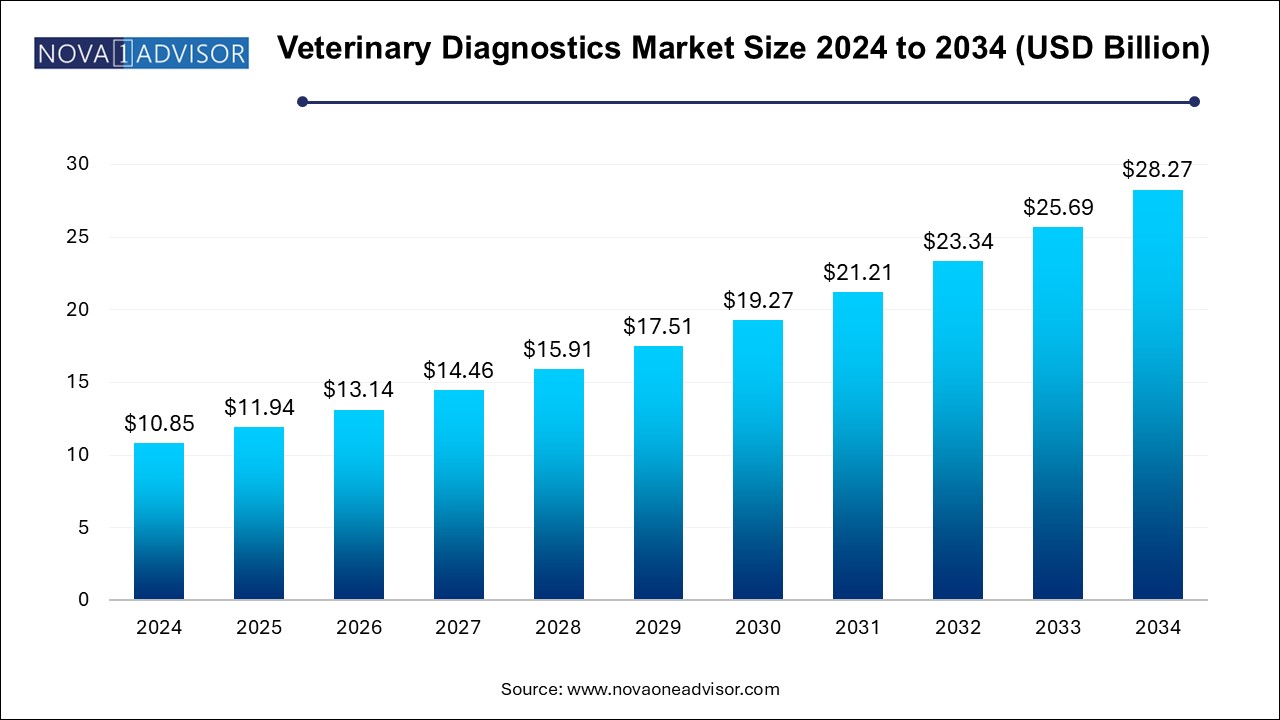

The veterinary diagnostics market size was exhibited at USD 10.85 billion in 2024 and is projected to hit around USD 28.27 billion by 2034, growing at a CAGR of 10.05% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 11.94 Billion |

| Market Size by 2034 | USD 28.27 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 10.05% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Testing Category, Animal Type, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Virbac; FUJIFILM Corporation |

Some of the key factors accounting for market growth include increased expenditure on animal health, rising incidence of diseases in animals, advancements in diagnostics, and growing medicalization rate. In September 2024, Zoetis launched Vetscan OptiCell, an AI-powered, cartridge-based hematology analyzer to deliver lab-quality CBC analysis at the point of care. This innovation offers enhanced diagnostic accuracy, efficiency, and a compact design. It will debut at the London Vet Show in November 2024.

