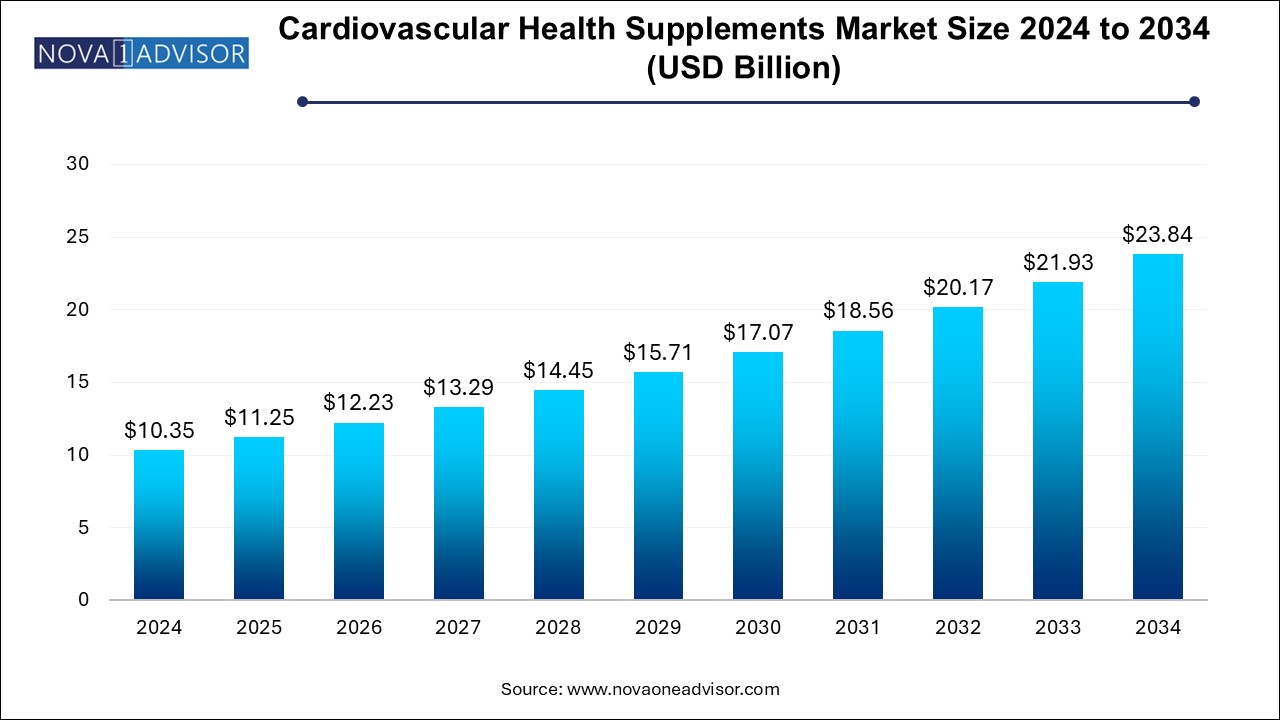

The cardiovascular health supplements market size was exhibited at USD 10.35 billion in 2024 and is projected to hit around USD 23.84 billion by 2034, growing at a CAGR of 8.7% during the forecast period 2025 to 2034.

An aging population and an increased prevalence of heart-related diseases are driving consumers' growing awareness of the importance of cardiovascular health. This awareness has increased interest in preventive healthcare, with individuals actively seeking supplements supporting heart health.

