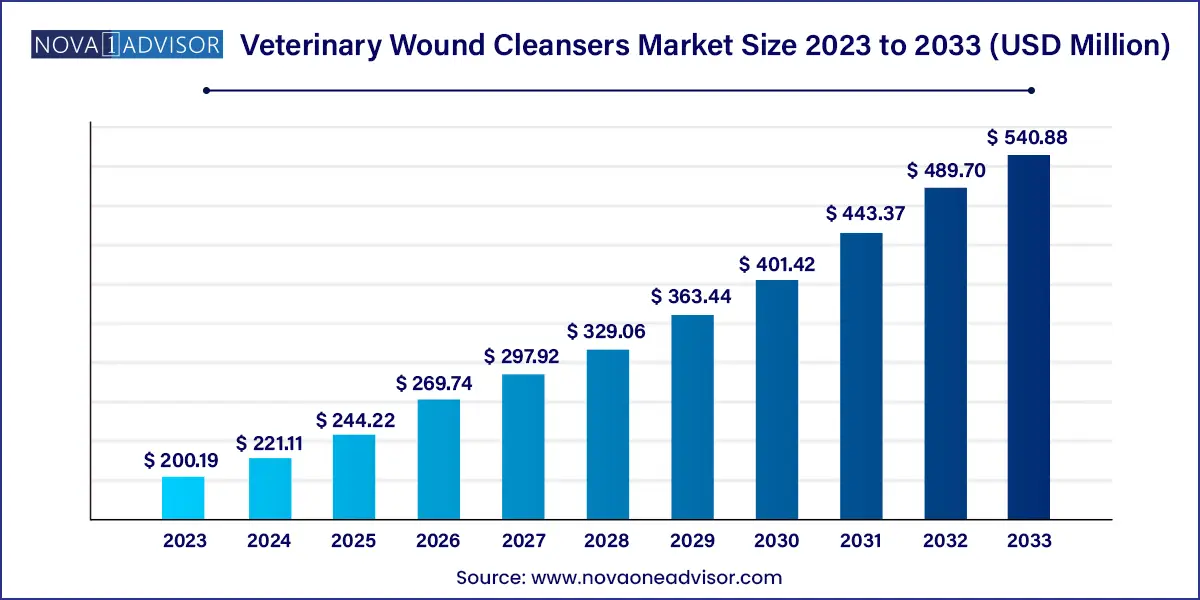

The global veterinary wound cleansers market size was valued at USD 200.19 million in 2023 and is anticipated to reach around USD 540.88 million by 2033, growing at a CAGR of 10.45% from 2024 to 2033.

The growing popularity of pet ownership, heightened consciousness about animal well-being, advancements in veterinary science and technology, and rising demand for specialized animal healthcare products collectively shape consumer preferences and market dynamics. These factors contribute to the expansion of available products for animal care, catering to the evolving needs of pet owners and veterinary professionals.

The 2023 - 2024 APPA National Pet Owners Survey found that 66.0% of U.S. households, which translates to around 86.9 million families, have pets as of 2024. Increased pet ownership is driving the demand for veterinary wound cleansers. This trend facilitates the early detection and treatment of wounds, enhancing the need for wound-cleansing products.

There is a growing awareness among pet owners regarding animal health and hygiene. With increased access to information through digital platforms and social media, pet owners are more informed about proper animal care practices. As per a survey conducted by the American Veterinary Medical Association (AVMA), over 88.0% of pet owners consider their pets as family members and prioritize routine physical checkups with the vet. This rising awareness translates into a greater willingness to invest in quality healthcare products, such as veterinary wound cleansers, essential for maintaining optimal hygiene during injury treatment and preventing infections.

