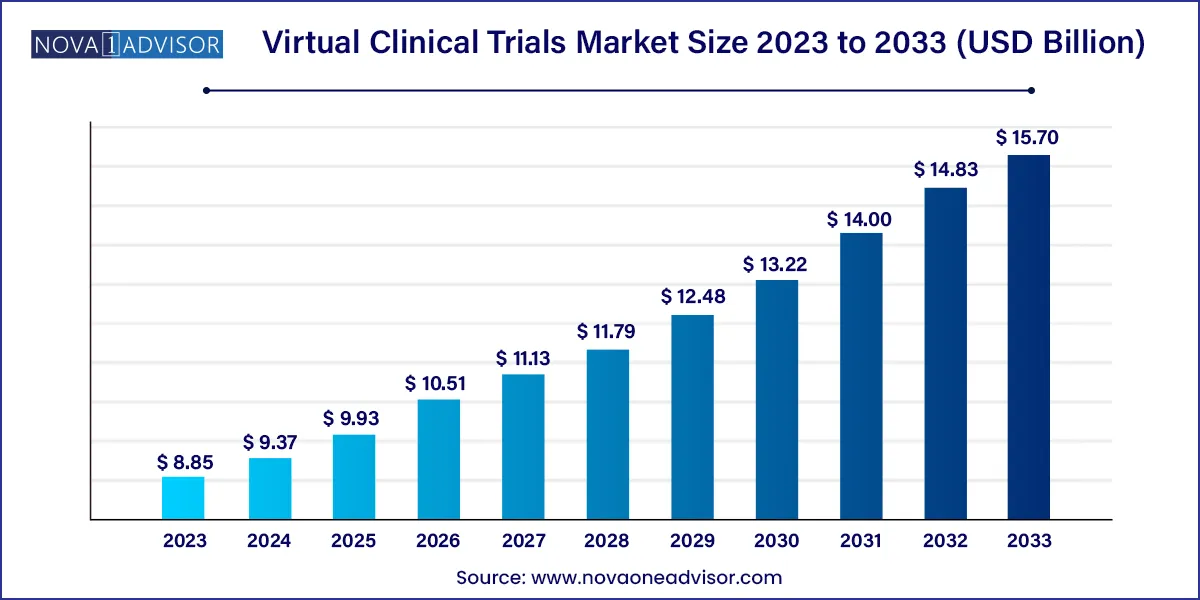

The global virtual clinical trials market size was exhibited at USD 8.85 billion in 2023 and is projected to hit around USD 15.70 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.37 Billion |

| Market Size by 2033 | USD 15.70 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Study Design, Indication, Phase, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | ICON, plc; Parexel International Corporation; IQVIA; Covance; PRA Health Sciences; LEO Innovation Lab; Medidata; Oracle; CRF Health; Clinical Ink; Medable, Inc; Clinical Ink; Halo Health Systems; Croprime |

The market is majorly driven by a rise in R&D activities, increasing healthcare digitization, as well as the adoption of telehealth. Besides, technological advancements, alliances between clinical research organizations, pharmaceutical, and biotechnology companies as well as supportive government initiatives are anticipated to drive the market. The COVID-19 pandemic changed the way of conducting ongoing or upcoming trials which positively impacted the virtual clinical trials industry.

Rising penetration of technology in healthcare is expected to drive the market growth. Digital technology is transforming the entire process of drug development. The advent of mobile & wearables, artificial intelligence, cloud technology, and associated platforms now enable collection of frequent, precise, and multidimensional data during the length of trials. These advanced technologies have the potential to enable innovative trial designs that lead to easy recruitment & retention, improve patient experience, and establish novel endpoints in clinical studies.

Moreover, to ensure efficiency of clinical trials based on new perspectives, an advanced strategy called patient-centricity has emerged. Clinical trial sponsors such as Pfizer and Sanofi have aligned their strategies of business development and designed new apps & wearables that enhance data collection and improve direct communication with patients.With apps & wearable devices directly connected to patients’ phones, clinical trials can now have access to data based on patients’ daily behavior.

