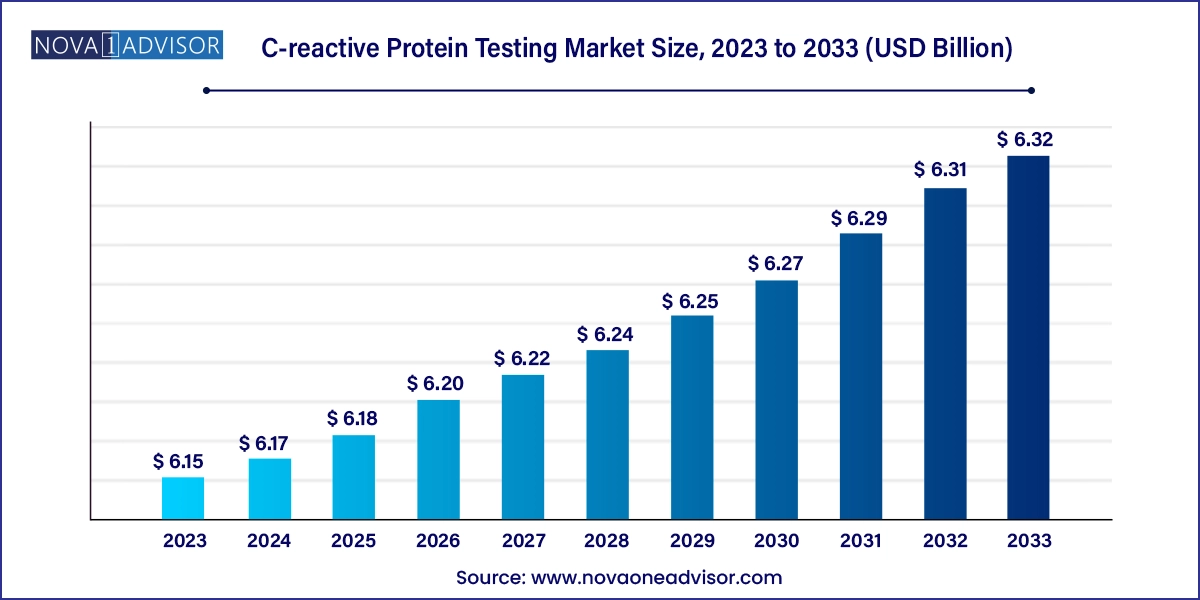

The global C-reactive protein testing market size was exhibited at USD 6.15 billion in 2023 and is projected to hit around USD 6.32 billion by 2033, growing at a CAGR of 0.28% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.17 Billion |

| Market Size by 2033 | USD 6.32 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 0.28% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Assay Type, Detection Range, Disease Area, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd; Danaher; Quest Diagnostics; Siemens Healthineers AG; Abbott; Merck KGaAA; Zoetis; Ortho Clinical Diagnostics; Getein Biotech, Inc; HORIBA, Ltd; Randox Laboratories Ltd; BODITECH MED, INC.; Aidian |

The market demand is anticipated to be driven by the growing prevalence of cardiovascular diseases, along with the increasing adoption of point-of-care devices. Furthermore, the growth of the market is expected to be propelled by increasing government initiatives for the implementation of point-of-care screening and the development of innovative techniques in C-reactive protein (CRP) testing. The growth of the market is being driven by several major factors such as the rising prevalence of chronic diseases such as inflammatory disorders, rheumatoid arthritis, and cardiovascular disease.

Moreover, there is an increasing incidence of endometriosis in women globally, which contributes to market growth. Furthermore, the growing demand for healthcare services also plays a significant role in driving the market. For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in May 2023, approximately 1 in 20 adults aged 20 and older were affected by coronary artery disease (CAD) in 2021. In addition, in the U.S. alone, approximately 805,000 individuals experience a heart attack each year. Therefore, the increased prevalence of cardiovascular diseases has resulted in increased adoption of CRP testing to identify the associated risks, thereby driving the growth of the market.

Government agencies’ initiatives to increase awareness and adoption of point-of-care solutions, along with increased funding and investments for research entities engaged in relevant research activities, are significant factors driving market growth. Plasmonic Nanoparticles (PNPs) are recognized for their versatile optical properties, making them valuable tools for biosensing applications. For instance, Aidan provides user-friendly portable QuikRead go instrument and Quickread go CRP tests for quantitative measurements of CRP. Companies such as Aidian and Abbott provide products that are supportive diagnostic tools for managing COVID-19 infections. The COVID-19 pandemic had a positive impact on the market.

