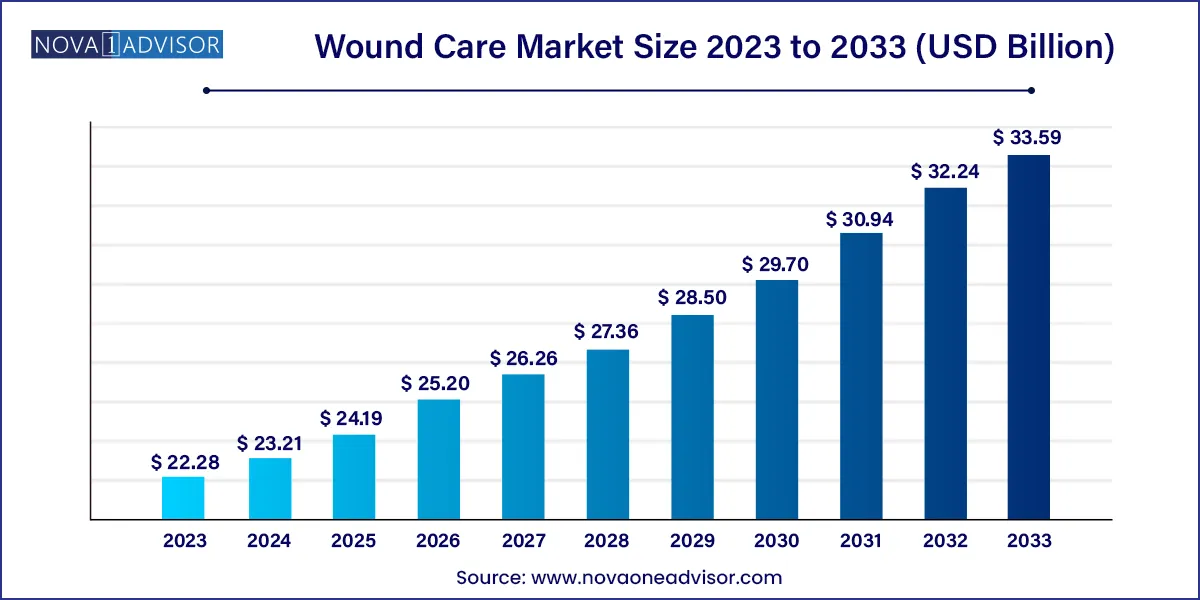

The global wound care market size was exhibited at USD 22.28 billion in 2023 and is projected to hit around USD 33.59 billion by 2033, growing at a CAGR of 4.19% during the forecast period 2024 to 2033.

Key Takeaways:

Wound Care Market Report Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 23.21 Billion |

| Market Size by 2033 | USD 33.59 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.19% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, End-use, Mode Of Purchase, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled | Smith & Nephew; Mölnlycke Health Care AB; Convatec Group PLC; Ethicon (Johnson & Johnson); Baxter International; DeRoyal Industries, Inc.; Coloplast Corp.; Medtronic; 3M; Integra LifeSciences, Inc.; Medline Industries, Inc.; B. Braun Melsungen AG; Cardinal Health, Inc.; Organogenesis Inc.; MIMEDX Group, Inc. |

The demand for wound care products is increasing owing to the increasing number of surgical cases and the rising prevalence of chronic diseases across the globe. Furthermore, the increasing incidence of diabetes due to a sedentary lifestyle is one of the leading factors contributing to market growth. For instance, as per a report by Centers for Disease Control and Prevention (CDC), which was last reviewed in April 2023, 37.3 million Americans have diabetes. Similarly, as per the same source, 96 million American adults have prediabetes.

Besides, wound care products help cure diabetic foot ulcers, which are prevalent in diabetic patients. For instance, according to a National Institute of Health (NIH) report, last updated in August 2023, diabetes is a major cause of non-traumatic amputations in the U.S. Overall, 5% of patients with diabetes develop foot ulcers, of which 1% may need an amputation. Wound care products such as hydrocolloid dressings help in moisture retention and allow rapid healing of wounds internally as well as externally. Moreover, these products help in the absorption of necrotic tissues, which are effective in cases of surgical site infections. Thus, healthcare professionals prefer to use wound care products, which is anticipated to propel the market growth over the forecast period.

Moreover, rising cases of burn injuries are another key factor fueling the market growth. One of the key factors responsible for its dominance is an increase in the number of burn cases. For instance, here are some general statistics on burn injuries based on data from the World Health Organization (WHO) and the American Burn Association:

An estimated 180,000 deaths occur each year worldwide due to burn injuries.

Furthermore, the increasing number of traumatic injuries globally is expected to propel the market. For instance, according to a WHO report (published in June 2022), around 1.3 million people die every year because of road traffic accidents. Similarly, as per nationgroup.com, in 2022, about 14,737 individuals died in Thailand as a result of traffic-related incidents. Collagenase-based enzymatic wound debridement products are majorly used to treat such acute wounds. Thus, such cases are expected to increase the demand for wound care products.

