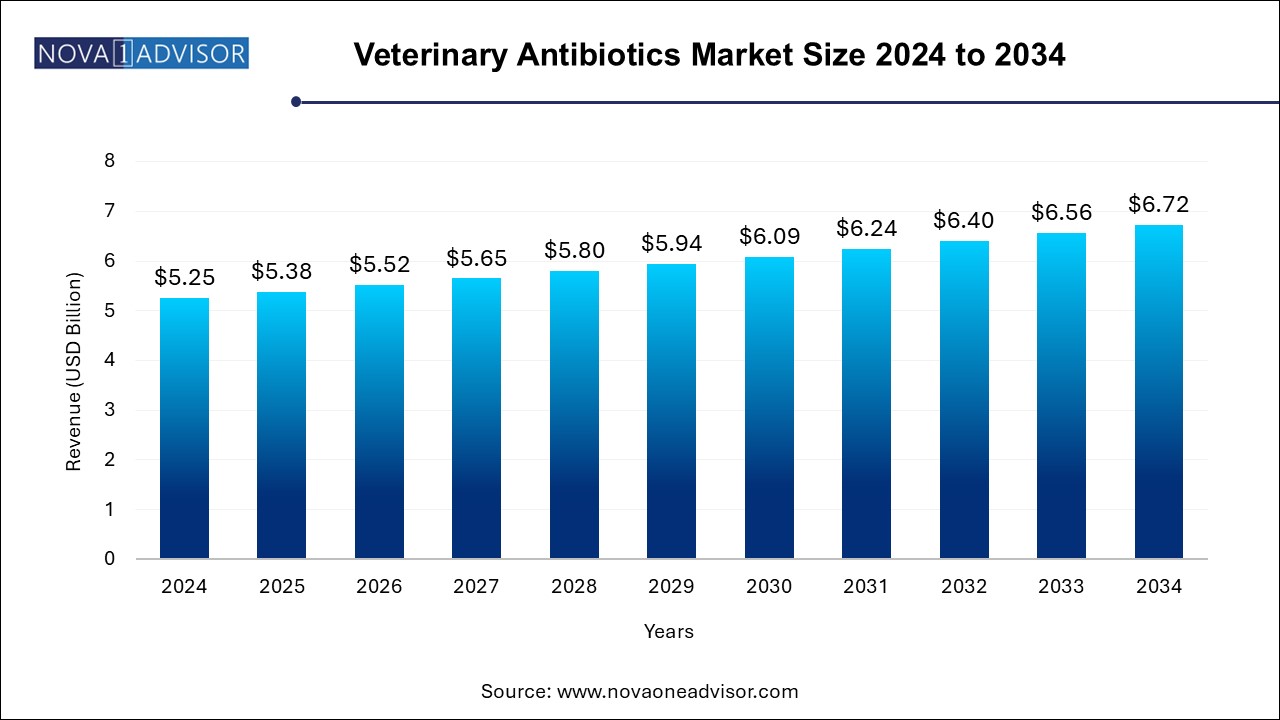

The veterinary antibiotics market size was exhibited at USD 5.25 billion in 2024 and is projected to hit around USD 6.72 billion by 2034, growing at a CAGR of 2.5% during the forecast period 2024 to 2034.

The veterinary antibiotics market plays a vital role in the global animal healthcare ecosystem, supporting disease prevention, treatment, and overall livestock productivity. Veterinary antibiotics are widely used to control infectious diseases caused by bacteria among both companion and livestock animals. With the growth in the global population and the subsequent rise in demand for animal-based food products such as meat, milk, and eggs, veterinary antibiotics have emerged as an indispensable tool to maintain animal health and sustain large-scale livestock production.

Moreover, advancements in animal farming practices, increased awareness about zoonotic diseases, and a stronger emphasis on biosecurity in animal husbandry have further propelled the demand for efficient antibiotic therapies. Livestock health directly impacts food safety and economic stability in agrarian economies. According to the Food and Agriculture Organization (FAO), livestock contributes to nearly 40% of global agricultural output, making animal disease management a priority. Consequently, antibiotics have become a cornerstone of veterinary care globally.

Despite facing regulatory scrutiny over antimicrobial resistance (AMR), the market continues to evolve through innovation in formulation, drug delivery, and species-specific treatments. Veterinary antibiotic usage is increasingly being monitored, with stricter laws and stewardship programs being implemented globally to curb misuse. Still, the sustained necessity for effective therapies, especially in developing countries, ensures ongoing market opportunities.

In the coming years, the market is expected to witness stable growth, driven by the balance between responsible usage and the need for disease control. The expansion of animal husbandry in Asia and Africa, technological integration in veterinary diagnostics, and the rising demand for high-quality animal protein will significantly influence market dynamics.