A growing demand is observed for specialized veterinary products tailored to specific needs within the animal healthcare sector. This includes wound cleansers designed for different animals such as dogs, cats, and horses-and various conditions ranging from minor cuts to surgical wounds. Introducing eco-friendly formulations also aligns with consumer preferences towards sustainable products, enhancing market appeal among environmentally conscious pet owners.

| Report Attribute | Details |

| Market Size in 2024 | USD 221.11 million |

| Market Size by 2033 | USD 540.88 million |

| Growth Rate From 2024 to 2033 | CAGR of 10.45% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, product, end use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Elanco; Vetoquinol; Virbac; Innovacyn, Inc.; Axio Biosolutions Pvt Ltd; Jorgen Kruuse; Dechra Pharmaceuticals; Neogen Corporation; Ethicon (Johnson & Johnson Services, Inc.) |

Based on type, the companion animal segment led the market with the largest revenue share of 58.34% in 2023. This trend is driven by the increasing pet population and awareness among pet owners regarding wound care and overall healthcare for their animals. As pet owners become more invested in their pets' health, there is a rising demand for effective wound management solutions, particularly considering the increasing number of veterinary surgeries and the prevalence of chronic conditions in pets. Moreover, companion animals help individuals remain calm and reduce stress. According to a Human Animal Bond Research Institute (HABRI) survey, 74.0% of pet owners reported that having a pet enhances their mental health.

The livestock animal segment is anticipated to grow at the fastest CAGR during the forecast period. The rising global demand for meat and dairy products led to increased livestock farming, necessitating enhanced animal health management practices, including effective wound care solutions. The prevalence of injuries and infections among livestock, often caused by rough handling or environmental factors, further emphasizes the need for specialized wound cleansers to promote healing and prevent complications.

Based on end use, the veterinary hospitals and clinics segment led the market with the largest revenue share of 67.28% in 2023. This trend is driven by these facilities' critical role in providing comprehensive animal healthcare, particularly treating injuries and managing post-operative care. Veterinary hospitals and clinics are the primary sites for administering advanced wound care treatments, utilizing specialized cleansers tailored to various animal species and wound types. The presence of skilled veterinary professionals and access to state-of-the-art equipment in these facilities contribute to the high demand for effective wound cleansers.

The homecare segment expected to grow at the fastest CAGR during the forecast period, driven by an increasing preference among pet owners for convenient and effective at-home care solutions. As pet ownership rises and owners become more proactive about their pets' health, there is a growing demand for user-friendly wound care products that can be easily applied at home. This trend is further supported by the increasing awareness of proper wound management, which encourages pet owners to seek out reliable cleansing solutions for minor injuries and post-operative care. The convenience of having effective wound care products readily available at home significantly contributes to this segment's rapid expansion.

North America dominated the veterinary wound cleansers market with the largest revenue share of 39.54% in 2023. There is a rising demand for effective wound management solutions. Innovations in product formulations, such as the introduction of antimicrobial wound cleansers, are becoming more common and reflecting advancements in veterinary care. In addition, the prevalence of chronic conditions in pets, including orthopedic issues, necessitates effective wound management, further fueling market growth. Pet owners with insurance are more inclined to pursue veterinary care for their pets, including treatment for minor injuries and wounds. According to the North American Pet Health Insurance Association Inc., the growth of pet insurance in Canada rose to 17.6% in 2022 compared to the previous year.

U.S. Veterinary Wound Cleansers Market Trends

The veterinary wound cleansers market in U.S. is anticipated to grow at the fastest CAGR during the forecast period. In the U.S., factors influencing the veterinary wound cleanser market include the prevalence of chronic conditions such as diabetes and orthopedic issues in pets, which necessitate effective wound management. The rising incidence of these health issues led to an increased focus on post-surgical care and the need for specialized wound care products. In the U.S., 66.0% of households own a pet, with dogs being the most common at 65.1 million households, followed by cats at 46.5 million. Pet owners are increasingly spending money on their companions' health and pain management, reflecting the growing humanization of pets.

Europe Veterinary Wound Cleansers Market Trends

The veterinary wound cleansers market in Europe is witnessing a significant shift towards innovative products catering to increasing animal health and welfare awareness. One prominent trend is the rise of natural and organic wound cleansers, driven by consumer demand for safer and more environmentally friendly options. In addition, the prevalence of chronic diseases among pets, such as diabetes and obesity, led to an increase in surgical procedures, thereby boosting the need for effective wound management solutions. The European market is also seeing a surge in product launches incorporating advanced technologies such as nanotechnology and antimicrobial agents to enhance healing processes.

