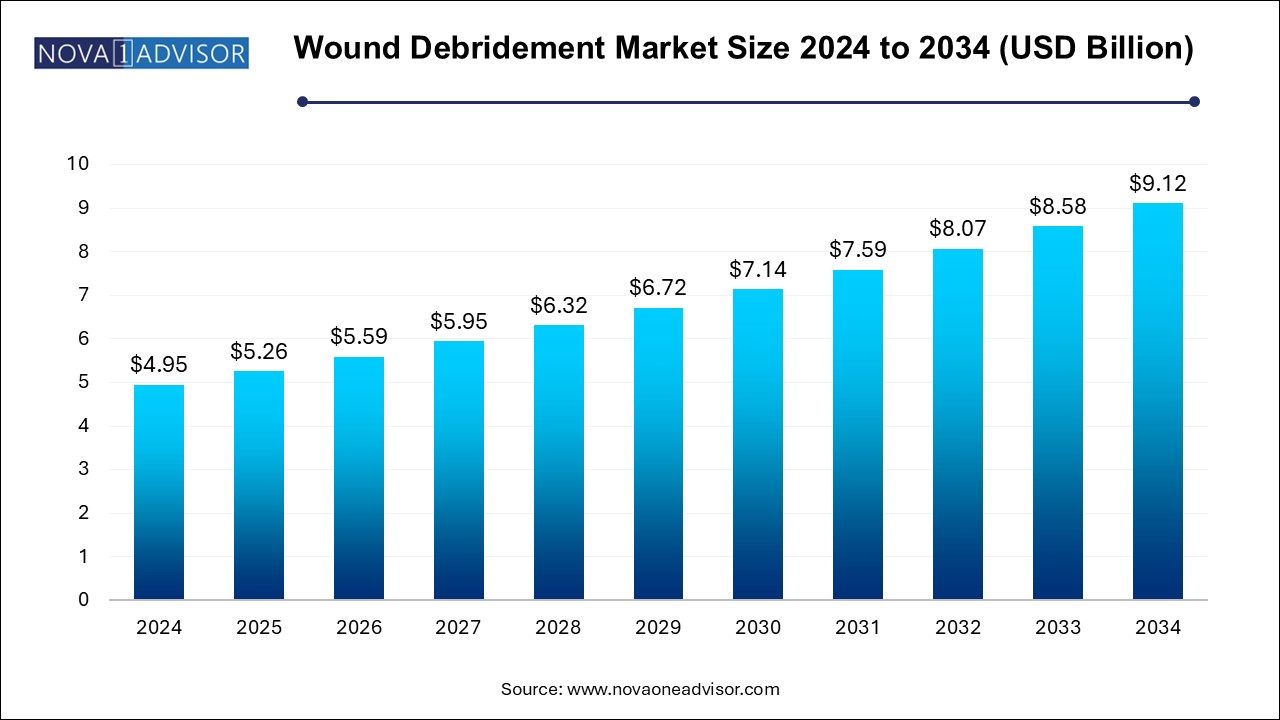

The wound debridement market size was exhibited at USD 4.95 billion in 2024 and is projected to hit around USD 9.12 billion by 2034, growing at a CAGR of 6.3% during the forecast period 2024 to 2034.

