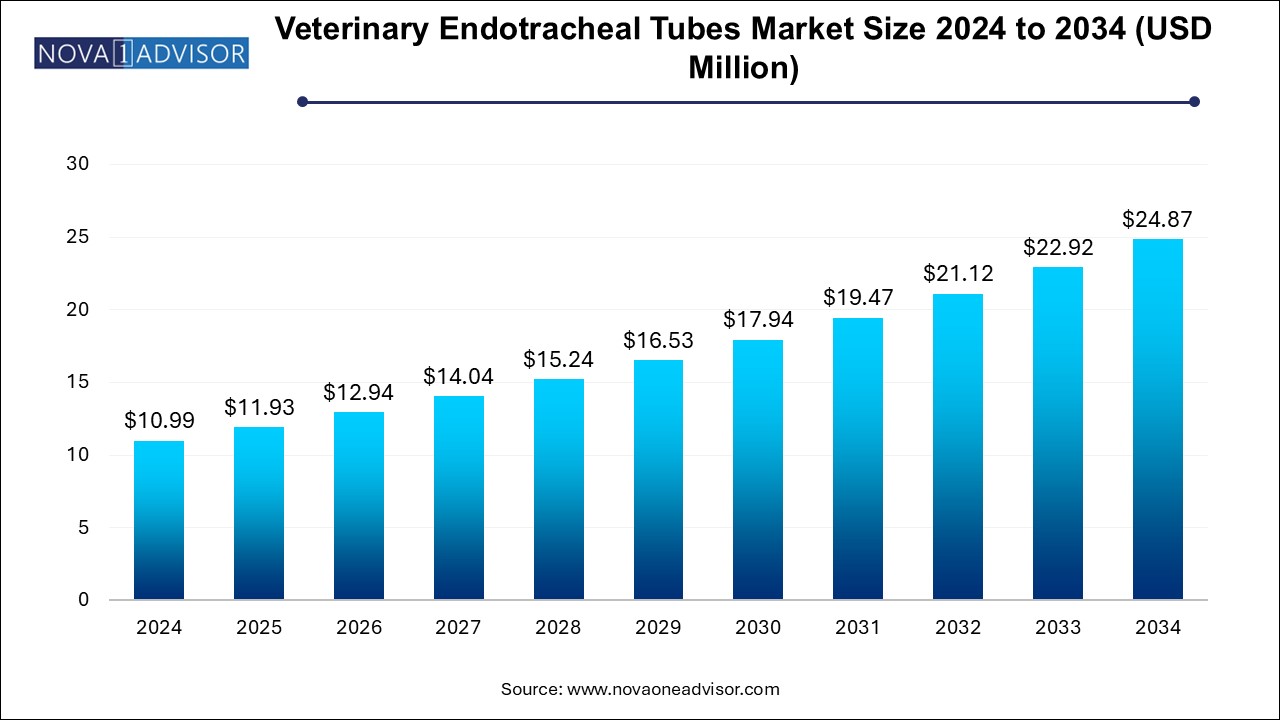

The veterinary endotracheal tubes market size was exhibited at USD 10.99 million in 2024 and is projected to hit around USD 24.87 million by 2034, growing at a CAGR of 8.51% during the forecast period 2025 to 2034.

