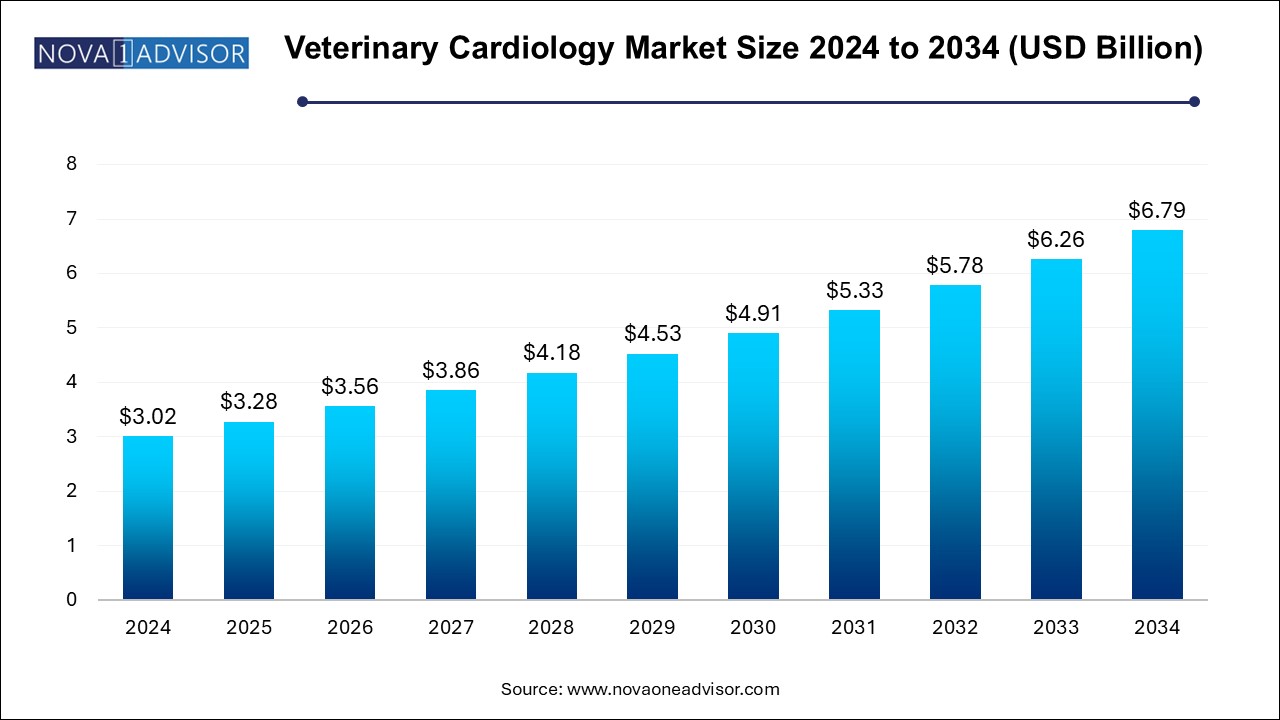

The veterinary cardiology market size was exhibited at USD 3.02 billion in 2024 and is projected to hit around USD 6.79 billion by 2034, growing at a CAGR of 8.42% during the forecast period 2025 to 2034.

