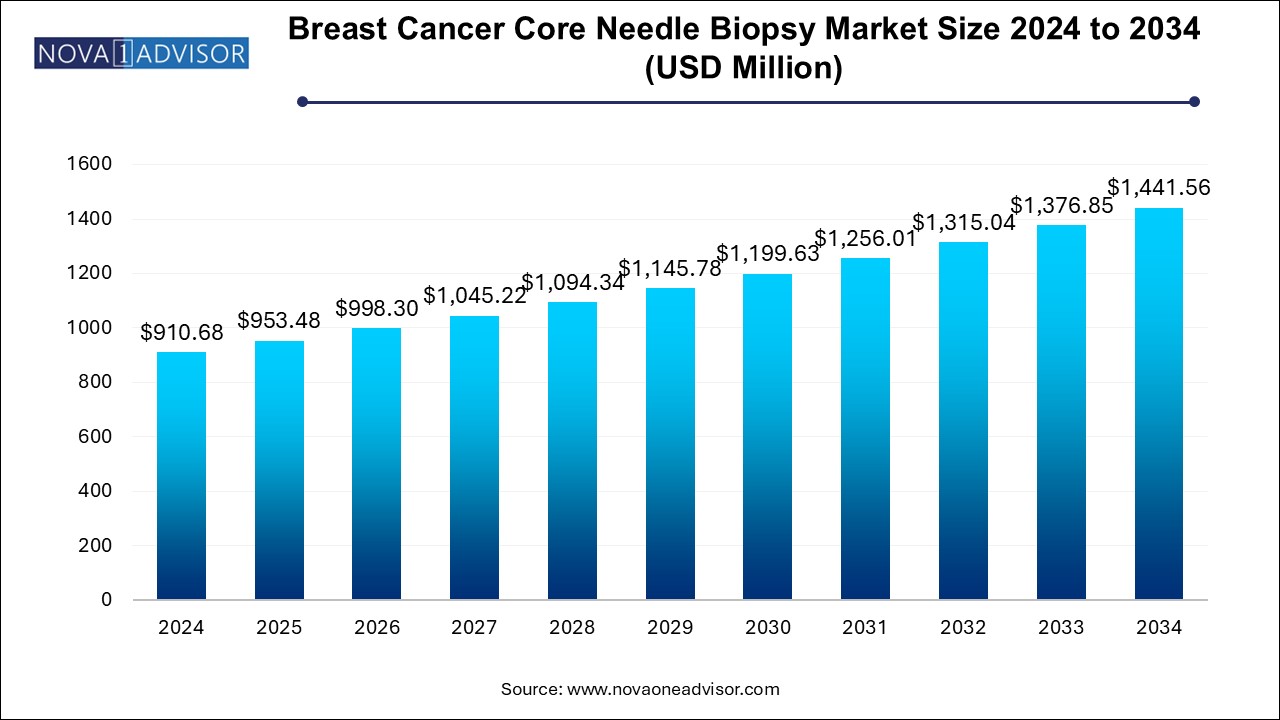

The breast cancer core needle biopsy market size was exhibited at USD 910.68 million in 2024 and is projected to hit around USD 1441.56 million by 2034, growing at a CAGR of 4.7% during the forecast period 2025 to 2034.

