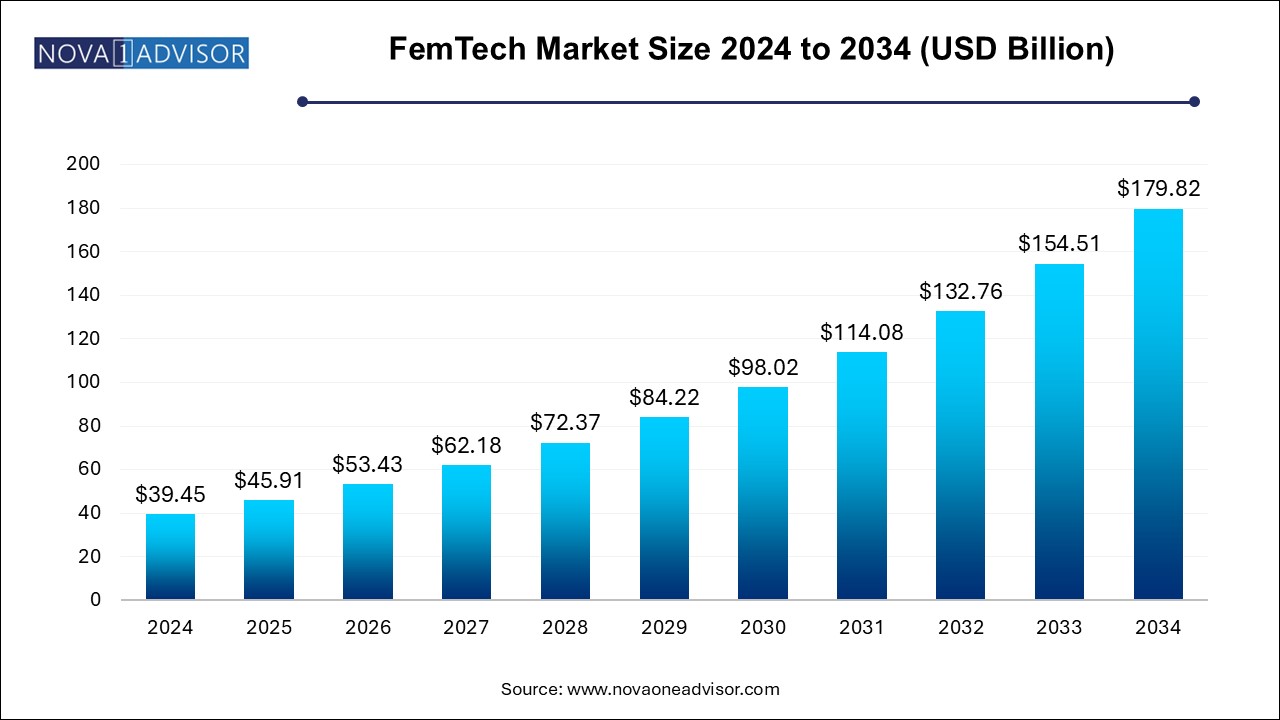

The FemTech market size was exhibited at USD 39.45 billion in 2024 and is projected to hit around USD 179.82 billion by 2034, growing at a CAGR of 16.38% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 45.91 Billion |

| Market Size by 2034 | USD 179.82 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 16.38% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Chiaro Technology Limited; HeraMED; Flo Health, Inc.; Natural Cycles USA Corp; Glow, Inc; Allara Health; NUVO Inc.; Bloomlife; Syrona Health; Sirona Hygiene Private Limited; Samplytics Technologies Private Limited; iSono Health, Inc.;Athena Feminine Technologies |

The growth of the FemTech industry is expected to be driven by several key factors, such as Increased adoption of digital health solutions, Innovative technologies like AI and virtual assistants are enabling the development of more personalized, efficient, and accessible femtech solutions. In addition, the femtech industry has been attracting substantial investments and funding, which is expected to fuel further growth and innovation in the sector.