The UK veterinary wound cleansers market is characterized by a well-established veterinary care infrastructure and a strong emphasis on innovation in the wound cleansers market. British companies are at the forefront of developing advanced wound care products tailored to the specific needs of companion animals and livestock. For instance, Beaphar Wound Ointment is a natural ointment made with honey designed to soothe, protect, and support the healing of superficial wounds.

The veterinary wound cleanser market in France is driven by most livestock conditions and the rising focus on enhancing animal interest criteria. The country's diverse agricultural landscape, which includes a significant cattle population, contributes to the demand for effective wound care solutions. French veterinary authorities implemented regulations to reduce antibiotic use in livestock, leading to a greater emphasis on preventive measures such as proper wound management.

Asia Pacific Veterinary Wound Cleansers Market Trends

The veterinary wound cleansers market in APAC region is witnessing significant growth. The region saw a surge in the adoption of companion animals, with countries such as China and India leading in pet ownership. This trend is accompanied by a growing recognition of the importance of proper wound care, fostering demand for specialized veterinary wound cleansers. Recent statistics indicate that the Asia-Pacific region boasts a larger population of pet dogs and cats than any other part of the world, with approximately 300 million of these animals living in households throughout the area-this figure is about 100 million higher than in North America.

The Japan veterinary wound cleansers market is anticipated to grow at the fastest CAGR during the forecast period. In Japan, unique market trends are emerging due to the country's advanced veterinary healthcare system and high standards of animal care. The Japanese market is characterized by the introduction of innovative wound care products that cater to companion animals and livestock. With a strong focus on research and development, Japanese companies are launching advanced formulations that enhance healing and prevent infections. In addition, the aging pet population in Japan is driving the demand for effective wound management solutions, as older animals are more susceptible to injuries and chronic conditions. A policy issued by Japan's Ministry of Environment indicates that cats in the nation have an increased lifespan, with the average age reaching a remarkable 15.79 years in 2023, roughly comparable to 79 years in human terms.

The veterinary wound cleansers market in India is growing. The country's diverse agricultural landscape contributes to a high demand for wound care products, particularly for cattle and other livestock. Innovative product launches tailored to the specific needs of Indian farmers are becoming more common, addressing infection management and post-operative care. Moreover, the rise of e-commerce platforms made it easier for pet owners to access various veterinary products, including wound cleansers.

Latin America Veterinary Wound Cleansers Market Trends

The veterinary wound cleansers market in Latin American is experiencing increasing awareness of animal health and the rising number of pet owners. The growing importance of wound care in animals, particularly among pet owners, is leading to a higher demand for effective veterinary wound cleansers. In addition, advancements in veterinary medicine and technology are fostering the development of innovative wound care products tailored for various animal species. For instance, introducing specialized formulations designed to prevent infections and promote faster healing is becoming increasingly common, reflecting a shift towards more comprehensive animal healthcare solutions.

The Brazil veterinary wound cleanser market is anticipated to grow at a significant CAGR during the forecast period. A significant prevalence of diseases affecting livestock and companion animals, coupled with a large animal population, is driving Brazil's market. The country's diverse agricultural landscape contributes to a high demand for effective wound care solutions, especially in the livestock sector, where injuries are common. Moreover, Brazil's growing focus on improving animal welfare standards drives investments in advanced veterinary care products. According to a household survey by the Brazilian Institute of Geography and Statistics (IBGE), Brazil has more pet dogs than young children. In 2022, Brazil ranked as the third-largest pet market globally, following the United States and China. With approximately 149 million pets in the country, the demand for pet products has nearly doubled over the last six years.