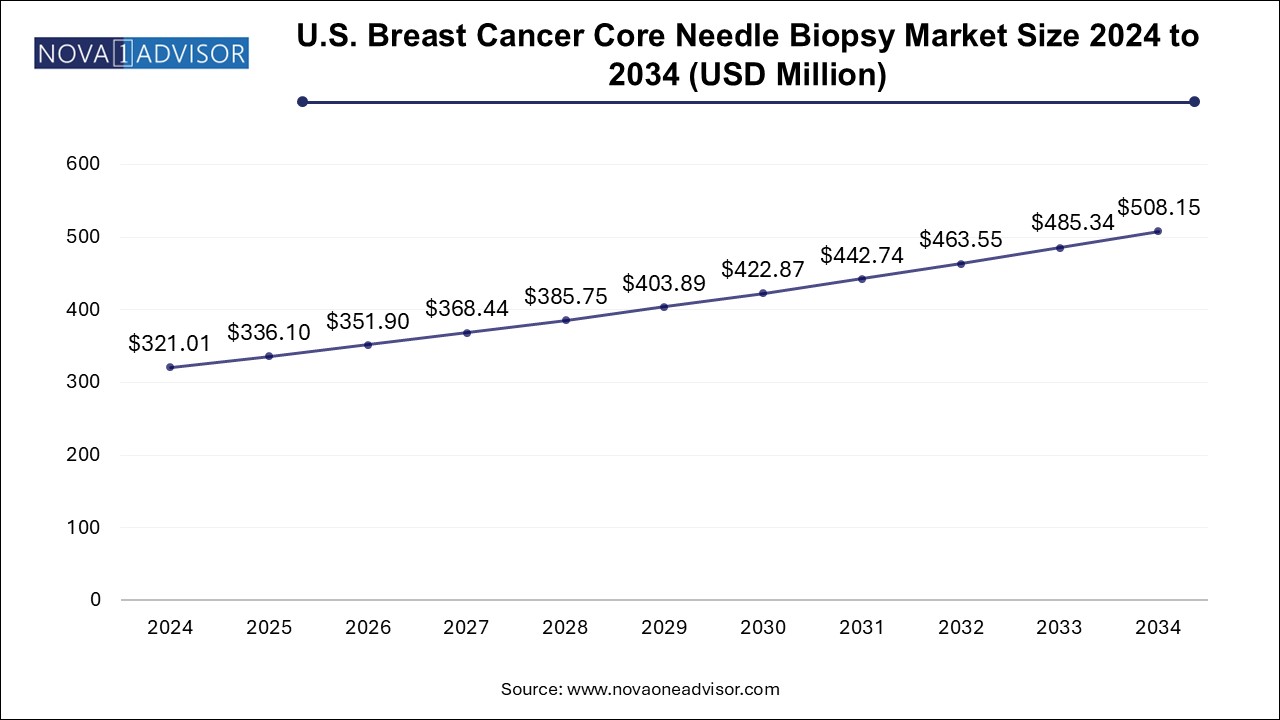

The U.S. breast cancer core needle biopsy market size is evaluated at USD 321.01 million in 2024 and is projected to be worth around USD 508.15 million by 2034, growing at a CAGR of 4.26% from 2025 to 2034.

North America breast cancer core needle biopsy industry dominated and accounted for a 46.26%of revenue share in 2024. The strong market leadership is attributed to its advanced healthcare systems, robust research capabilities, and concerted efforts to increase patient awareness. These factors collectively enhance early mammary tumor detection and improve management outcomes. Prominent medical institutions and diagnostic centers in the U.S. and Canada consistently advocate for regular screenings.

U.S. Breast Cancer Core Needle Biopsy Market Trends

The breast cancer core needle biopsy industry in the U.S. is estimated to grow progressively during the forecast period. The U.S. has a well-established healthcare system with access to cutting-edge medical technology and highly skilled healthcare professionals. This enables the adoption of advanced diagnostic tools, such as core needle biopsies, which are minimally invasive and highly effective in diagnosing mammary tumors

Europe Breast Cancer Core Needle Biopsy Market Trends

The Europe breast cancer core needle biopsy industry is likely to emerge as a lucrative region. There is a strong emphasis on early detection and screening for mammary tumors in public health campaigns and guidelines, such as those from the European Commission, which promote regular screening and the use of advanced diagnostic methods. This has increased patient awareness and demand for early-stage diagnostics

The breast cancer core needle biopsy market in the UK is projected to grow during the forecast period. The UK has a high incidence of breast tumors, driving demand for more diagnostic procedures, including biopsies. The growing number of mammary tumors cases is leading to an increased need for early-stage diagnostic methods like core needle biopsy to ensure better treatment outcomes.

France breast cancer core needle biopsy market is expected to show steady growth over the forecast period. France has national screening programs aimed at early detection of mammary tumors, such as The organized breast cancer screening program which invites women aged 50 to 74 for regular mammograms. This program has contributed to higher awareness and early-stage detection, driving the demand for biopsy procedures like core needle biopsies.

The breast cancer core needle biopsy market in Germany is projected to expand during the forecast period. There is a growing preference for minimally invasive diagnostic methods in Germany, especially in oncology. Core needle biopsy is favored due to its ability to provide accurate results with minimal discomfort and recovery time compared to traditional surgical biopsies. This has driven its adoption for diagnosing mammary tumors.