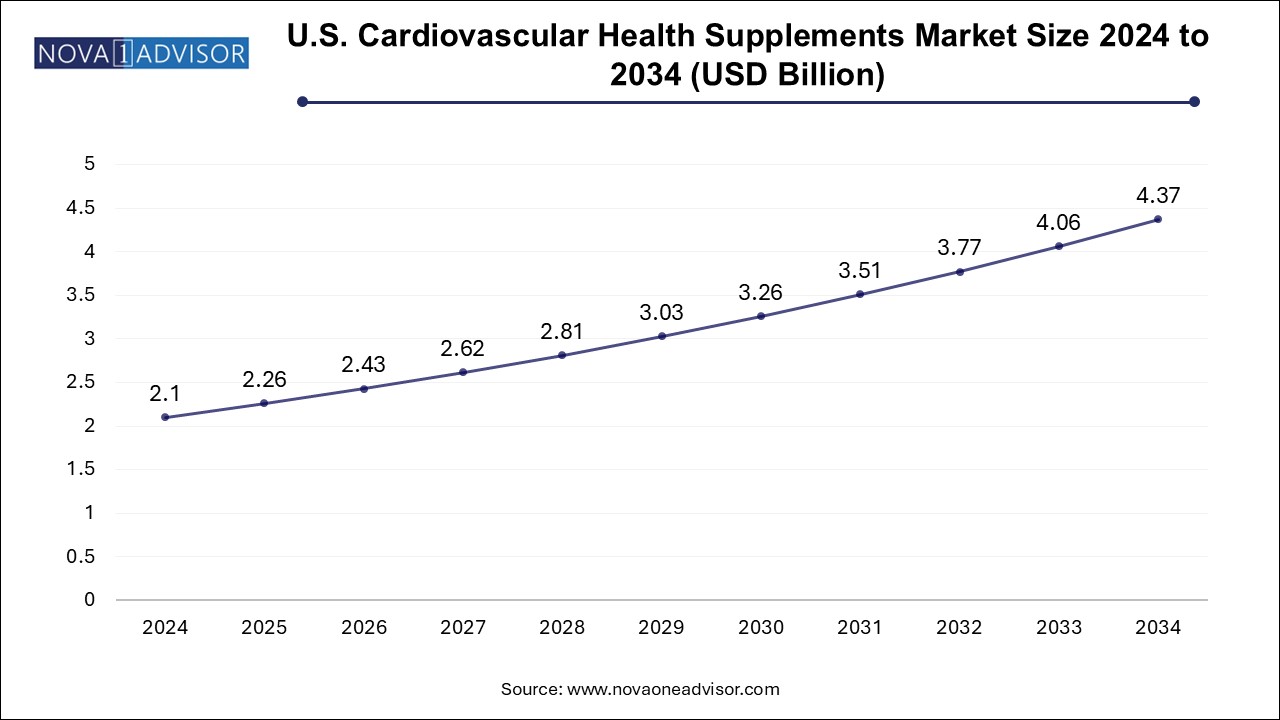

The U.S. cardiovascular health supplements market size is evaluated at USD 2.1 billion in 2024 and is projected to be worth around USD 4.37 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034.

North America cardiovascular health supplements market held a significant share of the global cardiovascular health supplements industry in 2024. The region’s health-conscious population, coupled with increased spending on preventive healthcare, has fueled demand for cardiovascular health supplements. Moreover, many American brands have established a strong global presence, leveraging successful marketing campaigns to highlight the numerous health benefits associated with these supplements. North America is also a notable exporter of cardiovascular health supplements, catering to a global consumer base. The region’s supplements are generally priced at a premium, reflecting the substantial investments in research and development that underpin product innovation.

U.S. Cardiovascular Health Supplements Market Trends

The U.S. cardiovascular health supplements market held a significant share of North America. The country has a substantial presence in the global cardiovascular health supplements market, driven by factors such as a high incidence of CVDs, an aging population, and a growing emphasis on preventive healthcare. Key ingredients such as omega fatty acids, Coenzyme Q10 (CoQ10), and plant sterols are in high demand in the country.

Moreover, endorsements from reputable organizations such as the American Heart Association and widespread public health initiatives focused on heart health have further boosted the market. According to an article published by Cison U.S. Inc. in November 2024, Healthycell has launched a groundbreaking product, Heart and Vascular Health, an ultra-absorbable gel supplement. This innovative formulation combines plant-based ingredients to help reduce cholesterol, triglyceride, and blood pressure levels.

