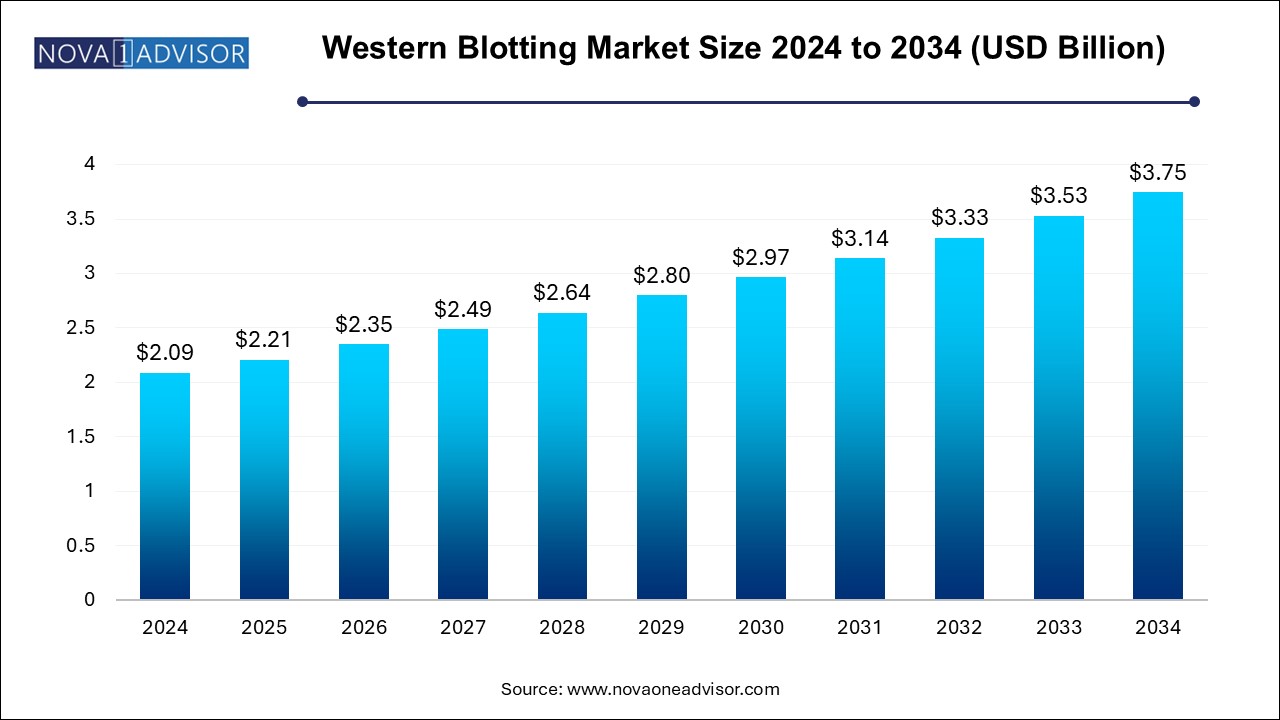

The western blotting market size was exhibited at USD 2.09 billion in 2024 and is projected to hit around USD 3.75 billion by 2034, growing at a CAGR of 6.02% during the forecast period 2025 to 2034.

The U.S. western blotting market size is evaluated at USD 20.01 billion in 2024 and is projected to be worth around USD 44.41 billion by 2034, growing at a CAGR of 7.51% from 2025 to 2034.

North America led the global western blotting market in 2024, supported by robust life sciences infrastructure, high research funding, and early technology adoption. The U.S. in particular accounts for a significant share of academic, pharmaceutical, and biotech research globally. Institutions such as the NIH, CDC, and leading universities routinely use western blotting in studies ranging from infectious disease to cancer biology. The region also benefits from the presence of major market players such as Bio-Rad Laboratories, Thermo Fisher Scientific, and LI-COR Biosciences, which contribute to product innovation and distribution efficiency.

Clinical applications also support the market’s strength in North America. FDA guidelines endorse western blotting for confirmatory diagnostics in several diseases, ensuring a baseline demand from clinical laboratories. The continued expansion of translational research, immunotherapy programs, and cell therapy trials further reinforces the region’s market dominance.

Asia Pacific is projected to witness the fastest growth, driven by rising investments in biotech infrastructure, expanding academic research, and increasing awareness of diagnostic technologies. Countries such as China, India, South Korea, and Japan are aggressively investing in their life sciences sectors, supported by government initiatives and private capital. China’s “Healthy China 2030” initiative and India’s Biotechnology Industry Research Assistance Council (BIRAC) have stimulated the setup of thousands of research labs and innovation hubs, many of which rely on western blotting for protein-level insights.

