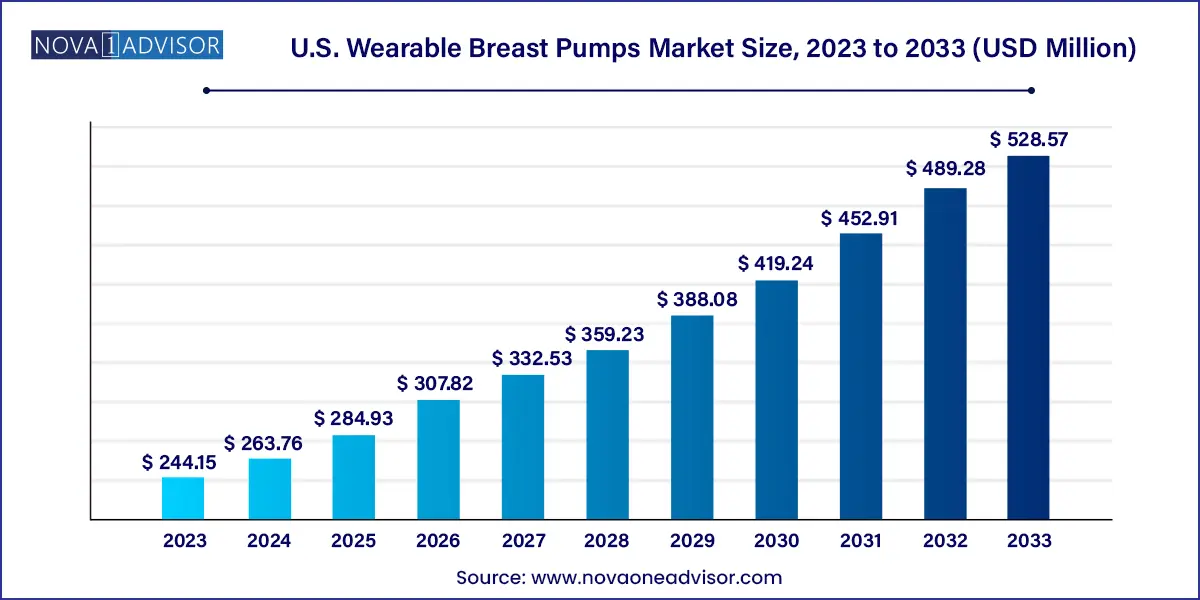

The U.S. wearable breast pumps market size was exhibited at USD 244.15 million in 2023 and is projected to hit around USD 528.57 million by 2033, growing at a CAGR of 8.03% during the forecast period 2024 to 2033.

The U.S. wearable breast pumps market is witnessing unprecedented growth, reflecting a cultural and technological shift in how breastfeeding is approached by modern mothers. Wearable breast pumps, distinct for their portability and discreet operation, are designed to fit directly inside a bra, freeing mothers from the confines of traditional wall-connected pumps. As more women return to work postpartum or juggle multiple responsibilities at home, the demand for hands-free, quiet, and efficient breast milk expression solutions has significantly increased.

The U.S. maternity and breastfeeding support infrastructure has evolved to accommodate lifestyle changes, with growing awareness around the benefits of breastfeeding, the rise of dual-income households, and increased insurance coverage under the Affordable Care Act (ACA). The ACA mandates health insurers to cover breastfeeding support, including the cost of breast pumps, leading to broader access and higher product uptake. This policy-driven push, coupled with innovation in wearable technology, has transformed wearable breast pumps from a niche product into a mainstream consumer health device.

The introduction of smart wearable breast pumps that connect to mobile apps, monitor milk output, track pumping sessions, and offer personalized tips further enhances the appeal of these devices. Brands such as Elvie, Willow, Medela, Momcozy, and Spectra are leading the charge by combining ergonomic design with technological sophistication. Market growth is also reinforced by a shift in consumer preferences towards comfort, discretion, and multi-tasking capabilities, especially among millennial and Gen Z parents.

Rise of smart wearable breast pumps with app connectivity: Integration of IoT features is enabling real-time tracking, performance optimization, and data logging.

Expanding insurance reimbursement and FSA/HSA eligibility: Broader coverage under health plans and eligibility for flexible spending accounts are driving affordability.

Increasing product launches in the hospital-grade wearable category: Brands are offering compact, high-suction, hospital-grade pumps for home use.

Growing e-commerce penetration and DTC (direct-to-consumer) models: Online platforms are enabling access to a broader consumer base, especially in suburban and rural areas.

Ergonomic and inclusive design focus: Companies are designing pumps for diverse body types and preferences, including silent operation and discreet styling.

Influencer-driven marketing and maternal health communities: Social media advocacy is significantly influencing brand visibility and consumer trust.