Continuous advancements in veterinary diagnostic technologies, including molecular diagnostics, imaging modalities, and point-of-care testing, have significantly expanded the capabilities of diagnosing animal diseases. These innovations enhance the accuracy and speed of diagnostics and contribute to the overall market growth as veterinarians and pet owners seek state-of-the-art solutions for comprehensive healthcare.Developing and adopting point-of-care diagnostic tools that provide rapid and on-site results has become a significant driver. These tools allow for quick decision-making in veterinary practices, enabling timely and efficient treatment, which is crucial for the health outcomes of animals.

The rise in animal infectious diseases, including zoonotic diseases, has emphasized the need for accurate and timely diagnostics. Veterinary diagnostic products are crucial in identifying and managing diseases, enabling prompt treatment, and preventing the spread of infections.As with humans, animals are susceptible to chronic and age-related conditions. The aging pet population, coupled with an increased focus on preventive healthcare, drives the demand for diagnostics that can aid in the early detection and management of conditions such as arthritis, diabetes, and cancer. The growing incidence of infectious animal ailments and chronic diseases is expected to fuel the demand for veterinary diagnostics in the near future.

Based on testing category, the clinical chemistry segment led the market with the largest revenue share of 23.21% in 2024. The segment comprises tests that facilitate the study of the chemical composition of a sample and organ function tests. These tests can help identify specific disorders, such as pancreatitis or diabetes and may also be used to monitor how the animal is responding to treatment. The wide availability and adoption of these tests contribute to the high share of the segment.

The cytopathology segment is anticipated to grow at the fastest CAGR of 13.91% over the forecast period. The segment includes the study of cells from body fluids or tissues to determine a diagnosis. In January 2024, IDEXX introduced the IDEXX in Vue Dx Cellular Analyzer, a slide-free, AI-powered device offering rapid, lab-quality cytology and blood morphology results in 10 minutes. This innovative system streamlines workflows, enhances diagnostic accuracy, and integrates seamlessly with IDEXX's hematology analyzers and practice management tools.

Based on animal type, the companion animals segment led the market with the largest revenue share of 59.26% in 2024. Amongst the companion animals category, the dog segment held the market with the largest revenue share of 54.67% in 2024, while the other companion animals segment is projected to grow at the fastest CAGR over the forecast period. The growing pet population, expenditure on pets, pet humanization, medicalization rate, and uptake of pet insurance are some of the key drivers of the segment. According to the American Pet Products Association (APPA) study conducted between 2023 and 2024, approximately 66% of households in the U.S. have at least one pet, totaling around 86.9 million households. Most insured pets are dogs, accounting for about 80% of the insured population, while cats comprise 20%.

The production animals segment is expected to register at the fastest CAGR from 2024 to 2034, due to rising demand for livestock health management, increasing collaborations, and R&D activities focused on innovative diagnostic solutions. These advancements enable early disease detection, enhancing productivity and supporting the growing global demand for animal-derived food products. For example, in October 2024, Norbrook, in collaboration with the University of Liverpool and Global Access Diagnostics, launched a rapid on-farm liver fluke test for cattle and sheep. This test delivers results in 10 minutes and is a portable and user-friendly kit that enables early detection and targeted treatment, helping farmers improve livestock health while combating anthelmintic resistance.

The consumables, reagents & kits segment led the market with the largest revenue share of 52.96% in 2024. Consumables, reagents, and kits are fundamental components necessary for conducting various diagnostic tests in veterinary medicine. These products are used in laboratories, veterinary clinics, and point-of-care settings for various diagnostic procedures, including blood tests, urinalysis, and immunoassays. The segment covers a broad spectrum of diagnostic applications. The versatility and diversity of consumables and reagents make them indispensable across various diagnostic scenarios.

The equipment & instruments segment is projected to grow at the fastest CAGR during the forecast period. This is owing to technological advancements in diagnostic equipment, increasing adoption of point-of-care testing (POCT) devices, demand for imaging equipment, and investment in veterinary healthcare. For instance, in July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. It features a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides highly precise glucose and lactate measurements, used in clinical settings for diabetes management and by elite sports teams for tracking lactate production in training.