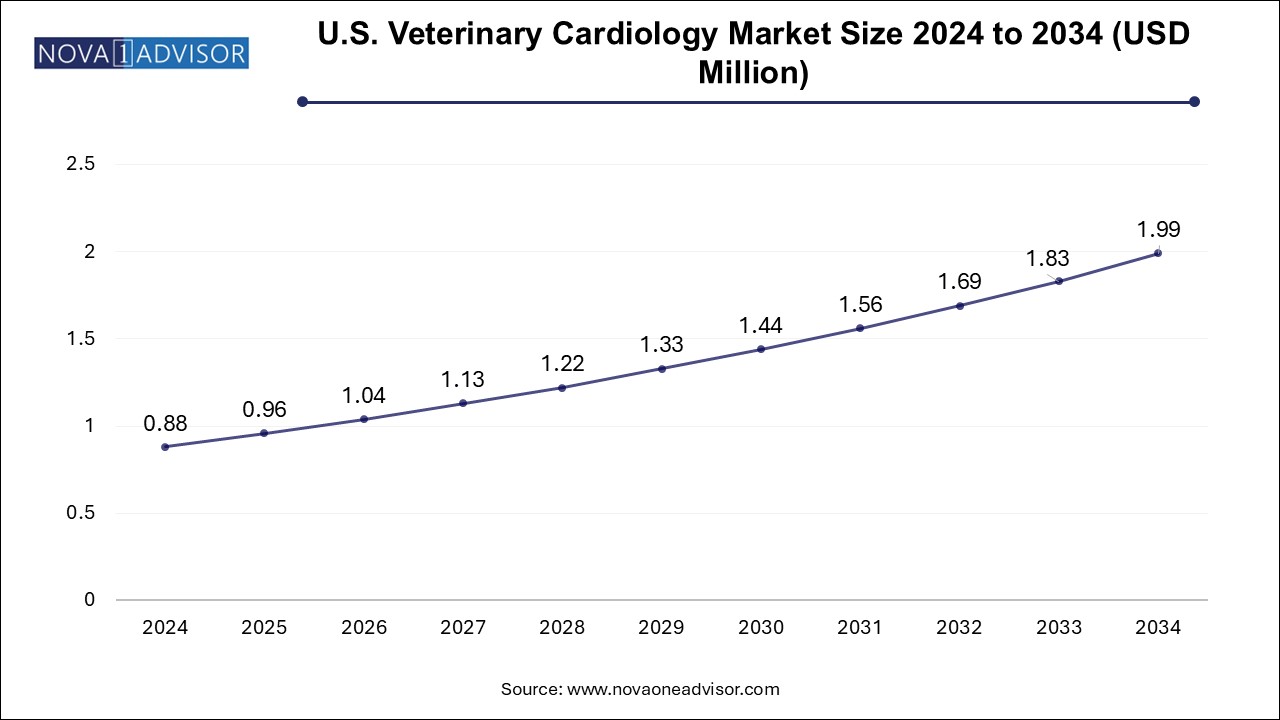

The U.S. veterinary cardiology market size is evaluated at USD 0.88 million in 2024 and is projected to be worth around USD 1.99 million by 2034, growing at a CAGR of 7.69% from 2025 to 2034.

North America dominated the veterinary cardiology market in 2024, primarily driven by the U.S. The region benefits from a high rate of pet ownership, a well-established veterinary infrastructure, and strong insurance coverage for animals. Leading academic and private veterinary hospitals in the U.S. and Canada have dedicated cardiology departments, offering advanced diagnostics and treatment protocols. The presence of key pharmaceutical players and a strong emphasis on pet wellness also contribute to this dominance. Additionally, frequent clinical trials and FDA approvals of veterinary cardiac drugs bolster the region's leadership position.

Asia Pacific is expected to be the fastest-growing region, propelled by rising awareness, increasing disposable income, and improving veterinary care. In countries like China, India, and Japan, rapid urbanization has led to a surge in pet adoption and healthcare spending. Pet clinics are modernizing and offering services that were once limited to referral centers. Moreover, government initiatives supporting veterinary education and telehealth programs are improving access in rural and tier-2 cities. The entry of global players through partnerships and localized manufacturing is also making diagnostics and pharmaceuticals more affordable and available.

The veterinary cardiology market is steadily expanding, driven by the increasing awareness of cardiac diseases in animals and advancements in veterinary healthcare. Cardiology in veterinary medicine involves the diagnosis and treatment of heart-related conditions in both companion and production animals. Similar to human cardiology, this discipline includes the use of pharmaceuticals, diagnostic imaging, and interventional techniques tailored for animal physiology. The rise in pet ownership, especially in urban settings, and the humanization of pets has led to a higher demand for specialized veterinary services, including cardiology.

Cardiac diseases such as congestive heart failure, myocardial disease, and arrhythmias are now commonly diagnosed in dogs, cats, and even horses. Innovations in diagnostics, including portable ECG and digital radiography, have made it easier for veterinarians to detect cardiac anomalies early. Pharmaceutical options such as pimobendan, spironolactone, and benazepril hydrochloride are gaining widespread usage, supported by clinical trials and approvals. With growing investments in animal healthcare infrastructure and increasing expenditure per pet, the market for veterinary cardiology services and products has become a significant subset of the broader veterinary healthcare landscape.

Veterinary cardiology is no longer limited to academic or referral centers. General practitioners are increasingly adopting cardiology diagnostics and therapeutics due to improved accessibility and training. Telemedicine, wearable monitors for pets, and AI-driven diagnostics are entering the market, enabling precise and personalized treatment. As the industry matures, the integration of cross-disciplinary technologies, combined with rising demand in emerging economies, is setting the stage for sustainable market expansion over the forecast period.

Rise in Pet Humanization: Owners increasingly consider pets as family members, leading to higher investment in specialized cardiac care.

Increased Prevalence of Heart Conditions in Companion Animals: Mitral valve disease in dogs and hypertrophic cardiomyopathy in cats are being reported more frequently, fueling diagnostics and treatment demand.

