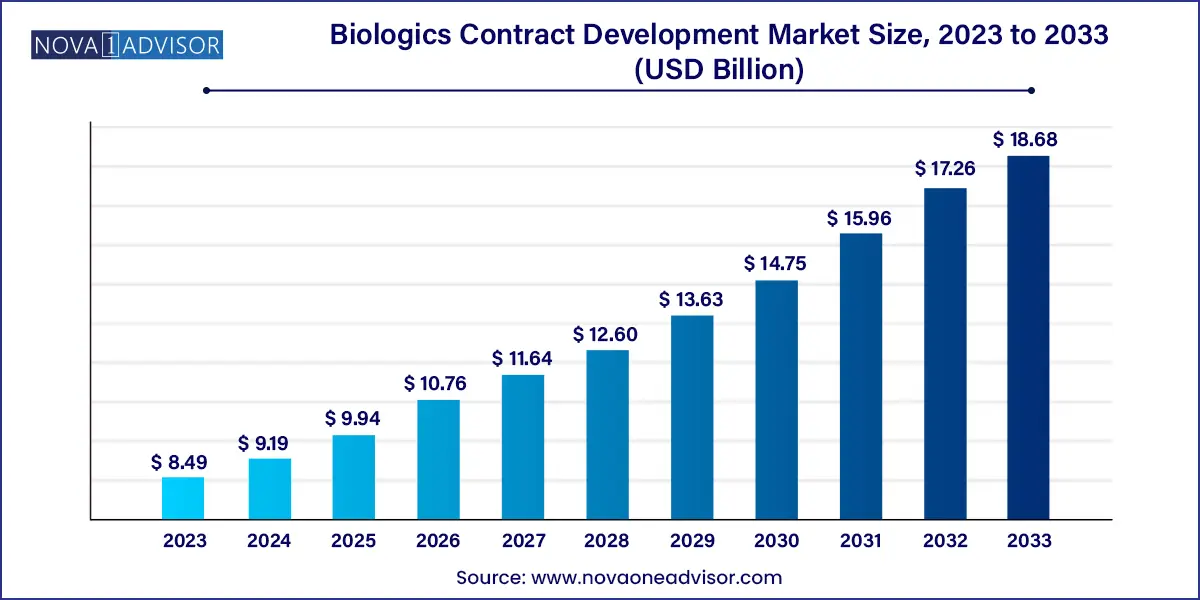

The global biologics contract development market size was estimated at USD 8.49 billion in 2023 and is projected to hit around USD 18.68 billion by 2033, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033.

Key Takeaways:

Biologics Contract Development Market Growth

Factors such as increasing adoption of advanced technologies for biological production; growing M&A activities; investment, a rise in outsourcing of R&D activities by pharma and biopharma companies; and a favorable regulatory environment for clinical trials in developing countries are driving the market. For instance, in March 2023, Samsung Biologics announced an investment of USD 1.5 billion to set up a new plant in South Korea. This is expected to fulfill the increased market demand for the company.

An increase in the number of partnerships and collaborations has increased pharma and biopharma outsourcing, with major industry players expanding into developing regions. For instance, in March 2023, Sweden-based Simris Alg AB partnered with Lonza to develop and manufacture antibody-drug conjugates. Such partnerships are likely to promote market growth in Sweden.

The prevalence of diseases such as neurological disorders, gynecological disorders, cancer, ophthalmic disorders, and cardiovascular disorders, is witnessing a steady rise. For instance, according to the WHO, cancer is one of the leading causes of death worldwide and it accounted for over 10 million deaths in 2020. The Cancer Tomorrow states that in the years to come the number of cancer cases is expected to rise. As per the estimates of Cancer Tomorrow, over 19.3 million cancer cases were reported in 2020 and this number is expected to rise to 30.2 million by 2040. In such cases, healthcare CDMOs can play a vital role in patient care. This is why many biopharma companies are developing novel therapies or first-in-class products for the treatment of diseases.

In the Pharma R&D Annual Review 2021, there is a consistent rise in the research pipeline of drugs. For instance, in 2020, 17,737 drugs were in the pipeline whereas in 2021, over 18,582 drugs were in the pipeline. The growing number of drugs in pipelines is expected to create opportunities for market growth.

Furthermore, developing countries, such as India and China, have proven to be an attractive choices for outsourcing clinical trials as these countries have a large population with diverse disease burdens, which helps in conducting efficient clinical studies and eases patient recruitment. According to Pharmaceutical Outsourcing, China, India, and Korea are the most active settings for clinical trials among developing nations due to increased market access and thus remain prime destinations for clinical research outsourcing. Governments in these countries support outsourcing as it brings in foreign investment. Moreover, regulatory bodies in developing countries are harmonizing their policies with EMA and FDA standards, thereby accelerating the process of approval and creating credibility. Thus promoting market growth in these countries.

There was a high demand for COVID-19 vaccines at the start of the pandemic. Owing to this several CROs made partnerships and collaboration agreements to speed up the research of COVID-19 vaccines in 2020. However, in the post-pandemic period, CROs are forming alliances for research of other diseases such as cancer, Alzheimer's, and other diseases. For instance, in July 2022, CRO Novotech expanded its presence in the U.S. by acquiring a US-based CRO, NCGS, providing research services in hematology, infectious disease, oncology, and CNS.

