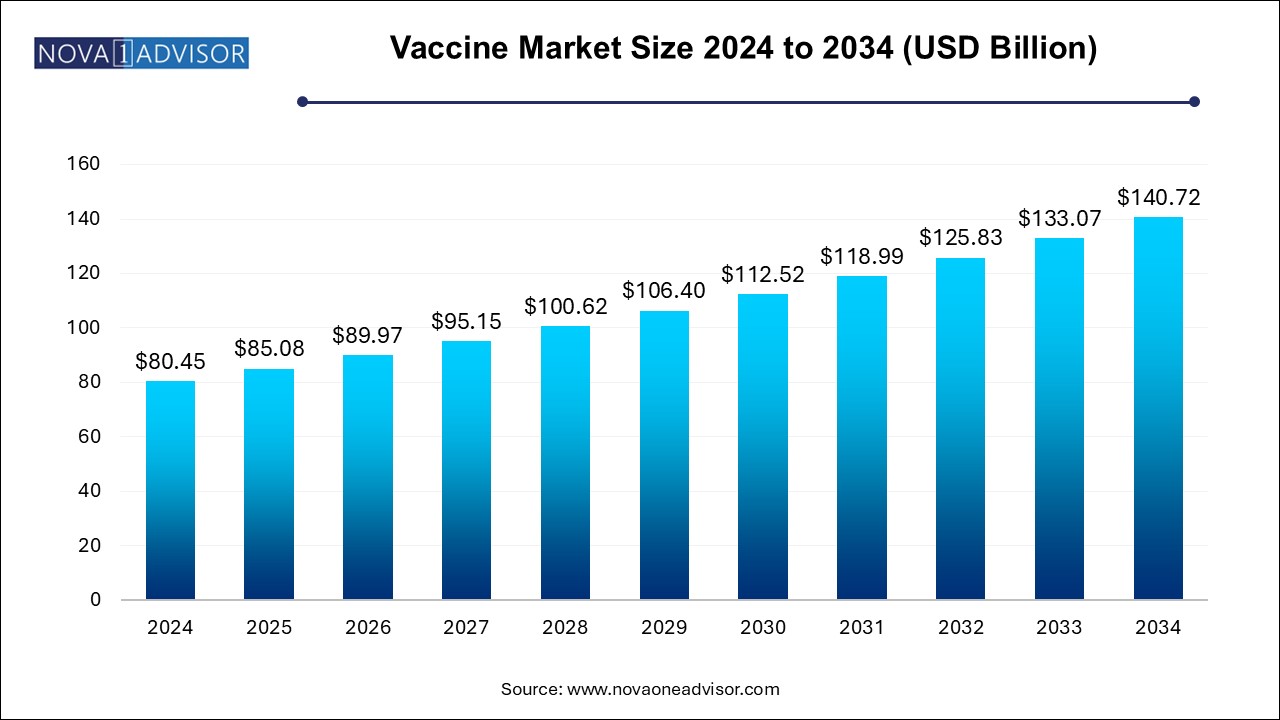

The vaccine market size was exhibited at USD 80.45 billion in 2024 and is projected to hit around USD 140.72 billion by 2034, growing at a CAGR of 5.75% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 85.08 Billion |

| Market Size by 2034 | USD 140.72 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 5.75% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Route of Administration, Disease Indication, Age Group, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Serum Institute of India Pvt. Ltd.; Seqirus; Sanofi; GSK Plc.; Merck & Co. Inc.; Pfizer Inc.; Moderna Inc.; Sinovac; BioNTech SE; AstraZeneca |

The vaccine market has been expanding globally, with an increase in vaccines targeting diseases that predominantly affect lower-income countries. In the U.S., the COVID-19 vaccine market transitioned to a commercial phase, following the depletion of the federal government's purchased stock. This shift will likely result in higher prices, as evidenced by Moderna's announcement in March 2024 that its COVID-19 vaccine price would rise to approximately USD 110 to USD 130 per dose. The privatization of the market will also intensify competition among manufacturers post pandemic.

In March 2024, the Serum Institute of India announced its plans to diversify beyond COVID-19 vaccines by developing new vaccines for malaria and dengue. Company officials, stated that the company has repurposed its COVID-19 vaccine manufacturing facilities to produce these new vaccines, potentially increasing its total production capacity to 4 billion doses annually. This strategic move allows Serum Institute to maintain high production levels and ensure rapid response capability in case of future pandemics.

By March 2024, Dr. Reddy’s Laboratories (DRL) will begin promoting and distributing Sanofi’s vaccine brands in India. This partnership includes well-known pediatric and adult vaccines such as Hexaxim, Pentaxim, Tetraxim, Menactra, FluQuadri, Adacel, and Avaxim 80U. These brands achieved combined sales of about USD 51 million as of February 2024. This collaboration strengthens DRL’s vaccine portfolio, positioning it as the second-largest vaccine player in India, while Sanofi continues to own, manufacture, and import these vaccines into the country.