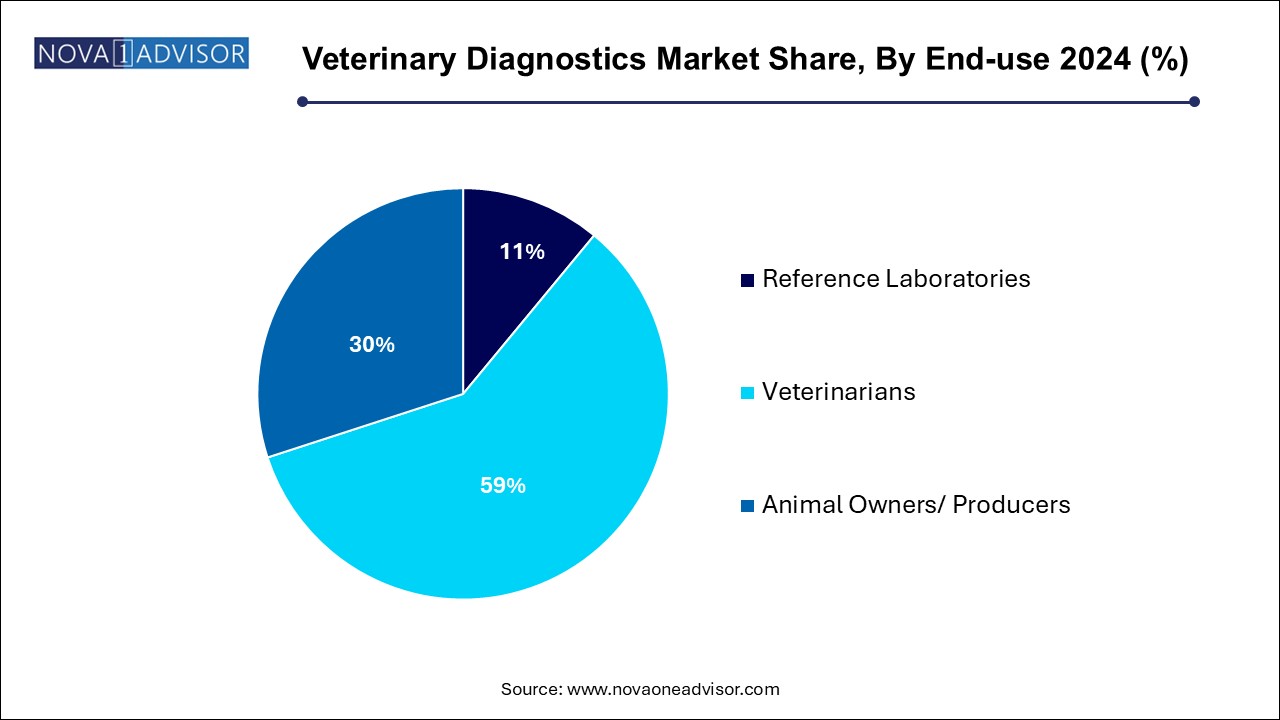

Based on end use, the veterinarian segment led the market with the largest revenue share of 59.0% in 2024. This segment traditionally holds the largest market share because veterinarians play a central role in animal diagnosis, treatment, and overall healthcare.Veterinary professionals utilize various diagnostic tools and services, including imaging equipment, laboratory tests, and point-of-care diagnostic devices.The segment's dominance is driven by the reliance of animal owners on veterinarians for expert guidance and the comprehensive nature of the diagnostic services they offer.

The animal owners/producers segment is estimated to grow at the fastest CAGR during the forecast period. This is due to the rising popularity of point-of-care testing (POCT) devices that allow on-site diagnostic testing. These devices enable quick and convenient testing at home or on the farm without the need to visit a veterinary clinic, making them attractive to animal owners and producers.For livestock owners and producers, diagnostic tools are crucial for managing herd health, optimizing production, and ensuring the safety of food products. The integration of diagnostics into on-farm practices enhances decision-making and contributes to overall farm management.

