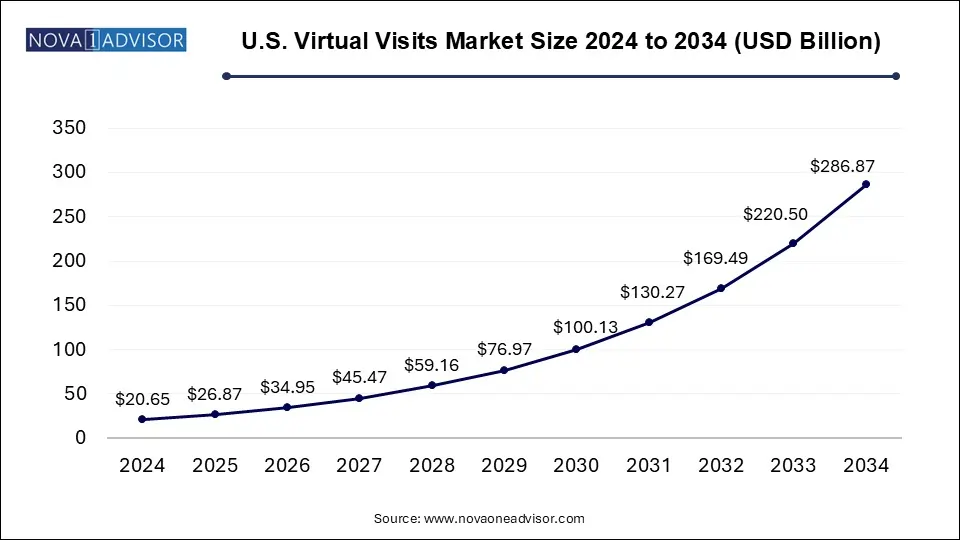

The U.S. virtual visits market size was exhibited at USD 20.65 billion in 2024 and is projected to hit around USD 286.87 billion by 2034, growing at a CAGR of 30.1% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 26.87 Billion |

| Market Size by 2034 | USD 286.87 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 30.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Service Type, Age Group, Gender, Commercial Plan Type |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | American Well; MDLIVE; Doctor On Demand by Included Health, Inc.; eVisit; Teladoc Health, Inc.; MeMD; HealthTap, Inc.; Vidyo, Inc.; PlushCare; Zipnosis |

The increase in penetration of smartphones has positively impacted the growth of the market in the U.S. In addition, the ever-increasing and changing technology and fast adoption rates by the population is also a key factor driving the growth of the market. The COVID-19 pandemic had a positive impact on the market. The pandemic brought about a change in the way patients took consultations, the new norm was teleconsultations to communicate with the healthcare practitioners, which was responsible for a substantial growth in the market.

According to a report published by the Centers for Disease Control and Prevention (CDC), there was a significant increase in telehealth encounters during week 13 of 2020, amounting to a 154% increase compared to the previous period in 2019. Oregon Health & Science University witnessed a substantial rise in the adoption of digital health services within one month in 2020. The number of visits escalated significantly from 1,100 visits in February to 13,000 visits in March. Furthermore, a recent study highlighted the growth in telehealth visits during April 2020, which reached a peak 78 times higher than the number recorded in February 2020. The number of initiatives by the government has fueled the growth of the virtual visits market and is expected to keep growing over the forecast period. The pandemic brought about a change in the way patients took consultations, and an increasing trend in teleconsultations to communicate with healthcare practitioners was witnessed, which was responsible for substantial growth in the virtual visits market.

The landscape of telehealth has been continuously changing with apps and devices bringing patients and caregivers closer virtually, with a significant shift in consumer behavior from patients and doctors in the wake of the pandemic. This not only created a huge market opportunity for technological advancements to develop around different apps and devices to monitor various health conditions but also for people to connect to doctors even in remote locations where there were no functional hospitals or care centers. The virtual visit market has become a way to provide remote and rural as well as urban areas with safe and convenient access to healthcare for conditions like migraines, birth control, diabetes, hypertension, and other health conditions.