An increasing number of Ambulatory Surgical Centers (ASCs) are expected to drive the growth of the market. ASCs offer a variety of services, such as surgical care, diagnostics, and preventive procedures. Surgeries for pain management, urology, orthopedics, restorative, reconstructive, or alternative plastic surgeries, and Gastrointestinal (GI) related surgeries are performed in ambulatory surgery centers. In addition, ASCs are increasing in number and thus offer cost-effective services. For instance, as per a report by Blue House Sales Group, in August 2023, there were about 6,179 Medicare-certified ASCs present in the U.S. Thus, with the increasing number of ASCs, the market is expected to grow during the forecast period.

The wound care industry trends are subject to ongoing developments and technological advancements. Continued advancements in wound care technologies, including smart dressings, bioengineered tissues, and digital wound monitoring, offer more sophisticated and effective solutions for wound management. For instance, in January 2023, researchers at the University of Arizona College of Medicine developed a smart bandage combining advanced electronics for accelerating tissue repair. It employs electrical stimulation and biosensors to help enhance blood flow to wounded tissue, close wounds faster, and prevent scar formation.

Furthermore, there is an increasing trend toward developing more environmentally friendly wound care solutions. Concerns about the environmental impact of medical waste, as well as the rising expense of standard wound care solutions, are driving this trend. Biodegradable materials are being used to create interactive wound dressings, minimizing their environmental impact, and increasing sustainability. Thus, the market is expected to witness ongoing collaborations, research endeavors, and the emergence of novel therapies and products aimed at advancing wound healing and patient well-being.

Market Concentration & Characteristics

The market growth stage is moderate, with an accelerating pace, characterized by a moderate-to-high degree of growth. Key drivers include the global rising prevalence of chronic and acute wounds, aging population, increasing number of surgeries, and advancements in technology. Regulatory compliance, reimbursement policies, and the trend toward home healthcare also shape the market dynamics. In addition, emerging trends towards tailoring wound care treatments to individual patient characteristics, including genetics and specific wound conditions, are gaining attention, leading to more personalized and targeted interventions.

Key strategies implemented by players in market are new product launches, expansion, acquisitions, partnerships, and other strategies. For instance, in September 2023, MiMedx Group, Inc. launched EPIEFFECT as the newest item in the company’s line of advanced wound care products. EPIEFFECT adds to the firm's core advanced wound care offering for clinicians treating acute and chronic, difficult-to-heal wounds such as diabetic foot ulcers ("DFUs") and venous leg ulcers ("VLUs"), among other ailments. EPIEFFECT has a thick, tri-layer structure that is ideal for suturing the graft in place. Furthermore, its product features and handling characteristics make it an ideal therapy alternative for deep or tunneling wounds.

The market is witnessing a substantial degree of innovation driven by rapid technological advancements and the increasing adoption of advanced products, particularly in home care settings. Home healthcare in the market has gained prominence due to several factors, including the aging population, technological advancements, cost-effectiveness, and the desire for patient-centric care. This shift toward patient-centric care involves developing wound care solutions that are not only effective but also consider patient comfort, ease of use, and the ability for patients to manage aspects of their care independently. In addition, telemedicine and remote monitoring technologies enable healthcare providers to assess and monitor wounds through virtual consultations, reducing the need for frequent hospital or clinic visits.

Regulations play a crucial role in shaping the market, influencing product development, marketing, patient safety, and overall industry practices. Various regulatory bodies and standards such as FDA (Food and Drug Administration) approvals in the United States or CE marking in the European Union oversee the approval and certification of wound care products. Compliance with regulatory standards is essential for market entry and product commercialization. Regulations set stringent quality and safety standards for wound care products. Manufacturers must adhere to Good Manufacturing Practices (GMP) and meet specific criteria to ensure the safety and effectiveness of their products. However, stringent regulatory requirements may act as barriers to entry for smaller companies or new market entrants. Compliance with regulations often involves significant investments in research, testing, and documentation.While compliance with regulatory requirements can pose challenges, it also serves to build trust among healthcare providers, patients, and regulatory authorities, contributing to the overall integrity of the wound care industry.

Companies are actively acquiring development-stage firms to broaden their service portfolios, catering to a larger patient base. Major companies may acquire smaller firms to strengthen their market position, expand product portfolios, or gain access to new technologies. For instance, in April 2023, Convatec Group PLC acquired 30 Technology Limited’s anti-infective nitric oxide technology platform, which includes new product assets and research and development. In addition to its applications in advanced wound care, the firm plans to explore the technical platform for use in other businesses.

The market is highly fragmented and competitive in nature with key players involved in continuous product development & partnership alliances to aid market penetration. Rising number of distributors and dealers is expected to increase industry rivalry in the coming years. Industry players are gaining market penetration via geographical expansion in developing countries.

Companies in the market are strategically focusing on regional expansion to capitalize on emerging opportunities and broaden their market presence. This entails establishing a stronger footprint in key geographical areas through partnerships, acquisitions, and localized marketing strategies. For instance, in April 2021, Mölnlycke Health Care AB expanded its presence in Malaysia with the construction of a new factory. This strategy helped the company establish itself in the Malaysian market. Moreover, by tailoring their products and services to meet regional healthcare needs, wound care firms aim to enhance accessibility and responsiveness, ensuring a more comprehensive and effective market penetration. Thus, regional expansion serves as a critical factor for industry leaders to tap into diverse markets, address specific healthcare demands, and ultimately drive sustained growth.