The COVID-19 pandemic highlights the limitations of relying solely on public investment and procurement strategies for optimal public health outcomes. Although around 15 billion vaccine doses were globally distributed by October 2022, only 12% were provided through COVAX, the global alliance for equitable access. This highlights the need for more comprehensive approaches to achieve equitable distribution and prepare for future pandemics.

Regulatory agencies and regional networks have been crucial in enhancing regulatory capacity and promoting coordinated efforts across countries, leading to better accessibility of new vaccines. The World Health Organization (WHO) has been instrumental in this regard, providing regulatory assistance through its prequalification program and helping countries develop efficient, stable, and integrated regulatory systems. As a result, the national regulatory authorities in 35 vaccine-producing countries have achieved a maturity level sufficient to oversee development, manufacturing, and release.

The mRNA segment dominated the vaccine market with a share of 32.32% in 2024. In the space Pfizer/BioNTech and Moderna have gained prominence with their mRNA COVID-19 vaccines. These vaccines offer significant advantages over traditional vaccines, such as the ability to quickly adjust antigen design and integrate sequences from multiple variants to address new mutations in the virus genome. This adaptability has been a key factor in their market dominance. The success of mRNA-based COVID-19 vaccines has also spurred the development of mRNA platforms for preventing other infectious diseases such as flu and RSV. For instance, in February 2024, Moderna announced interim results from its phase 3 trial for mRNA-1010, a seasonal flu shot. The vaccine showed superior results against influenza A strains but was less effective against certain influenza B strains. This ongoing research highlights the potential of mRNA technology to revolutionize the vaccine market further.

The subunit vaccines segment is expected to experience rapid growth during the forecast period. This growth is driven by several factors, including the increasing prevalence of infectious diseases, rising demand for safe and effective vaccines, and a growing emphasis on preventive healthcare. Moreover, there is a rising need for more efficient vaccines targeting diseases such as cancer, autoimmune disorders, and allergies. For instance, in November 2022, Curevo Vaccine (Curevo), a biotechnology company focusing on developing vaccines to combat infectious diseases, completed a Series A1 funding round worth USD 26 million. The funding will support the development of CRV-101, an adjuvanted subunit vaccine aimed at preventing shingles in older adults. This investment reflects the growing interest and investment in subunit vaccines to address various health challenges, contributing to the segment's projected growth in the vaccine market.

Parenteral administration is highly preferred for administering vaccines and hence the segment dominated the vaccine market with a share of 97.01% in 2024. Parenteral administration, which involves injections into the body, is preferred for its faster absorption, higher efficacy, and reduced risk of contamination and degradation. Currently, majority of vaccines on the market are administered intramuscularly or subcutaneously, which contributes to the dominance of this segment.

However, the oral administration segment is expected to grow steadily, over the forecasted period. This growth is attributed to the advantages of orally administered vaccines, such as the stimulation of both mucosal and systemic immunities, and the elimination of adverse events associated with injections. Vaccines such as polio and rotavirus, particularly used in pediatric vaccinations, are commonly administered orally, further driving the growth of this segment.

The viral diseases segment is further segmented into Hepatitis, Influenza, HPV, MMR, Rotavirus, Herpes Zoster, COVID-19 and others. This segment dominated the vaccine market with a share of 63.79% in 2024, majorly attributed to COVID-19 vaccines. The market is driven by factors such as increasing the incidence of viral diseases, growing awareness about the benefits of vaccination, and government initiatives to promote immunization programs. The market is highly competitive and is dominated by major players such as Pfizer, GSK, AstraZeneca and Serum Institute amongst others.

The market for bacterial diseases is expected to grow at a fastest CAGR during the forecast period. The growing demand for vaccination that can prevent bacterial infections, particularly in regions with high incidences of bacterial diseases is one of the major factors driving segment growth. This market includes the development and distribution of vaccination for a range of bacterial infections, such as pneumonia, meningitis, DPT, and others. In February 2024, BactiVac, the Bacterial Vaccines Network, received USD 1.25 million in funding from Wellcome to accelerate the development of bacterial vaccines and counteract the threat of antimicrobial resistance (AMR). The funding will be utilized to amplify the impact of the BactiVac Network during the next four years.

Adult accounted for a share of 57.25% in the vaccine market in 2024. Adult vaccination, including those for COVID-19, comprised 75% in terms of volume globally, while pediatric vaccines accounted for about 20%. In comparison to pre-Covid, adult vaccine volumes had a nine-fold increase primarily due to COVID-19 vaccination. In addition, non-COVID-19 adult vaccine volumes increased by 15% because of widespread use of seasonal influenza vaccination in high-income countries (HICs).