Access to quality, affordable health care is a basic human right, regardless of a patient's location, economic status, or race. According to the American Medical Association, telehealth is expected to become an important tool to address long-term health disparities in historically marginalized racial and ethnic groups that have been disproportionately affected by the COVID-19 pandemic. The American Medical Association motivates physicians to examine their practices to ensure fairness in nursing. Based on the increased awareness of the social impact of health determinants, physicians are paying more attention and prioritizing health equity to address the socioeconomic needs of patients.

The past few years have witnessed a significant surge in the demand for individualized healthcare services. This trend is particularly apparent in underserved regions where hospitals and healthcare facilities are already scarce. In these areas, there has been a lack of specialized and personalized care, leaving many individuals without proper medical attention. However, the introduction of teleconsultation services has effectively addressed this issue. This innovative approach to remote healthcare consultations has not only resolved the problem but also gained increasing acceptance among certified healthcare professionals. Initially driven by the urgent circumstances of the pandemic, teleconsultations have now emerged as the preferred method for providing remote care consultations.

Patients in remote areas can connect to specialists and experts from the comfort of their homes to anywhere in the country, This has resulted in faster and widespread adoption of telehealth and teleconsultations, resulting in the growth of the market. An increase in smartphone penetration and adoption of 4G & 5G technologies and devices have enabled both patients and caregivers to connect easily.

The increasing number of government initiatives has also positively affected the growth of the virtual visits market in the U.S. For instance, in April 2020, The Federal Communications Commission (FCC) established a USD 200 million COVID-19 Telehealth program, which connected and enabled caregivers to provide appropriate consultations to patients in rural settings and remote areas, the latest funding for this purpose was announced on January 26, 2024. In addition, in June 2021, the FCC also launched a connected care pilot program, wherein it approved guidance for this program to begin a 3-year project. Many more initiatives have been undertaken to improve the telehealth landscape in the country in turn boosting the growth of the market.

In terms of age group, the 18 – 34 years segment dominated the market with the largest revenue share in 2024. An increase in the penetration of smartphones in this age group, increasingly high internet usage, and a steady increase in the number of mental health issues have resulted in a large market share. The increase in the number of people reporting mental health issues and the increased rate of anxiety and depression among people in this age group is expected to propel growth in this segment.

The 35 to 49 years age group segment is expected to grow at the fastest CAGR over the forecast period due to the increasing prevalence of chronic illnesses like diabetes, hypertension, and various cardiovascular diseases. According to a report by the Centers for Disease Control and Prevention, nearly 18.2 million adults aged 20 and above suffer from coronary artery disease; nearly half the adult population in the U.S. has hypertension, and 47% population or 116 million people have hypertension. The numerous advantages associated with virtual visits like lesser waiting time due to pre-scheduling, decreased chances of contracting additional infections from hospitals, and ease and comfort of the process are all expected to propel the virtual visits market in the forecast period.

In terms of gender, the female segment dominated the market with the largest revenue share of 64.5% in 2024. The pandemic highlighted the need to access healthcare facilities in a safe environment for pregnant women to avoid the risk of contracting the virus through hospital visits, which was the primary factor for the large revenue share for this segment. Virtual visits were the need of the hour and were increasingly adopted by women all over the country.

The male segment is expected to grow at the fastest CAGR of 31.7% over the forecast period owing to the ease of use of teleconsultations for various conditions like increasing mental health issues, sexual health concerns like erectile dysfunction and STDs, stress management, and various other health conditions without visiting the doctor in person. Virtual visits have come a long way and are not just restricted to video calling, connected apps, and devices that make patient monitoring easier. Consumers are increasingly leaning towards this form of consultation to avoid wastage of time and resources by going to hospitals unless necessary. These factors are expected to boost the growth of the segment over the forecast period.