Segments Insights:

Product Insights

Based on product, the market has been segmented into advanced wound dressings, surgical wound care, traditional wound care, and wound therapy devices. The advanced wound dressing segment held the maximum share of 34.9% in 2023 in the product segment and is expected to register the highest CAGR during the forecast period. Advanced wound dressing is mainly used to treat chronic and non-healing wounds. Thus, increasing the number of chronic wounds, such as diabetic foot ulcers, is expected to help the wound care industrial propel. For instance, as per the National Center for Biotechnology Information (NCBI), in August 2023, incidence of diabetic foot ulcers globally is between 9.1 million and 26.1 million. In addition, about 15% to 25% of patients with diabetes may develop a diabetic foot ulcer during their lifetime. Therefore, due to the above-mentioned factors, the market is expected to propel during the forecast period.

The surgical wound care segment is anticipated to grow at a considerable growth rate of 4.30% during the forecast period. This can be attributed to rising surgical cases and surgical site infections worldwide. For instance, as per a report by NIH, published in January 2023, around 0.5% to 3% of patients undergoing surgery may experience surgical site infection. Thus, impelling the segment growth.

Application Insights

Chronic wounds segment held the largest share of 60.0% in 2023 and is anticipated to witness a considerable growth rate over the forecast period. An increasing number of geriatric populations, along with the rising prevalence of diabetic foot ulcers, venous pressure ulcers, and other chronic wounds, is expected to drive the segment's growth. For instance, as per a United Health Foundation report (published in May 2023), more than 55.8 million adults aged 65 and older lived in the U.S., accounting for about 16.8% of the nation's population in 2021.

Furthermore, the number of people suffering from varicose vein in the U.S. is increasing year on year. For instance, according to the Journal of the American Heart Association (AHA), approximately 23% i.e., 1 in every 4 U.S. resident have varicose veins. An increase in number of varicose veins may lead to development venous leg ulcers, thus, driving the growth.

Acute wound segment is expected to grow at the fastest CAGR of 4.28% during the forecast period. The increasing number of cases of different traumatic wounds and burns is the major factor driving the segment’s growth. The multiple benefits of acute wound products include reduced surgical site infections, improved results and patient satisfaction, and reduced hospital stays. There is also an increase in the number of burned wounds across the globe. Since acute wound products are majorly used for treating acute wounds such as traumatic wounds, the use of wound care products is expected to help surge the segment growth.

End-use Insights

The hospital segment held the largest share of 39.0% in 2023. The growth of this segment can be attributed to an upsurge in surgical procedures globally because of sedentary lifestyle, and rising bariatric surgeries which require the use of wound care products to contain surgical site infections. Furthermore, surgical wound care dressings and negative pressure wound therapy (NPWT) are predominantly suitable for hospital use and are not feasible for home care. In addition, hospital institutions are considered large buyers of wound care having long-term contracts with suppliers. Hence, owing to aforementioned factors, the segment is anticipated to propel during the forecast period.

In addition, the increase in hospital admissions due to surgeries is also anticipated to propel the segment growth over the forecast period. Patients after surgery generally require wound care products to heal from surgical site wounds. Therefore, the segment is expected to witness significant growth over the forecast period.

Home healthcare segment is expected to grow at the fastest CAGR of 5.51% during the forecast period. During the pandemic outbreak, home healthcare wound care products were more in demand. Wound care in homecare settings is majorly initiated with the introduction of single-use NPWT systems. These devices are lightweight, portable, canister-free, and are easy to use. In addition, cost-effectiveness of such therapy for treating wounds also encourages patients to adopt homecare settings over hospital stays.

Moreover, increasing number of geriatric populations is expected to propel the market segment. Geriatric population tends to opt for homecare settings or nursing home care. Furthermore, the presence of several organizations offering home care services in North America and Europe is promoting home care services market. Thus, with an increase in number of geriatric population and nursing home care, the segment is anticipated to impel during the forecast period.

Distribution Channel Insights

Institutional sales dominated the distribution channel segment. Wound care product manufacturers may also sell products directly to healthcare providers, such as hospitals and clinics, or patients through direct-to-consumer marketing. This approach can provide more control over the distribution process and enable manufacturers to build relationships with their customers. Institutional sales comprise mainly direct distributors and manufacturers. Hospitals, clinics, wound care centers, and other healthcare facilities, such as nursing homes, long-term care facilities, diagnostic laboratories, and birth centers, usually have long-term contracts and tie-ups with distributors and manufacturers. Key players are adopting long-term contracts with end-users as a strategy to expand their reach and strengthen their foothold in the market.

