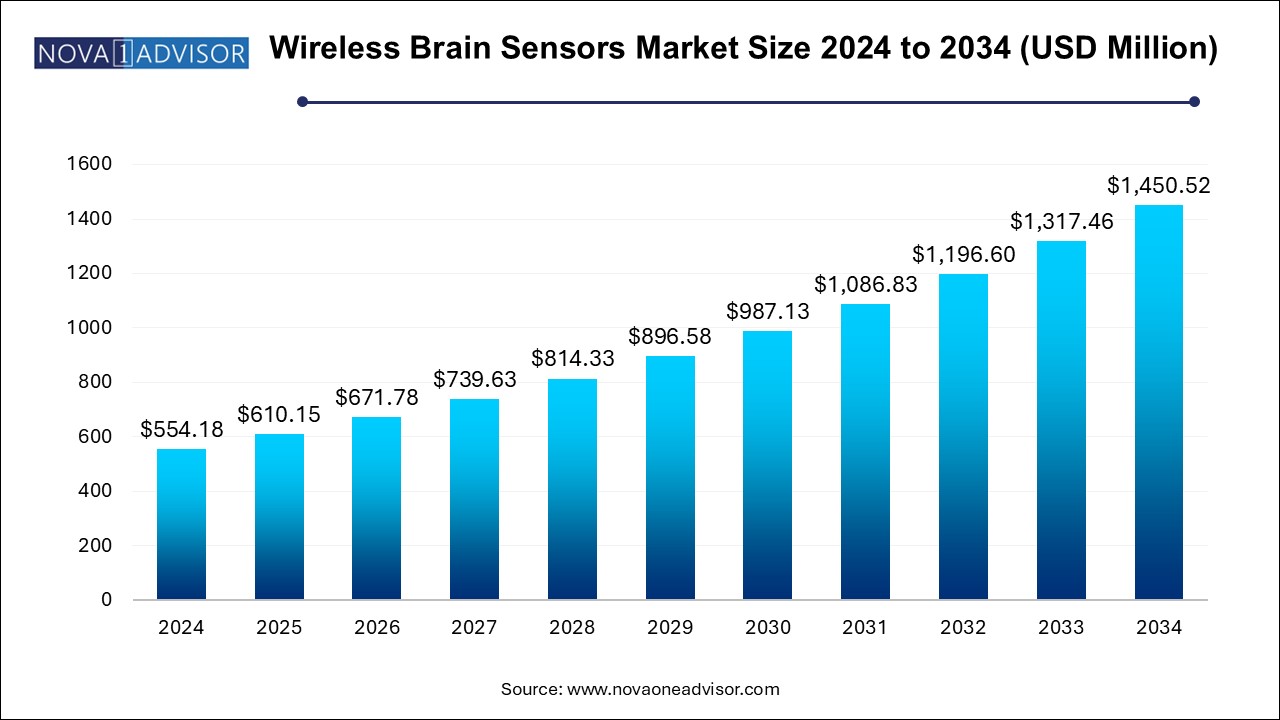

The wireless brain sensors market size was exhibited at USD 554.18 million in 2024 and is projected to hit around USD 1450.52 million by 2034, growing at a CAGR of 10.1% during the forecast period 2025 to 2034.