Advances in Veterinary Diagnostic Imaging: Portable ultrasound, ECG, and 3D echocardiography tools are now available for veterinary applications, enabling precise diagnosis.

Growing Demand for Targeted Pharmaceuticals: Formulations like pimobendan and combination therapies are being developed specifically for animal cardiology, enhancing treatment efficacy.

Expansion of Veterinary Telemedicine: Remote cardiology consultations and cloud-based diagnostic platforms are increasingly used in rural and underdeveloped regions.

Emergence of AI and Wearables in Veterinary Cardiology: Wearable ECG and heart monitors for pets are being developed to enable continuous monitoring.

Increasing Veterinary Training and Continuing Education: Veterinary cardiology specialization is gaining popularity in academic institutions and private practice settings.

Collaborations Between Veterinary Clinics and Pharma Companies: Joint efforts to pilot new drugs and devices in real-world clinical settings are becoming more common.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.28 Billion |

| Market Size by 2034 | USD 6.79 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.42% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Animal Type, Product, Indication, End use, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Boehringer Ingelheim International GmbH; Jurox Pty Limited; Ceva; Merck & Co., Inc.; IDEXX; Apex Bio Medical; SOUND; General Electric Company; FUJIFILM Holdings America Corporation; ESAOTE SPA |

Growing Companion Animal Ownership and Cardiac Awareness

A primary driver of the veterinary cardiology market is the global increase in companion animal ownership, particularly in developed and urbanizing regions. With this rise comes greater attention to chronic health conditions, including cardiovascular diseases. As pet parents become more informed through social media and veterinary advice, they are more likely to seek treatment for conditions like congestive heart failure or arrhythmias, which were historically underdiagnosed in animals.

According to the American Pet Products Association (APPA), the U.S. pet industry expenditure reached nearly $140 billion in 2024, with a growing portion attributed to veterinary services. Within that, cardiology is carving a niche due to better diagnostics, pharmaceutical accessibility, and longer pet life expectancy. Early screening programs and targeted therapies are further contributing to demand. Ultimately, emotional attachment and willingness to spend for pets’ well-being are sustaining growth in the companion animal cardiology segment.

High Cost and Limited Access to Specialized Veterinary Services

Despite the advancements and increasing demand, the high cost of veterinary cardiology services acts as a barrier, especially in lower-income and rural regions. Diagnostic tests such as echocardiograms, ECGs, and chest X-rays, along with ongoing pharmaceutical treatments, can result in significant cumulative costs. Unlike human healthcare, insurance coverage for pet health is still relatively limited, especially in emerging markets.

Moreover, veterinary cardiologists are not uniformly distributed across geographies. Specialized training is required to perform and interpret cardiac diagnostics, which many general practitioners may lack. This leads to referral delays and reduced access to timely intervention. Even when cardiology care is available, pet owners may be hesitant due to cost concerns or lack of understanding of the disease's severity, thereby limiting market penetration in several regions.

Emerging Demand in Asia Pacific and Latin American Markets

The untapped potential in Asia Pacific and Latin America offers a significant opportunity for market players. Urbanization, rising disposable income, and a cultural shift toward companion animal care are creating fertile ground for veterinary healthcare development. Countries such as China, India, Brazil, and Mexico are witnessing an increase in veterinary clinics, hospital chains, and pet care startups offering diagnostics and treatment at competitive costs.

Furthermore, international veterinary pharmaceutical firms are increasingly entering partnerships with regional distributors to expand their footprint. Education campaigns by NGOs and professional bodies are raising awareness of animal cardiovascular health. These trends, along with government support in veterinary infrastructure, offer a promising outlook for companies willing to localize their offerings and invest in veterinarian training in emerging markets.

The Dogs dominated the companion animal segment in 2024, holding the largest share due to the high incidence of cardiac diseases such as myxomatous mitral valve disease (MMVD), especially in small and aged dog breeds. MMVD alone accounts for over 70% of heart disease cases in dogs, particularly in breeds like Cavalier King Charles Spaniels and Dachshunds. The availability of dog-specific cardiac medications and breed-specific screening guidelines has further enabled early intervention and ongoing management. Pharmaceutical therapies such as pimobendan and ACE inhibitors are commonly prescribed for dogs, bolstering the demand in this subsegment.

Cats are projected to be the fastest-growing segment within the companion animals group. Hypertrophic cardiomyopathy (HCM) is increasingly being detected in felines, particularly through advanced echocardiography and regular veterinary checkups. With greater awareness and technological improvement, silent heart conditions in cats are being diagnosed earlier than ever. Veterinary cardiologists are now tailoring therapies for feline-specific responses, considering their unique physiological sensitivities. Pet owners are also becoming more proactive about feline health, including cardiac wellness, which is expected to further drive this market segment in the coming years.