Sustainability and eco-conscious design: Demand for reusable, BPA-free, and recyclable pump materials is increasing among environmentally conscious consumers.

| Report Coverage | Details |

| Market Size in 2024 | USD 263.76 Million |

| Market Size by 2033 | USD 528.57 Million |

| Growth Rate From 2024 to 2033 | CAGR of 8.03% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Technology |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Freemie; Ameda, Inc; Willow Innovations, Inc.; Babybuddha Products, Llc; Spectra; IAPOY; Lavie Mom; Motif Medical; Fridababy, Llc; Bodily; Lansinoh Laboratories, Inc.; Kindred Bravely; Bravado Designs; The Honest Company; Motherlove Herbal Company |

A central driver of the U.S. wearable breast pumps market is the increasing participation of women in the workforce. According to the U.S. Bureau of Labor Statistics, over 56% of women with children under one year old were in the labor force as of recent reports. Balancing professional responsibilities and infant care, especially breastfeeding, presents unique challenges for mothers. Traditional breast pumps, which often involve tubing, bottles, and stationary operation, limit mobility and privacy, especially in workplace environments.

Wearable breast pumps offer a transformative solution. They allow mothers to pump discreetly in meetings, during commutes, or while performing household chores, ensuring that feeding routines are not disrupted. This functionality resonates strongly in corporate environments that are still catching up on workplace accommodations for nursing mothers. Additionally, several states, under federal protections, mandate lactation rooms at workplaces. However, the flexibility offered by wearable pumps means that even without dedicated spaces, mothers can manage lactation effectively. These societal shifts driven by both policy and economic dynamics are fueling strong, sustained demand for innovative, wearable pumping solutions.

Despite the benefits, the high upfront cost of wearable breast pumps remains a significant barrier to wider adoption. Leading smart pumps such as the Willow Go and Elvie Pump retail between $300 and $500, excluding accessories such as milk containers, additional flanges, or cleaning kits. For comparison, standard electric or manual pumps may cost less than half that amount, creating a gap in accessibility for lower- and middle-income mothers.

While some insurance plans cover basic pump models, full coverage of wearable or app-connected smart pumps varies widely across providers. Many consumers find themselves bearing significant out-of-pocket expenses for upgraded models, especially when seeking features like app integration, hospital-grade suction, or battery-operated portability. In addition, replacement parts and consumables (e.g., valve membranes, reusable containers) add recurring costs. This price sensitivity can deter first-time mothers or those uncertain about long-term breastfeeding plans, thereby restraining market penetration despite technological advancements.

As social norms around parenting evolve, there is a significant opportunity in meeting the growing demand for discreet, efficient, and portable breastfeeding solutions. The modern American mother is increasingly mobile, tech-savvy, and focused on flexibility. Whether commuting, traveling, or multitasking at home, these users seek tools that integrate into their lifestyles rather than disrupt them. Wearable breast pumps align perfectly with this ethos.

The opportunity lies in not only developing quieter and more powerful devices but also in integrating data analytics, wellness tracking, and real-time performance feedback. For example, a smart pump that tracks hydration levels, suggests optimal pumping times based on hormonal cycles, or integrates with nutrition apps could appeal to a growing cohort of health-focused, data-conscious mothers. Moreover, providing discreet designs with noise reduction technology and minimalist aesthetics can allow mothers to feel more confident pumping in public or shared spaces. Companies that prioritize this intersection of design, functionality, and user empowerment are likely to lead market growth in the next five years.