Retail sales are expected to witness the fastest growth in the forecast period, with a CAGR of 4.6%. Retail sales mainly comprise retail pharmacy stores, e-commerce, etc. Customers benefit from pharmacies as they are large in numbers. They offer various delivery options and usually provide good service. Customers typically purchase prescription and non-prescription wound care products at retail pharmacy stores and specialty pharmacies. These pharmacies may stock wound care products such as dressings, ointments, and bandages, and may also provide wound care advice and services. The e-commerce segment is anticipated to expand at the fastest CAGR over the forecast period. Online stores and mail-order companies are quite similar, and their main advantages are cheap prices and ease of access. Rising online and e-commerce accessibility of wound care products will likely aid in market expansion. eHealth is a fast-growing part of e-commerce.

Mode Of Purchase Insights

The prescribed segment is anticipated to dominate the market and is projected to grow at a fastest CAGR of 5.0% over the forecast period. The prescribed wound care products depend on the type of product and the severity of the wound. For mild to moderate wounds, over-the-counter wound care products such as bandages, gauze, and antiseptic creams can be purchased at pharmacies, drug stores, or online retailers. For more severe wounds, prescription wound care products such as wound dressings, wound cleansers, and topical antibiotics may be required.

These products can only be obtained with a prescription from a healthcare provider and can be purchased at a pharmacy. Moreover, people are inclined toward prescribed wound care products as Medicare covers around 80% of the cost of medically necessary wound care supplies and surgical dressings. This encourages people to visit physicians and receive prescribed wound care medication.

Regional Insights

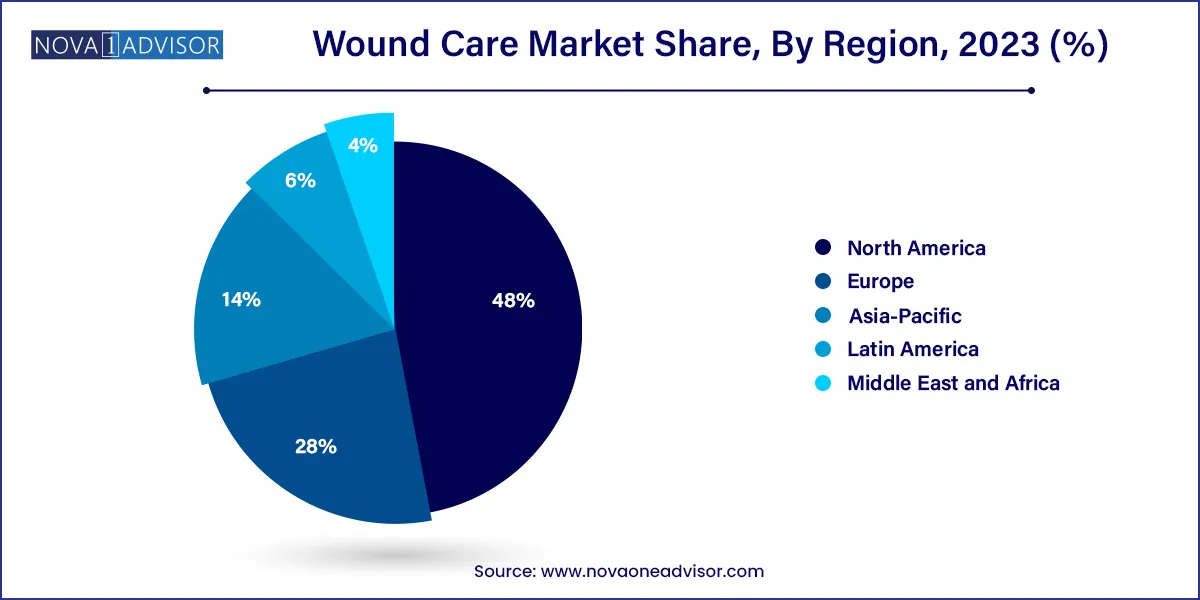

North America dominated the market with the share of 48.0% in 2023 and is expected to witness the considerable growth rate over the forecast period. Presence of a large population base and, a rising patient pool in countries such as the U.S. are major factors driving the market growth in this region. Moreover, geriatric population is at a higher risk of wounds, this will surge the demand for wound care products in this region. For instance, as per a United Health Foundation report (Published in May 2023), more than 55.8 million adults ages 65 and older live in the U.S., accounting for about 16.8% of the nation's population in 2021. In addition, the increasing number of road accidents, and availability of skilled professionals in this region is expected to drive the demand for wound care products in North America.

Asia Pacific region is estimated to witness the highest growth of CAGR 4.8% in the wound market over the forecast period. Presence of developing economies, such as China, India, and Japan, is anticipated to boost the market in the region. This can be attributed to rising changes in lifestyle leading to an increase in incidence of chronic diseases in this region. In addition, technological advancements, increasing geriatric population, and growing prevalence of chronic diseases, such as diabetes & cancer, are anticipated to boost the regional market. Moreover, medical tourism in this region is contributing to an increase in demand for wound care products. Thus, owing to above mentioned factors, Asia-Pacific is anticipated to witness the fastest growth over the forecast period.

Wound care industry in India is anticipated to grow at a CAGR of 6.15% over the forecast period. Key factors estimated to drive the market growth are presence of a high target population, increasing prevalence of chronic diseases, and rising healthcare awareness. For instance, according to Down to Earth organization, as of December 2021, India has 74.2 million diabetic patients aged 20 - 79. Moreover, the number is expected to increase to 124.8 million by 2045. Furthermore, medical tourism in this nation is increasing, which in turn increases the number of surgeries performed. In addition, continued innovation, emphasis on affordability, and strategic collaborations within the industry were key aspects driving the growth of the market in India.

