The U.S. wellness & fitness products market size was exhibited at USD 28.85 billion in 2023 and is projected to hit around USD 53.15 billion by 2033, growing at a CAGR of 6.3% during the forecast period 2024 to 2033.

The U.S. Wellness & Fitness Products Market has witnessed transformative growth over the past decade, fueled by a convergence of health awareness, technological innovations, and a societal shift toward preventive health care. This market encompasses a broad spectrum of products designed to support fitness regimes and enhance physical well-being, including apparel, footwear, cardio and strength training equipment, and fitness accessories. These products cater to a diverse demographic, from fitness enthusiasts and athletes to aging populations seeking to maintain health.

The increasing prevalence of lifestyle-related conditions such as obesity, cardiovascular disease, and diabetes has catalyzed a demand for fitness solutions that are accessible, effective, and aligned with individual goals. Furthermore, post-pandemic behavioral shifts have ingrained at-home fitness practices, pushing the market toward digital integration and at-home fitness equipment sales. The widespread adoption of mobile health applications, wearable fitness trackers, and online training programs continues to bolster product demand.

In 2024, the U.S. is considered one of the most mature and dynamic markets for wellness and fitness products globally, characterized by well-established infrastructure, a consumer base with high purchasing power, and a growing culture of self-care and holistic health.

Digital Integration and Smart Equipment: Integration of IoT in fitness equipment such as treadmills and stationary bikes enables real-time tracking, virtual coaching, and personalized workout plans.

Wearable Technology and App-Based Ecosystems: Surge in usage of smartwatches, heart rate monitors, and fitness bands that sync with fitness apps, creating seamless health monitoring.

Sustainable and Eco-Friendly Fitness Products: Brands are focusing on sustainable manufacturing practices, including biodegradable yoga mats, recyclable packaging, and organic fitness wear.

Personalized Fitness Programs: Growth in demand for custom-tailored training programs and AI-driven coaching solutions.

Celebrity and Influencer Fitness Brands: Launches of fitness apparel and accessories lines by influencers and celebrities are shaping consumer preferences.

Hybrid Fitness Models: Combination of in-gym and virtual workouts has given rise to hybrid fitness ecosystems offering flexibility and community engagement.

Rise in Premium Wellness Products: Consumers are increasingly opting for high-quality, tech-enabled, and aesthetically pleasing fitness gear.

Increased Focus on Mental Wellness Products: Growing consumer interest in products that support both mental and physical health, such as meditation aids and recovery tools.

| Report Coverage | Details |

| Market Size in 2024 | USD 30.67 Billion |

| Market Size by 2033 | USD 53.15 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Price Range, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Peloton Interactive, Inc.;Performance Health;Black Mountain Products, Inc.;Sunny Health and Fitness;Life Fitness;iFIT Health & Fitness Inc.;Johnson Health Tech (Matrix);Adidas ;Nike, Inc.; and lululemon athletica |

One of the primary drivers of the U.S. wellness and fitness products market is the growing awareness surrounding health and physical well-being. Across all age demographics, there is an increasing understanding of the long-term benefits associated with regular physical activity, balanced nutrition, and stress management. This shift is especially prevalent among millennials and Gen Z consumers, who prioritize self-care and actively seek out tools to maintain a healthy lifestyle. High obesity rates and sedentary behavior have triggered national-level wellness campaigns and employer-driven health programs, further encouraging the adoption of fitness-related products. With rising healthcare costs, consumers are more motivated to invest in preventive care, positioning fitness and wellness products as proactive solutions.

Despite the growing demand, the market faces limitations due to the high cost associated with premium fitness equipment and branded apparel. Smart equipment, designer workout wear, and advanced strength-training machines can be prohibitively expensive for a significant portion of the population. This pricing barrier restricts market penetration among low-income households and rural populations. Moreover, maintenance and space requirements for home-use fitness equipment like treadmills or multi-station machines can also deter potential customers. Although mass-market alternatives exist, they often lack the durability and features consumers expect, creating a gap in quality that impacts broader adoption.