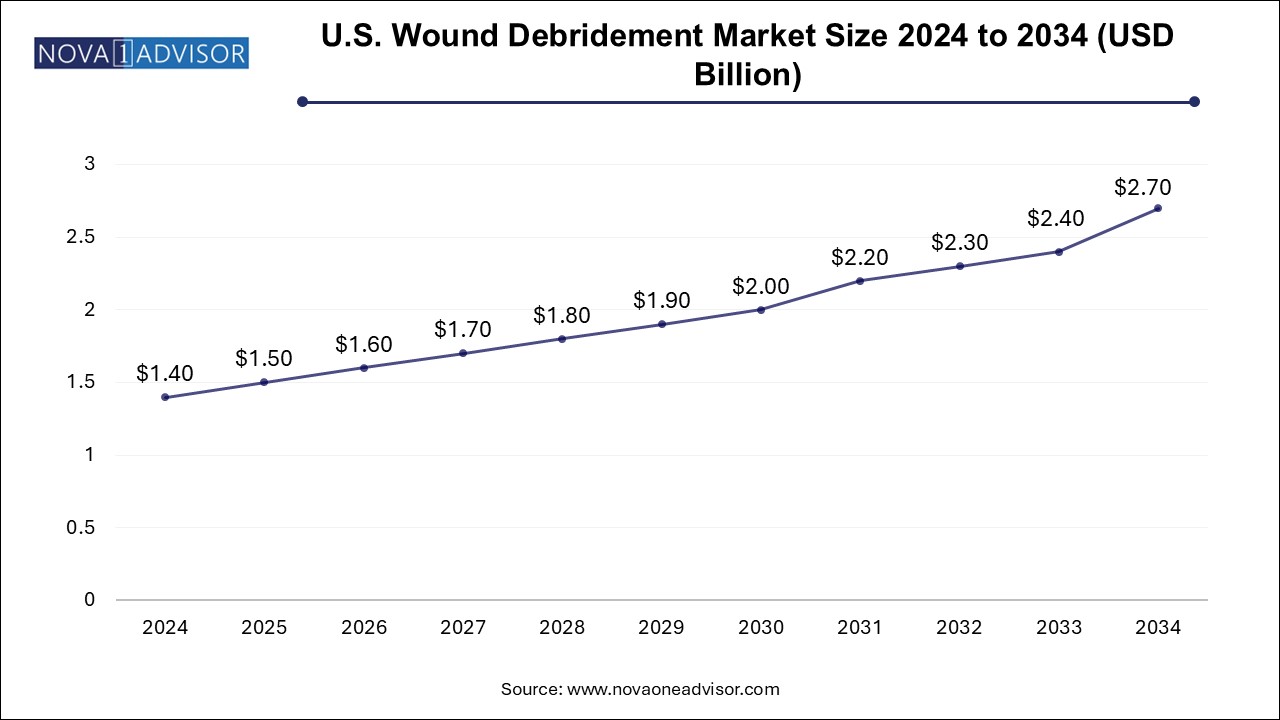

The U.S. wound debridement market size is evaluated at USD 1.4 billion in 2024 and is projected to be worth around USD 2.7 million by 2034, growing at a CAGR of 6.15% from 2024 to 2034.

North America held the dominant market share of 38.0% in 2024. This supremacy can be attributed to the region's well-developed healthcare infrastructure, growing awareness, and the presence of significant important actors. Additionally, the market for wound debridement is anticipated to be driven by an increase in surgical procedures in the North American area.

For instance, the Life Span Organization estimates that about 500,000 open heart operations were carried out in the United States in 2018. Similarly, 40,000 children in the U.S. have congenital heart surgery, according to AHA Journals. Since these operations require wound debridement products, North America is expected to dominate the wound debridement products over the forecast period.

However, Asia Pacific is estimated to witness the fastest CAGR of 7.1% over the forecast period. This can be attributed to the region's growing diabetes population. For instance, the Down to Earth organization estimates that India had 74.2 million diabetics between the ages of 20 and 79 as of December 2021. Furthermore, it is expected that this figure would rise to 124.8 million by 2045. Similarly, the IDF estimates that 3,993,300 of the 63,265,700 individuals living in the Philippines had diabetes in 2019. Therefore, an increase in the diabetic population may help the wound debridement industry’s growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.26 Billion |

| Market Size by 2034 | USD 9.12 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 6.3% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Method, Wound type, End-use, Mode of Purchase, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Integra LifeSciences; Molnlycke Health Care AB, B. Braun SE; Brightwake Ltd., Lohmann & Rauscher; 3M. |

Based on products, the medical gauze segment held the largest share of 22.73% in 2024. Medical gauzes help in maintaining moisture surrounding the wound, which enables rapid healing. Since these wound care products enable faster healing, wound dressings are highly recommended for chronic wounds, such as diabetic ulcers, burn injuries, pressure ulcers, and other slow-healing wounds. Gauzes are majorly composed of substances such as collagen, hydrocolloids, hydrogels, foams, and alginates.

The gels segment is projected to impel at a growth rate of CAGR 5.2% during the forecast duration. Gels maintain a moist wound environment and have certain benefits as compared to other products. Gels are amorphous and clear hydrogel remains in prominent use for the treatment of sloughy and necrotic tissue in chronic wounds. Increasing cases of surgical wounds or Surgical Site Infection (SSI) among patients and rising incidence of chronic wounds, especially diabetic foot ulcers, are among the major factors contributing to the segment growth

Based on method, the market is segmented into autolytic, enzymatic, surgical, mechanical, and others. The surgical wound debridement segment dominated the market in 2024 with a share of 26.99%. It is the fastest way of wound debridement procedure to achieve a clean wound bed, thereby, contributing to the segment’s growth. The autolytic wound debridement segment is expected to expand at the highest CAGR of 6.8% during the forecast period.