Investors are increasingly focusing on funding solutions that address women's fitness and well-being. Investors are broadening their focus beyond conventional areas such as fertility and pregnancy, concentrating more funding towards menopause, menstrual, mental, and other neglected aspects of women's health. This is expected to boost the market's growth. In November 2022, a teletherapy startup focusing on women's health, Maven Clinic raised USD 90 million in Series E funding. This round was led by General Catalyst, with participation from Sequoia Capital, Intermountain Ventures, and CVS Health Ventures. Maven has raised over USD 300 million in total funding, reflecting strong investor confidence in the FemTech sector. Such investments are expected to promote the growth of the market.

Furthermore, the market is expected to experience growth due to increased investment in R&D activities and rising awareness of women's health issues. For instance, in March 2022, Sasha Cayward has developed a new menstrual health app that uses AI to provide personalized advice on fitness, nutrition, and task management, alongside monitoring menstrual cycles and symptoms. This is expected to significantly expand the market.

Based on type, the devices segment dominated the market with a revenue share of 33.33% in 2024 and expected to have the fastest growth rate during the forecast period. The increasing focus on women's health and wellness is driving the demand for FemTech devices. The shifting trend toward value-based care and a consumer-led model is driving growth. Wearable devices are becoming more essential as people prioritize wellness, self-care, and digital health. Female users are looking for features like seamless smartphone integration, wireless connectivity, and longer battery life in wearable devices.

In addition, as per data from the Pew Research Center in June 2019, around 21% of people in the U.S. were using wearable devices. This indicates a rising trend in the popularity of wearable technology, encompassing fitness trackers and smartwatches. The demand for these devices is expected to grow further due to ongoing improvements in their design and capabilities, including features such as predictive analytics, cloud synchronization, and gamification.

On the other hand, the software segment is expected to experience significant growth in the coming years. This is due to the increasing trend of preventive healthcare and the rising penetration of smartphones, along with improving internet connectivity, which is driving consumer adoption of health applications for smartphones. In 2023-24, Guidea announced the selection of 30 early-stage FemTech startups for its UX design sponsorship program called Femovate. This program aims to improve the usability and accessibility of products designed for women's health. One of the notable startups in this program is Epowar, which has developed a safety app that can detect physical attacks, alert contacts, and share location data.

Based on application, the pregnancy and nursing care segment dominated the market in 2024 with a revenue share of 17.72%. The FemTech industry, particularly in the areas of pregnancy and nursing care, is experiencing significant growth driven by various factors such as increasing awareness, technological advancements, cultural shifts, Direct-to-Consumer (DTC) models, and significant market potential, positioning it as a vital sector within women's health. Companies are developing innovative solutions that help women navigate pregnancy and postpartum experiences, providing resources for health monitoring and support.

Various mobile applications are being developed to help women track their pregnancy progress, manage postpartum recovery, and access mental health resources. These apps often include features like symptom checkers, reminders for medical appointments, and community support forums. In October 2023, the Janam App was launched in Leicester to provide support for South Asian families. The app, created by the University Hospitals of Leicester NHS Trust, is specifically designed to assist South Asian women and birthing individuals. It is available in five different South Asian languages such as Urdu, Hindi, Gujarati, Bengali, and Punjabi, as well as English. The app offers reliable content based on national and international guidelines, covering various aspects of pregnancy, including routine antenatal care, potential complications, labor, pain relief options, and postnatal support.

The menstrual health segment is expected to grow at the fastest rate during the forecast period. The market for menstrual health apps is driven by heightened awareness of women's health issues, including menstrual hygiene management and reproductive disorders. This awareness has resulted in a greater need for tools that can help women monitor their menstrual health more effectively.