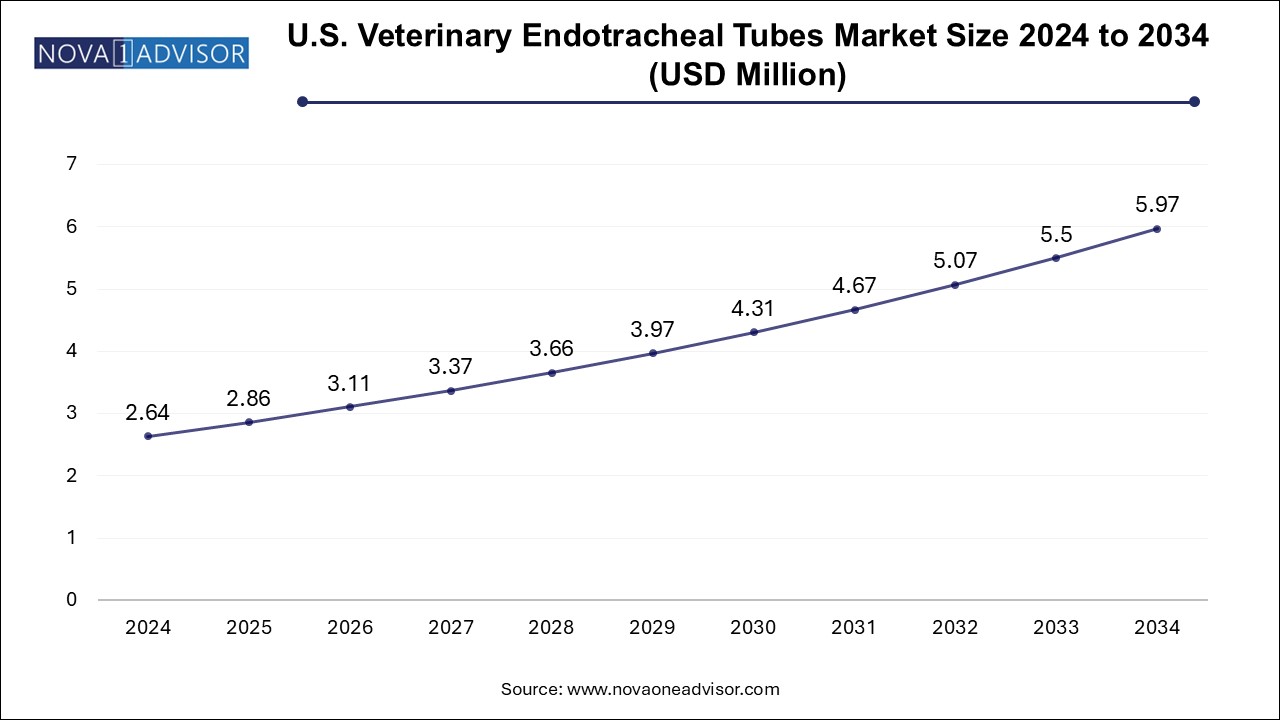

The U.S. veterinary endotracheal tubes market size is evaluated at USD 2.64 billion in 2024 and is projected to be worth around USD 5.97 billion by 2034, growing at a CAGR of 7.76% from 2025 to 2034.

North America emerged as the leading region in 2024, driven by high pet adoption rates, sophisticated veterinary infrastructure, and increased expenditure on companion animal healthcare. The U.S. veterinary sector is highly developed, with a dense network of hospitals, clinics, and teaching institutions, all of which perform a large number of surgical procedures requiring airway management. The growing trend of "pet humanization" in North America has led to greater investment in comprehensive diagnostics and surgical care, supporting the demand for high-quality intubation tools.

Additionally, the region is home to many leading manufacturers of veterinary surgical equipment, and regulatory clarity regarding device usage in animals promotes market maturity. Advanced veterinary education and continuous professional development ensure that veterinary professionals are well-versed in intubation techniques, further contributing to regular and safe use of endotracheal tubes.

Asia Pacific is projected to be the fastest-growing region, due to improving veterinary services, rising pet ownership in urban centers, and the growing prevalence of veterinary academic institutions and research centers. Countries like China, India, South Korea, and Australia are investing in pet infrastructure, including advanced clinics and mobile veterinary services. In these emerging economies, the willingness of pet owners to spend on elective surgeries and emergency interventions is steadily increasing.

Moreover, Asia is a major hub for animal research and preclinical drug development, particularly in countries with strong pharmaceutical R&D sectors. This expands the demand for laboratory-grade endotracheal tubes tailored for use in small animal models. As local manufacturers enter the market and regulatory standards align more closely with international norms, Asia Pacific is expected to witness sustained growth in both volume and value terms.

The veterinary endotracheal tubes market is an integral part of the veterinary anesthesia and airway management landscape. Endotracheal tubes are used in animals to maintain a patent airway during surgeries, emergency interventions, or in intensive care settings, ensuring effective delivery of oxygen, anesthetic gases, or ventilation support. As veterinary care becomes more specialized and technologically advanced, particularly in urban and developed markets, the demand for high-quality endotracheal tubes tailored to different species and sizes of animals is steadily increasing.