Pediatric segment is estimated to be the fastest growing segment over the forecast period. During the COVID-19 pandemic, overall pediatric vaccines volumes decreased by 14% compared to the pre-pandemic, which was driven by a decreased use of oral polio vaccine (OPV) and measles-rubella vaccine (MR) in supplemental immunization activities (SIAs). The approval of COVID vaccines of pediatric use will further boost segment growth. For instance, in June 2022, Pfizer/BioNTech COVID vaccine received emergency use approval (EUA) for use in children aged 6 months to 4 years of age.

Government suppliers dominated the vaccine market in 2024 with a share of 60.0%. In contrast to other pharmaceutical products, vaccines are primarily financed by public funds through government and pooled procurement arrangements, with private sector procurement playing a minor role. Concentrated demand can assist in planning the necessary supply investments. However, the predictability of demand remains a significant factor affecting access to vaccinations. For instance, the U.S. government has recently announced that it planned to purchase more than 1.5 million Novavax Inc's COVID-19 vaccine doses in February 2024. As per the recent agreement, funds have been allocated for the development of an updated vaccine, expected to be ready by fall of the same year.

Hospital & retail pharmacies supply channel is estimated to be the fastest growing distribution channel in the vaccine market. Moreover, pharmacies have become an increasingly important source of vaccine supply in many developed countries. They provide convenient access to public vaccination and help increase vaccination rates. Furthermore, the opening of the private market for COVID vaccines in 2024 in the U.S. will also contribute to the market growth.

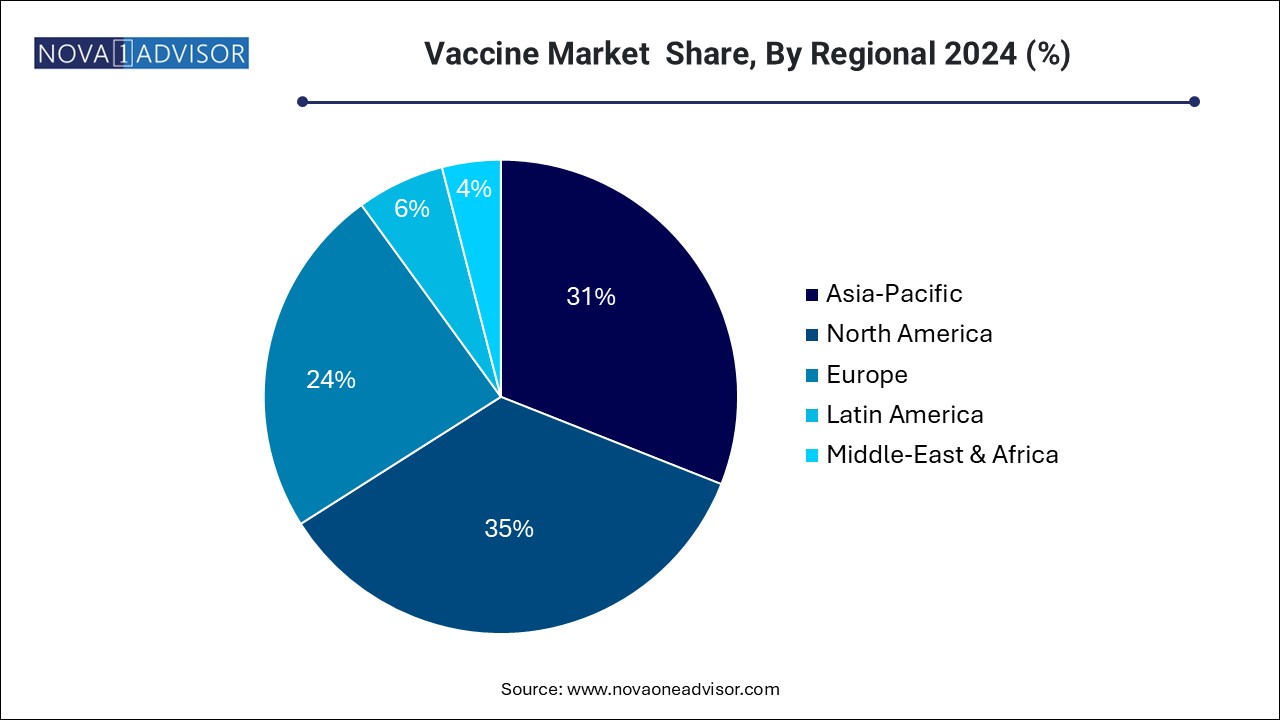

North America vaccines market is estimated to grow at a fastest CAGR of 8.42% over the forecast period. Government initiatives promoting immunization and heightened awareness post-pandemic drive adoption. For instance, the Hepatitis B Foundation strongly supports the updated adult hepatitis B vaccination recommendations from the U.S. Centers for Disease Control and Prevention (CDC). The Foundation is actively coordinating with a panel of experts to facilitate the effective implementation of these guidelines, aiming to enhance vaccination coverage against this dangerous virus among millions of U.S. adults. In the U.S., chronic hepatitis B affects around 2.4 million individuals, with thousands dying due to the disease annually. Left untreated, chronic hepatitis B carries a significant 25% to 40% lifetime risk of developing the often fatal condition of liver cancer.