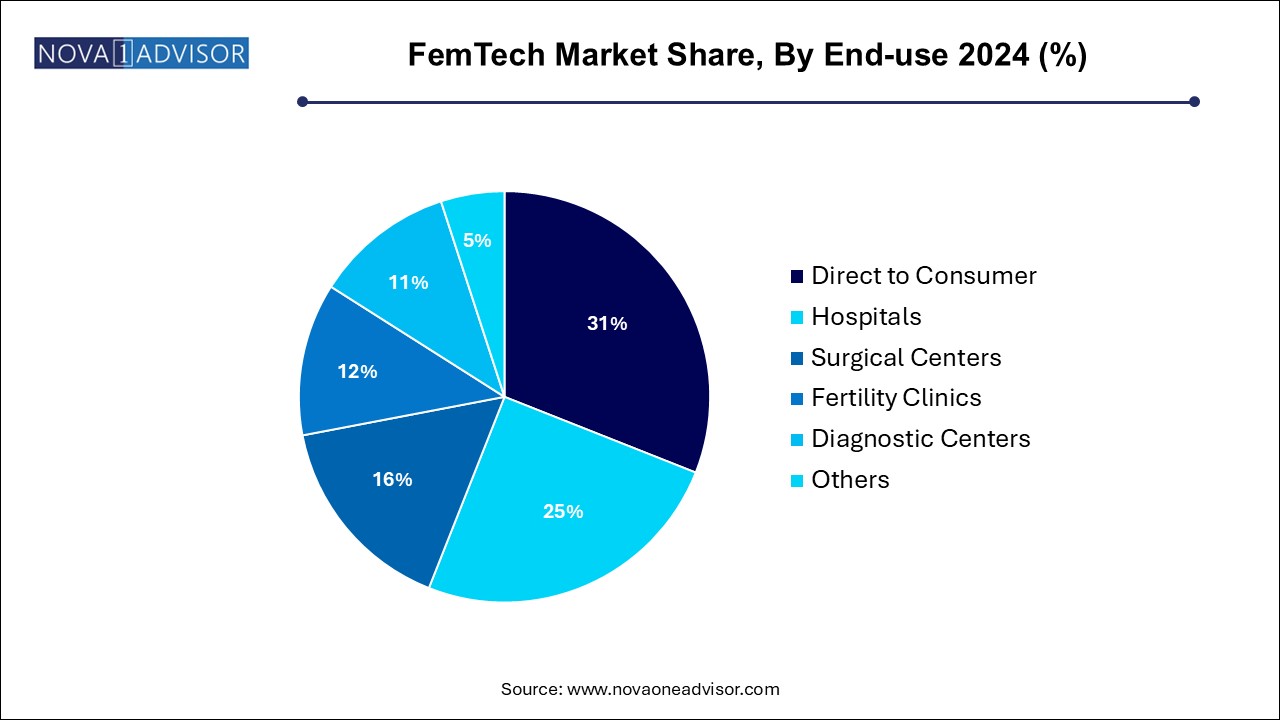

Based on end use, the direct-to-consumer segment dominated the market with a revenue share of 31.0% in 2024 and expected to have the fastest growth rate during the forecast period. This dominance is attributed to the convenience and accessibility that DTC models provide, allowing consumers to purchase products directly through online platforms without intermediaries. This streamlined process enhances consumer trust and engagement, as women can communicate directly with brands and make informed health decisions.

In June 2024, Unfabled, a UK-based platform focused on women's health and wellbeing, is introducing Unfabled Labs, a new DTC platform in FemTech, which has launched a consumer insights platform and introduced a range of signature supplements focused on women's health. This platform utilize data from more than 400,000 women and non-binary individuals to assist in the creation of new products and services that cater specifically to their health requirements. These initiatives are expected to significantly drive market growth across various sectors during the forecast period.

The hospitals segment is expected to experience significant growth during the forecast period. Hospitals are beginning to adopt FemTech solutions to enhance patient care. For instance, products like Oova, an at-home hormone testing kit, and Babyscripts, which monitor maternal health vitals, are being integrated into clinical settings. These tools allow healthcare providers to offer personalized care plans based on real-time data, improving outcomes for women.

North America FemTech market region dominated the market with largest revenue share of 45.90% in 2024. The growing technological advancements, such as AI in FemTech products are expected to drive market growth over the forecast period. For instance, in February 2023, a women's health start-up in Texas launched an AI-based chat application inspired by ChatGPT. These advancements contribute to the increased adoption of FemTech apps, leading to market growth in the region.