Asia Pacific Breast Cancer Core Needle Biopsy Market Trends

The Asia Pacific breast cancer core needle biopsy industry is expected to experience the highest growth rate of 5.2% CAGR during the forecast period. The incidence of mammary tumors is on the rise across several countries, such as China, India, Japan, and South Korea. This is driving the demand for early diagnostic methods like core needle biopsy, as these countries are focusing on improving tumor detection and treatment outcomes.

The breast cancer core needle biopsy market in China is projected to expand throughout the forecast period. China has been making significant investments in healthcare infrastructure, including modern hospitals and diagnostic centers equipped with advanced medical technologies. With improvements in diagnostic equipment, such as mammography, ultrasound, and MRI, core needle biopsy is becoming more accessible to patients, further supporting market growth.

Japan breast cancer core needle biopsy market is anticipated to grow during the forecast period, driven by the presence of advanced healthcare infrastructure, high cancer awareness, and technological innovations in diagnostics.

Latin America Breast Cancer Core Needle Biopsy Market Trends

The breast cancer core needle biopsy industry in the Latin America is likely to show significant growth over the forecast period. Breast tumor is one of the most common cancers among women in Latin America. Countries such as Brazil and Argentina have seen an increase in the number of breast cancer cases in the past few years, which is likely to drive demand for better diagnostic methods.

Brazil breast cancer core needle biopsy market is anticipated to grow during the forecast period. The Brazilian government has made efforts to improve breast cancer diagnosis and treatment through national screening programs. Initiatives like the Program for the Early Detection of Breast Cancer aim to provide mammography services to women over 50 and encourage earlier detection of the disease.

Middle East And Africa Breast Cancer Core Needle Biopsy Market Trends

The breast cancer core needle biopsy market in the Middle East and Africa is anticipated to grow at a steady rate over the forecast period. The regional market is growing due to the increasing prevalence of breast cancer, one of the most common cancers among women in the region. Improved awareness campaigns and early detection initiatives have fueled the need for accurate diagnostic tools in the region.

Saudi Arabia breast cancer core needle biopsy market is expected to show substantial growth in the coming years. The Saudi government has implemented a range of initiatives aimed at improving cancer detection and treatment, including cancer. The country’s Vision 2030 healthcare reforms aim to enhance the overall quality and accessibility of healthcare services, with a particular focus on cancer care.

| Report Coverage | Details |

| Market Size in 2025 | USD 953.48 Million |

| Market Size by 2034 | USD 1441.56 Million |

| Growth Rate From 2025 to 2034 | CAGR of 4.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Technology, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Intact Medical Corporation; Ethicon Surgical Technologies; Gallini SRL; Leica Biosystems Nussloch GmbH; Hologic, Inc.; Argon Medical Devices; Encapsule Medical Devices LLC.; Cook Medical Incorporated; Becton, Dickinson and Company; C.R. Bard, Inc. |

The ultrasound-based breast biopsy segment accounted for the largest revenue share of 41.9% in 2024. The segment dominance can be attributed to the growing preference for ultrasound-guided biopsies due to their notable advantages. In addition, the rise in product launches and regulatory approvals is anticipated to further boost segment growth. For instance, in April 2021, Mammotome introduced the HydroMARK breast biopsy site marker, designed to enhance long-term ultrasound visibility. Similarly, in August 2022, TransMed7, LLC unveiled its SpeedBird mammary biopsy device, which offers improved ease in performing image-guided biopsies. Furthermore, in June 2024, a group of doctors at Soochow University developed a contrast-enhanced ultrasound-based model which enables detection of axillary lymph node metastasis in mammary cancer patients. These advancements in the industry are expected to contribute significantly to the segment's growth.

CT-based breast biopsy is anticipated to grow at a CAGR of 3.8% in the coming years. The segment growth is driven by ongoing technological advancements in CT breast biopsy and improved accessibility to this technology. Additionally, increased research and development efforts are expected to further support the segment's growth. Techniques such as FDG PET/CT and FES PET/CT have also demonstrated their potential to enhance the diagnosis and treatment of metastatic mammary tumors, contributing to the segment's expansion.