U.S. Vaccines Market Trends

The vaccines market in the U.S. accounted for the major revenue share of the global vaccine market in 2024. Rapid technological advancements, recent U.S. FDA approvals for influenza vaccine, and intense competition between companies are expected to boost the market over the forecast period. For instance, in June 2022, CSL Seqirus announced the completion of a USD 156 million expansion at its production facility in the U.S. This expansion is expected to support the formulation of its cell-based influenza vaccines in prefilled syringes. In addition, in October 2021, Seqirus announced U.S. FDA approval of its quadrivalent influenza vaccine FLUCELVAX QUADRIVALENT. This newly approved vaccine has an expanded age indication for children as young as 6 months old. Moreover, this product is the first and only cell-based influenza vaccine approved in the U.S.

Europe Vaccines Market Trends

Europe vaccines market held the second-largest share in 2024, following Asia Pacific over the forecast period. The market growth can be attributed to an increase in research funding and the presence of local key market players in this region. The number of biopharmaceutical companies is growing in Europe owing to increasing investments. For instance, in February 2022, the UK pledged USD 192 million to the Coalition for Epidemic Preparedness Innovations to boost vaccine development.

The vaccine market in the UK is one of the major markets in the region. High vaccine uptake against the flu, better immunization programs, favorable government initiatives, and increased R&D activities in the country are driving the market growth. Following this development, in January 2024, Pfizer gained a positive opinion from the CHMP for its 20-Valent Pneumococcal Conjugate Vaccine (20vPnC). This vaccine offers broad coverage against pneumococcal disease, encompassing all 20 serotypes contained within the vaccine. These serotypes represent a significant portion of circulating pneumococcal disease globally and in the EU.

The France vaccine market is growing majorly due to awareness programs conducted by various government and non-government organizations. France launched a flu vaccine campaign to spread awareness regarding flu and influenza in the country. Such awareness programs help people identify symptoms, thereby creating more demand for influenza vaccines. France has a blend of several regional and multinational players offering influenza vaccines. Thus, several strategic initiatives undertaken by leading participants are likely to fuel market expansion.

The vaccine market in Germany dominated the European region owing to the presence of research institutions and leading vaccine manufacturers. In addition, a surge in R&D activities and various strategic initiatives undertaken by leading participants are factors propelling market expansion.

Moreover, in November 2022, BioNTech SE & Pfizer, Inc. initiated a phase I trial for a single-dose mRNA-based combination vaccine candidate for COVID-19 and influenza. In addition, in recent years, Bavarian Nordic A/S established a collaboration with Dynavax Technologies Corporation, a biopharmaceutical firm dedicated to creating and promoting innovative vaccines. This partnership aims to facilitate the marketing and distribution of HEPLISAV B [Hepatitis B Vaccine (Recombinant), Adjuvanted] in Germany.

Asia Pacific Vaccines Market Trends

The vaccine market in Asia Pacific held the largest share of 31.0% in 2024. The vaccine market in Asia Pacific is expected to grow at the fastest rate over the forecast period due to various factors, including improving healthcare reforms. Some of the other factors contributing to market growth are increasing geriatric population, improving healthcare infrastructure, and the entry of new players.

Some of the major players operating in Asia Pacific market are GSK plc, AstraZeneca, Sanofi, and Serum Institute of India (SII). In addition, owing to the region’s large population, the rate of influenza transmission is also higher. For instance, according to the Singapore Ministry of Health, the country has a higher burden of respiratory infections such as influenza than other diseases.

The vaccines market in India is driven by increasing prevalence of influenza in the country, coupled with several awareness campaigns arranged by local governments. India has a flourishing pharmaceutical sector owing to the emergence of generic manufacturers and the presence of leading pharmaceutical players. In addition, rising government efforts to bring next-generation influenza vaccines into the country is another factor propelling the country’s market.

The China vaccines market is experiencing steady growth driven by the local presence of a large number of vaccine manufacturers, favorable government initiatives, and high disease burden due to its large population. In addition, a supportive regulatory framework and high demand for innovative vaccines are expected to offer lucrative growth opportunities.

The vaccines market in Japan is one of the most technologically advanced market in Asia Pacific. Its vaccine market is expected to grow rapidly over the forecast period owing to high government spending for reducing the flu burden. Multiple initiatives, such as government grants to various research institutes and companies, can help develop practical solutions for the influenza burden in the country. In September 2024, Pfizer Japan filed for the approval of its 20-valent pneumococcal conjugate vaccine, Apexxnar, targeting older adults and individuals at high risk of contracting pneumococcal infections. This vaccine aims to provide broader protection by covering seven additional serotypes beyond Prevenar 13, Pfizer's existing pneumococcal vaccine.