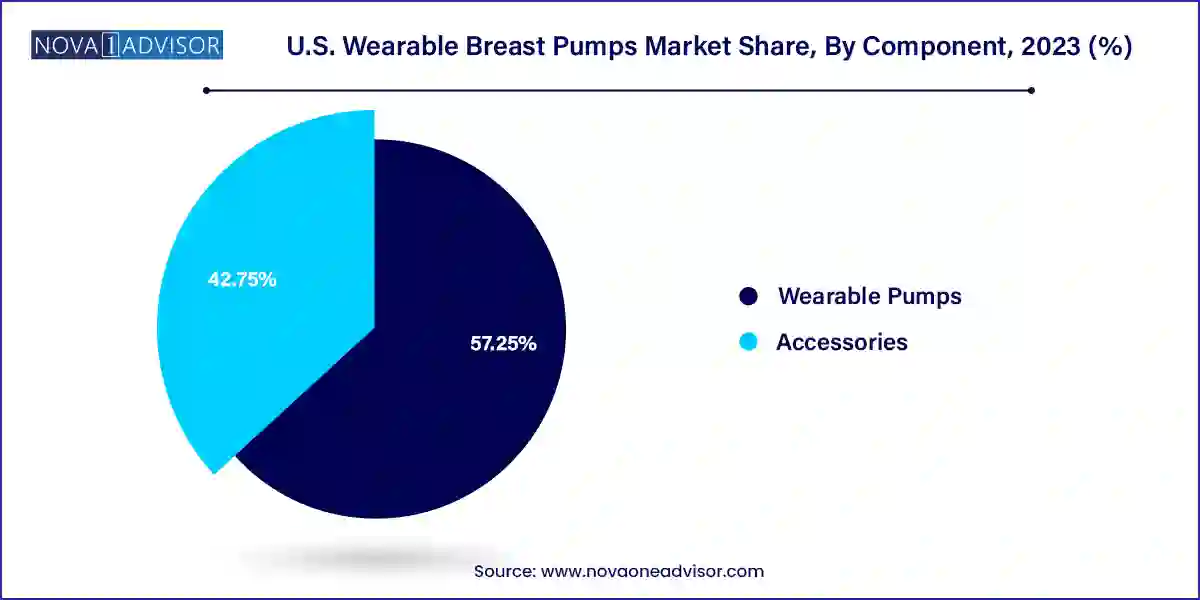

Wearable pumps dominated the U.S. market by component, accounting for the lion’s share of revenue. These pumps serve as the core technology and are responsible for the primary value proposition of hands-free, mobile milk expression. Demand for the wearable pump unit itself continues to surge, especially for electric and smart pump models. Companies are investing in ergonomic engineering, leak-proof architecture, and high-efficiency suction motors to differentiate their offerings. Consumers typically purchase a pair of pumps, driving higher average order value compared to single-use components.

Accessories, though a smaller portion by value, represent the fastest-growing component segment. These include milk storage bags, flanges, charging cords, cleaning brushes, and wearable pump bras. As the installed base of wearable pumps grows, the recurring demand for accessories follows suit. Moreover, personalization of fit through flange size kits and skin-safe materials is becoming a focus area for manufacturers. Subscription models for consumables and replacement parts are also gaining traction, creating a stable secondary revenue stream for pump brands.

Battery-operated wearable breast pumps dominated the market, favored for their portability and convenience over manual options. These pumps are ideal for busy mothers who require efficient and hands-free functionality during work, errands, or home activities. Most of the best-selling models from brands like Elvie, Willow, and Momcozy fall within this category. Innovations like dual-motor pumps, multiple suction modes, and rechargeable battery packs with USB-C support further enhance the appeal. These pumps eliminate the need for external power sources, expanding use cases across diverse settings.

Smart wearable breast pumps are the fastest-growing segment, as tech-enabled parenting gains momentum. These pumps connect via Bluetooth to smartphone apps, allowing users to monitor pumping volume, duration, suction strength, and battery levels. Real-time alerts and personalized pumping schedules are becoming standard features. In March 2024, Elvie launched the "Elvie Stride Plus" across major U.S. retailers, combining hospital-grade power with Bluetooth functionality and app syncing. The company reported a 35% sales increase in the first month post-launch, underlining the rising preference for digital integration. The convergence of wearables and healthtech is fueling this surge, especially among younger, tech-friendly consumers.

The United States stands as the most developed and innovation-centric market for wearable breast pumps globally. The country benefits from a confluence of favorable demographics, advanced healthcare policies, and a robust consumer healthtech ecosystem. Federal regulations such as the Affordable Care Act have normalized insurance-based access to breast pumps, while evolving workplace policies increasingly support lactation breaks and pumping facilities. However, the convenience of wearable pumps makes them especially appealing in environments where dedicated pumping spaces may still be unavailable or impractical.

The U.S. market is also heavily influenced by e-commerce dynamics. Platforms like Amazon, Target, and Walmart.com have facilitated widespread product access, supported by consumer reviews, influencer endorsements, and user-generated content. Social media platforms particularly TikTok, YouTube, and Instagram play a pivotal role in driving product awareness, with many mothers sharing unboxing experiences, product comparisons, and daily usage tips. Moreover, healthcare providers and lactation consultants across hospitals and birth centers are increasingly recommending wearable pumps for new mothers, further enhancing trust and adoption.

Consumer behavior in the U.S. also reflects a growing preference for subscription models, ergonomic customization, and bundling (e.g., pumps with accessories, storage kits, and nursing bras). As tech integration becomes more mainstream, U.S. consumers are actively seeking devices that provide seamless digital experiences, from milk tracking to smart alerts and cloud-based data storage. All these factors contribute to the country’s dominance in both innovation and adoption rates within the global wearable breast pump ecosystem.

March 2024 – Elvie officially launched its Elvie Stride Plus in the U.S. market, introducing a compact hospital-grade wearable breast pump with Bluetooth-enabled performance tracking. The company partnered with major retailers like Target and BuyBuy Baby to improve accessibility nationwide.

February 2024 – Willow Innovations announced a collaboration with the March of Dimes to provide breast pump access and lactation education to underserved communities in the U.S., addressing equity in maternal care.

January 2024 – Momcozy introduced an updated S12 Pro wearable pump, featuring softer silicone shields and improved noise-reduction technology. The company emphasized its DTC growth strategy, with expanded warehouse operations in California to meet rising demand.

November 2023 – Medela U.S. launched the Freestyle Hands-Free Pump, combining wearable form with 2-phase expression technology. The product was featured in a national campaign promoting maternal health and breastfeeding support in partnership with pediatric hospitals.

October 2023 – Spectra Baby USA received FDA clearance for its Spectra Wearable 360, incorporating a dual-motor system and app-based tracking tools. The launch targets working mothers and telecommuters seeking discreet, mobile-friendly pumping solutions.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. wearable breast pumps market

Component

Technology