Biologics Contract Development Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 9.19 Billion |

| Market Size by 2033 | USD 18.68 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Source, service, indication, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | WuXi Biologics; Abzena Ltd; Fujifilm Diosynth Biotechnologies; KBI Biopharma; AGC Biologics; Thermo Fisher Scientific Inc.; Curia Global, Inc.; Genscript; Bionova Scientific, Inc.; BioXcellence (Boehringer Ingelheim Biopharmaceuticals GmbH); STC Biologics |

Segments Insights:

Source Insights

The mammalian source segment accounted for the largest revenue share of 55.17% in 2023 in the market for biologics contract development. The segment is expected to witness a significant CAGR during the forecast period. This is because using mammalian cells for protein expression offers a major benefit by producing mammalian proteins with correct post-translational modifications that provide a native structure. Mammalian cells like Chinese Hamster Ovary (CHO) cell lines have been among the most preferred and about 70.0% of the protein therapeutics are developed from CHO cells.

The microbial source segment gained a significant share in 2023. Microbial systems are widely used for producing recombinant protein therapeutics. Around 650 protein drugs have been approved worldwide to date, among which, about 400 were obtained from microbial recombinant technologies. Moreover, approximately 48.0% of biologics approved for manufacturing are produced by microbial sources, which are primarily used by CDMOs to produce cytokines, hormones, enzymes, and MABs. These factors are supporting the segment growth.

Service Insights

The process development services accounted for the largest revenue share of 74.5% in 2023 in the biologics contract development market. Biologics process development is characterized by two techniques - upstream process development and downstream process development. Upstream process development mainly includes the selection of the right cell line, culture medium, bioreactor systems, and operating parameters. Upstream process development services are provided by the majority of biologics manufacturing organizations and are highly specific to the client's business needs, regulatory constraints, and project timelines. Companies, such as AGC Biologics, Curia Global, Inc., and Bionova Scientific, offer upstream process development for mammalian and microbial large-scale manufacturing services.

The cell line development service is expected to hold a significant share of the market in 2023. According to NCBI, cell lines are being rigorously used in testing vaccine production, drug metabolism & cytotoxicity, generation of artificial tissues (e.g., artificial skin), gene function studies, antibody production, and synthesis of biological compounds. The usage of cell lines has revolutionized scientific research. The development of efficient cell lines is requisite, as they can be used to investigate anticipated clinical results. The production of efficient cell lines influences productivity and product quality. Varied characteristics of cell lines also enhance process development to achieve target productivity and quality.

Indication Insights

The oncology segment accounted for the largest revenue share of 49.8% in 2023 in the market for biologics contract development. As cancers are formed through malfunctioning of the immune system, biologic therapy is stated to repair, stimulate, or enhance the immune response, and hence many pharmaceutical and biopharmaceutical companies are willing to invest in cancer-related novel treatments. Cancer can proliferate in any organ of the body, and thus there is an extensive need for treatment, which in turn is boosting investments in R&D and outsourcing by various companies.

The immunological disorder disease segment is anticipated rise with the fastest growth rate of 8.9% CAGR during the forecast period. Immunological diseases or conditions caused by dysfunction of the immune system include diseases such as asthma, allergy, autoimmune diseases, and others. According to NCBI, autoimmune inflammatory diseases affect approximately 7.6% to 9.4% of the world’s population, especially young and middle-aged women.

Biologic medicines have gained significant importance in treating diseases such as arthritis, rheumatologic diseases, and others. The high efficiency and safety of these medications are likely to improve the demand for biologics for treating immunological disorders which is expected to have a positive impact on the market.

Regional Insights

North America dominated the market for biologics contract development in 2023 and accounted for a revenue share of 43.16% in 2023. The region is expected to showcase a significant CAGR over the forecast period. This is attributed to increasing R&D investments and the local presence of global players and their efforts to obtain new patents. The growth of contract development organizations (CDOs) can be primarily attributed to the increasing outsourcing activities and the rise in the number of clinical trials in the region. For instance, as per ClinicalTrial.Gov as of July 2022, over 32% of the global studies were conducted in the U.S. alone. A high number of researches conducted in the U.S. further support the regional market growth.

In Asia Pacific, the market for biologics contract development is expected to witness the highest CAGR of 11.2% over the forecast period. Various regulatory organization amendments to change clinical trial evaluation standards following global requirements are generating interest among biotechnology companies to invest in the Asia Pacific region. Asia Pacific countries have a large patient pool and promise potential with advanced medical expertise. In comparison to Western countries, the cost of conducting a clinical trial is very low in the region. These aforementioned factors are expected to contribute to the region's market growth.

Key Companies & Market Share Insights

The market for biologics contract development is highly competitive. One of the key factors driving competitiveness among market players is the rapid adoption of advanced technologies. For instance, CDOs are shifting toward Single-Use Bioreactors (SBUs), smaller batch sizes, and smaller-volume bioreactor tank sizes for biopharmaceutical production.

Moreover, a prominent number of these players are rapidly opting for strategic collaborations and partnerships through mergers and acquisitions in emerging and economically favorable regions. For instance, Lonza, in February 2023, expanded its presence in the U.S. by establishing a new laboratory dedicated to developing drugs in the early stages of clinical trials. Additionally, in September 2022, Lonza collaborated with biotechnology company Touchlight to expand its product portfolio with different sources of DNA for developing mRNA. Touchlight entered into this partnership to expand the consumer base to its novel doggybone DNA (dbDNA) technology via Lonza's offerings. Some prominent players in the global biologics contract development market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Biologics Contract Development market.

By Source

By Service

By Indication

By Region