In terms of service type, the urgent care segment dominated the market with the largest revenue share of 30.0% in 2024. The increase in demand for virtual visits within the urgent care segment can be attributed to the convenience and accessibility that virtual visits offer to patients. By seamlessly integrating technology into the urgent care industry, individuals have the opportunity to seek medical advice and treatment remotely, thereby eliminating the need for physical visits to healthcare facilities.

The allergies segment is expected to grow at the fastest CAGR of 35.5% over the forecast period. Allergies, which can cause mild discomfort to severe reactions, are a prevalent health condition that affects a large percentage of the U.S. population. Individuals can seek medical advice and treatment for allergy-related illnesses through virtual visits, which eliminates the need for in-person visits to healthcare institutions. Virtual visits enable individuals to communicate with licensed healthcare providers via a variety of online portals, smartphone apps, and telecommunication channels. Individuals seeking allergy-related care have found this ease of access to virtual appointments to be extremely beneficial.

The cold and flu management segment held a considerable market share of 29.8% in 2024. This can be attributed to the fact that patients are increasingly preferring virtual visits to consult physicians regarding cold and flu symptoms. The majority of the patients in this category resorted to teleconsultations to avoid the spread of infection and contracting additional symptoms through physical visits to hospitals. An increase in the prevalence of influenza during the pandemic has also resulted in the growth of the segment. In 2020, there was a huge spike in the number of influenza cases that led to the growth of this segment.

Behavioral health is expected to grow at a significant rate during the forecast period. The onset of the pandemic made teleconsultations and virtual visits a norm, even in the behavioral health segment. The increasing demand for virtual visits for several conditions like depression, anxiety, LGBTQ counseling, and a wide array of mental health issues has resulted in the growth of this segment. The pandemic saw a massive increase in the number of patients suffering from depression and anxiety, also contributing to the growth of the behavioral health segment.

In terms of commercial plan type, the self-funded/ASO group plans segment dominated the market with the largest revenue share in 2024 owing to an increase in the prevalence of chronic diseases, skyrocketing healthcare costs, and an increase in demand for affordable healthcare solutions.

The small group commercial plan segment is anticipated to grow at the fastest CAGR over the forecast period. Demand for virtual care has been steadily increasing and more so due to the COVID-19 pandemic, Several initiatives undertaken by both public and private entities to decrease the burden of healthcare costs on small businesses and their employees, which in turn is expected to boost the growth of small group commercial plan segment.

Despite the various advantages of telehealth and virtual consultations, Medicare and Medicaid programs do not comprehensively cover all expenses related to these services. This coverage gap places a financial burden on patients and caregivers. However, the implementation of specific healthcare plans tailored to address this issue has led to improved access to healthcare services and enhanced patient adherence. As a result, the utilization of such plans has contributed to the expansion of this segment, providing greater opportunities for individuals to receive necessary medical care through telehealth and virtual consultations.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. virtual visits market

By Service Type

By Age Group

By Gender

By Commercial Plan Type

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Service type

1.1.2. Age group

1.1.3. Gender

1.1.4. Commercial plan type

1.1.5. Regional scope

1.1.6. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Service type outlook

2.2.2. Age group outlook

2.2.3. Gender outlook

2.2.4. Commercial plan type outlook

2.2.5. Regional outlook

2.3. Competitive Insights

Chapter 3. U.S. Virtual Visits Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Market Dynamics

3.3.1. Market driver analysis

3.3.2. Market restraint analysis

3.4. U.S. Virtual Visits Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. U.S. Virtual Visits: Service Type Estimates & Trend Analysis

4.1. U.S. Virtual Visits Market: Key Takeaways

4.2. U.S. Virtual Visits Market: Movement & Market Share Analysis, 2022 & 2030

4.3. Cold and Flu Management

4.3.1. Cold and flu management market estimates and forecasts, 2018 to 2030 (USD Million)

4.4. Allergies

4.4.1. Allergies market estimates and forecasts, 2018 to 2030 (USD Million)

4.5. Urgent Care

4.5.1. Urgent care market estimates and forecasts, 2018 to 2030 (USD Million)

4.6. Preventive Care

4.6.1. Preventive care market estimates and forecasts, 2018 to 2030 (USD Million)

4.7. Chronic Care management

4.7.1. Chronic care management market estimates and forecasts, 2018 to 2030 (USD Million)

4.8. Behavioral Health

4.8.1. Behavioral health market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 5. U.S. Virtual Visits Market: Age Group Estimates & Trend Analysis

