materials and chassis-mounted systems designed specifically for EVs.

In the industrial realm, automated manufacturing systems use high-speed motors, precision actuators, and robotic arms that are sensitive to vibrations. Slight oscillations can affect production precision, reduce machine efficiency, and increase defect rates. Therefore, vibration control technologies—like dynamic mounts, isolating pads, and feedback-loop actuators—are becoming critical in reducing downtime and maintaining throughput in smart factories.

This industry-wide digital transformation continues to create demand for bespoke, embedded, and smart vibration control components in both mobility and industrial environments.

Despite the widespread applicability of vibration control systems, a significant restraint lies in the cost and complexity of system customization and installation. Unlike off-the-shelf components, most vibration control systems must be tailored to specific machinery, environmental conditions, and performance goals. This involves detailed vibration modeling, prototyping, and iterative testing, which prolongs the development cycle and increases project costs.

Additionally, installation of these systems—especially in constrained environments like aircraft, naval vessels, or semiconductor clean rooms—can be labor-intensive and disruptive to operations. In legacy infrastructure, retrofitting vibration control measures may require significant redesigns or adjustments to accommodate modern systems, further increasing the capital expenditure. This barrier is particularly pronounced for small and mid-sized enterprises (SMEs) with limited technical and financial resources.

An emerging opportunity in the U.S. vibration control market is the development and deployment of smart systems that utilize sensors and predictive analytics to monitor and respond to vibration in real time. These systems, integrated with cloud platforms or on-premise data processors, continuously collect vibration signatures and use AI/ML algorithms to predict potential failures.

Such predictive vibration control is particularly valuable in high-cost environments like aerospace, defense, semiconductor manufacturing, and power generation, where unplanned downtime can result in substantial financial loss or safety risks. Smart vibration systems can also be paired with active damping technologies to adjust isolation levels dynamically based on operating conditions.

OEMs that can offer end-to-end platforms—combining hardware with analytics dashboards—are likely to gain a competitive advantage. As industries adopt digital twins, automated maintenance, and connected equipment ecosystems, intelligent vibration control systems will become integral to operational efficiency and predictive maintenance strategies.

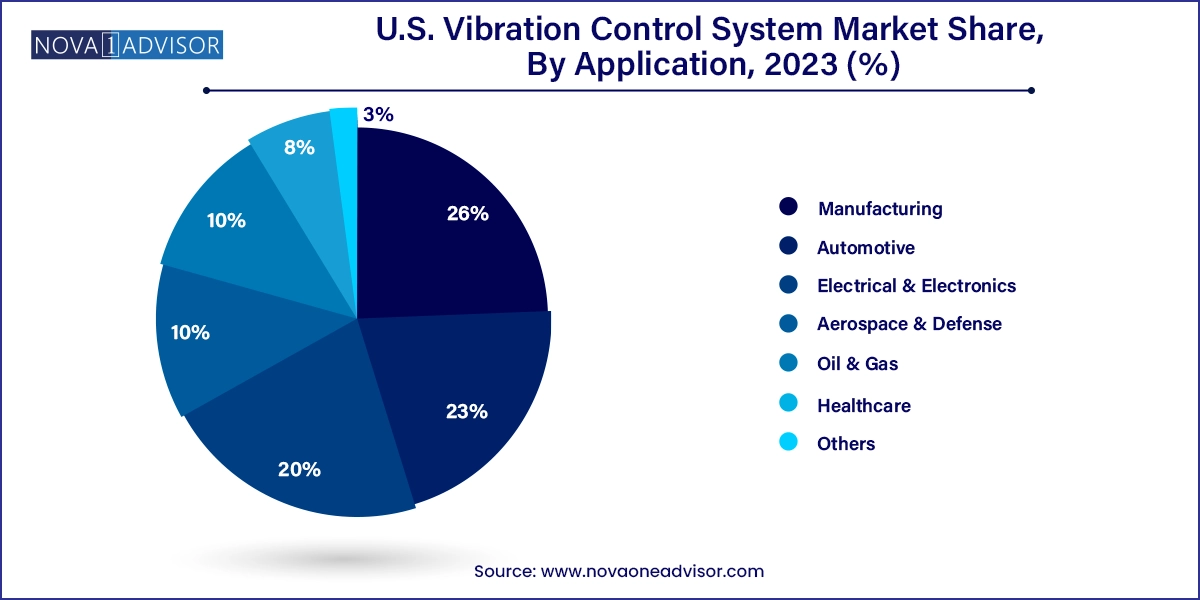

The automotive segment remains the largest user of vibration control systems in the U.S., due to the sheer volume of vehicles produced and the complexity of components requiring damping. From engine mounts to exhaust hangers, cabin dampers to suspension bushes, vibration management is central to both performance and comfort. With increasing regulatory pressure around noise, vibration, and harshness (NVH) standards, as well as customer expectations for ride quality, manufacturers are innovating with materials and component design. The electrification of drivetrains is further pushing demand for bespoke vibration solutions tailored to high-frequency electric motors and battery packaging.

The aerospace & defense segment is the fastest-growing, driven by expanding military aircraft programs, commercial aviation demand, and increased investment in space systems. Vibration control is essential in maintaining the structural integrity of aircraft, improving sensor performance, and ensuring operational safety. Advanced isolators are used in jet engines, cockpit assemblies, and radar mounts to eliminate distortion and fatigue failure. Spacecraft systems demand micro-vibration suppression for sensitive instruments. As drones and next-gen VTOL (vertical take-off and landing) aircraft enter the commercial and defense markets, demand for ultra-light, high-performance vibration solutions will continue to rise.

Vibration control systems dominate the U.S. market in terms of both volume and value. These systems are essential across heavy machinery, automotive assemblies, building structures, and even consumer electronics. Vibration control components—such as isolating pads, isolators, dampers, and composite mounts—help suppress both high-frequency and low-frequency vibrations. Their use is particularly critical in environments where stability is paramount, such as precision CNC operations, bridge construction, and skyscraper stabilization. For instance, isolators used in semiconductor fabs prevent sub-micron level vibrations from disrupting nanometer-scale processes.

Motion control systems are growing faster, especially as new applications emerge in robotics, medical devices, and electric mobility platforms. Springs, hangers, mounts, and bushes under this category not only manage motion but also dampen associated shocks. Advances in materials, such as thermoplastic elastomers and hybrid composites, have made motion control components more durable and adaptive. OEMs are developing multifunctional components that provide both motion guidance and damping in one unit, thus streamlining system design in dynamic applications like robotics and drone systems.

The U.S. vibration control system market is driven by the country’s strong industrial base, technological innovation, and sector-specific performance expectations. The automotive industry, centered in states like Michigan and Ohio, sets global benchmarks for NVH control, while aerospace hubs like Seattle, Huntsville, and Southern California push the envelope in precision damping for aviation and space exploration.

Federal regulations from OSHA and the Department of Transportation (DOT), combined with the U.S. Department of Defense's specifications for vibration control in vehicles, aircraft, and naval platforms, ensure consistent investment in advanced solutions. Meanwhile, data centers and semiconductor fabs in Arizona, Texas, and Oregon are deploying anti-vibration flooring and platform systems to maintain equipment reliability.

The U.S. also benefits from a strong innovation ecosystem with major OEMs, engineering firms, and universities collaborating on next-gen materials and predictive maintenance platforms. Tax incentives for R&D and infrastructure modernization programs are indirectly boosting demand for smart vibration control systems in civil engineering, manufacturing, and energy sectors.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. vibration control system market

System Type

Application