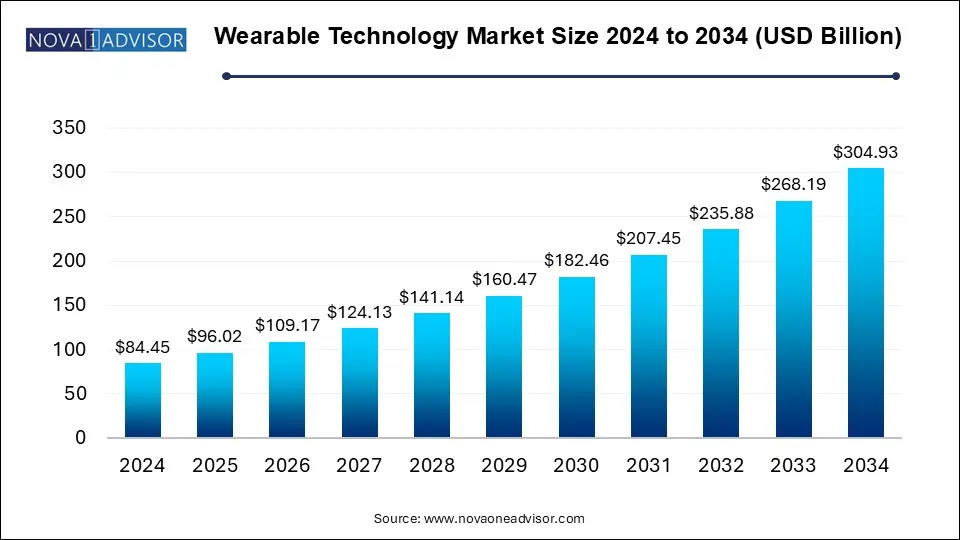

The wearable technology market size was exhibited at USD 84.45 billion in 2024 and is projected to hit around USD 304.93 billion by 2034, growing at a CAGR of 13.7% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 96.02 Billion |

| Market Size by 2034 | USD 304.93 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 13.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Google LLC; Apple Inc.; adidas AG.; Garmin Ltd.; Huawei Technologies Co., Ltd.; Nike, Inc.; Samsung Electronics Co., Ltd.; Sony Corporation; Xiaomi; Imagine Marketing Ltd. |

The rising concerns for obesity and chronic diseases are significantly contributing to the adoption of wearable products such as body monitors and activity trackers. Wearable devices provide information on heartbeat monitoring, quality of sleep, blood pressure, cholesterol levels, oxygen levels, calorie burn, and other information required to keep track of health on a daily basis.

Further, Smartwatches, earbuds, and smart shoes are attracting a wide consumer base, including athletes, adventurers, and sports enthusiasts. These devices provide fitness-related metrics and encourage a healthy lifestyle by providing information on calorie intake, water intake, and steps taken. These are the primary factors expected to propel the growth of the wearable technology market over the forecast period.

The use of wearable devices is rapidly growing in the areas of health and fitness owing to the rising consumer awareness of physical well-being, diet, daily footsteps, and other physical activity monitoring methods. Wearable devices help users track their activity levels, sleep patterns, heart rate, and other health-related metrics, empowering them to make and apply changes in their daily activities, lifestyle, and fitness routines. Advanced and innovative wearable devices include fitness-tracking smartwatches that are equipped with heart rate monitors, oxygen level trackers, and glucose monitoring, among other features, which assist in tracking health parameters that can help customers receive everyday health updates.

The adoption of technology is increasing, and this is offering sports players such as runners, golfball players, and football enthusiasts high-end wearable product categories such as smart sunglasses, smart shoes, smartwatches, smart body gear, and headphones. For instance, in July 2023, adidas AG introduced MC80, a newly designed spikeless footwear pervaded with premium material and technologies and aesthetically aligned with the company’s history of golf footwear. The MC80’s iconic TORSION bar offers golfers additional torsion stability and control. The company also incorporated a technical spikeless TPU in the MC80 outsole for additional traction.

The wrist-wear segment accounted for the largest revenue share of over 58% in 2024, owing to the rising popularity of health and fitness, entertainment, gaming, and connected technology devices. The use of smartwatches is not only limited to sharing and receiving text messages and notifications it is now being actively used for health monitoring, calling, and music-controlling purposes. With the introduction of advanced technologies in wearable devices, key players are offering users information on health updates, fitness monitoring, and performance tracking when engaged in sports, gaming, music, and other related activities.