Latin America Vaccines Market Trends

The Latin America vaccine market exhibited significant growth in the past few years owing to the high disease burden and increased demand for infectious disease vaccines. Mexico, Brazil, and Argentina are the major markets for influenza vaccines in Latin America. Favorable government initiatives and research collaborations are anticipated to contribute to the market growth. In addition, the demand for influenza vaccines increased owing to the current disease burden and high demand from healthcare providers.

The vaccine market in Brazil is significantly driven by supportive government initiatives to promote vaccine supply and uptake. For instance, in July 2022, Emergex Vaccines Holding Limited announced a partnership with the Molecular Biology Institute of Paraná (IBMP) in Brazil. The IBMP, a national organization for research of vaccines, is linked to the Health Ministry of Brazil. This agreement allowed IBMP to gain official rights for the commercialization of novel vaccines in Brazil.

MEA Vaccines Market Trends

The MEA vaccines market is expected to grow owing to economic development witnessed in emerging markets, such as South Africa, highly unmet healthcare needs, and high prevalence of diseases. Moreover, the increased prevalence of flu and the risk of seasonal influenza are propelling the market growth in the region.

Influenza vaccination can help prevent influenza-related illness, even in people who are at high risk of developing severe complications from the virus. This propelled many organizations, such as the WHO, the Agency of Preventive Medicine, and Ministry of Health in Africa, to collaborate for monitoring & evaluating the occurrence of influenza among the population and initiate vaccination programs in the region.

The vaccines market in Saudi Arabia, despite having a low local output of branded drugs relative to generic products, Saudi Arabia has the largest pharmaceutical market in the Middle East and African region. Moreover, the country is experiencing an increased prevalence of influenza. According to the Saudi Ministry of Health, seasonal influenza causes a variety of complications, the most serious of which are bronchitis, pneumonia, blood poisoning, ear infection, and death. As a result, in October 2022, the Ministry of Health launched an awareness campaign to encourage seasonal influenza vaccination, focusing on groups most vulnerable to it, such as the elderly, people with chronic diseases or immunodeficiency, healthcare workers, and pregnant women. The ministry emphasized that vaccination is safe, has few adverse effects, and has been proven to be effective around the world. Such initiatives are expected to increase vaccination rates in the country and propel the market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the vaccine market

By Type Scope

By Route of Administration Scope

By Disease Indication Scope

By Age Scope

By Distribution Channel Scope

By Regional

Chapter 1. Methodology And Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. Route of Administration

1.2.3. Disease Indication

1.2.4. Age Group

1.2.5. Distribution Channel

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Market Variables, Trends, & Scope