The hospitals & diagnostic laboratories segment captured the highest revenue share of 61.0% in 2024. The increasing number of patient visits to hospitals, along with the rising adoption of advanced instruments and equipment in healthcare facilities, is expected to create a supportive environment for the segment's growth. In addition, the segment is anticipated to experience the fastest CAGR during the forecast period, driven by the rapid expansion in the installation of biopsy instruments. For instance, in July 2024, Sir HN Reliance Foundation Hospital installed the first MR fusion biopsy instrument, which uses artificial intelligence to detect tumorous growth. These developments are expected to further boost the segment's growth prospects.

The academic & research institutes segment is predicted to grow at an exponential CAGR of 4.4% from 2025 to 2034 in the breast cancer core needle biopsy industry. The growing investments in academic institutions to support research activities are expected to drive the segment's growth. For example, in October 2023, the Bren Simon Comprehensive Cancer Center and Indiana University Melvin were awarded USD 2.2 million in funding for research on metastatic mammary tumor. Such financial support is likely to accelerate innovation and advancements in the field, further contributing to the segment's expansion.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the breast cancer core needle biopsy market

By Technology

By End-use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Technology

1.2.2. End use

1.2.3. Regional scope

1.2.4. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Technology outlook

2.2.2. End use outlook

2.2.3. Regional outlook

2.3. Competitive Insights

Chapter 3. Breast Cancer Core Needle Biopsy Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Growing prevalence of breast cancer

3.2.1.2. Advancement in imaging technologies and biopsy techniques

3.2.1.3. Rising inclination towards minimally invasive procedures

3.2.2. Market restraint analysis

3.2.2.1. High cost of core needle biopsy procedures

3.2.2.2. Limited expertise and training

3.3. Breast Cancer Core Needle Biopsy Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

Chapter 4. Breast Cancer Core Needle Biopsy Market: Technology Estimates & Trend Analysis

4.1. Technology Market Share, 2024 & 2034

4.2. Segment Dashboard

4.3. Global Breast Cancer Core Needle Biopsy Market by Technology Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

4.4.1. MRI-Based Breast Biopsy

4.4.1.1. Market estimates and forecasts 2021 to 2034 (USD million)

4.4.2. Fermentation Ultrasound-Based Breast Biopsy

4.4.2.1. Market estimates and forecasts 2021 to 2034 (USD Million)

4.4.3. Mammography-Based (Stereotactic) Breast Biopsy

4.4.3.1. Market estimates and forecasts 2021 to 2034 (USD Million)

4.4.4. CT-Based Breast Biopsy

4.4.4.1. Market estimates and forecasts 2021 to 2034 (USD Million)

4.4.5. Other Image-Based Breast Biopsy

4.4.5.1. Market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 5. Breast Cancer Core Needle Biopsy Market: End Use Estimates & Trend Analysis

5.1. End Use Market Share, 2024 & 2034

5.2. Segment Dashboard

5.3. Global Breast Cancer Core Needle Biopsy Market by End Use Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2021 to 2034 for the following

5.4.1. Hospitals & Diagnostic Laboratories

5.4.1.1. Market estimates and forecasts 2021 to 2034 (USD million)

5.4.2. Pharmaceutical & Biotechnology companies

5.4.2.1. Market estimates and forecasts 2021 to 2034 (USD Million)

5.4.3. Academic & Research Institutes

5.4.3.1. Market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 6. Breast Cancer Core Needle Biopsy Market: Regional Estimates & Trend Analysis