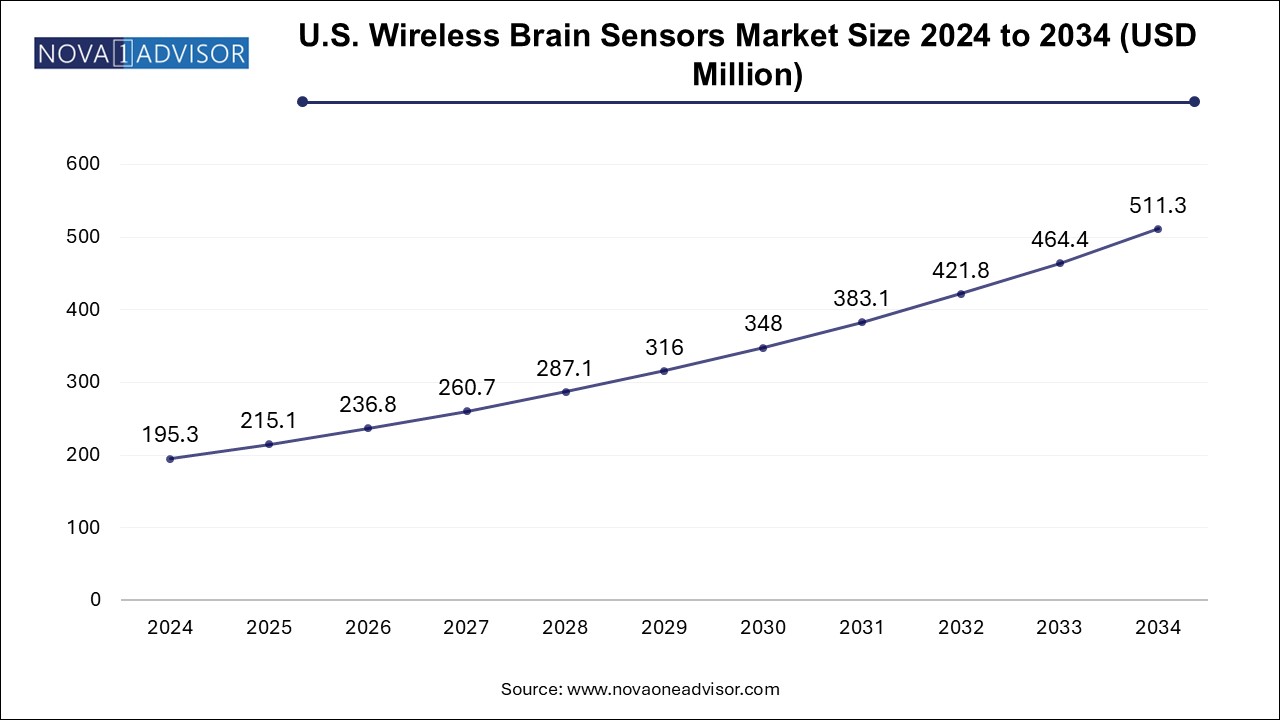

The U.S. wireless brain sensors market size is evaluated at USD 195.3 million in 2024 and is projected to be worth around USD 511.3 million by 2034, growing at a CAGR of 9.14% from 2025 to 2034.

North America led the wireless brain sensors market in 2024, supported by high healthcare spending, a strong innovation ecosystem, and early adoption of digital health technologies. The United States is home to numerous neurology research institutions, medical device companies, and neurotechnology startups developing EEG, ICP, and brain-machine interface products. Regulatory support from the FDA for novel neurology devices has accelerated commercialization.

Moreover, the rising prevalence of neurological disorders such as Alzheimer’s, Parkinson’s, and epilepsy, combined with government-funded brain research programs (e.g., the BRAIN Initiative), has significantly boosted demand for advanced brain monitoring tools. Hospitals and outpatient centers in the U.S. are increasingly adopting wireless EEGs and ICP monitors to improve diagnostic accuracy and reduce inpatient time. Telehealth integration and cloud-based diagnostics platforms are further accelerating the region’s leadership.

Asia Pacific is projected to register the highest growth rate, driven by a combination of demographic trends, infrastructure modernization, and increased research investment. Countries such as China, India, South Korea, and Japan are experiencing rising neurological disease burdens, fueled by aging populations, pollution, and lifestyle-related stress factors. Government initiatives such as “Healthy China 2030” and India’s National Health Mission are enhancing neurological care access and diagnostic capacity.

Additionally, Asia’s robust electronics manufacturing ecosystem supports local development of wireless EEG and biosensor components at competitive prices. Academic collaborations and startup accelerators in Singapore, South Korea, and Japan are fostering innovation in wearable neurotech. With rising awareness, improving affordability, and a large underserved patient base, Asia Pacific is poised to become a central growth hub in the wireless brain sensors market.

The wireless brain sensors market represents a dynamic and transformative segment of the neurotechnology landscape, blending cutting-edge neuroscience with advanced wireless communication and miniaturized electronics. These sensors are revolutionizing how brain activity is measured, monitored, and interpreted, offering non-invasive or minimally invasive solutions for real-time brain data acquisition. Wireless brain sensors are used across a wide spectrum of clinical and research settings, supporting applications ranging from the diagnosis and treatment of neurological disorders to cognitive performance monitoring, brain-computer interface (BCI) development, and neuroprosthetics.

The increasing prevalence of neurological conditions such as epilepsy, Parkinson’s disease, dementia, and traumatic brain injuries (TBIs) is one of the most significant drivers of market growth. Traditional wired monitoring systems, although accurate, often limit patient mobility and can compromise the quality of data collected in natural settings. Wireless brain sensors overcome these limitations by offering greater freedom of movement, improved patient comfort, and prolonged monitoring capabilities outside clinical environments. As healthcare systems shift toward personalized and ambulatory care models, the demand for portable, non-invasive, and continuously monitoring devices is soaring.