2.1. Market Segmentation and Scope

2.2. Market Lineage Outlook

2.2.1. Parent Market Outlook

2.2.2. Related/Ancillary Market Outlook

2.3. Market Trends and Outlook

2.4. Market Dynamics

2.4.1. Rise in the importance of immunization across the globe

2.4.2. Growing Burden of Chronic and Infectious Diseases

2.4.3. Technology advancements in the vaccination development

2.5. Market Restraint Analysis

2.5.1. Lack of healthcare infrastructure

2.5.2. Cost of immunization

2.6. Business Environment Analysis

2.6.1. SWOT Analysis; By Factor (Political & Legal, Economic and Technological)

2.6.2. Porter’s Five Forces Analysis

2.7. COVID-19 Impact Analysis

Chapter 3. Type Business Analysis

3.1. Type Market Share, 2024 & 2034

3.2. Segment Dashboard

3.3. Vaccines Market by Type Outlook

3.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

3.5. Subunit Vaccines

3.5.1. Vaccine Market for Subunit Vaccines, 2021 - 2034 (USD Billion)

3.5.2. Recombinant vaccines

3.5.2.1. Vaccine Market for Recombinant vaccines, 2021 - 2034 (USD Billion)

3.5.3. Conjugate Vaccines

3.5.3.1. Vaccine Market for Conjugate vaccines, 2021 - 2034 (USD Billion)

3.5.4. Toxoid vaccines

3.5.4.1. Vaccine Market for Toxoid vaccines, 2021 - 2034 (USD Billion)

3.6. Inactivated

3.6.1. Vaccine Market for Inactivated, 2021 - 2034 (USD Billion)

3.7. Live Attenuated

3.7.1. Vaccine Market for Live Attenuated, 2021 - 2034 (USD Billion)

3.8. mRNA vaccines

3.8.1. Vaccine Market for mRNA vaccines, 2021 - 2034 (USD Billion)

3.9. Viral vector vaccines

3.9.1. Vaccine Market for Viral vector vaccines, 2021 - 2034 (USD Billion)

Chapter 4. Route Of Administration Business Analysis

4.1. Route of administration Market Share, 2024 & 2034

4.2. Segment Dashboard

4.3. Vaccines Market by Route of administration Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

4.5. Oral

4.5.1. Vaccine Market for Oral, 2021 - 2034 (USD Billion)

4.6. Parenteral

4.6.1. Vaccine Market for Parenteral, 2021 - 2034 (USD Billion)

4.7. Nasal

4.7.1. Vaccine Market for Nasal, 2021 - 2034 (USD Billion)

Chapter 5. Disease Indication Business Analysis

5.1. Disease Indication Market Share, 2024 & 2034

5.2. Segment Dashboard

5.3. Vaccines Market by Disease Indication Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.5. Viral Diseases

5.5.1. Vaccine Market for Viral Diseases, 2021 - 2034 (USD Billion)

5.5.2. Hepatitis

5.5.2.1. Vaccine Market for Hepatitis, 2021 - 2034 (USD Billion)

5.5.3. Influenza

5.5.3.1. Vaccine Market for Influenza, 2021 - 2034 (USD Billion)

5.5.4. HPV

5.5.4.1. Vaccine Market for HPV, 2021 - 2034 (USD Billion)

5.5.5. MMR

5.5.5.1. Vaccine Market for MMR, 2021 - 2034 (USD Billion)

5.5.6. Rotavirus

5.5.6.1. Vaccine Market for Rotavirus, 2021 - 2034 (USD Billion)

5.5.7. Herpes Zoster

5.5.7.1. Vaccine Market for Herpes Zoster, 2021 - 2034 (USD Billion)

5.5.8. COVID-19

5.5.8.1. Vaccine Market for Covid-19, 2021 - 2034 (USD Billion)

5.5.9. Others

5.5.9.1. Vaccine Market for Others, 2021 - 2034 (USD Billion)

5.6. Bacterial Vaccines

5.6.1. Vaccine Market for Bacterial Vaccines, 2021 - 2034 (USD Billion)

5.6.2. Meningococcal Diseases

5.6.2.1. Vaccine Market for Meningococcal Diseases, 2021 - 2034 (USD Billion)

5.6.3. Pneumococcal Diseases

5.6.3.1. Vaccine Market for Pneumococcal Diseases, 2021 - 2034 (USD Billion)

5.6.4. DPT

5.6.4.1. Vaccine Market for DPT, 2021 - 2034 (USD Billion)

5.6.5. Others

5.6.5.1. Vaccine Market for Others, 2021 - 2034 (USD Billion)

5.7. Cancer Vaccines

5.7.1. Vaccine Market for Cancer Vaccines, 2021 - 2034 (USD Billion)

5.8. Allergy Vaccines

5.8.1. Vaccine Market for Allergy Vaccines, 2021 - 2034 (USD Billion)

Chapter 6. Age Group Business Analysis

6.1. Age Group Market Share, 2024 & 2034

6.2. Segment Dashboard

6.3. Vaccines Market by Age Group Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

6.5. Pediatric

6.5.1. Vaccine Market for Pediatric, 2021 - 2034 (USD Billion)

6.6. Adult

6.6.1. Vaccine Market for Adult, 2021 - 2034 (USD Billion)

Chapter 7. Distribution Channel Business Analysis

7.1. Distribution Channel Market Share, 2024 & 2034