North America veterinary diagnostics market dominated the global market with the largest revenue share of 38.25% in 2024. This is owing to established veterinary healthcare infrastructure, advanced technology adoption, high disposable income, and the presence of key players. Strategic initiatives undertaken by these companies are expected to continue fueling regional market growth. For instance, in September 2023, Embark Veterinary partnered with Assistance Dogs International (ADI) to provide DNA testing kits to North American members of ADI's breeding cooperative. This partnership helps screen for over 250 genetic health conditions in assistance dogs, ensuring healthier breeding practices and longer service dog careers. Thus, partnerships between companies like Embark Veterinary and Assistance Dogs International and Mars Petcare's collaboration with the Broad Institute are expected to enhance access to genetic testing and expand research capabilities.

U.S. Veterinary Diagnostics Market Trends

The veterinary diagnostics market in the U.S. is growing rapidly due to the rise in technological advancements to enhance early disease detection and personalized treatment options for pets, along with the presence of key market players. For example, in September 2022, Antech expanded its canine cancer diagnostic capabilities with new molecular tests like SearchLight DNA and OncoK9 to enhance early detection. These innovations integrate digital cytology, imaging technologies, and molecular diagnostics to support veterinarians and improve outcomes for dogs with cancer. Furthermore, key trends in the U.S. market include the adoption of advanced molecular tests, such as DNA-based assays and biomarker identification tools, which improve diagnostic accuracy in veterinary oncology and other specialized fields.

Europe Veterinary Diagnostics Market Trends

The veterinary diagnostics market in Europe is influenced by several trends, driven by the rising prevalence of several animal disease outbreaks, advancements in disease surveillance, rising pet ownership rates, and the need for effective diagnostic solutions. There were reported outbreaks of various other infectious animal diseases across Europe, including Avian influenza A, Lumpy skin disease, Rift Valley fever, Aujeszky's disease, Bluetongue virus, and African swine fever.

The Germany veterinary diagnostics market is anticipated to grow at a constant CAGR during the forecast period, due to rising animal disease outbreaks, increasing demand for accurate and rapid disease diagnosis, and the adoption of veterinary diagnostic products and solutions. For instance, Germany has reported outbreaks of various diseases, such as African Swine Fever (ASF), Avian Influenza, and Bovine Viral Diarrhea (BVD). According to a new report published by the European Food Safety Authority (EFSA) in 2022, Germany reported 1,444 ASF cases in wild boar, with a significant increase in cases in the eastern part of the country. Similarly, Germany reported 144 outbreaks of Avian Influenza in poultry, with a significant increase in cases in the northern part of the country in 2022.

The veterinary diagnostics market in the UK is anticipated to grow at a significant CAGR during the forecast period, due to rising pet ownership and increased awareness of preventive care. Pets are commonly found in homes everywhere in the UK. A 2024 article published by Pet Keen stated that the pet population in the UK in 2021 was estimated to be 12.5 million dogs & 12.2 million cats. Due to the COVID-19 pandemic and the isolation that followed, there has been a rise in pet ownership in recent years. In addition, people are adopting new pets for love, company, and fun. Currently, 62% of UK residents are pet owners.

Asia Pacific Veterinary Diagnostics Market Trends

The veterinary diagnostics market in Asia Pacific is driven by rising pet ownership, increased awareness of pet health, and a growing demand for breed identification and genetic insights. In countries like Japan and Australia, pet owners are increasingly investing in DNA tests to monitor health risks and hereditary conditions. In addition, the expansion of e-commerce platforms in the region has made veterinary diagnostics testing kits more accessible. Market growth in the region can be attributed to a significantly large cattle population. For instance, China & India constitute more than 30% of the global cattle population. The large livestock population has enhanced the demand for meat & dairy production, which is expected to further boost the demand for veterinary medicines for livestock animals. An increase in the number of veterinary hospitals and clinics in countries such as China is further boosting market growth.