The integration of these sensors with smartphone applications, cloud platforms, and machine learning algorithms has expanded their utility beyond conventional clinical applications. Athletes, mental health practitioners, researchers, and even consumer tech companies are exploring these sensors for neurofeedback, sleep quality monitoring, mental wellness tracking, and neuroenhancement purposes. Academic institutions, neurotech startups, and established medical device firms are investing heavily in R&D to improve signal quality, energy efficiency, and sensor miniaturization, paving the way for next-generation neural diagnostics and therapeutics.

Furthermore, increasing government and private funding in neuroscience research, favorable regulatory pathways, and the growing need for remote neurological care solutions are boosting adoption. As wireless brain sensing technology continues to evolve, it is expected to play a pivotal role in shaping the future of neurology, mental health, and brain-computer interface systems.

Miniaturization and Wearable Integration: Development of ultra-thin, flexible, and skin-mounted wireless brain sensors suitable for long-term wear and comfort.

AI and Real-Time Data Analytics: Integration of machine learning algorithms for predictive modeling, seizure forecasting, and personalized neurofeedback.

Remote Patient Monitoring and Tele-Neurology: Expansion of wireless EEG and ICP monitoring to home-based and outpatient settings, driven by telemedicine growth.

BCI Applications Beyond Healthcare: Use of wireless brain sensors in gaming, AR/VR, military training, and consumer wellness for cognitive tracking.

Growth in Sleep Technology: Rising use of wireless sensors in sleep clinics and consumer markets to diagnose and manage sleep disorders.

Cloud-Connected Platforms: Real-time brain data streaming to cloud dashboards for clinical decision-making and research collaboration.

Biocompatible and Implantable Devices: Progress in developing fully implantable wireless brain sensors with long battery life and biocompatibility.

Cross-Industry Collaborations: Partnerships between medtech firms, tech giants, and academic institutions to accelerate innovation and commercial readiness.

| Report Coverage | Details |

| Market Size in 2025 | USD 610.15 Million |

| Market Size by 2034 | USD 1450.52 Million |

| Growth Rate From 2025 to 2034 | CAGR of 10.1% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product, Application, End Use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | EMOTIV; Advanced Brain Monitoring, Inc; NeuroSky; Neuroelectrics; Neuronetrix Solutions, LLC |

The most compelling driver for the wireless brain sensors market is the global rise in neurological conditions, particularly age-related and trauma-induced disorders. Neurological diseases account for more than 9 million deaths globally each year and are a leading cause of disability-adjusted life years (DALYs). Conditions such as Alzheimer’s, Parkinson’s, epilepsy, and traumatic brain injuries are increasingly diagnosed, driven by aging populations, lifestyle factors, and improved screening.

In this context, wireless brain sensors offer a paradigm shift in how neurological data is collected and analyzed. For example, wireless EEG systems are now used for long-term epilepsy monitoring outside hospital settings, reducing hospitalization costs and improving diagnostic accuracy. Similarly, ICP monitors are critical for managing TBIs in emergency care and neurosurgery. The ability to gather uninterrupted, high-fidelity neural data in real-world settings helps clinicians make better-informed decisions and enables proactive intervention—improving outcomes and reducing healthcare burden.

Despite their clinical promise, data privacy and cybersecurity concerns remain a key barrier to the widespread adoption of wireless brain sensors. These devices collect highly sensitive neurophysiological data, often continuously, and transmit it wirelessly to cloud-based platforms or healthcare systems. This opens up potential vulnerabilities related to unauthorized access, data leaks, or hacking—especially in non-clinical or consumer use cases.

The lack of uniform global regulations for handling brain data complicates matters further. While frameworks such as HIPAA in the U.S. offer some protections, evolving technologies like brain-computer interfaces or cognitive tracking in consumer devices may operate in regulatory gray zones. Ensuring end-to-end encryption, data anonymization, and user consent protocols are critical, but compliance can be technically complex and costly—particularly for startups. Without clear, enforceable standards, privacy concerns could undermine trust in the technology and slow market expansion.