Europe Cardiovascular Health Supplements Market Trends

Europe cardiovascular health supplements market is expected to grow at a significant CAGR of 8.2% from 2025 to 2034. This can be attributed to the growing aging population in Europe. This demographic trend has created a substantial market for cardiovascular health supplements, as older individuals often turn to dietary supplements to complement their heart-healthy lifestyle choices. Moreover, regulatory agencies in many European countries have approved nutritional supplements and functional foods, which has boosted industry growth. The process of approving such supplements has been simplified due to reforms and adjustments in the regulations.

Germany cardiovascular health supplements market is expected to experience significant growth, driven by escalating demand for organic and natural products. German consumers, known for being discerning and well-informed, opt for organic and natural alternatives due to growing awareness of product ingredients and production processes. This shift in consumer behavior has prompted manufacturers to expand their portfolios to include organic and natural options, thereby driving market growth. Furthermore, rising awareness of the health benefits associated with supplement consumption is expected to fuel market expansion as consumers seek to enhance their overall well-being.

Asia Pacific Cardiovascular Health Supplements Market Trends

Asia Pacific cardiovascular health supplements market dominated the market in 2024 with a revenue share of 38.6%, which can be attributed to the rising awareness of heart health and the increasing prevalence of CVDs in the region, which have fueled the demand for supplements to promote cardiovascular well-being. Consumers are becoming more health-conscious and proactive in managing their heart health, leading to a surge in the consumption of dietary supplements containing ingredients such as omega-3 fatty acids, coenzyme Q10, and antioxidants believed to support heart health. Moreover, the increasing focus of market players on developing nations such as India and China is anticipated to support regional growth over the forecast period.

China cardiovascular health supplements market is witnessing rapid growth, fueled by a combination of traditional values and modern health awareness. The COVID-19 pandemic has accelerated this trend, with Chinese consumers seeking dietary supplements to support their health and wellness. CVDs pose a significant healthcare burden in China due to their rising prevalence and incidence rates. According to a research article, “Cardiovascular Disease Mortality And Potential Risk Factor in China: A Multi-Dimensional Assessment by a Grey Relational Approach,” published in April 2022, CVD is a major healthcare concern in China, affecting a substantial population. Alarmingly, China accounts for 40% of total CVD-related mortality worldwide. This considerable burden and persistent risk of CVD in China are expected to drive demand for cardiology medical devices, ultimately boosting market growth.

| Report Coverage | Details |

| Market Size in 2025 | USD 11.25 Billion |

| Market Size by 2034 | USD 23.84 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Type, Ingredient, Form, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | NOW Foods; Bright, Lifecare Private Ltd (Truebasics.com); Natural Organics, Inc.; DaVinci Laboratories of Vermont; Nordic Naturals; Thorne, Inc.; Nestlé Health Science(Pure Encapsulations, LLC) ; Amway Corp.; InVite Health; GNC Holdings, LLC |

The natural supplements segment held the largest market share of 69.7% in 2024 and is expected to grow at the fastest CAGR of 9.0% over the forecast period. This can be attributed to the increasing awareness of the importance of health and wellness, which has driven consumers to seek natural alternatives over conventional pharmaceuticals. Many people are adopting a holistic approach to health, focusing on preventive measures and natural solutions, boosting the demand for natural supplements.

The synthetic supplements segment is anticipated to grow significantly from 2025 to 2034. Various factors, including perceived health benefits, lifestyle choices, aging demographics, nutritional awareness, medical recommendations, and price considerations shape the segment demand. Understanding these factors is essential for supplement manufacturers and marketers to effectively meet consumer needs and preferences in the competitive cardiovascular health supplements industry.

The omega fatty acids segment held the largest revenue share of 27.0% in 2024. Scientific research has consistently demonstrated the significant cardiovascular benefits of omega-3 fatty acids, particularly Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA). These essential fatty acids reduce triglyceride levels, lower blood pressure, and improve overall heart health. With growing awareness of these health benefits, consumer demand for cardiovascular supplements containing omega fatty acids has risen substantially. For instance, according to a study published in the Journal of the American Heart Association in June 2022, consuming 3 grams of omega-3 fatty acids daily via supplements or food decreases blood pressure.