The market includes both cuffed and uncuffed variants of endotracheal tubes, manufactured in various diameters and lengths to accommodate a wide range of animal anatomies—from companion animals like dogs and cats to lab animals and small exotic pets. The precision and safety of airway management are paramount in veterinary surgeries, and the increasing focus on animal welfare, surgical standards, and emergency preparedness has brought endotracheal tube usage into routine veterinary protocols.

Veterinary endotracheal tube demand is also rising in correlation with the increasing rates of pet ownership, growing awareness of preventive animal healthcare, and the professionalization of veterinary services across the globe. Emerging economies are witnessing infrastructure development in veterinary clinics and hospitals, further supporting market expansion. Meanwhile, academic institutions and research labs rely heavily on airway management tools, including endotracheal tubes, for procedures involving lab animals.

Veterinary anesthesiology has progressed significantly in recent decades, borrowing advancements from human medicine while adapting them for animals. Innovations such as silicone-based tubes, laser-resistant materials, and radiopaque lines for imaging guidance are shaping the future of this niche but critical market. With both companion animal and research animal care gaining ground, the veterinary endotracheal tubes market is poised for continued evolution and robust growth.

Rising Pet Ownership and Spending: Increased demand for safe surgical procedures and anesthetic care in pets is driving product usage.

Customization and Species-Specific Designs: Introduction of anatomically adapted tubes for small animals, exotics, and lab models.

Preference for Cuffed Tubes: Surge in adoption due to better airway sealing and reduced aspiration risk during complex surgeries.

Disposable vs. Reusable Tube Debate: Ongoing shift toward disposable, single-use tubes to reduce cross-contamination and improve safety.

Veterinary Hospital Infrastructure Growth: Clinics are equipping surgical units with better anesthetic accessories, including modern endotracheal tubes.

Increased Academic and Lab Use: Research institutions use endotracheal tubes in experimental surgeries, particularly in rodents and small mammals.

Product Innovations with Biocompatible Materials: Emergence of softer, kink-resistant materials to reduce trauma during intubation.

Expansion of Online Veterinary Equipment Sales: Digital channels offering easy access to bulk and specialized airway products.

| Report Coverage | Details |

| Market Size in 2025 | USD 11.93 Million |

| Market Size by 2034 | USD 24.87 Million |

| Growth Rate From 2025 to 2034 | CAGR of 8.51% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Animal, Product, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Medtronic, Conduct Science, Harvard Apparatus (Harvard Bioscience Inc.), Jorgensen Laboratories, Vetamac, Inc., RWD Life Science Co., LTD |

The most significant driver fueling the veterinary endotracheal tubes market is the increase in surgical interventions and anesthesia use in veterinary medicine. From routine sterilizations to complex orthopedic, dental, and emergency procedures, animals increasingly require controlled, safe anesthetic administration—which mandates the use of endotracheal tubes. The expanding scope of veterinary care, particularly in urbanized areas, means more animals undergo surgical procedures that previously would have been deemed impractical or unaffordable.

Pet owners are now more willing to invest in comprehensive treatment, especially for chronic conditions like airway obstruction, neoplasia, or trauma, which require operative intervention. This growing demand for high-quality veterinary care has prompted clinics to standardize surgical protocols, including intubation. Furthermore, developments in surgical procedures for small and exotic animals have necessitated specialized airway devices, creating a consistent demand for varied endotracheal tube designs and sizes.

A key restraint in the veterinary endotracheal tubes market is the limited standardization in tube selection and a lack of specialized skills among veterinary staff, especially in developing regions. Intubation in animals—particularly cats, rabbits, rodents, and exotic species—requires not only species-specific tubes but also technical proficiency. Improper tube selection or poor intubation technique can lead to trauma, inadequate ventilation, or aspiration pneumonia.

Veterinary practices in rural or underserved areas often lack access to high-quality, anatomically correct tubes or may resort to reusing equipment due to cost constraints. Additionally, the absence of established guidelines for intubation procedures in non-standard species contributes to inconsistent outcomes. Until veterinary anesthesia training becomes more uniform globally and tube designs are more intuitively adapted for animal anatomy, these factors may limit market penetration, especially in cost-sensitive or low-resource settings.