A transformative opportunity for wireless brain sensors lies in the emerging field of brain-computer interfaces, where real-time brain activity is translated into commands for external devices or digital systems. BCIs have enormous potential across healthcare and non-medical domains, from restoring communication in patients with paralysis to enabling immersive gaming and augmented reality experiences. Wireless brain sensors are at the heart of these applications, serving as the interface layer that captures the brain’s electrical signals non-invasively.

Tech companies, such as Neuralink, Facebook (Meta), and Valve Corporation, are investing in BCI research, while startups are experimenting with consumer-grade EEG headsets for meditation, focus training, and digital control. Healthcare applications include motor rehabilitation, prosthetic control, and neurofeedback therapy for ADHD, depression, or PTSD. As sensor accuracy improves and algorithms become more sophisticated, the commercial feasibility of BCI systems will grow, positioning wireless brain sensors as a key enabling technology in this futuristic domain.

The Electroencephalography (EEG) devices dominated the wireless brain sensors market in 2024, driven by their versatility, non-invasiveness, and broad applicability across neurological disorders. EEG devices are used extensively in diagnosing and monitoring epilepsy, sleep disorders, cognitive impairments, and mood conditions. Wireless EEGs enhance patient comfort and enable prolonged, real-time monitoring in both clinical and ambulatory settings. Innovations such as dry electrode EEG caps, smartphone-connected headsets, and AI-driven signal processing are making EEG more accessible for both clinical and wellness applications.

Intracranial pressure (ICP) monitors are expected to be the fastest-growing product segment, particularly due to their critical role in managing traumatic brain injuries, hydrocephalus, and post-neurosurgical care. Wireless ICP monitoring systems are reducing the need for ICU-bound monitoring, allowing for less invasive, ambulatory pressure tracking. These devices are increasingly adopted in military field medicine, trauma centers, and neurosurgical wards where rapid and continuous pressure data can inform life-saving interventions. As biocompatible materials and miniaturized electronics improve, this segment is poised for rapid technological evolution.

The Multispecialty hospitals held the dominant market share, due to their infrastructure, staffing, and capacity to integrate wireless brain sensors into comprehensive neurodiagnostic and neurosurgical workflows. Hospitals commonly use these sensors in emergency care, epilepsy monitoring units, operating rooms, and intensive care settings. They are often the first adopters of high-end EEG, ICP, and Doppler systems, integrating them into EHRs and digital imaging platforms to provide holistic care.

Research institutes are expected to witness the fastest growth, especially with the rise in neuroscience funding, translational brain research, and interdisciplinary BCI initiatives. Academic centers and research labs are using wireless brain sensors to study cognitive function, neuroplasticity, consciousness, and neurodegenerative disease mechanisms. They are also key players in developing and testing next-generation sensor platforms, including implantable and AI-integrated systems. As grant funding rises and public-private partnerships expand, this segment will remain at the forefront of innovation.

Epilepsy accounted for the largest application share, owing to the extensive use of EEG-based brain monitoring for seizure detection, localization, and post-surgical evaluation. Wireless EEG systems are increasingly used in ambulatory epilepsy monitoring units, where continuous brain activity recording over days or weeks is needed to capture rare seizure events. These systems improve patient comfort and reduce hospital stays, while enabling neurologists to make more precise diagnostic and surgical planning decisions.

Dementia is projected to be the fastest-growing application, as the prevalence of Alzheimer’s and related neurodegenerative disorders surges globally. Early detection and continuous cognitive monitoring are critical for slowing disease progression. Wireless brain sensors can track subtle changes in brain activity associated with memory, attention, and executive function. Devices integrated with cognitive assessments and AI-based trend analysis offer promise in detecting early-stage dementia before clinical symptoms manifest. Aging populations in regions like Europe, Japan, and North America will significantly boost demand in this segment.

In March 2025, Neuroelectrics announced the launch of its new wireless EEG platform, Starstim Pro, designed for remote epilepsy monitoring and transcranial stimulation.

In January 2025, Biogen and Apple revealed results from a joint study using the Apple Watch and connected wireless brain sensors to detect early signs of cognitive decline.

In November 2024, BrainScope received FDA clearance for its handheld wireless EEG system for concussion and mild traumatic brain injury assessment in emergency departments.

In September 2024, Neuralink conducted successful human trials of its fully implantable wireless brain chip, offering real-time brain signal transmission with no external wiring.

In July 2024, Emotiv launched its consumer-grade EEG headset, Insight X, offering wireless neurofeedback for stress, focus, and sleep tracking.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the wireless brain sensors market

By Product

By Application

By End Use

By Regional