Recent Developments

Some of the prominent players in the Wound care market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global wound care market.

Product

Application

End-use

Mode of Purchase

Distribution Channel

By Region

Chapter 1. Wound Care Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Application

1.1.3. End-use

1.1.4. Mode of purchase

1.1.5. Distribution channel

1.1.6. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.3.5.1. Data for primary interviews in North America

1.3.5.2. Data for primary interviews in Europe

1.3.5.3. Data for primary interviews in Asia Pacific

1.3.5.4. Data for primary interviews in Latin America

1.3.5.5. Data for Primary interviews in MEA

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.6.2. Volume price analysis (Model 2)

1.6.2.1. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Wound Care Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Product outlook

2.2.2. Application outlook

2.2.3. End-use outlook

2.2.4. Mode of purchase outlook

2.2.5. Distribution channel outlook

2.3. Competitive Insights

Chapter 3. Wound Care Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. User Perspective Analysis

3.3. Covid-19 Impact Analysis

3.4. Trend of Self-medication

3.5. Market Dynamics

3.5.1. Market driver analysis

3.5.1.1. Increasing prevalence of chronic diseases and conditions affecting wound healing capabilities

3.5.1.2. Rising incidence of burn injuries

3.5.1.3. Introduction of innovative and advanced wound products

3.5.1.4. Rising geriatric population

3.5.1.5. Increasing number of ambulatory surgical centers (ASCs)

3.5.1.6. Increasing number of road accidents

3.5.1.7. Steep rise in the number of hospitals & urgent care centers and an increase in hospital admissions

3.5.2. Market restraint analysis

3.5.2.1. Stringent manufacturing policies

3.5.2.2. High cost of advanced wound care products and chronic wound treatments

3.5.2.3. Delayed diagnosis and lower treatment rates in emerging nations

3.5.3. Market opportunity analysis

3.5.3.1. Improvements in public and private hospital infrastructure

3.5.3.2. Growth potential in emerging economies in wound care market

3.5.3.3. Leveraging digital platforms and telemedicine in wound care market

3.5.4. Market challenge analysis

3.5.4.1. Growing instances of product recalls

3.5.4.2. Lack of awareness about proper wound care practices and available treatment options

3.6. U.S. Wound Care Market Analysis Tools

3.6.1. Industry Analysis - Porter’s

3.6.1.1. Supplier power

3.6.1.2. Buyer power

3.6.1.3. Substitution threat

3.6.1.4. Threat of new entrant

3.6.1.5. Competitive rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political landscape

3.6.2.2. Economic landscape

3.6.2.3. Social landscape

3.6.2.4. Technological landscape

3.6.2.5. Environmental landscape

3.6.2.6. Legal landscape

Chapter 4. Wound Care Market: Product Estimates & Trend Analysis

4.1. Definitions and Scope

4.1.1. Advanced wound dressing

4.1.2. Surgical wound care

4.1.3. Traditional wound care

4.1.4. Wound therapy devices

4.2. Product Market Share, 2018 & 2030

4.3. Segment Dashboard

4.4. Wound Care Market by Product Outlook

4.5. Market Size & Forecasts and Trend Analyses, 2023 to 2030 for the following

4.5.1. Advanced wound dressing

4.5.1.1. Advanced wound dressing market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.2. Foam dressings

4.5.1.2.1. Foam dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.3. Hydrocolloid dressings

4.5.1.3.1. Hydrocolloid dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.4. Film dressings

4.5.1.4.1. Film dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.5. Alginate dressings

4.5.1.5.1. Alginate dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.6. Hydrogel dressings

4.5.1.6.1. Hydrogel dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.7. Collagen dressings

4.4.1.7.1. Collagen dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.1.8. Other advanced dressings

4.5.1.8.1. Other advanced dressings market estimates and forecast 2021 - 2033 (USD Million)

4.5.2. Surgical wound care

4.5.2.1. Surgical wound care market estimates and forecast 2021 - 2033 (USD Million)

4.5.2.2. Sutures & staples

4.5.2.2.1. Sutures & staples market estimates and forecast 2021 - 2033 (USD Million)