The herbs & botanicals segment is anticipated to grow at the fastest CAGR of 10.0% from 2025 to 2034. Herbal and botanical supplements, such as garlic, hawthorn, and green tea extracts, have gained popularity for their heart health benefits. The demand for these natural ingredients continues to rise, driven by their traditional use and scientific validation. According to a study published in Rupa, Inc. in May 2023, garlic is high in allicin, an antioxidant responsible for many beneficial cardiovascular effects. Supplementation with Aged Garlic Extract (AGE) has been proven to reduce total and LDL cholesterol by 10%, reduce blood clotting, and significantly drop blood pressure in hypertensive patients by 8.4/7.3 mmHg on average.

The softgels segment held the largest share of 36.6% in 2024. Softgels are known for their ease of consumption and digestibility, making them a preferred choice for individuals seeking cardiovascular health support. This user-friendly format appeals to many consumers, including those with difficulty swallowing pills or capsules. The bioavailability and absorption rates of nutrients in softgel formulations are often higher than those in other supplement forms. This characteristic is especially advantageous in cardiovascular health supplements, as it can lead to quicker and more effective results. These factors are expected to drive the segment growth over the coming years.

The capsules segment is projected to exhibit the fastest CAGR of 9.6% over the forecast period. Capsules can hold well-formulated combinations of various ingredients clinically studied for their positive effects on heart health. This allows for a comprehensive supplementation approach that aligns with the growing demand for holistic and preventive healthcare solutions. In addition, capsules have an extended shelf life, ensuring the stability and potency of the supplement over time. This factor further bolsters the segment growth.

The offline segment held the largest market share of 71.0% in 2024. It includes brick-and-mortar stores, pharmacies, and health food stores, which offer consumers a physical location to explore and purchase health supplements. This drives their preference among consumers. Moreover, several companies have been investing significantly in opening offline stores to reach a wider customer base. For instance, in May 2023, Nordic Naturals partnered with Walmart to offer its omega-3 supplement across 2,500 Walmart stores. The aim behind the strategy was to expand its retail footprint.

On the contrary, the online segment is projected to register the fastest CAGR of 10.9% from 2025 to 2034. The online distribution channel experienced steep growth during the COVID-19 pandemic. Moreover, to increase the reach of products, companies are collaborating with e-commerce platforms or focusing on digital distribution channels. For instance, as per a report in November 2020, Amway Corp. has witnessed significant growth in online sales, which doubled to more than 70% from 33.6% in February 2020.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cardiovascular health supplements market

By Type

By Ingredient

By Form

By Distribution Channel

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Cardiovascular Health Supplements Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Cardiovascular Health Supplements Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Cardiovascular Health Supplements Market: Type Estimates & Trend Analysis

4.1. Type Market Share, 2025 & 2034

4.2. Type Segment Dashboard

4.3. Market Size & Forecasts and Trend Analysis, by Type, 2021 to 2034 (USD Million)

4.4. Natural Supplements

4.4.1. Natural supplements Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.5. Synthetic Supplements

4.5.1. Synthetic Supplements Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. Cardiovascular Health Supplements Market: Ingredient Estimates & Trend Analysis

5.1. Ingredient Market Share, 2025 & 2034

5.2. Ingredient Segment Dashboard

5.3. Market Size & Forecasts and Trend Analysis, by Ingredient Class, 2021 to 2034 (USD Million)

5.4. Vitamins & Minerals

5.4.1. Vitamins & Minerals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.5. Herbs & Botanicals

5.5.1. Herbs & Botanicals Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Omega Fatty Acids

5.6.1. Omega Fatty Acids Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.7. Coenzyme Q10 (CoQ10)

5.7.1. Coenzyme Q10 (CoQ10) Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.8. Others

5.8.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. Cardiovascular Health Supplements Market: Form Estimates & Trend Analysis