Increased Regulation and Antimicrobial Stewardship Programs

Regulatory bodies globally are enforcing tighter controls on the use of antibiotics in animals to mitigate antimicrobial resistance and preserve public health.

Shift Toward Narrow-Spectrum Antibiotics

Manufacturers and veterinarians are prioritizing narrow-spectrum formulations to target specific pathogens and minimize the risk of resistance.

Technological Integration in Veterinary Diagnostics

Point-of-care diagnostics and rapid bacterial identification systems are being adopted to enable targeted antibiotic therapy in animals.

Growth in Companion Animal Healthcare Spending

Urbanization and pet humanization are increasing the demand for veterinary antibiotics in companion animals, especially in North America and Europe.

Innovation in Drug Delivery Systems

Novel dosage forms, including long-acting injectables and palatable oral formulations, are improving compliance and therapeutic outcomes.

Rising Popularity of Organic and Antibiotic-Free Meat

Growing consumer demand for antibiotic-free animal products is reshaping livestock practices and encouraging the use of alternative treatments.

Expansion in Emerging Markets

Governments in Asia and Africa are investing in veterinary infrastructure, driving increased accessibility to veterinary pharmaceuticals, including antibiotics.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.38 Billion |

| Market Size by 2034 | USD 6.72 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 2.5% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Animal Type, Drug Class, Dosage Form, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Merck & Co., Inc.; Ceva Santé Animale; Vetoquinol; Zoetis Services LLC; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Elanco Animal Health Incorporated; Virbac S.A.; Calier; Bimeda, Inc.; Prodivet pharmaceuticals SA/NV; Norbrook Laboratories |

A key factor propelling the growth of the veterinary antibiotics market is the surge in global demand for animal-derived food, including meat, milk, and eggs. As per the OECD-FAO Agricultural Outlook, global meat consumption is expected to rise by over 12% by 2030, driven by economic development, population growth, and dietary shifts in emerging economies. This upsurge necessitates the maintenance of large-scale, disease-free livestock populations to ensure food security and quality.

To meet these demands, farmers are increasingly relying on antibiotics to prevent outbreaks, reduce mortality, and enhance growth rates in production animals such as poultry, cattle, and pigs. For instance, in countries like Brazil and India, the integration of veterinary antibiotics in herd management protocols has significantly improved livestock yields. Without effective antimicrobial therapy, diseases like bovine respiratory disease (BRD) and swine dysentery can devastate animal populations, leading to economic losses and food shortages.

While antibiotics are indispensable in veterinary care, their excessive and inappropriate use has given rise to antimicrobial resistance (AMR), a major global health challenge. Resistant bacterial strains compromise the efficacy of standard treatments, making infections harder to treat in both animals and humans. The World Health Organization (WHO) and the World Organisation for Animal Health (WOAH) have consistently warned about the transfer of resistant bacteria from animals to humans through food chains and direct contact.

Governments worldwide are enacting stringent legislation to reduce antibiotic use in livestock. For example, the European Union banned the use of antibiotics as growth promoters in 2006, and similar regulations have been enforced in the United States, including restrictions on medically important antibiotics. These restrictions, though necessary, limit the use of some widely adopted antibiotics, creating uncertainty in the market and forcing companies to invest in alternative therapies and novel drug classes.

A significant opportunity lies in the rapid expansion of veterinary services in emerging markets, particularly in Asia Pacific, Latin America, and parts of Africa. These regions are experiencing an agricultural transformation marked by an increase in commercial farming, animal exports, and government-funded livestock development programs. However, disease outbreaks remain prevalent due to poor veterinary infrastructure, lack of awareness, and limited access to treatments.

International organizations, including FAO and the World Bank, are supporting veterinary public health projects in these regions. For example, India's National Animal Disease Control Programme (NADCP), launched in 2019, aims to eradicate foot-and-mouth disease and brucellosis through mass vaccinations and healthcare access. Such initiatives boost the market potential for antibiotic products, especially long-acting formulations and broad-spectrum drugs suited for field conditions. Market entrants focusing on affordability and localization stand to benefit significantly.

The cattle segment held the dominant market share of 39.69% in 2024. Cattle diseases such as mastitis, metritis, and BRD require consistent antibiotic intervention to avoid productivity loss. Developed regions like North America and Europe extensively use injectable and intramammary antibiotics in dairy cattle, while emerging economies are rapidly integrating antibiotic protocols into organized dairy cooperatives. The global demand for milk, forecast to reach nearly 1 billion metric tons by 2030, necessitates robust disease management, solidifying cattle as the leading segment.