4.5.2.3. Tissue adhesives & sealants

4.5.2.3.1. Tissue adhesives & sealants market estimates and forecast 2021 - 2033 (USD Million)

4.5.2.4. Anti-infective dressing

4.5.2.4.1. Anti-infective dressing market estimates and forecast 2021 - 2033 (USD Million)

4.5.3. Traditional wound care

4.5.3.1. Traditional wound care market estimates and forecast 2021 - 2033s, (USD Million)

4.5.3.2. Medical tapes

4.5.3.2.1. Medical tapes market estimates and forecast 2021 - 2033 (USD Million)

4.5.3.3. Cotton

4.5.3.3.1. Cotton market estimates and forecast 2021 - 2033 (USD Million)

4.5.3.4. Bandages

4.5.3.4.1. Bandages market estimates and forecast 2021 - 2033 (USD Million)

4.5.3.5. Gauzes

4.5.3.5.1. Gauzes market estimates and forecast 2021 - 2033 (USD Million)

4.5.3.6. Sponges

4.5.3.6.1. Sponges market estimates and forecast 2021 - 2033 (USD Million)

4.5.3.7. Cleansing agents

4.5.3.7.1. Cleansing agents market estimates and forecast 2021 - 2033 (USD Million)

4.5.4. Wound therapy devices

4.5.4.1. Wound therapy devices market estimates and forecast 2021 - 2033s, (USD Million)

4.5.4.2. Negative pressure wound therapy

4.5.4.2.1. Negative pressure wound therapy market estimates and forecast 2021 - 2033 (USD Million)

4.5.4.3. Oxygen and hyperbaric oxygen equipment

4.5.4.3.1. Oxygen and hyperbaric oxygen equipment market estimates and forecast 2021 - 2033 (USD Million)

4.5.4.4. Electric stimulation devices

4.5.4.4.1. Electric stimulation devices market estimates and forecast 2021 - 2033 (USD Million)

4.5.4.5. Pressure relief devices

4.5.4.5.1. Pressure relief devices market estimates and forecast 2021 - 2033 (USD Million)

4.5.4.6. Others

4.5.4.6.1. Others market estimates and forecast 2021 - 2033 (USD Million)

Chapter 5. Wound Care Market: Application Estimates & Trend Analysis

5.1. Definitions and Scope

5.1.1. Acute Wounds

5.1.2. Chronic Wounds

5.2. Application Market Share, 2018 & 2030

5.3. Segment Dashboard

5.4. Wound Care Market by Application Outlook

5.5. Market Size & Forecasts and Trend Analyses, 2023 to 2030 for the following

5.5.1. Acute Wounds

5.5.1.1. Acute wounds market estimates and forecast 2021 - 2033 (USD Million)

5.5.1.2. Surgical & traumatic wounds

5.5.1.2.1. Surgical & traumatic wounds market estimates and forecast 2021 - 2033 (USD Million)

5.5.1.3. Burns

5.5.1.3.1. Burns market estimates and forecast 2021 - 2033 (USD Million)

5.5.2. Chronic Wounds

5.5.2.1. Chronic wounds market estimates and forecast 2021 - 2033 (USD Million)

5.5.2.2. Diabetic foot ulcers

5.5.2.2.1. Diabetic foot ulcers market estimates and forecast 2021 - 2033 (USD Million)

5.5.2.3. Pressure ulcers

5.5.2.3.1. Pressure ulcers market estimates and forecast 2021 - 2033 (USD Million)

5.5.2.4. Venous leg ulcers

5.5.2.4.1. Venous leg ulcers market estimates and forecast 2021 - 2033 (USD Million)

5.5.2.5. Others chronic wounds

5.5.2.5.1. Others chronic wounds market estimates and forecast 2021 - 2033 (USD Million)

Chapter 6. Wound Care Devices: End-use Estimates & Trend Analysis

6.1. Definitions and Scope

6.1.1. Hospitals

6.1.2. Specialty clinics

6.1.3. Home healthcare

6.1.4. Physician’s office

6.1.5. Nursing homes

6.1.6. Others

6.2. End-use Market Share, 2018 & 2030

6.3. Segment Dashboard

6.4. Wound Care Market by End-use Outlook

6.5. Market Size & Forecasts and Trend Analyses, 2021 - 2033 for the following

6.5.1. Hospitals

6.5.1.1. Hospitals market estimates and forecast 2021 - 2033 (USD Million)

6.5.2. Specialty clinics

6.5.2.1. Specialty clinics centers market estimates and forecast 2021 - 2033 (USD Million)

6.5.3. Home healthcare

6.5.3.1. Home healthcare market estimates and forecast 2021 - 2033 (USD Million)

6.5.4. Physician’s office

6.5.4.1. Physician’s office market estimates and forecast 2021 - 2033 (USD Million)

6.5.5. Nursing Homes

6.5.5.1. Nursing homes market estimates and forecast 2021 - 2033 (USD Million)

6.5.6. Others

6.5.6.1. Others market estimates and forecast 2021 - 2033 (USD Million)

Chapter 7. Wound Care Market: Mode of Purchase Estimates & Trend Analysis

7.1. Definitions and Scope

7.1.1. Prescribed

7.1.2. Non-prescribed (OTC)

7.2. Mode of Purchase Market Share, 2018 & 2030

7.3. Segment Dashboard

7.4. Wound Care Market by Mode of Purchase Outlook