6.1. Regional Market Share Analysis, 2024 & 2034

6.2. Regional Market Dashboard

6.3. Global Regional Market Snapshot

6.4. Market Size & Forecasts Trend Analysis, 2021 to 2034:

6.5. North America

6.5.1. U.S.

6.5.1.1. Key country dynamics

6.5.1.2. Regulatory framework/ reimbursement structure

6.5.1.3. Competitive scenario

6.5.1.4. Target Disease Prevalence

6.5.1.5. U.S. market estimates and forecasts 2021 to 2034 (USD Million)

6.5.2. Canada

6.5.2.1. Key country dynamics

6.5.2.2. Regulatory framework/ reimbursement structure

6.5.2.3. Target Disease Prevalence

6.5.2.4. Competitive scenario

6.5.2.5. Canada market estimates and forecasts 2021 to 2034 (USD Million)

6.5.3. Mexico

6.5.3.1. Key country dynamics

6.5.3.2. Regulatory framework/ reimbursement structure

6.5.3.3. Target Disease Prevalence

6.5.3.4. Competitive scenario

6.5.3.5. Mexico market estimates and forecasts 2021 to 2034 (USD Million

6.6. Europe

6.6.1. UK

6.6.1.1. Key country dynamics

6.6.1.2. Regulatory framework/ reimbursement structure

6.6.1.3. Target Disease Prevalence

6.6.1.4. Competitive scenario

6.6.1.5. UK market estimates and forecasts 2021 to 2034 (USD Million)

6.6.2. Germany

6.6.2.1. Key country dynamics

6.6.2.2. Regulatory framework/ reimbursement structure

6.6.2.3. Target Disease Prevalence

6.6.2.4. Competitive scenario

6.6.2.5. Germany market estimates and forecasts 2021 to 2034 (USD Million)

6.6.3. France

6.6.3.1. Key country dynamics

6.6.3.2. Regulatory framework/ reimbursement structure

6.6.3.3. Target Disease Prevalence

6.6.3.4. Competitive scenario

6.6.3.5. France market estimates and forecasts 2021 to 2034 (USD Million)

6.6.4. Italy

6.6.4.1. Key country dynamics

6.6.4.2. Regulatory framework/ reimbursement structure

6.6.4.3. Target Disease Prevalence

6.6.4.4. Competitive scenario

6.6.4.5. Italy market estimates and forecasts 2021 to 2034 (USD Million)

6.6.5. Spain

6.6.5.1. Key country dynamics

6.6.5.2. Regulatory framework/ reimbursement structure

6.6.5.3. Target Disease Prevalence

6.6.5.4. Competitive scenario

6.6.5.5. Spain market estimates and forecasts 2021 to 2034 (USD Million)

6.6.6. Norway

6.6.6.1. Key country dynamics

6.6.6.2. Regulatory framework/ reimbursement structure

6.6.6.3. Target Disease Prevalence

6.6.6.4. Competitive scenario

6.6.6.5. Norway market estimates and forecasts 2021 to 2034 (USD Million)

6.6.7. Sweden

6.6.7.1. Key country dynamics

6.6.7.2. Regulatory framework/ reimbursement structure

6.6.7.3. Target Disease Prevalence

6.6.7.4. Competitive scenario

6.6.7.5. Sweden market estimates and forecasts 2021 to 2034 (USD Million)

6.6.8. Denmark

6.6.8.1. Key country dynamics

6.6.8.2. Regulatory framework/ reimbursement structure

6.6.8.3. Target Disease Prevalence

6.6.8.4. Competitive scenario

6.6.8.5. Denmark market estimates and forecasts 2021 to 2034 (USD Million)

6.7. Asia Pacific

6.7.1. Japan

6.7.1.1. Key country dynamics

6.7.1.2. Regulatory framework/ reimbursement structure

6.7.1.3. Target Disease Prevalence

6.7.1.4. Competitive scenario

6.7.1.5. Japan market estimates and forecasts 2021 to 2034 (USD Million)

6.7.2. China

6.7.2.1. Key country dynamics

6.7.2.2. Regulatory framework/ reimbursement structure

6.7.2.3. Target Disease Prevalence

6.7.2.4. Competitive scenario

6.7.2.5. China market estimates and forecasts 2021 to 2034 (USD Million)

6.7.3. India

6.7.3.1. Key country dynamics

6.7.3.2. Regulatory framework/ reimbursement structure

6.7.3.3. Target Disease Prevalence

6.7.3.4. Competitive scenario

6.7.3.5. India market estimates and forecasts 2021 to 2034 (USD Million)

6.7.4. Australia

6.7.4.1. Key country dynamics

6.7.4.2. Regulatory framework/ reimbursement structure

6.7.4.3. Target Disease Prevalence

6.7.4.4. Competitive scenario