Autolytic debridement is the removal of necrotic debris and damaged tissues from a wound site by the body’s endogenous enzymes that engulf specific components of body tissues/cells. This method is usually comfortable and effective, but it takes a longer time than other methods of debridement. However, if significant autolysis is not observed within 1-2 weeks, then another method of debridement is considered.

Based on wound type, the wound debridement industry is segmented into pressure ulcers, diabetic foot ulcers, venous leg ulcers, burn wounds, and others. The diabetic foot ulcers segment is anticipated to capture the largest market share of 32.96% in 2024. This dominance can be accredited to the increased number of diabetic patients, coupled with several foot deformities, and trauma.

For instance, according to International Diabetes Federation, around 90 million people alone in South East Asia suffer from diabetes. This number rises further to 206 million in the Western Pacific region. As per NCBI, the risk of developing a diabetic foot ulcer in diabetic patients is around 2%, which increases to around 17%-60%, if the person suffered from a diabetic foot ulcer previously. Thus, with a dramatic rise in the diabetic population along with the risk of diabetic foot ulcers, the diabetic foot ulcers segment is projected to have a significant growth rate over the forecast period.

However, the pressure ulcers segment is expected to witness the fastest growth over the forecast duration. Pressure ulcers are also known as bed sores; it usually occurs due to prolonged intense pressure on the skin. Prolonged hospital stay is the most common cause of such ulcers and it mostly occurs among the geriatric population. Pressure ulcers generally occur at the bony areas of the body like ankles, hips, and tailbone. The rising geriatric population across the globe is the major driving factor for the segment’s growth. For instance, according to WHO, the number of the 60+ population in 2019 was expected to reach 254 million, whereas, it is anticipated to reach 24% by 2040.

Based on end-use, the hospital segment dominated the wound debridement industry with a market share of 55.04% in 2024. This can be attributed to an increase in surgical procedures and the rising number of hospitals. For instance, a study by NCBI in 2020 predicted that 310 million surgical cases were performed annually over the world, of which 40 million to 50 million were done in the U.S. alone. Additionally, the number of hospitals and hospitalizations has increased globally.

For instance, the number of hospitalizations in Australia has grown, according to the Australian Institute of Health & Welfare. 11.1 million individuals in Australia were hospitalized in 2019-2020. As a result of the aforementioned considerations, it is anticipated that the hospital segment will dominate the end-use segment.

However, the homecare segment is projected to witness the fastest growth rate at a CAGR of 6.8% during the forecast period. Homecare settings remain on the rise in many countries. Moreover, many surgeries require a prolonged recovery period, leading to frequent debridement of wounds. Further, the geriatric population and bariatric population prefer homecare settings. Thus, the rising bariatric population & geriatric population is anticipated to boost the home healthcare segment.

For instance, as per WHO, world obesity has tripled since 1975. Additionally, as per a similar source, in 2020, 39 million children under the age of five were overweight or obese. Thereby, impelling the homecare segment over the forecast period.

Based on mode of purchase, the prescription segment dominated the wound debridement industry with a market share of 59.0% in 2024. The dominance can be attributed to the availability of reimbursement for wound debridement products if the products are prescribed by a certified medical practitioner. For instance, Medicare covers around 80% of the cost for medically necessary wound care supplies. This encourages people to visit physicians and receive prescribed wound debridement medication.

However, the over-the-counter segment is projected to witness the fastest growth rate of CAGR 6.5% over the forecast of 2024-2034. Several OTC wound debridement products are available for the treatment of various wounds, such as cuts, abrasions, scrapes, and scratches. In addition, easy access to wound debridement products, previous experience, and economic factors plays an important role in people opting for OTC wound debridement products. Further, e-commerce platforms, such as Amazon and Walmart’s online pharmacy, and the presence of several online key vendors, such as 1mg, Netmeds, and Apollo Pharmacy, have increased the availability of OTC wound debridement products. Thereby, boosting the segment growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the wound debridement market

By Product

By Method

By Wound Type

By End-use

By Mode of Purchase

By Regional