6.1. Form Market Share, 2025 & 2034

6.2. Form Segment Dashboard

6.3. Market Size & Forecasts and Trend Analysis, by Form, 2021 to 2034 (USD Million)

6.4. Liquid

6.4.1. Liquid Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.5. Tablet

6.5.1. Tablet Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.6. Capsules

6.6.1. Capsules Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.7. Softgels

6.7.1. Softgels Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.8. Powder

6.8.1. Powder Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

6.9. Others

6.9.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. Cardiovascular Health Supplements Market: Distribution Channel Estimates & Trend Analysis

7.1. Distribution Channel Market Share, 2025 & 2034

7.2. Distribution Channel Segment Dashboard

7.3. Market Size & Forecasts and Trend Analysis, by Distribution Channel, 2021 to 2034 (USD Million)

7.4. Offline

7.4.1. Offline Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

7.5. Online

7.5.1. Online Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 8. Cardiovascular Health Supplements Market: Regional Estimates & Trend Analysis

8.1. Regional Market Share Analysis, 2025 & 2034

8.2. Regional Market Dashboard

8.3. Market Size & Forecasts Trend Analysis, 2021 to 2034

8.4. North America

8.4.1. North America Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.2. U.S.

8.4.2.1. Key Country Dynamics

8.4.2.2. Regulatory Framework

8.4.2.3. Competitive Insights

8.4.2.4. U.S. Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.3. Canada

8.4.3.1. Key Country Dynamics

8.4.3.2. Regulatory Framework

8.4.3.3. Competitive Insights

8.4.3.4. Canada Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.4.4. Mexico

8.4.4.1. Key Country Dynamics

8.4.4.2. Regulatory Framework

8.4.4.3. Competitive Insights

8.4.4.4. Mexico Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5. Europe

8.5.1. Europe Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.2. Germany

8.5.2.1. Key Country Dynamics

8.5.2.2. Regulatory Framework

8.5.2.3. Competitive Insights

8.5.2.4. Germany Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.3. UK

8.5.3.1. Key Country Dynamics

8.5.3.2. Regulatory Framework

8.5.3.3. Competitive Insights

8.5.3.4. UK Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.4. France

8.5.4.1. Key Country Dynamics

8.5.4.2. Regulatory Framework

8.5.4.3. Competitive Insights

8.5.4.4. France Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.5. Italy

8.5.5.1. Key Country Dynamics

8.5.5.2. Regulatory Framework

8.5.5.3. Competitive Insights

8.5.5.4. Italy Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.6. Spain

8.5.6.1. Key Country Dynamics

8.5.6.2. Regulatory Framework

8.5.6.3. Competitive Insights

8.5.6.4. Spain Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.7. Sweden

8.5.7.1. Key Country Dynamics

8.5.7.2. Regulatory Framework

8.5.7.3. Competitive Insights

8.5.7.4. Sweden Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.8. Denmark

8.5.8.1. Key Country Dynamics

8.5.8.2. Regulatory Framework

8.5.8.3. Competitive Insights

8.5.8.4. Denmark Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.5.9. Norway

8.5.9.1. Key Country Dynamics

8.5.9.2. Regulatory Framework

8.5.9.3. Competitive Insights

8.5.9.4. Norway Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6. Asia Pacific

8.6.1. Asia Pacific Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.2. China

8.6.2.1. Key Country Dynamics

8.6.2.2. Regulatory Framework

8.6.2.3. Competitive Insights

8.6.2.4. China Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.3. Japan

8.6.3.1. Key Country Dynamics

8.6.3.2. Regulatory Framework

8.6.3.3. Competitive Insights

8.6.3.4. Japan Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.4. India

8.6.4.1. Key Country Dynamics

8.6.4.2. Regulatory Framework