U.S. FemTech Market Trends

The U.S. FemTech market held the largest share in 2024, owing to the launch of new products and increased investments in healthcare, the FemTech market is expected to experience growth in U.S. over the forecast period. For instance, in April 2022, Conceive, a FemTech company, secured a USD 3.7 million investment for their fertility solution. Such investments are likely to support the market demand in the region.

Asia Pacific FemTech Market Trends

Asia Pacific FemTech market expected to witness the fastest growth over the forecast period. The growth of the market in the region driven by increasing awareness, technological advancements, and a rising number of female entrepreneurs. As societal attitudes shift and the conversation around women's health becomes more normalized, the potential for innovation and investment in this sector is significant. The establishment of networks like the FemTech Association of Asia further supports this growth by promoting community and collaboration among stakeholders in the FemTech ecosystem.

China FemTech market held significant largest share in 2024,as awareness of women's health issues rises and more women enter investment roles, there is a growing opportunity for FemTech startups to secure funding and expand their presence. Furthermore, the market growth is driven by a proliferation of startups focused on women's health, such as Babytree, Meiyou, and Dayima, which aim to provide innovative solutions for various health issues affecting women.

India FemTech market is driven by factors such as the increased awareness, technological advancements, investment, and the active participation of millennial women. Furthermore, Startups leveraging technology to create user-centric products is expected to drive the growth of the market in the country. For instance, CareMother provides a mobile platform for pregnant women to connect with healthcare providers, while CervAstra offers AI-driven cervical cancer detection solutions.

Europe FemTech Market Trends

The market in Europe is anticipated to grow significantly due to European FemTech companies diversifying their offerings. Menstrual pain management, menopause solutions, and fertility technologies are all areas of focus. For instance, startups like Elvie and Clue are leading in menstrual health and reproductive tracking, while new entrants like Omena are focusing on menopause tech.

UK FemTech market is expected to grow significantly over the forecast period,this growth, driven by increasing investments and innovations in women's health technology.Collaborative initiatives among the NHS, academia, and industry are essential for advancing FemTech solutions. These partnerships aim to enhance education, improve access to digital resources, and bridge gender-based data gaps in healthcare. For instance, new NHS datasets focusing on female health outcomes are being introduced to ensure better integration of women's health considerations in clinical services.

Germany FemTech market held the largest share in 2024. The market is experiencing significant advancements marked by innovative startups, increasing investments, and a growing recognition of women's health issues. However, challenges such as funding disparities and market awareness remain critical areas for development.

Latin America FemTech Market Trends

The market in Latin America is anticipated to grow significantly due to the integration of digital health technologies is creating new opportunities for FemTech products, which include apps, wearables, and other health management tools tailored specifically for women's health needs. The demand for personalized healthcare solutions is also on the rise, further propelling market growth.

Brazil FemTech market is expected to experience substantial growth during the forecast period. In June 2022, Feel and Lilit, two startups in the FemTech segment in Brazil, have made a great move by entering into the partnership. This consolidation of the brands will result in an expanded range of proprietary products and services, as well as an increased offering in collaboration with other startups focused on the journey of intimate female well-being. These developments highlight the growing innovation and consolidation in the Brazilian FemTech market, driven by the increasing demand for advanced and patient-centric solutions in sexual wellness and fertility care.

Middle East & Africa FemTech Market Trends

The market in the Middle East and Africa is anticipated to grow significantly due to growing awareness and acceptance of women's health issues, leading to more discussions and initiatives focused on FemTech. This cultural shift is encouraging women to seek health solutions tailored to their needs, thereby expanding the market for FemTech products and services in the region.

Israel FemTech market is rapidly evolving, positioning the country as a significant player in the global landscape. Israel ranks fourth globally in the number of FemTech companies, with over 100 FemTech companies.According to the Startup Nation Central report, Israel also holds the second position in terms of investment, having raised approximately USD 154 million in 2022, which accounted for 13% of the total investment in Israel's MedTech sector.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the FemTech market

By Type

By Application

By End-use

By Regional