The region is also emerging as a hub for clinical trials and biosimilar production, both of which require validated protein analysis workflows. As local universities upgrade their labs and biotech start-ups scale up their platforms, the demand for affordable, high-quality western blotting instruments and consumables is rising. Global players are responding by setting up manufacturing or distribution facilities in Asia to meet this demand efficiently.

The western blotting market represents a foundational segment within the molecular biology and proteomics industries, functioning as a critical tool for protein analysis. Widely used in biomedical research, disease diagnostics, and pharmaceutical development, western blotting allows scientists to detect and quantify specific proteins in a complex sample, providing insight into protein expression patterns, post-translational modifications, and disease biomarkers.

Western blotting, also known as immunoblotting, follows a sequence of gel electrophoresis, protein transfer, and immunodetection using labeled antibodies. While the technique has been standard in labs for decades, ongoing technological advancements have modernized the process. Innovations in blotting instruments, imaging systems, and reagent chemistries have enhanced accuracy, reduced processing time, and improved sensitivity. The market has witnessed a paradigm shift toward automated systems and multiplex detection technologies that offer higher throughput and reproducibility.

Demand for western blotting is surging due to its central role in validating antibodies, monitoring disease biomarkers, confirming the expression of recombinant proteins, and supporting vaccine research. Moreover, it remains a gold-standard method for confirming HIV diagnoses and certain neurodegenerative conditions. The technique’s reliability in confirming results generated from other methods such as ELISA or qPCR continues to sustain its relevance in both research and clinical settings.

The market is also benefiting from the rapid expansion of academic and industrial life sciences research. Pharmaceutical and biotechnology companies rely on western blotting during preclinical trials and quality control processes for biologics and biosimilars. Government funding for proteomics research, the rise of personalized medicine, and increased interest in cell signaling pathways further boost the application scope. As life sciences evolve toward multi-omics integration, western blotting remains a vital technique underpinning protein research and diagnostic verification.

Automation of Western Blotting Workflows: Labs are adopting automated blotting systems that minimize manual intervention and improve reproducibility.

Rise in Multiplex Western Blotting: Simultaneous detection of multiple proteins in a single run is gaining traction, reducing reagent use and turnaround time.

Advancement in Imaging Systems: High-resolution chemiluminescent and fluorescent imagers with cloud integration are becoming standard.

Growth of Ready-to-Use Reagents and Kits: Pre-formulated buffers and antibody kits are simplifying western blotting protocols in busy labs.

Integration with Digital Data Management: Western blot results are being digitized and connected to LIMS and data repositories for enhanced analysis and traceability.

Increased Application in Disease-Specific Diagnostics: The method remains a confirmatory tool in conditions like HIV, Lyme disease, and prion diseases.

Expansion in Emerging Markets: Universities and pharma labs in Asia Pacific and Latin America are rapidly adopting western blotting technologies.

Sustainability and Reagent Optimization: Eco-friendly membranes and low-toxicity chemistries are emerging to address lab waste concerns.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.21 Billion |

| Market Size by 2034 | USD 3.75 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.02% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; LI-COR, Inc.; Merck KGaA; F. Hoffmann-La Roche Ltd.; Bio-Techne Corporation; GE Healthcare; QIAGEN; Advansta Inc.; and Cell Signaling Technology, Inc. |

A primary driver of the western blotting market is the escalating global investment in life sciences research, particularly in the domains of proteomics, disease biology, and pharmaceutical innovation. As governments, academic institutions, and private investors pour funds into understanding disease mechanisms at the molecular level, western blotting remains an indispensable tool for protein validation and pathway analysis.

For instance, cancer biology research extensively employs western blotting to study signaling proteins such as p53, Bcl-2, and Akt. Neuroscience labs rely on it to track the aggregation of proteins like tau or α-synuclein in neurodegenerative diseases. The increased focus on COVID-19, HIV, and autoimmune disease mechanisms has further solidified western blotting’s position in the molecular diagnostics pipeline. The proliferation of grants from agencies such as the NIH (U.S.), Horizon Europe, and Japan’s AMED continues to fuel instrument procurement and reagent usage, sustaining long-term market demand.

Despite its widespread use, a significant restraint of the western blotting market is its time-consuming and labor-intensive workflow. Traditional western blotting can span 1–2 days, requiring multiple manual steps including gel casting, protein transfer, blocking, antibody incubation, washing, and image capture. Each step introduces variability, especially in labs without access to trained personnel or standardized protocols.

Manual workflows are also susceptible to errors such as inconsistent transfer efficiency or uneven signal detection, leading to repeat experiments and reagent wastage. Additionally, traditional methods demand substantial bench space, cold storage for reagents, and regular calibration of electrophoresis systems. While automated systems exist, they are cost-prohibitive for many labs, particularly in developing regions. These challenges hinder throughput and may encourage researchers to shift to alternative techniques like ELISA or mass spectrometry for protein analysis.