7.2. Segment Dashboard

7.3. Vaccines Market by Distribution Channel Outlook

7.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

7.5. Hospital & Retail Pharmacies

7.5.1. Vaccine Market for Hospital & Retail Pharmacies, 2021 - 2034 (USD Billion)

7.6. Government Suppliers

7.6.1. Vaccine Market for Government Suppliers 2021 - 2034 (USD Billion)

7.7. Others

7.7.1. Vaccine Market for Others, 2021 - 2034 (USD Billion)

Chapter 8. Regional Business Analysis

8.1. Vaccine Market Share By Region, 2024 & 2034

8.2. North America

8.2.1. North America Vaccines Market 2021 - 2034 (USD Billion)

8.2.2. U.S.

8.2.2.1. Key Country Dynamics

8.2.2.2. Target Disease Prevalence

8.2.2.3. Competitive Scenario

8.2.2.4. Regulatory Framework

8.2.2.5. Reimbursement Scenario

8.2.2.6. U.S. Vaccine Market 2021 - 2034 (USD Billion)

8.2.3. Canada

8.2.3.1. Key Country Dynamics

8.2.3.2. Target Disease Prevalence

8.2.3.3. Competitive Scenario

8.2.3.4. Regulatory Framework

8.2.3.5. Reimbursement Scenario

8.2.3.6. Canada Vaccine Market 2021 - 2034 (USD Billion)

8.3. Europe

8.3.1. Europe Vaccines Market 2021 - 2034 (USD Billion)

8.3.2. Germany

8.3.2.1. Key Country Dynamics

8.3.2.2. Target Disease Prevalence

8.3.2.3. Competitive Scenario

8.3.2.4. Regulatory Framework

8.3.2.5. Reimbursement Scenario

8.3.2.6. Germany Vaccine Market 2021 - 2034 (USD Billion)

8.3.3. UK

8.3.3.1. Key Country Dynamics

8.3.3.2. Target Disease Prevalence

8.3.3.3. Competitive Scenario

8.3.3.4. Regulatory Framework

8.3.3.5. Reimbursement Scenario

8.3.3.6. UK Vaccine Market 2021 - 2034 (USD Billion)

8.3.4. France

8.3.4.1. Key Country Dynamics

8.3.4.2. Target Disease Prevalence

8.3.4.3. Competitive Scenario

8.3.4.4. Regulatory Framework

8.3.4.5. Reimbursement Scenario

8.3.4.6. France Vaccine Market 2021 - 2034 (USD Billion)

8.3.5. Italy

8.3.5.1. Key Country Dynamics

8.3.5.2. Target Disease Prevalence

8.3.5.3. Competitive Scenario

8.3.5.4. Regulatory Framework

8.3.5.5. Reimbursement Scenario

8.3.5.6. Italy Vaccine Market 2021 - 2034 (USD Billion)

8.3.6. Spain

8.3.6.1. Key Country Dynamics

8.3.6.2. Target Disease Prevalence

8.3.6.3. Competitive Scenario

8.3.6.4. Regulatory Framework

8.3.6.5. Reimbursement Scenario

8.3.6.6. Spain Vaccine Market 2021 - 2034 (USD Billion)

8.3.7. Denmark

8.3.7.1. Key Country Dynamics

8.3.7.2. Target Disease Prevalence

8.3.7.3. Competitive Scenario

8.3.7.4. Regulatory Framework

8.3.7.5. Reimbursement Scenario

8.3.7.6. Denmark Vaccine Market 2021 - 2034 (USD Billion)

8.3.8. Sweden

8.3.8.1. Key Country Dynamics

8.3.8.2. Target Disease Prevalence

8.3.8.3. Competitive Scenario

8.3.8.4. Regulatory Framework

8.3.8.5. Reimbursement Scenario

8.3.8.6. Sweden Vaccine Market 2021 - 2034 (USD Billion)

8.3.9. Norway

8.3.9.1. Key Country Dynamics

8.3.9.2. Target Disease Prevalence

8.3.9.3. Competitive Scenario

8.3.9.4. Regulatory Framework

8.3.9.5. Reimbursement Scenario

8.3.9.6. Norway Vaccine Market 2021 - 2034 (USD Billion)

8.4. Asia Pacific

8.4.1. Asia Pacific Vaccine Market, 2021 - 2034 (USD Billion)

8.4.2. Japan

8.4.2.1. Key Country Dynamics

8.4.2.2. Target Disease Prevalence

8.4.2.3. Competitive Scenario

8.4.2.4. Regulatory Framework

8.4.2.5. Reimbursement Scenario

8.4.2.6. Japan Vaccine Market 2021 - 2034 (USD Billion)

8.4.3. China

8.4.3.1. Key Country Dynamics

8.4.3.2. Target Disease Prevalence

8.4.3.3. Competitive Scenario

8.4.3.4. Regulatory Framework

8.4.3.5. Reimbursement Scenario

8.4.3.6. China Vaccine Market 2021 - 2034 (USD Billion)

8.4.4. India

8.4.4.1. Key Country Dynamics

8.4.4.2. Target Disease Prevalence

8.4.4.3. Competitive Scenario

8.4.4.4. Regulatory Framework

8.4.4.5. Reimbursement Scenario

8.4.4.6. India Vaccine Market 2021 - 2034 (USD Billion)

8.4.5. South Korea

8.4.5.1. Key Country Dynamics

8.4.5.2. Target Disease Prevalence

8.4.5.3. Competitive Scenario

8.4.5.4. Regulatory Framework

8.4.5.5. Reimbursement Scenario

8.4.5.6. South Korea Vaccine Market 2021 - 2034 (USD Billion)

8.4.6. Australia

8.4.6.1. Key Country Dynamics

8.4.6.2. Target Disease Prevalence