Middle East & Africa Veterinary Wound Cleansers Market Trends

The veterinary wound cleansers market in the Middle East and Africa is experiencing significant growth, driven by increasing animal health and welfare awareness. This trend is particularly pronounced due to rising pet ownership rates and a growing livestock industry, which increased demand for effective wound management solutions. The region witnessed a surge in veterinary clinics and animal hospitals, increasingly adopting advanced wound care products to treat animal injuries and infections. In addition, the prevalence of zoonotic diseases prompted governments and organizations to invest more in veterinary healthcare, further boosting the market for wound cleansers.

The Saudi Arabia veterinary wound cleanser market is anticipated to grow at the fastest CAGR during the forecast period. The rapid urbanization, changing lifestyles, and a growing population of pets contributed for the market growth. The Kingdom's Vision 2030 initiative emphasizes improving healthcare services, including veterinary care, which led to increased funding for animal health initiatives. The country also faces challenges related to livestock diseases such as foot-and-mouth disease (FMD) and avian influenza, necessitating effective wound management solutions for affected animals. Riyadh's MAS Company signed a USD 60.0 million agreement with Argentina's Biogénesis Bágo to establish Saudi Arabia's first foot-and-mouth disease vaccine manufacturing plant, supported by the Saudi Ministry of Environment.

In March 2023, the Tamil Nadu government (India) introduced 245 mobile veterinary clinics through a public-private partnership model to treat domestic animals and poultry affected by diseases

In August 2022, Elanco Animal Health Incorporated and AgNext at Colorado State University formed a strategic partnership to advance sustainability solutions for animal agriculture. This marks a significant step toward transforming opportunities in livestock sustainability

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Veterinary Wound Cleansers market.

By Type

By Product

By End Use

By Region

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Type

1.2.2. Product

1.2.3. End Use

1.2.4. Regional scope

1.2.5. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. nova one advisor internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Type Outlook

2.2.2. Product Outlook

2.2.3. End Use Outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. Veterinary Wound Cleansers Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Rising number of pet owners

3.2.1.2. Advancements in Veterinary Medicine

3.2.1.3. Growing Awareness of Animal Health

3.2.2. Market restraint analysis

3.2.2.1. Low Awareness Among Pet Owners

3.3. Veterinary Wound Cleansers Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Veterinary Wound Cleansers Market: Type Estimates & Trend Analysis

4.1. Global Veterinary Wound Cleansers Market: Type Dashboard

4.2. Global Veterinary Wound Cleansers Market: Type Movement Analysis

4.3. Global Veterinary Wound Cleansers Market by Type, Revenue

4.4. Companion Animal

4.4.1. Companion animal market estimates and forecasts, 2021 to 2033 (USD Million)

4.5. Livestock Animal

4.5.1. Livestock animal market estimates and forecasts, 2021 to 2033 (USD Million)

Chapter 5. Veterinary Wound Cleansers Market: Product Estimates & Trend Analysis

5.1. Global Veterinary Wound Cleansers Market: Product Dashboard

5.2. Global Veterinary Wound Cleansers Market: Product Movement Analysis

5.3. Global Veterinary Wound Cleansers Market Estimates and Forecasts, by Product, Revenue (USD Million)

5.4. Traditional Cleansers

5.4.1. Traditional cleansers market estimates and forecasts, 2021 to 2033 (USD Million)

5.5. Advanced Cleansers

5.5.1. Advanced cleansers market estimates and forecasts, 2021 to 2033 (USD Million)

5.6. Natural Cleansers

5.6.1. Natural cleansers market estimates and forecasts, 2021 to 2033 (USD Million)

Chapter 6. Veterinary Wound Cleansers Market: End Use Estimates & Trend Analysis

6.1. Global Veterinary Wound Cleansers Market: End Use Dashboard

6.2. Global Veterinary Wound Cleansers Market: End Use Movement Analysis

6.3. Global Veterinary Wound Cleansers Market Estimates and Forecasts, By End Use, Revenue (USD Million)

6.4. Veterinary Hospitals & Clinics

6.4.1. Veterinary hospitals & clinics market estimates and forecasts, 2021 to 2033 (USD Million)

6.5. Homecare

6.5.1. Homecare market estimates and forecasts, 2021 to 2033 (USD Million)

6.6. Research Institutes

6.6.1. Research institutes market estimates and forecasts, 2021 to 2033 (USD Million)

Chapter 7. Veterinary Wound Cleansers Market: Regional Estimates & Trend Analysis by Type, Product, and End Use