8.6.4.3. Competitive Insights

8.6.4.4. India Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.5. South Korea

8.6.5.1. Key Country Dynamics

8.6.5.2. Regulatory Framework

8.6.5.3. Competitive Insights

8.6.5.4. South Korea Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.6. Australia

8.6.6.1. Key Country Dynamics

8.6.6.2. Regulatory Framework

8.6.6.3. Competitive Insights

8.6.6.4. Australia Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.6.7. Thailand

8.6.7.1. Key Country Dynamics

8.6.7.2. Regulatory Framework

8.6.7.3. Competitive Insights

8.6.7.4. Thailand Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7. Latin America

8.7.1. Latin America Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.2. Brazil

8.7.2.1. Key Country Dynamics

8.7.2.2. Regulatory Framework

8.7.2.3. Competitive Insights

8.7.2.4. Brazil Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.7.3. Argentina

8.7.3.1. Key Country Dynamics

8.7.3.2. Regulatory Framework

8.7.3.3. Competitive Insights

8.7.3.4. Argentina Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8. Middle East and Africa

8.8.1. Middle East and Africa Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.2. South Africa

8.8.2.1. Key Country Dynamics

8.8.2.2. Regulatory Framework

8.8.2.3. Competitive Insights

8.8.2.4. South Africa Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key Country Dynamics

8.8.3.2. Regulatory Framework

8.8.3.3. Competitive Insights

8.8.3.4. Saudi Arabia Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.4. UAE

8.8.4.1. Key Country Dynamics

8.8.4.2. Regulatory Framework

8.8.4.3. Competitive Insights

8.8.4.4. UAE Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key Country Dynamics

8.8.5.2. Regulatory Framework

8.8.5.3. Competitive Insights

8.8.5.4. Kuwait Cardiovascular Health Supplements Market Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 9. Competitive Landscape

9.1. Participant Overview

9.2. Company Market Position Analysis

9.3. Company Categorization

9.4. Strategy Mapping

9.5. Company Profiles/Listing

9.5.1. NOW Foods

9.5.1.1. Participant’s Overview

9.5.1.2. Financial Performance

9.5.1.3. Product Benchmarking

9.5.1.4. Recent Developments/ Strategic Initiatives

9.5.2. Bright Lifecare Private Ltd (Truebasics.com)

9.5.2.1. Participant’s Overview

9.5.2.2. Financial Performance

9.5.2.3. Product Benchmarking

9.5.2.4. Recent Developments/ Strategic Initiatives

9.5.3. Natural Organics, Inc.

9.5.3.1. Participant’s Overview

9.5.3.2. Financial Performance

9.5.3.3. Product Benchmarking

9.5.3.4. Recent Developments/ Strategic Initiatives

9.5.4. DaVinci Laboratories of Vermont

9.5.4.1. Participant’s Overview

9.5.4.2. Financial Performance

9.5.4.3. Product Benchmarking

9.5.4.4. Recent Developments/ Strategic Initiatives

9.5.5. Nordic Naturals

9.5.5.1. Participant’s Overview

9.5.5.2. Financial Performance

9.5.5.3. Product Benchmarking

9.5.5.4. Recent Developments/ Strategic Initiatives

9.5.6. Thorne

9.5.6.1. Participant’s Overview

9.5.6.2. Financial Performance

9.5.6.3. Product Benchmarking

9.5.6.4. Recent Developments/ Strategic Initiatives

9.5.7. Nestlé Health Science (Pure Encapsulations, LLC.)

9.5.7.1. Participant’s Overview

9.5.7.2. Financial Performance

9.5.7.3. Product Benchmarking

9.5.7.4. Recent Developments/ Strategic Initiatives

9.5.8. Amway Corp.

9.5.8.1. Participant’s Overview

9.5.8.2. Financial Performance

9.5.8.3. Product Benchmarking

9.5.8.4. Recent Developments/ Strategic Initiatives

9.5.9. InVite Health

9.5.9.1. Participant’s Overview

9.5.9.2. Financial Performance

9.5.9.3. Product Benchmarking

9.5.9.4. Recent Developments/ Strategic Initiatives

9.5.10. GNC Holdings, LLC

9.5.10.1. Participant’s Overview

9.5.10.2. Financial Performance

9.5.10.3. Product Benchmarking

9.5.10.4. Recent Developments/ Strategic Initiatives