8.4.6.3. Competitive Scenario

8.4.6.4. Regulatory Framework

8.4.6.5. Reimbursement Scenario

8.4.6.6. Australia Vaccine Market 2021 - 2034 (USD Billion)

8.4.7. Thailand

8.4.7.1. Key Country Dynamics

8.4.7.2. Target Disease Prevalence

8.4.7.3. Competitive Scenario

8.4.7.4. Regulatory Framework

8.4.7.5. Reimbursement Scenario

8.4.7.6. Thailand Vaccine Market 2021 - 2034 (USD Billion)

8.5. Latin America

8.5.1. Latin America Vaccine Market, 2021 - 2034 (USD Billion)

8.5.2. Brazil

8.5.2.1. Key Country Dynamics

8.5.2.2. Target Disease Prevalence

8.5.2.3. Competitive Scenario

8.5.2.4. Regulatory Framework

8.5.2.5. Reimbursement Scenario

8.5.2.6. Brazil Vaccine Market 2021 - 2034 (USD Billion)

8.5.3. Mexico

8.5.3.1. Key Country Dynamics

8.5.3.2. Target Disease Prevalence

8.5.3.3. Competitive Scenario

8.5.3.4. Regulatory Framework

8.5.3.5. Reimbursement Scenario

8.5.3.6. Mexico Vaccine Market 2021 - 2034 (USD Billion)

8.5.4. Argentina

8.5.4.1. Key Country Dynamics

8.5.4.2. Target Disease Prevalence

8.5.4.3. Competitive Scenario

8.5.4.4. Regulatory Framework

8.5.4.5. Reimbursement Scenario

8.5.4.6. Argentina Vaccine Market 2021 - 2034 (USD Billion)

8.6. MEA

8.6.1. MEA Vaccine Market, 2021 - 2034 (USD Billion)

8.6.2. South Africa

8.6.2.1. Key Country Dynamics

8.6.2.2. Target Disease Prevalence

8.6.2.3. Competitive Scenario

8.6.2.4. Regulatory Framework

8.6.2.5. Reimbursement Scenario

8.6.2.6. South Africa Vaccine Market 2021 - 2034 (USD Billion)

8.6.3. Saudi Arabia

8.6.3.1. Key Country Dynamics

8.6.3.2. Target Disease Prevalence

8.6.3.3. Competitive Scenario

8.6.3.4. Regulatory Framework

8.6.3.5. Reimbursement Scenario

8.6.3.6. Saudi Arabia Vaccine Market 2021 - 2034 (USD Billion)

8.6.4. UAE

8.6.4.1. Key Country Dynamics

8.6.4.2. Target Disease Prevalence

8.6.4.3. Competitive Scenario

8.6.4.4. Regulatory Framework

8.6.4.5. Reimbursement Scenario

8.6.4.6. UAE Vaccine Market 2021 - 2034 (USD Billion)

8.6.5. Kuwait

8.6.5.1. Key Country Dynamics

8.6.5.2. Target Disease Prevalence

8.6.5.3. Competitive Scenario

8.6.5.4. Regulatory Framework

8.6.5.5. Reimbursement Scenario

8.6.5.6. Kuwait Vaccine Market 2021 - 2034 (USD Billion)

Chapter 9. Competitive Landscape

9.1. Participant’s overview

9.2. Financial performance

9.3. Participant categorization

9.3.1. Market Leaders

9.3.2. Vaccine Market Share Analysis, 2023

9.3.3. Company Profiles

9.3.3.1. Serum Institute of India Pvt. Ltd.

9.3.3.1.1. Company Overview

9.3.3.1.2. Financial Performance

9.3.3.1.3. Product Benchmarking

9.3.3.1.4. Strategic Initiatives

9.3.3.2. Seqirus

9.3.3.2.1. Company Overview

9.3.3.2.2. Financial Performance

9.3.3.2.3. Product Benchmarking

9.3.3.2.4. Strategic Initiatives

9.3.3.3. Sanofi

9.3.3.3.1. Company Overview

9.3.3.3.2. Financial Performance

9.3.3.3.3. Product Benchmarking

9.3.3.3.4. Strategic Initiatives

9.3.3.4. GSK Plc.

9.3.3.4.1. Company Overview

9.3.3.4.2. Financial Performance

9.3.3.4.3. Product Benchmarking

9.3.3.4.4. Strategic Initiatives

9.3.3.5. Merck & Co., Inc.

9.3.3.5.1. Company Overview

9.3.3.5.2. Financial Performance

9.3.3.5.3. Product Benchmarking

9.3.3.5.4. Strategic Initiatives

9.3.3.6. Pfizer Inc.

9.3.3.6.1. Company Overview

9.3.3.6.2. Financial Performance

9.3.3.6.3. Product Benchmarking

9.3.3.6.4. Strategic Initiatives

9.3.3.7. Moderna Inc.

9.3.3.7.1. Company Overview

9.3.3.7.2. Financial Performance

9.3.3.7.3. Product Benchmarking

9.3.3.7.4. Strategic Initiatives

9.3.3.8. Sinovac

9.3.3.8.1. Company Overview

9.3.3.8.2. Financial Performance

9.3.3.8.3. Product Benchmarking

9.3.3.8.4. Strategic Initiatives

9.3.3.9. BioNTech SE

9.3.3.9.1. Company Overview

9.3.3.9.2. Financial Performance

9.3.3.9.3. Product Benchmarking

9.3.3.9.4. Strategic Initiatives

9.3.3.10. AstraZeneca

9.3.3.10.1. Company Overview

9.3.3.10.2. Financial Performance

9.3.3.10.3. Product Benchmarking

9.3.3.10.4. Strategic Initiatives

9.3.4. Strategy Mapping

9.3.4.1. Expansion

9.3.4.2. Acquisition

9.3.4.3. Collaborations

9.3.4.4. Product/Service Launch

9.3.4.5. Partnerships

9.3.4.6. Others