The India veterinary diagnostics market is witnessing notable growth, driven by increasing adoption of advanced PCR-based techniques for early disease detection in livestock and companion animals, growing supportive government initiatives, and rising demand for improved animal healthcare across the country. In addition, the rise in government initiatives to encourage the animal health sector in India is expected to drive market growth during the forecast period. For instance, the Indian Council of Agricultural Research (ICAR) & Indian Veterinary Research Institute (IVRI), under the “Make in India” initiative, developed two diagnostic kits, Bluetongue Sandwich ELISA (sELISA) and Japanese Encephalitis IgM ELISA kits for application in sheep, goats, cattle, buffalo, camel, & other dairy animals. In 2023, the Central Institute for Research on Buffaloes launched an early pregnancy diagnosis test kit called the Preg-D kit, which uses a urine-based diagnostic technique.

Latin America Veterinary Diagnostics Market Trends

The veterinary diagnostics market in Latin America is experiencing significant growth, driven by rising pet ownership and increased awareness of animal health and genetics. The demand for animal protein is increasing in Latin America, expanding the livestock industry. This has resulted in a greater need for accurate and rapid disease diagnosis to ensure animal health and prevent disease outbreaks. In addition, Latin America has experienced outbreaks of various animal diseases, such as Foot-and-Mouth Disease, Avian Influenza, and Porcine Reproductive and Respiratory Syndrome (PRRS). The need for accurate and rapid diagnosis of these diseases drives market growth.

The Brazil veterinary diagnostics market is anticipated to grow at a significant CAGR during the forecast period, as there is an increase in pet ownership, advancements in diagnostic technologies, and rising awareness of animal health. Growth in livestock farming and government initiatives to combat zoonotic diseases further support market expansion. In Brazil, high mortality rates among beef cattle due to infectious diseases underscore the urgent demand for skilled veterinary professionals proficient in molecular diagnostics. This necessity addresses significant financial losses and supports market growth in one of the world's leading beef-producing nations.

Middle East & Africa Veterinary Diagnostics Market Trends

The veterinary diagnostics market in the Middle East & Africa is witnessing significant growth, driven by rising pet adoption rates and increasing awareness about animal health. Growing investment in veterinary healthcare infrastructure and the adoption of advanced diagnostic technologies are also expected to boost market growth. For instance, countries like South Africa and the UAE are leading the adoption with increased spending on veterinary services and diagnostic tools, reflecting the region's evolving healthcare landscape.

The South Africa veterinary diagnostics market is witnessing significant growth driven by increased product launches from domestic players. Companies are introducing innovative testing solutions tailored to local pet owners' needs. For example, the launch of breed identification and health screening tests by local firms like EasyDNA South Africa and International Biosciences South Africa has expanded consumer access to affordable genetic testing options. These products help identify breed composition and screen for potential genetic health risks, empowering pet owners to make informed care decisions. This surge in domestic offerings fosters competition and enhances market awareness, ultimately driving growth in the veterinary diagnostics sector across South Africa.

The veterinary diagnostics market in Saudi Arabia is experiencing significant growth due to the rapid expansion of poultry production in line with the Saudi Vision 2030 initiative. This strategic plan by the Saudi Ministry of Environment, Water and Agriculture (MEWA) aims to significantly increase local poultry production, reducing dependence on oil and diversifying the economy. In 2020, Saudi Arabia produced 900,000 MT of chicken meat, meeting 60% of its domestic consumption needs. The country's poultry production is projected to reach 1.55 million metric tons annually. This expansion in poultry production is driving market growth in Saudi Arabia. As the poultry industry grows, there is an increasing demand for advanced diagnostic tools to ensure animal health and productivity. The focus on improving veterinary diagnostics aligns with the broader goals of enhancing food security and supporting sustainable agricultural practices.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary diagnostics market

Product

Testing Category

Animal Type

End-use

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. Internal Database

1.3.3. Secondary Sources

1.3.4. Primary Research

1.4. Information/Data Analysis

1.5. Market Formulation & Visualization

1.6. Data Validation & Publishing

1.7. Model Details

1.7.1. Commodity flow analysis

1.7.2. Global Market: CAGR Calculation

1.8. List of Secondary Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Veterinary Diagnostics Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Drivers Analysis