The growing demand for convenience, coupled with advancements in digital technology, has opened up vast opportunities for companies offering at-home fitness solutions. Online platforms providing virtual classes, on-demand workout videos, and app-based coaching have gained popularity, especially post-COVID. Brands are now integrating subscription-based fitness services with their products, creating a recurring revenue stream and elevating user engagement. Companies that provide bundled solutions—such as smart stationary bikes with live-streamed classes—are capitalizing on this trend. The integration of gamification, AI coaching, and social features enhances motivation, making fitness more interactive and less monotonous, thereby opening new frontiers for product innovation and market expansion.

Apparel dominated the product segment in 2024, driven by the blend of fashion, function, and fitness. The U.S. fitness apparel market is no longer just about utility; it's a lifestyle choice. Athleisure—activewear that doubles as casual wear—has seen soaring popularity. Brands like Lululemon and Athleta have seen sustained growth as consumers seek versatile and comfortable clothing for both workouts and day-to-day wear. Apparel is now infused with moisture-wicking, anti-odor, and stretchable properties, making it attractive to fitness and non-fitness users alike. Social media and influencer culture have played an instrumental role in elevating apparel sales, as aspirational imagery encourages brand-specific purchases.

Fitness accessories emerged as the fastest-growing subsegment, propelled by their affordability and portability. Items such as resistance bands, foam rollers, yoga mats, skipping ropes, and balance balls have become essentials in home gyms. The ease of purchase via online platforms and increasing awareness around mobility and injury prevention have supported this trend. The popularity of HIIT, yoga, and Pilates has also fueled demand for accessories that enhance these routines. Notably, consumers prefer compact and multifunctional gear that fits seamlessly into their homes, making fitness accessories an entry point for many first-time buyers.

Mass-priced fitness products lead the market due to accessibility and affordability. Mass-market brands dominate in supermarket chains and online platforms, catering to everyday consumers who prioritize functionality over luxury. Products like basic free weights, home-use exercise bikes, and budget-friendly apparel witness high turnover rates. These offerings are essential for individuals beginning their fitness journey and those adhering to budget constraints. Retailers like Walmart, Target, and Amazon provide a vast range of mass fitness products, enabling volume-based growth.

Premium-priced products, however, are registering the fastest CAGR, thanks to increasing demand for high-end experiences. Consumers are investing in luxury fitness equipment, such as Peloton bikes, NordicTrack treadmills, and Theragun recovery tools, reflecting a shift toward quality and longevity. These products are often enhanced with technological features, ergonomic designs, and superior materials. High-income urban consumers and fitness-savvy professionals view these purchases as long-term investments into their wellness routines. The premium segment is also benefitting from brand loyalty and subscription-based ecosystems that keep users engaged.