7.1. Regional Dashboard

7.2. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

7.3. North America

7.3.1. U.S.

7.3.1.1. Key country dynamics

7.3.1.2. Regulatory framework/ reimbursement structure

7.3.1.3. Competitive scenario

7.3.1.4. U.S. market estimates and forecasts, 2021 to 2033 (USD Million)

7.3.2. Canada

7.3.2.1. Key country dynamics

7.3.2.2. Regulatory framework/ reimbursement structure

7.3.2.3. Competitive scenario

7.3.2.4. Canada market estimates and forecasts, 2021 to 2033 (USD Million)

7.3.3. Mexico

7.3.3.1. Key country dynamics

7.3.3.2. Regulatory framework/ reimbursement structure

7.3.3.3. Competitive scenario

7.3.3.4. Mexico market estimates and forecasts, 2021 to 2033 (USD Million)

7.4. Europe

7.4.1. UK

7.4.1.1. Key country dynamics

7.4.1.2. Regulatory framework/ reimbursement structure

7.4.1.3. Competitive scenario

7.4.1.4. UK market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.2. Germany

7.4.2.1. Key country dynamics

7.4.2.2. Regulatory framework/ reimbursement structure

7.4.2.3. Competitive scenario

7.4.2.4. Germany market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.3. France

7.4.3.1. Key country dynamics

7.4.3.2. Regulatory framework/ reimbursement structure

7.4.3.3. Competitive scenario

7.4.3.4. France market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.4. Italy

7.4.4.1. Key country dynamics

7.4.4.2. Regulatory framework/ reimbursement structure

7.4.4.3. Competitive scenario

7.4.4.4. Italy market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.5. Spain

7.4.5.1. Key country dynamics

7.4.5.2. Regulatory framework/ reimbursement structure

7.4.5.3. Competitive scenario

7.4.5.4. Spain market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.6. Norway

7.4.6.1. Key country dynamics

7.4.6.2. Regulatory framework/ reimbursement structure

7.4.6.3. Competitive scenario

7.4.6.4. Norway market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.7. Sweden

7.4.7.1. Key country dynamics

7.4.7.2. Regulatory framework/ reimbursement structure

7.4.7.3. Competitive scenario

7.4.7.4. Sweden market estimates and forecasts, 2021 to 2033 (USD Million)

7.4.8. Denmark

7.4.8.1. Key country dynamics

7.4.8.2. Regulatory framework/ reimbursement structure

7.4.8.3. Competitive scenario

7.4.8.4. Denmark market estimates and forecasts, 2021 to 2033 (USD Million)

7.5. Asia Pacific

7.5.1. Japan

7.5.1.1. Key country dynamics

7.5.1.2. Regulatory framework/ reimbursement structure

7.5.1.3. Competitive scenario

7.5.1.4. Japan market estimates and forecasts, 2021 to 2033 (USD Million)

7.5.2. China

7.5.2.1. Key country dynamics

7.5.2.2. Regulatory framework/ reimbursement structure

7.5.2.3. Competitive scenario

7.5.2.4. China market estimates and forecasts, 2021 to 2033 (USD Million)

7.5.3. India

7.5.3.1. Key country dynamics

7.5.3.2. Regulatory framework/ reimbursement structure

7.5.3.3. Competitive scenario

7.5.3.4. India market estimates and forecasts, 2021 to 2033 (USD Million)

7.5.4. Australia

7.5.4.1. Key country dynamics

7.5.4.2. Regulatory framework/ reimbursement structure

7.5.4.3. Competitive scenario

7.5.4.4. Australia market estimates and forecasts, 2021 to 2033 (USD Million)

7.5.5. South Korea