3.2.1.1. Increasing prevalence of diseases in animals

3.2.1.2. Increasing animal health expenditure

3.2.1.3. Increasing medicalization rate

3.2.1.4. Increasing humanization of pets

3.2.2. Market Restraints Analysis

3.2.2.1. Lack of standardized regulations

3.2.2.2. Lack of animal health awareness in developing economies

3.3. Veterinary Diagnostics Market Analysis Tools

3.3.1. Porter’s Analysis

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Economic and Social Landscape

3.3.2.3. Technological landscape

3.3.2.4. Environmental Landscape

3.3.2.5. Legal landscape

3.4. Estimated Animal Population, by Key Species & Key Countries, 2024

3.5. COVID-19 Impact Analysis

3.6. Regulatory Framework

3.7. Pricing Analysis

Chapter 4. Veterinary Diagnostics Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Veterinary Diagnostics Market: Product Movement Analysis, 2024 & 2034 (USD Billion)

4.3. Consumables, Reagents & Kits

4.3.1. Consumables, Reagents & Kits Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.4. Equipment & Instruments

4.4.1. Equipment & Instruments Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Veterinary Diagnostics Market: Testing Category Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Veterinary Diagnostics Market: Testing Category Movement Analysis, 2024 & 2034 (USD Billion)

5.3. Clinical Chemistry

5.3.1. Clinical Chemistry Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.4. Microbiology

5.4.1. Microbiology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Parasitology

5.5.1. Parasitology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Histopathology

5.6.1. Histopathology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.7. Cytopathology

5.7.1. Cytopathology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.8. Hematology

5.8.1. Hematology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.9. Immunology & Serology

5.9.1. Immunology & Serology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.10. Imaging

5.10.1. Imaging Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.11. Molecular Diagnostics

5.11.1. Molecular Diagnostics Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.12. Other Categories

5.12.1. Other Categories Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Veterinary Diagnostics Market: Animal Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Veterinary Diagnostics Market: Animal Type Movement Analysis, 2024 & 2034 (USD Billion)

6.3. Production Animals

6.3.1. Production Animals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.3.2. Cattle

6.3.2.1. Cattle Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.3.3. Poultry

6.3.3.1. Poultry Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.3.4. Swine

6.3.4.1. Swine Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.3.5. Other Production Animals

6.3.5.1. Other Production Animals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4. Companion Animals

6.4.1. Companion Animals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.2. Dogs

6.4.2.1. Dogs Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.3. Cats

6.4.3.1. Cats Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.4. Horses

6.4.4.1. Horses Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.4.5. Other Companion Animals

6.4.5.1. Other Companion Animals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Veterinary Diagnostics Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Veterinary Diagnostics Market: End Use Movement Analysis, 2024 & 2034 (USD Billion)

7.3. Reference Laboratories

7.3.1. Reference Laboratories Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.4. Veterinarians

7.4.1. Veterinarians Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5. Animal Owners/ Producers

7.5.1. Animal Owners/ Producers Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8. Veterinary Diagnostics Market: Regional Estimates & Trend Analysis