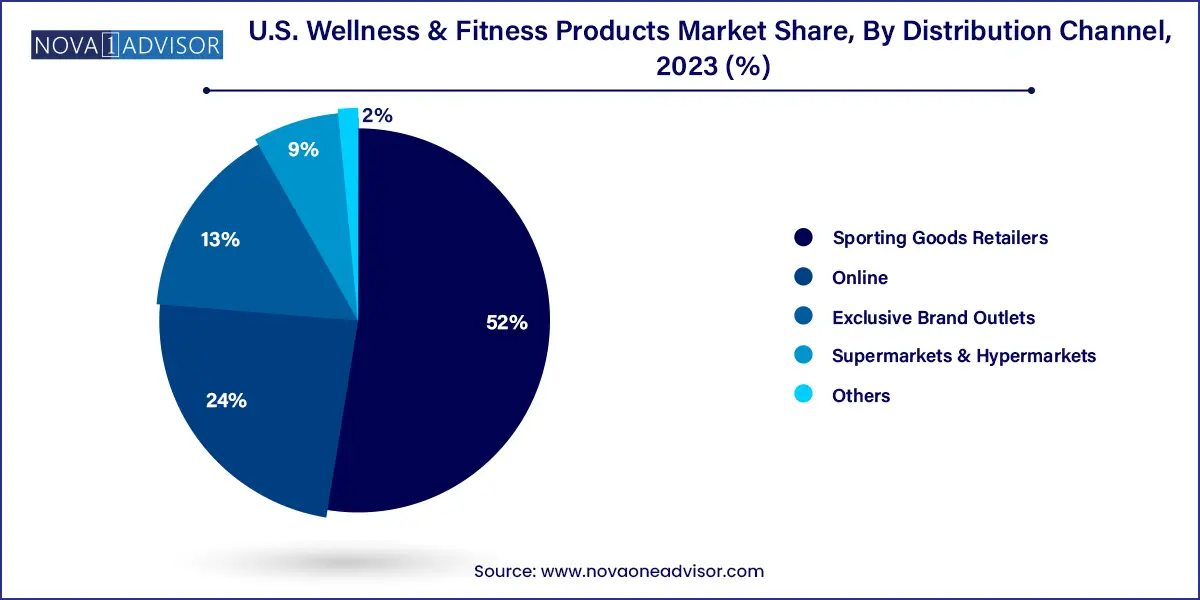

Online channels dominate the distribution segment, reflecting consumer preferences for convenience, variety, and competitive pricing. E-commerce platforms like Amazon, brand-specific websites, and specialty fitness retailers have enhanced the shopping experience with detailed product descriptions, user reviews, and personalized recommendations. The shift toward direct-to-consumer (D2C) models, particularly among digitally native fitness brands, has further streamlined sales and customer engagement. Online sales also soared during the pandemic, setting a new norm for fitness gear purchases. Additionally, the integration of AR tools to visualize equipment at home and AI-based recommendations has elevated the online shopping journey.

Exclusive brand outlets are emerging as the fastest-growing channel, driven by experiential retail. Companies like Lululemon, Nike, and Under Armour offer immersive in-store experiences, personalized fittings, and exclusive collections, creating strong brand-consumer relationships. These outlets often serve as both retail and community spaces, hosting in-store workouts, wellness seminars, and influencer meet-ups. Such initiatives boost customer retention and enhance brand value, especially in metropolitan areas where foot traffic and brand consciousness are high.

The U.S. fitness and wellness culture is deeply embedded in its societal structure, encompassing everything from workplace wellness programs to public fitness initiatives. The government, private sector, and healthcare organizations emphasize preventive health, encouraging fitness routines and healthy lifestyles. Metropolitan areas like Los Angeles, New York, and Miami lead in consumer spending on fitness products, supported by widespread gym culture and access to high-end wellness brands.

Moreover, the rise of boutique studios, corporate wellness programs, and fitness-tech integration has created a robust demand pipeline. Tech-savvy American consumers are quick to adopt new fitness innovations—from wearable health trackers to app-integrated home gym equipment. Gen Z and millennial demographics, in particular, are shaping the market's trajectory by aligning wellness with sustainability, convenience, and community-driven experiences. The surge in fitness product sales during key shopping seasons—Black Friday, New Year, and Amazon Prime Days—demonstrates strong consumer enthusiasm and spending capacity within the U.S. market.

January 2025: Peloton Interactive introduced its next-generation treadmill, the Peloton Tread Ultra, featuring a curved belt and gamified training interface, aiming to boost its market share in home cardio equipment.

February 2025: Nike launched a new line of sustainable performance footwear, Nike Revive, made from 85% recycled materials, targeting eco-conscious consumers and aligning with its “Move to Zero” campaign.

March 2025: Lululemon unveiled Mindful Moves, a new wellness gear collection including meditation cushions and stretchwear, emphasizing the convergence of physical and mental fitness.

January 2025: NordicTrack partnered with the popular wellness app Calm to integrate guided mindfulness sessions into its treadmill consoles, enhancing the overall wellness experience for users.

February 2025: Under Armour announced the expansion of its D2C operations with five new experiential stores across the U.S., focused on premium customer service, fitness consultations, and in-store trials.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. wellness & fitness products market

Product

Price Range

Distribution Channel