7.5. Market Size & Forecasts and Trend Analyses, 2021 - 2033 for the following

7.5.1. Prescribed

7.5.1.1. Prescribed market estimates and forecast 2021 - 2033 (USD Million)

7.5.2. Non-prescribed (OTC)

7.5.2.1. Non-prescribed (OTC) market estimates and forecast 2021 - 2033 (USD Million)

Chapter 8. Wound Care Market: Distribution Channel Estimates & Trend Analysis

8.1. Definitions and Scope

8.1.1. Institutional sales

8.1.2. Retail sales

8.2. Distribution Channel Market Share, 2018 & 2030

8.3. Segment Dashboard

8.4. Wound Care Market by Distribution Channel Outlook

8.5. Market Size & Forecasts and Trend Analyses, 2021 - 2033 for the following

8.5.1. Institutional sales

8.5.1.1. Institutional sales market estimates and forecast 2021 - 2033 (USD Million)

8.5.2. Retail sales

8.5.2.1. Retail sales market estimates and forecast 2021 - 2033 (USD Million)

Chapter 9. Wound Care Market: Regional Estimates & Trend Analysis

9.1. Regional market share analysis, 2024 & 2033

9.2. Regional Market Dashboard

9.3. Global Regional Market Snapshot

9.4. Market Application, & Forecasts and Trend Analysis, 2021 - 2033

9.5. North America

9.5.1. Market estimates and forecast, 2021 - 2033 (Revenue, USD Million)

9.5.2. U.S.

9.5.2.1. Key country dynamics

9.5.2.2. Competitive scenario

9.5.2.3. Regulatory framework

9.5.2.4. Reimbursement scenario

9.5.2.5. U.S. market estimates and forecasts, 2021 - 2033

9.5.3. Canada

9.5.3.1. Key country dynamics

9.5.3.2. Competitive scenario

9.5.3.3. Regulatory framework

9.5.3.4. Reimbursement scenario

9.5.3.5. Canada market estimates and forecasts, 2021 - 2033¬

9.6. Europe

9.6.1. UK

9.6.1.1. Key country dynamics

9.6.1.2. Competitive scenario

9.6.1.3. Regulatory framework

9.6.1.4. Reimbursement scenario

9.6.1.5. UK market estimates and forecasts, 2021 - 2033

9.6.2. Germany

9.6.2.1. Key country dynamics

9.6.2.2. Competitive scenario

9.6.2.3. Regulatory framework

9.6.2.4. Reimbursement scenario

9.6.2.5. Germany market estimates and forecasts, 2021 - 2033

9.6.3. France

9.6.3.1. Key country dynamics

9.6.3.2. Competitive scenario

9.6.3.3. Regulatory framework

9.6.3.4. Reimbursement scenario

9.6.3.5. France market estimates and forecasts, 2021 - 2033

9.6.4. Italy

9.6.4.1. Key country dynamics

9.6.4.2. Competitive scenario

9.6.4.3. Regulatory framework

9.6.4.4. Reimbursement scenario

9.6.4.5. Italy market estimates and forecasts, 2021 - 2033

9.6.5. Spain

9.6.5.1. Key country dynamics

9.6.5.2. Competitive scenario

9.6.5.3. Regulatory framework

9.6.5.4. Reimbursement scenario

9.6.5.5. Spain market estimates and forecasts, 2021 - 2033

9.6.6. Denmark

9.6.6.1. Key country dynamics

9.6.6.2. Competitive scenario

9.6.6.3. Regulatory framework

9.6.6.4. Reimbursement scenario

9.6.6.5. Denmark market estimates and forecasts, 2021 - 2033

9.6.7. Sweden

9.6.7.1. Key country dynamics

9.6.7.2. Competitive scenario

9.6.7.3. Regulatory framework

9.6.7.4. Reimbursement scenario

9.6.7.5. Sweden market estimates and forecasts, 2021 - 2033

9.6.8. Norway

9.6.8.1. Key country dynamics

9.6.8.2. Competitive scenario

9.6.8.3. Regulatory framework

9.6.8.4. Reimbursement scenario

9.6.8.5. Norway market estimates and forecasts, 2021 - 2033

9.7. Asia Pacific

9.7.1. Japan

9.7.1.1. Key country dynamics

9.7.1.2. Competitive scenario

9.7.1.3. Regulatory framework

9.7.1.4. Reimbursement scenario

9.7.1.5. Japan market estimates and forecasts, 2021 - 2033

9.7.2. India

9.7.2.1. Key country dynamics

9.7.2.2. Competitive scenario

9.7.2.3. Regulatory framework

9.7.2.4. Reimbursement scenario

9.7.2.5. India market estimates and forecasts, 2021 - 2033

9.7.3. China

9.7.3.1. Key country dynamics

9.7.3.2. Competitive scenario

9.7.3.3. Regulatory framework

9.7.3.4. Reimbursement scenario

9.7.3.5. China market estimates and forecasts, 2021 - 2033

9.7.4. South Korea

9.7.4.1. Key country dynamics

9.7.4.2. Competitive scenario

9.7.4.3. Regulatory framework

9.7.4.4. Reimbursement scenario

9.7.4.5. South Korea market estimates and forecasts, 2021 - 2033

9.7.5. Australia

9.7.5.1. Key country dynamics

9.7.5.2. Competitive scenario

9.7.5.3. Regulatory framework

9.7.5.4. Reimbursement scenario

9.7.5.5. Australia market estimates and forecasts, 2021 - 2033