5.1. U.S. Virtual Visits Market: Key Takeaways

5.2. U.S. Virtual Visits Market: Movement & Market Share Analysis, 2022 & 2030

5.3. Age 18-34

5.3.1. Age 18-34 market estimates and forecasts, 2018 to 2030 (USD Million)

5.4. Age 35-49

5.4.1. Age 35-49 market estimates and forecasts, 2018 to 2030 (USD Million)

5.5. Age 50-64

5.5.1. Age 50-64 market estimates and forecasts, 2018 to 2030 (USD Million)

5.6. Age 65 and above

5.6.1. Age 65 and above market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 6. U.S. Virtual Visits Market: Gender Estimates & Trend Analysis

6.1. U.S. Virtual Visits Market: Key Takeaways

6.2. U.S. Virtual Visits Market: Movement & Market Share Analysis, 2022 & 2030

6.3. Male

6.3.1. Male market estimates and forecasts, 2018 to 2030 (USD Million)

6.4. Female

6.4.1. Female market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 7. U.S. Virtual Visits Market: Commercial Plan Type Estimates & Trend Analysis

7.1. U.S. Virtual Visits Market: Key Takeaways

7.2. U.S. Virtual Visits Market: Movement & Market Share Analysis, 2022 & 2030

7.3. Small Group

7.3.1. Small group market estimates and forecasts, 2018 to 2030 (USD Million)

7.4. Self-Funded/ASO Group Plans

7.4.1. Self-funded/ASO group plans market estimates and forecasts, 2018 to 2030 (USD Million)

7.5. Medicaid

7.5.1. Medicaid market estimates and forecasts, 2018 to 2030 (USD Million)

7.6. Medicare

7.6.1. Medicare market estimates and forecasts, 2018 to 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Market Participant Categorization

8.2.1. American Well

8.2.1.1. Company overview

8.2.1.2. Financial performance

8.2.1.3. Product benchmarking

8.2.1.4. Strategic initiatives

8.2.2. MDLIVE

8.2.2.1. Company overview

8.2.2.2. Financial performance

8.2.2.3. Product benchmarking

8.2.2.4. Strategic initiatives

8.2.3. Doctor On Demand by Included Health, Inc.

8.2.3.1. Company overview

8.2.3.2. Financial performance

8.2.3.3. Product benchmarking

8.2.3.4. Strategic initiatives

8.2.4. eVisit

8.2.4.1. Company overview

8.2.4.2. Financial performance

8.2.4.3. Product benchmarking

8.2.4.4. Strategic initiatives

8.2.5. Teladoc Health, Inc.

8.2.5.1. Company overview

8.2.5.2. Financial performance

8.2.5.3. Product benchmarking

8.2.5.4. Strategic initiatives

8.2.6. MeMD

8.2.6.1. Company overview

8.2.6.2. Financial performance

8.2.6.3. Product benchmarking

8.2.6.4. Strategic initiatives

8.2.7. HealthTap, Inc.

8.2.7.1. Company overview

8.2.7.2. Financial performance

8.2.7.3. Product benchmarking

8.2.7.4. Strategic initiatives

8.2.8. Vidyo, Inc.

8.2.8.1. Company overview

8.2.8.2. Financial performance

8.2.8.3. Product benchmarking

8.2.8.4. Strategic initiatives

8.2.9. PlushCare

8.2.9.1. Company overview

8.2.9.2. Financial performance

8.2.9.3. Product benchmarking

8.2.9.4. Strategic initiatives

8.2.10. Zipnosis

8.2.10.1. Company overview

8.2.10.2. Financial performance

8.2.10.3. Product benchmarking

8.2.10.4. Strategic initiatives