The Pharmaceuticals dominated the veterinary cardiology market in 2024, driven by widespread use of established drugs like pimobendan and combination therapies involving spironolactone and benazepril hydrochloride. These medications improve cardiac function, delay disease progression, and enhance quality of life. Pimobendan, in particular, is a cornerstone therapy for treating congestive heart failure in dogs. Increasing R&D investments have led to improved formulations and extended-release options, making compliance easier for pet owners. The availability of generics in select markets has also helped expand access and boost volume.

Diagnostics are the fastest-growing product segment, supported by growing investment in veterinary imaging and non-invasive testing. Diagnostic tools such as ECGs, echocardiography, and chest X-rays are being routinely used not only by specialists but also by general veterinary practitioners. The adoption of portable, point-of-care ultrasound machines and AI-powered interpretation platforms is transforming cardiac diagnostics in animals. Additionally, pet insurance penetration in developed markets has made these diagnostics more affordable for owners, thus accelerating adoption.

The Congestive Heart Failure (CHF) led the indication segment in 2024, as it represents a common final manifestation of many underlying cardiac conditions in animals. CHF in dogs is frequently linked to MMVD, while in cats, it may result from HCM. The clinical management of CHF requires a combination of diagnostics, long-term medication, and dietary adjustments. CHF cases also generate recurring revenue for veterinary clinics and pharmaceutical companies due to ongoing treatment and monitoring needs. As pets are living longer, age-related CHF is becoming more prevalent, reinforcing its dominant market position.

Arrhythmias are emerging as the fastest-growing indication, thanks to increased screening and advancements in ECG technology. Cardiac arrhythmias are being detected more frequently due to wearable monitors and ambulatory diagnostic devices used in both clinical and at-home settings. Certain breeds are genetically predisposed to arrhythmias, and genetic screening is further improving diagnostic accuracy. With novel antiarrhythmic drugs under development and expanding veterinary cardiologist networks, this segment is set to experience rapid growth.

Veterinary Hospitals & Clinics dominated the market by end use, due to their access to specialized diagnostic tools, experienced personnel, and infrastructure for complex treatments. Most cardiac diagnostics, including echocardiograms and ECGs, are administered in clinical settings. Veterinary hospitals often have partnerships with pharmaceutical companies and diagnostics equipment manufacturers, enabling them to offer advanced care. Additionally, hospitals act as referral centers for severe cardiac cases, particularly in urban and semi-urban areas.

Others (including mobile vet units and independent practices) are showing the fastest growth, driven by rising demand for accessible and home-based cardiac care. Independent clinics are investing in portable diagnostic devices and teleconsultation platforms to cater to underserved regions. As these players become more capable of managing basic cardiac conditions and screenings, their role in expanding the overall market becomes more prominent, especially in emerging economies.

The Hospital/Clinic Pharmacies led the distribution segment, largely due to the immediate need for cardiac medications post-diagnosis. Vets typically prescribe and dispense drugs directly, ensuring proper usage and compliance. In-clinic pharmacies also provide convenience for pet owners, fostering loyalty and better follow-up care. Regulations in many countries also favor prescriptions being filled at the point of care, strengthening this channel’s dominance.

E-Commerce is the fastest-growing distribution channel, reflecting global shifts toward online pet care solutions. Online platforms offer home delivery of cardiac medications and diagnostics, along with automated refill systems. As tech-savvy pet owners prioritize convenience and cost-efficiency, this segment is poised to grow significantly. In regions with limited veterinary infrastructure, e-commerce is also enabling wider access to vital cardiac drugs and monitoring tools.

In February 2025, Boehringer Ingelheim received conditional FDA approval for a new formulation of pimobendan designed for improved absorption in small dog breeds.

In December 2024, Vetoquinol launched an AI-based ECG diagnostic platform tailored for veterinary clinics across Europe and North America.

In October 2024, Zoetis partnered with a leading Asian distributor to expand access to benazepril hydrochloride in emerging markets.

In August 2024, IDEXX Laboratories unveiled a new wearable heart monitor for dogs and cats, with real-time cloud-based diagnostics and alerts for arrhythmias.

In May 2024, Elanco Animal Health announced a collaborative study with Cornell University on genetic markers for feline hypertrophic cardiomyopathy.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary cardiology market

By Animal Type

By Product

By Indication

By End Use

By Distribution Channel

By Regional