9.7.6. Thailand

9.7.6.1. Key country dynamics

9.7.6.2. Competitive scenario

9.7.6.3. Regulatory framework

9.7.6.4. Reimbursement scenario

9.7.6.5. Thailand market estimates and forecasts, 2021 - 2033

9.8. Latin America

9.8.1. Brazil

9.8.1.1. Key country dynamics

9.8.1.2. Competitive scenario

9.8.1.3. Regulatory framework

9.8.1.4. Reimbursement scenario

9.8.1.5. Brazil market estimates and forecasts, 2021 - 2033

9.8.2. Mexico

9.8.2.1. Key country dynamics

9.8.2.2. Competitive scenario

9.8.2.3. Regulatory framework

9.8.2.4. Reimbursement scenario

9.8.2.5. Mexico market estimates and forecasts, 2021 - 2033

9.8.3. Argentina

9.8.3.1. Key country dynamics

9.8.3.2. Competitive scenario

9.8.3.3. Regulatory framework

9.8.3.4. Reimbursement scenario

9.8.3.5. Argentina market estimates and forecasts, 2021 - 2033

9.9. MEA

9.9.1. South Africa

9.9.1.1. Key country dynamics

9.9.1.2. Competitive scenario

9.9.1.3. Regulatory framework

9.9.1.4. Reimbursement scenario

9.9.1.5. South Africa market estimates and forecasts, 2021 - 2033

9.9.2. Saudi Arabia

9.9.2.1. Key country dynamics

9.9.2.2. Competitive scenario

9.9.2.3. Regulatory framework

9.9.2.4. Reimbursement scenario

9.9.2.5. Saudi Arabia market estimates and forecasts, 2021 - 2033

9.9.3. UAE

9.9.3.1. Key country dynamics

9.9.3.2. Competitive scenario

9.9.3.3. Regulatory framework

9.9.3.4. Reimbursement scenario

9.9.3.5. UAE market estimates and forecasts, 2021 - 2033

9.9.4. Kuwait

9.9.4.1. Key country dynamics

9.9.4.2. Competitive scenario

9.9.4.3. Regulatory framework

9.9.4.4. Reimbursement scenario

9.9.4.5. Kuwait market estimates and forecasts, 2021 - 2033

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company/Competition Categorization

10.2.1. Innovators

10.3. Vendor Landscape

10.3.1. List of key distributors and channel partners

10.3.2. Key customers

10.3.3. Key company market share analysis, 2024

10.3.4. Smith & Nephew

10.3.4.1. Company overview

10.3.4.2. Financial performance

10.3.4.3. Product benchmarking

10.3.4.4. Strategic initiatives

10.3.5. Mölnlycke Health Care AB

10.3.5.1. Company overview

10.3.5.2. Financial performance

10.3.5.3. Product benchmarking

10.3.5.4. Strategic initiatives

10.3.6. ConvaTec Group PLC

10.3.6.1. Company overview

10.3.6.2. Financial performance

10.3.6.3. Product benchmarking

10.3.6.4. Strategic initiatives

10.3.7. Ethicon (Johnson & Johnson)

10.3.7.1. Company overview

10.3.7.2. Financial performance

10.3.7.3. Product benchmarking

10.3.7.4. Strategic initiatives

10.3.8. Baxter International

10.3.8.1. Company overview

10.3.8.2. Financial performance

10.3.8.3. Product benchmarking

10.3.8.4. Strategic initiatives

10.3.9. DeRoyal Industries, Inc.

10.3.9.1. Company overview

10.3.9.2. Financial performance

10.3.9.3. Product benchmarking

10.3.9.4. Strategic initiatives

10.3.10. Coloplast Corp.

10.3.10.1. Company overview

10.3.10.2. Financial performance

10.3.10.3. Product benchmarking

10.3.10.4. Strategic initiatives

10.3.11. Medtronic

10.3.11.1. Company overview

10.3.11.2. Financial performance

10.3.11.3. Product benchmarking

10.3.11.4. Strategic initiatives

10.3.12. 3M

10.3.12.1. Company overview

10.3.12.2. Financial performance

10.3.12.3. Product benchmarking

10.3.12.4. Strategic initiatives

10.3.13. Integra LifeSciences, Inc.

10.3.13.1. Company overview

10.3.13.2. Financial performance

10.3.13.3. Product benchmarking

10.3.13.4. Strategic initiatives

10.3.14. Medline Industries, Inc.

10.3.14.1. Company overview

10.3.14.2. Financial performance

10.3.14.3. Product benchmarking

10.3.14.4. Strategic initiatives

10.3.15. B. Braun Melsungen AG

10.3.15.1. Company overview

10.3.15.2. Financial performance

10.3.15.3. Product benchmarking

10.3.15.4. Strategic initiatives

10.3.16. Cardinal Health, Inc.

10.3.16.1. Company overview

10.3.16.2. Financial performance

10.3.16.3. Product benchmarking

10.3.16.4. Strategic initiatives

10.3.17. Organogenesis Inc.

10.3.17.1. Company overview

10.3.17.2. Financial performance

10.3.17.3. Product benchmarking

10.3.17.4. Strategic initiatives

10.3.18. MIMEDX Group, Inc.

10.3.18.1. Company overview

10.3.18.2. Financial performance

10.3.18.3. Product benchmarking

10.3.18.4. Strategic initiatives