8.1. Veterinary Diagnostics Market Share, By Region, 2024 & 2034, USD Million

8.2. Regional Outlook

8.3. North America

8.3.1. North America Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.2. U.S.

8.3.2.1. Key Country Dynamics

8.3.2.2. U.S. Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.3.3. Canada

8.3.3.1. Key Country Dynamics

8.3.3.2. Canada Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4. Europe

8.4.1. Europe Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.2. UK

8.4.2.1. Key Country Dynamics

8.4.2.2. UK Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.3. Germany

8.4.3.1. Key Country Dynamics

8.4.3.2. Germany Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.4. France

8.4.4.1. Key Country Dynamics

8.4.4.2. France Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.5. Italy

8.4.5.1. Key Country Dynamics

8.4.5.2. Italy Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.6. Spain

8.4.6.1. Key Country Dynamics

8.4.6.2. Spain Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.7. Sweden

8.4.7.1. Key Country Dynamics

8.4.7.2. Sweden Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.8. Denmark

8.4.8.1. Key Country Dynamics

8.4.8.2. Denmark Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.9. Netherlands

8.4.9.1. Key Country Dynamics

8.4.9.2. Netherlands Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5. Asia Pacific

8.5.1. Asia Pacific Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.2. China

8.5.2.1. Key Country Dynamics

8.5.2.2. China Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.3. Japan

8.5.3.1. Key Country Dynamics

8.5.3.2. Japan Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.4. India

8.5.4.1. Key Country Dynamics

8.5.4.2. India Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.5. South Korea

8.5.5.1. Key Country Dynamics

8.5.5.2. South Korea Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.6. Australia

8.5.6.1. Key Country Dynamics

8.5.6.2. Australia Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.7. Thailand

8.5.7.1. Key Country Dynamics

8.5.7.2. Thailand Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6. Latin America

8.6.1. Latin America Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.2. Brazil

8.6.2.1. Key Country Dynamics

8.6.2.2. Brazil Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.3. Mexico

8.6.3.1. Key Country Dynamics

8.6.3.2. Mexico Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.4. Argentina

8.6.4.1. Key Country Dynamics

8.6.4.2. Argentina Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7. Middle East and Africa

8.7.1. Middle East and Africa Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.2. Saudi Arabia

8.7.2.1. Key Country Dynamics

8.7.2.2. Saudi Arabia Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.3. UAE

8.7.3.1. Key Country Dynamics

8.7.3.2. UAE Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.4. South Africa

8.7.4.1. Key Country Dynamics

8.7.4.2. South Africa Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.5. Kuwait

8.7.5.1. Key Country Dynamics

8.7.5.2. Kuwait Veterinary Diagnostics Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 9. Competitive Landscape

9.1. Market Participant Categorization

9.2. Company Market Position Analysis/ Heap Map Analysis

9.3. Estimated Company Market Share Analysis, 2024

9.4. Strategy Mapping

9.4.1. Mergers & Acquisitions

9.4.2. Partnerships & Collaborations

9.4.3. Others

9.5. Company Profiles

9.5.1. IDEXX Laboratories, Inc.

9.5.1.1. Participant’s Overview

9.5.1.2. Financial Performance

9.5.1.3. Product Benchmarking

9.5.1.4. Strategic Initiatives

9.5.2. Zoetis

9.5.2.1. Participant’s Overview

9.5.2.2. Financial Performance

9.5.2.3. Product Benchmarking

9.5.2.4. Strategic Initiatives

9.5.3. Antech Diagnostics, Inc. (Mars Inc.)

9.5.3.1. Participant’s Overview

9.5.3.2. Financial Performance

9.5.3.3. Product Benchmarking

9.5.3.4. Strategic Initiatives

9.5.4. Agrolabo S.p.A.

9.5.4.1. Participant’s Overview

9.5.4.2. Financial Performance

9.5.4.3. Product Benchmarking

9.5.4.4. Strategic Initiatives

9.5.5. Embark Veterinary, Inc.

9.5.5.1. Participant’s Overview

9.5.5.2. Financial Performance

9.5.5.3. Product Benchmarking

9.5.5.4. Strategic Initiatives

9.5.6. Esaote SPA

9.5.6.1. Participant’s Overview

9.5.6.2. Financial Performance

9.5.6.3. Product Benchmarking

9.5.6.4. Strategic Initiatives

9.5.7. Thermo Fisher Scientific, Inc.

9.5.7.1. Participant’s Overview

9.5.7.2. Financial Performance

9.5.7.3. Product Benchmarking

9.5.7.4. Strategic Initiatives

9.5.8. Innovative Diagnostics SAS

9.5.8.1. Participant’s Overview

9.5.8.2. Financial Performance

9.5.8.3. Product Benchmarking

9.5.8.4. Strategic Initiatives

9.5.9. Virbac

9.5.9.1. Participant’s Overview

9.5.9.2. Financial Performance

9.5.9.3. Product Benchmarking

9.5.9.4. Strategic Initiatives

9.5.10. FUJIFILM Corporation

9.5.10.1. Participant’s Overview

9.5.10.2. Financial Performance

9.5.10.3. Product Benchmarking

9.5.10.4. Strategic Initiatives