6.7.4.5. Australia market estimates and forecasts 2021 to 2034 (USD Million)

6.7.5. South Korea

6.7.5.1. Key country dynamics

6.7.5.2. Regulatory framework/ reimbursement structure

6.7.5.3. Target Disease Prevalence

6.7.5.4. Competitive scenario

6.7.5.5. South Korea market estimates and forecasts 2021 to 2034 (USD Million)

6.7.6. Thailand

6.7.6.1. Key country dynamics

6.7.6.2. Regulatory framework/ reimbursement structure

6.7.6.3. Target Disease Prevalence

6.7.6.4. Competitive scenario

6.7.6.5. Thailand market estimates and forecasts 2021 to 2034 (USD Million)

6.8. Latin America

6.8.1. Brazil

6.8.1.1. Key country dynamics

6.8.1.2. Regulatory framework/ reimbursement structure

6.8.1.3. Target Disease Prevalence

6.8.1.4. Competitive scenario

6.8.1.5. Brazil market estimates and forecasts 2021 to 2034 (USD Million)

6.8.2. Argentina

6.8.2.1. Key country dynamics

6.8.2.2. Regulatory framework/ reimbursement structure

6.8.2.3. Target Disease Prevalence

6.8.2.4. Competitive scenario

6.8.2.5. Argentina market estimates and forecasts 2021 to 2034 (USD Million)

6.9. MEA

6.9.1. South Africa

6.9.1.1. Key country dynamics

6.9.1.2. Regulatory framework/ reimbursement structure

6.9.1.3. Target Disease Prevalence

6.9.1.4. Competitive scenario

6.9.1.5. South Africa market estimates and forecasts 2021 to 2034 (USD Million)

6.9.2. Saudi Arabia

6.9.2.1. Key country dynamics

6.9.2.2. Regulatory framework/ reimbursement structure

6.9.2.3. Target Disease Prevalence

6.9.2.4. Competitive scenario

6.9.2.5. Saudi Arabia market estimates and forecasts 2021 to 2034 (USD Million)

6.9.3. UAE

6.9.3.1. Key country dynamics

6.9.3.2. Regulatory framework/ reimbursement structure

6.9.3.3. Target Disease Prevalence

6.9.3.4. Competitive scenario

6.9.3.5. UAE market estimates and forecasts 2021 to 2034 (USD Million)

6.9.4. Kuwait

6.9.4.1. Key country dynamics

6.9.4.2. Regulatory framework/ reimbursement structure

6.9.4.3. Target Disease Prevalence

6.9.4.4. Competitive scenario

6.9.4.5. Kuwait market estimates and forecasts 2021 to 2034 (USD Million)

Chapter 7. Competitive Landscape

7.1. Recent Developments & Impact Analysis, By Key Market Participants

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. Key company market share analysis, 2024

7.3.2. Intact Medical Corporation

7.3.2.1. Company overview

7.3.2.2. Financial performance

7.3.2.3. Product benchmarking

7.3.2.4. Strategic initiatives

7.3.3. Ethicon Surgical Technologies

7.3.3.1. Company overview

7.3.3.2. Financial performance

7.3.3.3. Product benchmarking

7.3.3.4. Strategic initiatives

7.3.4. Gallini SRL

7.3.4.1. Company overview

7.3.4.2. Financial performance

7.3.4.3. Product benchmarking

7.3.4.4. Strategic initiatives

7.3.5. Leica Biosystems Nussloch GmbH

7.3.5.1. Company overview

7.3.5.2. Financial performance

7.3.5.3. Product benchmarking

7.3.5.4. Strategic initiatives

7.3.6. Hologic, Inc

7.3.6.1. Company overview

7.3.6.2. Financial performance

7.3.6.3. Product benchmarking

7.3.6.4. Strategic initiatives

7.3.7. Argon Medical Devices

7.3.7.1. Company overview

7.3.7.2. Financial performance

7.3.7.3. Product benchmarking

7.3.7.4. Strategic initiatives

7.3.8. Encapsule Medical Devices LLC

7.3.8.1. Company overview

7.3.8.2. Financial performance

7.3.8.3. Product benchmarking

7.3.8.4. Strategic initiatives

7.3.9. Cook Medical Incorporated

7.3.9.1. Company overview

7.3.9.2. Financial performance

7.3.9.3. Product benchmarking

7.3.9.4. Strategic initiatives

7.3.10. Becton, Dickinson and Company

7.3.10.1. Company overview

7.3.10.2. Financial performance

7.3.10.3. Product benchmarking

7.3.10.4. Strategic initiatives

7.3.11. C.R. Bard, Inc.

7.3.11.1. Company overview

7.3.11.2. Financial performance

7.3.11.3. Product benchmarking

7.3.11.4. Strategic initiatives