The eyewear & headwear segment is expected to grow at a significant rate during the forecast period. Eyewear & Headwear wearable devices such as smart sunglasses, headbands, and helmets are designed to monitor and track users’ biometric data such as body temperature, brainwave, body pressure, and heart rate. Smart helmets help sports enthusiasts, including swimmers, riders, hikers, and travelers, gain insights, capture moments, and share real-time location updates with others. Furthermore, smart eyewear devices offer features to control music and take calls via intuitive and simple gesture controls.

The consumer electronics segment accounted for the largest revenue share of 50.0% in 2024, owing to the use of fashionable wearable devices providing influencers with a unique platform to showcase interactive content that can boost engagement and assist them in developing their brands. Moreover, companies approach influencers such as boAt, Xiaomi, and Samsung to partner with and promote their wearable device brands. The companies in the market target various customer groups looking for specifications, including brand name, affordability, durability, features, technology, and the latest product offerings.

The healthcare segment is expected to grow at a significant rate during the forecast period. Key market players are focusing on innovating and introducing breakthrough wearable technologies for monitoring everyday consumer health including blood sugar levels, heart rate, oxygen rate, stress level, among others. Furthermore, the rising innovations in wearable rings, bodywear, and wristwear devices to gain real-time health updates, early detection and prevention, and unwanted healing issues are expected to drive the growth of the segment over the forecast period.

North America wearable technology industry held the major revenue share of over 34% of the wearable technology market in 2024. Countries in the region, such as the U.S. and Canada, are home to some of the largest technology companies in the world, such as Google LLC and Apple Inc., among others, which are active in the wearable technology market. Rising health concerns, growing awareness about fitness and lifestyle, and increasing popularity of sports have been particularly driving the growth of the North America wearable technology market over the past few years.

U.S. Wearables Technology Market Trends

The wearable technology industry in the U.S. is expected to grow significantly from 2025 to 2030. Some of the key trends driving the growth of the U.S. wearable technology market include the growing preference for wearables, such as smartwatches, smart shoes, and smart sunglasses, with long-lasting batteries and water resistance features, and particularly earbuds and headphones with active noise-cancelation and sound-controlling technologies.

Europe Wearable Technology Market Trends

The Europe wearable technology industry is growing significantly at a CAGR of over 25% from 2025 to 2030. A huge customer base scouting for zero-impact and sustainable electronic devices has been building up lately across Europe. At the same time, various governments across Europe have also been drafting favorable regulations for environmental safety, thereby promoting the adoption of sustainable, high-tech wearable gadgets in the region.

The wearable technology industry in the UK is expected to grow rapidly in the coming years. In the UK, the demand for earbuds, smartwatches, and smart shoes, which offer standard features, such as Bluetooth connectivity, tracking, controlling, and better synchronization with other smart devices, is particularly prompting market players to diversify their product offerings to meet the unique requirements and specifications across different categories of customers in the country.

The Germany wearable technology industry held a substantial revenue share in 2024. In Germany, the growing preference for high-quality audio products, fitness watches, and smart eyewear is prompting key market players to pursue technological improvements, thereby driving the growth of the German wearable technology market over the forecast period.

Asia Pacific Wearable Technology Market Trends

The wearable technology market in the Asia Pacific is growing significantly at a CAGR of over 15% from 2025 to 2030. The growing demand for affordable wearables with unique features is driving the growth of the Asia Pacific wearable technology market. As such, exclusive features of the latest, modern wearables, such as support for voice assistants, water resistance, health management, and personal alerts and notifications, among others, are increasingly being integrated into the wearables being launched in Asia Pacific.

The Japan wearable technology industry is expected to grow rapidly in the coming years. Rapid advances in technology, a higher reliance on private jobs, and relatively longer working hours and traveling routes are some of the major factors poised to drive the growth of the Japanese wearable technology market over the forecast period.

The wearable technology market in China held a substantial revenue share in 2024. the presence of key contract manufacturers and component manufacturers, coupled with the easy availability of various resources, is expected to drive the growth of the Chinese wearable technology market over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the wearable technology market

By Product

By Application

By Regional