Virtual methods let people take part in the trial from their homes ensuring research can continue even when site visits cannot, hence, representing a novel approach of collecting safety and efficacy data from participants of clinical studies. Virtual visits and remote patient monitoring of in-person site visits give participants a choice and peace of mind for not being exposed to unnecessary risks. virtual studies enable sponsors to include a larger population in the study, thus improving recruitment, engagement, and retention. Also, it enables continuous real-time data collection through digital health technologies. Eventually, virtual connectivity, monitoring as well as management can significantly decrease an effort, time commitment, and burden on the participants, CRCs, and investigators.

Market growth stage is medium, and pace of the market growth is accelerating. The virtual clinical trials market is characterized by a high degree of innovation. Rapid advancement of technology, particularly in the fields of telemedicine, remote monitoring, wearable devices, and electronic data capture, has paved the way for more sophisticated virtual clinical trial methodologies.

Virtual clinical trials market is also characterized by a medium level of merger and acquisition (M&A) activity by a leading player. Leading players are engaging M&A activities to expand their market presence and diversify their service offerings. Acquiring complementary technologies, expertise, or capabilities allows companies to strengthen their position in the virtual clinical trials ecosystem.

Virtual clinical trials market is characterized by a high impact of regulations. Regulatory agencies emphasize the importance of protecting the safety and rights of study participants. In virtual clinical trials, where participants may be remotely located, ensuring informed consent and monitoring participant safety become critical.

Virtual clinical trials market is characterized by a medium impact of service expansion.The virtual clinical trials market heavily relies on rapidly evolving technologies, and there is a need for some level of standardization to ensure interoperability and seamless integration of various tools and platforms. Service expansion may be moderate due to ongoing efforts to standardize technologies across the industry.

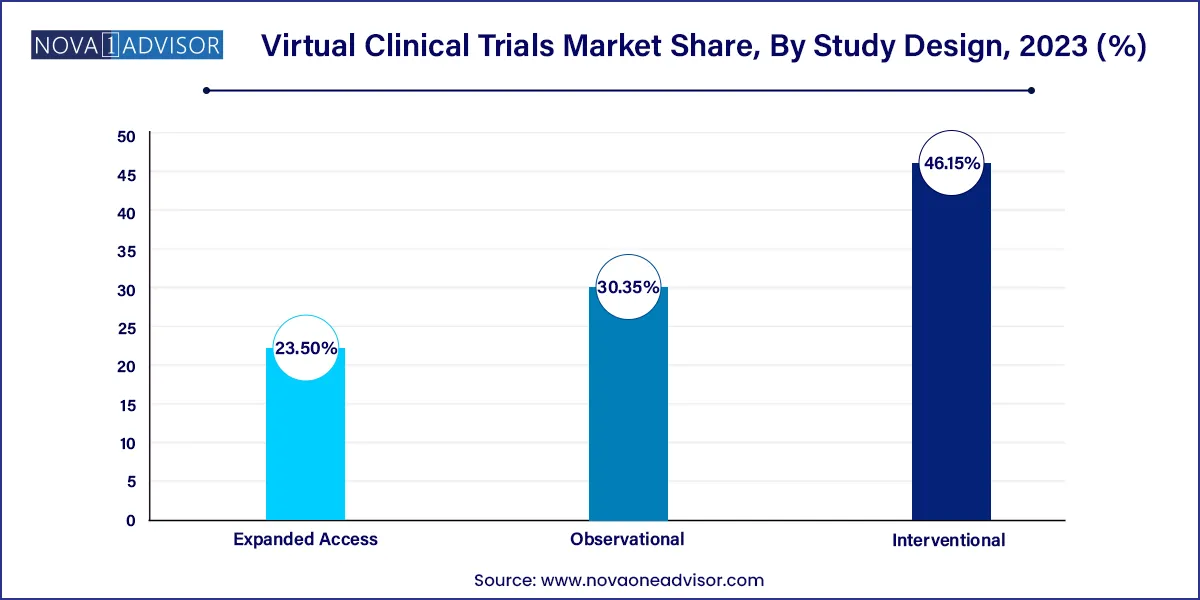

Interventional design segment led the virtual clinical trials market with largest revenue share of 46.15% in 2023. The rapid increase in number of experiments to develop novel medications for various diseases and the digitalization of laboratories are factors driving the segment. The outbreak of coronavirus has raised the demand for testing and trials of new drugs and vaccines to combat the situation around the world as the traditional method of clinical trials comes with a huge risk of infection in people. Thus, propelling the demand for interventional study designs.