One of the most promising opportunities for market expansion lies in the increasing establishment of specialty veterinary hospitals and animal intensive care units (ICUs). These facilities often treat high-risk cases such as respiratory disease, trauma, post-operative recovery, and complex surgeries—all requiring extended or controlled airway management. The growing number of referral centers and 24-hour emergency clinics has increased the need for ready access to diverse endotracheal tubes for use across species and sizes.

Additionally, the trend of developing "pet-centric" hospitals equipped with advanced anesthetic machines, surgical monitoring tools, and dedicated anesthesia departments is gaining traction. Clinics are beginning to stock different lengths, internal diameters, cuffed/uncuffed types, and even laser-safe tubes to accommodate a range of procedures. Companies that innovate in tube ergonomics, safety features, and species-specific adaptations can position themselves to capture significant demand from this growing niche.

The Dogs represented the dominant share in the veterinary endotracheal tubes market in 2024, attributed to their higher surgical caseload compared to other companion animals. Common procedures such as spaying, neutering, dental cleanings, orthopedic repairs, and emergency surgeries typically require intubation and controlled anesthesia. Larger anatomical size also facilitates easier intubation compared to cats or rodents, increasing tube usage consistency. Dogs’ susceptibility to conditions like laryngeal paralysis, brachycephalic airway syndrome, and aspiration pneumonia further necessitates controlled airway management during treatment.

The "Others" category—including small lab animals like mice, rats, guinea pigs, and rabbits—is expected to be the fastest-growing, especially driven by research institutions and academic labs. These animals are widely used in experimental pharmacology, disease modeling, and surgical research. Advancements in micro-scale intubation tools and miniaturized endotracheal tubes have made it feasible to anesthetize these animals with greater safety. With pharmaceutical R&D spending on the rise and preclinical models gaining prominence, demand for small-diameter tubes for rodents is poised for sharp growth.

Cuffed endotracheal tubes dominated the market, primarily due to their advantages in creating an airtight seal, reducing the risk of aspiration, and enabling positive pressure ventilation during prolonged surgeries. Cuffed tubes are particularly recommended for dogs and in any case involving deep anesthesia, thoracic surgery, or controlled ventilation. They are also used in animals prone to regurgitation or when fluid management is critical during dental or abdominal procedures.

Uncuffed tubes are likely to grow rapidly, especially in pediatric animals and smaller species like cats, rabbits, and rodents. These tubes are preferred when there's a concern about tracheal trauma, as the absence of a cuff reduces pressure on the airway walls. They are easier to insert and more suitable for short-duration procedures where full airway sealing is not essential. The increasing volume of feline patients and the growing sophistication of small-animal clinics is expected to drive demand for high-quality uncuffed designs.

The Hospitals held the dominant position, benefiting from greater infrastructure, surgical caseloads, and access to advanced anesthesia monitoring. Veterinary hospitals—particularly multispecialty facilities—have the resources and medical protocols to conduct surgeries that demand precise airway management. These institutions routinely invest in high-quality disposable and reusable tubes, stock multiple sizes, and train staff in airway management techniques.

Clinics, however, are projected to witness the fastest growth, as small animal practices increasingly incorporate surgical capabilities and anesthetic services. Many clinics are expanding their service offerings to include elective and minor surgeries, which necessitate basic intubation equipment. As pet ownership rises and veterinary clinics multiply in urban and semi-urban areas, the volume of day surgeries is growing—fueling steady demand for economical, easy-to-use endotracheal tubes.

In March 2025, Vetamac announced the launch of a new range of micro-sized silicone endotracheal tubes designed for rodents and small mammals used in research facilities and academic labs.

In January 2025, Jorgensen Laboratories introduced color-coded veterinary endotracheal tube kits to assist in rapid size selection during emergency intubation.

In October 2024, Smiths Medical entered into a partnership with a leading veterinary distributor in Europe to expand its Portex™ veterinary tube product line, featuring cuffed and laser-safe variants.

In August 2024, B. Braun VetCare GmbH began clinical trials on a biodegradable endotracheal tube prototype aimed at reducing waste in high-volume veterinary surgical centers.

In June 2024, Henry Schein Animal Health announced expanded e-commerce distribution for its in-house AirSecure™ veterinary airway management line, including disposable tubes and laryngoscope accessories.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary endotracheal tubes market

By Animal

By Product

By End Use

By Regional