7.5.5.1. Key country dynamics

7.5.5.2. Regulatory framework/ reimbursement structure

7.5.5.3. Competitive scenario

7.5.5.4. South Korea market estimates and forecasts, 2021 to 2033 (USD Million)

7.5.6. Thailand

7.5.6.1. Key country dynamics

7.5.6.2. Regulatory framework/ reimbursement structure

7.5.6.3. Competitive scenario

7.5.6.4. Thailand market estimates and forecasts, 2021 to 2033 (USD Million)

7.6. Latin America

7.6.1. Brazil

7.6.1.1. Key country dynamics

7.6.1.2. Regulatory framework/ reimbursement structure

7.6.1.3. Competitive scenario

7.6.1.4. Brazil market estimates and forecasts, 2021 to 2033 (USD Million)

7.6.2. Argentina

7.6.2.1. Key country dynamics

7.6.2.2. Regulatory framework/ reimbursement structure

7.6.2.3. Competitive scenario

7.6.2.4. Argentina market estimates and forecasts, 2021 to 2033 (USD Million)

7.7. MEA

7.7.1. South Africa

7.7.1.1. Key country dynamics

7.7.1.2. Regulatory framework/ reimbursement structure

7.7.1.3. Competitive scenario

7.7.1.4. South Africa market estimates and forecasts, 2021 to 2033 (USD Million)

7.7.2. Saudi Arabia

7.7.2.1. Key country dynamics

7.7.2.2. Regulatory framework/ reimbursement structure

7.7.2.3. Competitive scenario

7.7.2.4. Saudi Arabia market estimates and forecasts, 2021 to 2033 (USD Million)

7.7.3. UAE

7.7.3.1. Key country dynamics

7.7.3.2. Regulatory framework/ reimbursement structure

7.7.3.3. Competitive scenario

7.7.3.4. UAE market estimates and forecasts, 2021 to 2033 (USD Million)

7.7.4. Kuwait

7.7.4.1. Key country dynamics

7.7.4.2. Regulatory framework/ reimbursement structure

7.7.4.3. Competitive scenario

7.7.4.4. Kuwait market estimates and forecasts, 2021 to 2033 (USD Million)

Chapter 8. Competitive Landscape

8.1. Company/Competition Categorization

8.2. Vendor Landscape

8.2.1. List of key distributors and channel partners

8.2.2. Key company market share analysis, 2023

8.2.3. Elanco

8.2.3.1. Company overview

8.2.3.2. Financial performance

8.2.3.3. Product benchmarking

8.2.3.4. Strategic initiatives

8.2.4. Vetoquinol

8.2.4.1. Company overview

8.2.4.2. Financial performance

8.2.4.3. Product benchmarking

8.2.4.4. Strategic initiatives

8.2.5. Virbac

8.2.5.1. Company overview

8.2.5.2. Financial performance

8.2.5.3. Product benchmarking

8.2.5.4. Strategic initiatives

8.2.6. Innovacyn, Inc.

8.2.6.1. Company overview

8.2.6.2. Financial performance

8.2.6.3. Product benchmarking

8.2.6.4. Strategic initiatives

8.2.7. Axio Biosolutions Pvt Ltd

8.2.7.1. Company overview

8.2.7.2. Financial performance

8.2.7.3. Product benchmarking

8.2.7.4. Strategic initiatives

8.2.8. Jorgen Kruuse

8.2.8.1. Company overview

8.2.8.2. Financial performance

8.2.8.3. Product benchmarking

8.2.8.4. Strategic initiatives

8.2.9. Dechra Pharmaceuticals

8.2.9.1. Company overview

8.2.9.2. Financial performance

8.2.9.3. Product benchmarking

8.2.9.4. Strategic initiatives

8.2.10. Neogen Corporation

8.2.10.1. Company overview

8.2.10.2. Financial performance

8.2.10.3. Product benchmarking

8.2.10.4. Strategic initiatives

8.2.11. Ethicon (Johnson & Johnson Services, Inc.)

8.2.11.1. Company overview

8.2.11.2. Financial performance

8.2.11.3. Product benchmarking

8.2.11.4. Strategic initiatives