Virtual trials are better suited for chronic diseases as well as less interventional observational studies including cardiovascular diseases, immunology, gastrointestinal, dermatology, respiratory, and endocrinology. The firm that first started this concept conducted an entire interventional Phase2b “site-less” clinical trial with 372 patients across 10 states using their proprietary mobile telemedicine-based platform namely “NORA”.

Expanded access segment is projected to witness a rapid growth of 5.9% during a forecast period. Expanded access is a potential pathway that is appropriate where the potential benefit for the patient subdues the potential risks, hence continuous emergence of new variants of COVID-19 is expected to drive demand for expanded access to new drugs over a short ter

Oncology segment dominated a market for virtual/decentralized clinical trials and accounted for a largest revenue share of over 25.0% in 2023. The segment is also anticipated to contribute to the maximum share of a market during the forecast period. This is attributed to a rising cases of cancer globally and the increasing number of oncology clinical trials. Cancer patients are the most vulnerable during the COVID-19 pandemic. Investigators and sponsors managing oncology clinical trials have quickly incorporated virtual and remote trials to keep patients safe and trials moving forward.

Cardiovascular segment is anticipated to witness a significant growth rate over a forecast period. Rising incidence of cardiovascular disorder across the globe is expected to drive the segment growth. According to WHO, an estimated 17.9 million people die every year owing to cardiovascular diseases, making it the biggest cause of death globally. According to CDC, one person dies every 36 seconds in the U.S. due to cardiovascular diseases.

Phase II segment dominated virtual clinical trials market and accounted for largest revenue share of over 30% in 2023. This is largely due to the adoption of DCT tools and platforms in phase II and phase I clinical trial procedures for patient participation. Virtual clinical trials are most beneficial in phase II of the clinical trials as It delivers value to the biopharmaceutical and pharmaceutical industry by saving time-sensitive patient data, delayed approvals, and site payments.

Traditional phase II clinical trials are the most expensive trials because s largest expense is the central clinical located in a large hospital to which the participants are required to report on a regular basis. Also, there is a large number of participants in the phase II clinical trials. While phase II virtual clinical trials are performed remotely with a help of the Internet, from recruiting to screening the data, which reduces a travel burden of the participants in the phase II trials and also reduces the cost of trials that no longer need to support frequent visit to the hospitals.

Phase III segment is anticipated to register a fastest CAGR of over 5.0% over the forecast period. Digital forces such as Big Data, Artificial Intelligence, Computing, Cloud, robotics, and social media offer opportunities to reimagine clinical trial processes. Some pharmaceutical companies are conducting virtual trials in addition to onsite traditional trials in Phase III & phase IV for additional data from diverse patient populations across the globe. Virtual clinical trials in phase III could automate data collection, increase patient engagement and retention, and data can be easily accessed through a monitoring device by trial investigators in real-time. The aforementioned associated benefits are further anticipated to provide this segment with lucrative growth opportunities in the near future.