The poultry segment is the fastest-growing, driven by the rising global consumption of chicken meat and eggs, which is more cost-effective compared to other animal protein sources. Poultry farming, especially in Asia Pacific, has seen unprecedented industrialization, leading to dense stocking practices that heighten disease transmission. To combat conditions such as necrotic enteritis and salmonellosis, broad-spectrum antibiotics are widely used. The shorter lifecycle of poultry makes it ideal for continuous antimicrobial management, driving higher demand and innovation in feed-integrated and water-soluble antibiotic solutions.

The tetracyclines segment dominated the veterinary antibiotics market in 2024 with a share of 29.04%. They are effective against a wide range of gram-positive and gram-negative bacteria and are commonly employed in treating respiratory, urinary, and gastrointestinal infections. Their versatile application and over-the-counter availability in many developing countries further support their extensive usage. Moreover, generic competition has driven prices down, making them a go-to choice in resource-limited settings.

Fluoroquinolones are among the fastest-growing drug classes, offering superior efficacy in treating complicated infections, particularly respiratory diseases in cattle and swine. Their rapid bactericidal action and favorable pharmacokinetics make them a preferred option for veterinarians. With increasing bacterial resistance against older antibiotics, fluoroquinolones are being explored as alternative treatments, especially in Asia and South America. Products like enrofloxacin and marbofloxacin have gained popularity, although their use is closely monitored due to concerns about cross-resistance in human medicine.

The oral solutions segment dominated the market share of 50.0% in 2024. Intramuscular and subcutaneous injections are particularly favored in cattle and pigs for diseases like pneumonia, enteritis, and mastitis. Long-acting injectable formulations reduce the need for repeated dosing and are ideal for large-scale farming. Products like long-acting oxytetracycline and penicillin G are widely used in herd management and veterinary hospital settings, making injectable forms the mainstay of treatment.

The other segment is anticipated to grow at the fastest CAGR over the forecast period. Their ease of administration, especially in flocks or herds, has led to their rising adoption in emerging economies. These formulations are ideal for integrating into automated feeding and watering systems, minimizing labor and ensuring uniform drug distribution. Companies are also improving palatability and bioavailability, encouraging further adoption in small ruminants and pets.

The veterinary antibiotics market in North America accounted for the largest revenue share of 32.37% in 2024. The U.S. Department of Agriculture (USDA) enforces strict animal health regulations, ensuring the widespread adoption of antimicrobial stewardship programs. Livestock producers in the U.S. and Canada rely on a structured supply chain of antibiotics regulated by veterinary oversight. Major cattle and pig farming operations in Texas, Iowa, and Alberta are significant antibiotic consumers.

Moreover, the region’s thriving pet care market contributes to demand from the companion animal segment. High awareness among pet owners, coupled with pet insurance coverage, has increased access to antibiotic treatments for conditions like skin infections and periodontal disease. Companies like Zoetis and Elanco dominate product development and distribution, further reinforcing North America's dominance.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is the fastest-growing region due to rapid agricultural industrialization, increasing meat consumption, and government focus on animal disease control. China and India are the world's top meat producers, and the need to protect livestock health drives the uptake of veterinary pharmaceuticals. However, unregulated antibiotic usage and lack of veterinarian accessibility in rural regions have also been prevalent, prompting stricter guidelines and new investment in veterinary services.

Countries such as Vietnam, Indonesia, and Bangladesh are also showing increased antibiotic use in poultry and aquaculture sectors. International partnerships and funding for disease eradication campaigns, combined with economic incentives for livestock producers, are creating fertile ground for market growth. The expansion of local generic drug manufacturers has also made antibiotics more accessible to smallholder farmers.

March 2025: Elanco Animal Health announced the launch of a new long-acting injectable oxytetracycline formulation targeting respiratory infections in cattle and pigs, with enhanced tissue penetration and compliance benefits.

January 2025: Zoetis acquired a majority stake in a South Korean veterinary drug manufacturer, expanding its presence in the Asia Pacific market and enhancing access to its antibiotic portfolio.

November 2024: Boehringer Ingelheim Animal Health partnered with a Kenyan veterinary NGO to supply antibiotics and conduct training workshops aimed at reducing livestock mortality in East Africa.

August 2024: Ceva Santé Animale introduced an oral antibiotic solution for poultry in India, optimized for hot climates and mass administration via waterlines.

June 2024: Phibro Animal Health Corporation opened a new manufacturing unit in Brazil to locally produce veterinary antibiotics and serve the Latin American livestock sector more effectively.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary antibiotics market

Animal Type

Drug Class

Dosage Form

Regional