An expanding opportunity for the western blotting market lies in its growing application within clinical diagnostics and personalized medicine. Although western blotting has historically been confined to research settings, its utility in confirmatory diagnostics is gaining attention in clinical laboratories. In infectious disease diagnostics, western blotting remains the confirmatory test for HIV and Lyme disease due to its specificity and reliability in antibody detection.

Moreover, the rise of personalized medicine has created a demand for techniques that can validate biomarker expression in patient samples. Western blotting is now being used in cancer diagnostics, immunological profiling, and rare disease investigations to confirm the presence of target proteins or therapeutic response indicators. As diagnostic labs move toward multi-omics platforms, integrating western blotting for proteomic confirmation offers a unique value proposition. Companies investing in clinical-grade reagents, automated systems, and regulatory-compliant platforms stand to gain significantly from this transition.

The Consumables dominated the western blotting market in 2024, due to their recurring usage across academic, pharmaceutical, and diagnostic laboratories. Reagents such as antibodies, blocking buffers, transfer membranes, and detection substrates are essential for each run and constitute the bulk of laboratory spending. Pre-made kits tailored for specific targets or pathways—such as apoptosis, cytokine expression, or GPCR signaling—are also gaining popularity for their convenience and time-saving advantages. Leading reagent manufacturers are increasingly offering optimized kits that include primary/secondary antibodies, pre-formulated buffers, and detection substrates to minimize variability and streamline protocols.

Instruments are expected to be the fastest-growing product segment, propelled by rising adoption of automated blotting platforms, high-speed electrophoresis systems, and advanced imaging solutions. Blotting systems—particularly semi-dry blotting devices—are gaining traction for their rapid transfer capabilities and space-saving designs. Imaging platforms, including chemiluminescent and fluorescent imagers, are also evolving with enhanced resolution, digital image management, and multiplex detection capacity. The demand for instruments is further fueled by labs upgrading from manual to semi-automated or fully automated systems to increase throughput and reduce hands-on time.

The Biomedical and biochemical research held the largest application share, as western blotting is deeply embedded in experimental workflows involving protein analysis. From basic cellular studies to translational drug discovery programs, researchers rely on western blotting to validate gene expression, track post-translational modifications, and confirm experimental hypotheses. Universities, research institutes, and pharma R&D labs form the backbone of this segment. The method’s versatility, affordability, and visual data output make it a go-to tool for early-career and seasoned researchers alike.

Disease diagnostics is the fastest-growing application, largely driven by the need for confirmatory testing in clinical settings. Western blotting remains the gold standard in the diagnosis of conditions such as HIV and Lyme disease, where accuracy and reproducibility are critical. Hospitals and clinical labs are investing in semi-automated blotting platforms capable of processing patient samples efficiently. Additionally, the method is gaining ground in neurological and oncological diagnostics, where confirmation of biomarker proteins can influence treatment decisions or clinical trial enrollment.

The Academic and research institutes dominated the end-use segment, owing to their pivotal role in fundamental and applied sciences. Western blotting is widely taught and used in university laboratories for student training, faculty research, and collaborative projects. These institutes often operate with internal grants or government funding and are early adopters of new kits or protocols. Furthermore, many academic institutions serve as clinical trial sites or preclinical research hubs, expanding their reliance on protein detection methods.

Pharmaceutical and biotechnology companies are the fastest-growing end users, driven by increasing R&D investments in biologics, biosimilars, and cell-based therapies. Western blotting is integral to the characterization of therapeutic proteins, quality control testing, and antibody validation workflows. Biotech firms are also using western blotting in high-throughput settings for target identification and pathway screening. These firms demand high precision, reproducibility, and regulatory-grade documentation, creating opportunities for companies offering validated kits and compliant instrumentation.

In March 2025, Bio-Rad Laboratories launched a fully automated western blotting system, the ChemiDoc™ Connect HD, with enhanced multiplex detection and AI-based image analysis.

In January 2025, Thermo Fisher Scientific introduced a new line of EcoReady™ pre-made buffers and blotting membranes designed to minimize waste and improve reproducibility.

In November 2024, LI-COR Biosciences expanded its Odyssey® imaging platform with dual-channel fluorescence detection and cloud integration for data sharing.

In October 2024, Merck KGaA announced a strategic partnership with a South Korean university to develop western blotting protocols tailored for neurological diagnostics.

In August 2024, Abcam plc released a series of disease-specific western blot kits, including products for Alzheimer’s, rheumatoid arthritis, and colorectal cancer research.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the western blotting market

By Product

By Application

By End Use

By Regional