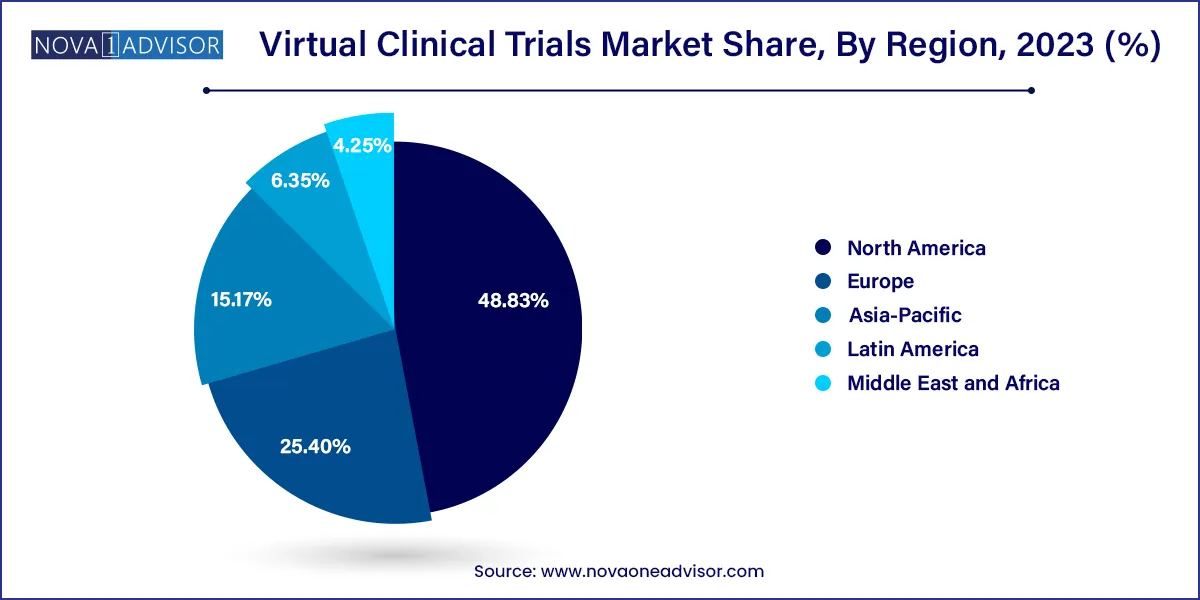

North America accounted for a largest regional revenue share of 48.83% in 2023 and is expected to continue its dominance over the forecast period. This can be attributed to increasing R&D in this region, increasing an adoption of new technologies in clinical research as well as government support. Furthermore, market players are also using digital technologies to meet client needs. For instance, Parexel performed more than 100 decentralized trials including hybrid and virtual approaches. Covance also has around 1,900 LabCorp Patient Service Centers across the U.S. that bring the trial to patients.

The U.S. contributed to a maximum share of the North American market. It accounted for over 90% of the North American virtual clinical trials market. This can be attributed to the presence of several players (such as ICON plc; IQVIA Holdings, Inc.; Covance, Inc.; PAREXEL; PRA Health Sciences; Medable, Inc.) that provide decentralized clinical trial services. Moreover, players are also introducing new products to increase their market share. Furthermore, due to the COVID 19 pandemic, the interest of researchers in virtual clinical trials has increased. The number of studies has risen exponentially since the pandemic, accelerating a long-simmering trend of virtual clinical trials that might persistently change the face of clinical research.

Asia Pacific is expected to witness exponential growth of 6.8% over a forecast period. Increasing rate of cardiovascular diseases and growing geriatric population are among factors projected to boost a growth of virtual clinical trials market over the forecast period. An increasing number of clinical trials to find effective and reliable solutions to decrease or cure and avoid the spread of cardiovascular and other diseases is expected to boost the demand for virtual clinical trials during the forecast period. Indian virtual clinical trials market is expected to be a fastest growing in Asia Pacific region in the next seven years, followed by China. Japan was the largest market in Asia Pacific region in 2023, majorly due to high healthcare and R&D expenditure and increasing demand for virtual clinical trials in the market.

Japan is a fifth largest market for virtual clinical trials in Asia Pacific region. Some of the major factors contributing to a growth of this market are rapid technological advancements and considerable healthcare expenditure. Japan is also expected to dominate the market owing to increasing demand for new and cost-effective clinical trials. Thus, increase in the need to maintain standards and curb healthcare expenditure are anticipated to drive the market in Japan. As Japan is technologically developed, there are various CROs that provide virtual solutions for clinical research

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global virtual clinical trials market.

Study Design

Indication

Phase

By Region