There was an increase in the demand for services and products, as CRP is a crucial biomarker for assessing the seriousness of infection and inflammation. Key market players have introduced supportive tools for CRP testing specifically for SARS-CoV-2 infection. For instance, in March 2020, Abbott launched ID NOW COVID-19, a rapid point-of-care (POC) CRP test capable of detecting COVID-19 within five minutes. In addition, several studies have been conducted on COVID-19 patients to assess CRP as a prognostic indicator. The significance of CRP testing in COVID-19 infection for patient stratification has resulted in an increased demand for CRP testing, thereby impacting market growth during the pandemic.

The market is anticipated to be driven by advancements in technology used for measuring CRP levels in patients. Significant investments are being made to develop new technologies that enhance the accuracy and adoption of CRP testing, further contributing to market growth. For instance, in November 2023, LumiraDx Healthcare Private Limited launched a highly sensitive CRP point-of-care antigen test in India. This test is designed to be utilized in various clinical settings and aims to reduce the unnecessary prescription of antibiotics, which thereby can contribute to the development of antimicrobial resistance.

Based on assay type, immunoturbidimetric assays dominated the market with a revenue share of 48.53% in 2023. The revenue growth of the segment is expected to be fueled by the development and accessibility of cost-efficient automated immunoturbidimetric assays that offer high sensitivity for measuring a wide range of CRP levels. These assays are widely used in clinical biochemistry for routine analysis of CRP and high-sensitivity CRP, which serve as indicators of systemic inflammation and risk of atherosclerosis. In addition, the increasing research activities regarding immunoturbidimetric assays are also anticipated to contribute to the revenue growth of this segment throughout the forecast period.

The market is expected to experience growth driven by technological advances in immunoturbidimetric assays. Key market players actively participate in the development of advanced and innovative assays to enable rapid and precise testing of CRP. For instance, a study published in January 2021 showcased the use of a latex-enhanced immunoturbidimetric assay by researchers from DM Vasudevan Agappe Diagnostic Limited, India. The study demonstrated the assay's effectiveness in detecting high sensitivity and a wide range of CRP levels in human serum.

These innovations in immunoturbidimetric assays are expected to be a significant driving force behind the market growth. The ELISA segment is estimated to have a substantial growth rate during the forecast period. The global cancer burden has increased to 19.3 million cases and 10 million cancer-related deaths in 2020, as reported by Globocan. Further, the segment is expected to experience growth due to the increased adoption of ELISA tests for cancer detection worldwide. ELISA tests are recognized as valuable techniques for early cancer detection, leading to rising demand for these tests and driving the growth of the segment.

The hs-CRP 3 segment dominated the market in 2023 with a revenue share of approximately 42.80%. The hs-CRP test is utilized to detect inflammation and accurately detect lower levels of CRP compared to that of the standard CRP test. It has a measurement range of 0.3 to 10 mg/L for quantifying CRP levels. The test offers enhanced accuracy compared to standard CRP-based assays and has a detection range that is lower than that of conventional methods. According to the American Heart Association (AHA) and the Centers for Disease Control and Prevention (CDC), hsCRP serves as an independent marker that aids in the estimation of cardiovascular disorders, including myocardial infarction. In addition, research studies on inflammatory markers have demonstrated an association between elevated hsCRP levels and disease activity in rheumatoid arthritis.

These studies suggest that higher levels of serum hsCRP can potentially serve as a biomarker for determining the pathogenesis of rheumatoid arthritis. A published study in March 2023 summarized the progress made in the development of advanced CRP biosensors using biomaterial and nanomaterial hybrids, specifically focusing on electrochemical, spectroscopy-based, and electrical techniques. These advancements are expected to drive the adoption of advanced CRP tools among end users. Further, the conventional CRP segment is expected to have substantial growth during the forecast period.

Based on the disease areas, the cardiovascular diseases (CVD) segment dominated the market with the largest share of 22.67% in 2023. A rise in the prevalence of CVDs is the major factor contributing to the growth of the CRP testing market.CRP serves as a crucial marker and indicator for detecting CVDs by assessing the risk of atherosclerosis. Elevated CRP levels are commonly observed in patients with CVDs, and assays are capable of detecting even low levels of CRP. As a result, the adoption of CRP testing has increased significantly for the detection of cardiovascular diseases, thereby driving the revenue growth of this segment during the forecast period. Cancer represents a significant portion of the market share, being a substantial public health burden globally.

The European region, for instance, witnesses over 1.9 million deaths and 3.7 million new cancer cases annually, emphasizing the need for widespread adoption of point-of-care (POC) testing solutions to aid in cancer management in both developed and developing countries worldwide. Moreover, the rapid spread of the COVID-19 infection has resulted in a surge in demand for CRP testing products and services. As a result, there has been a remarkable increase of over 600% in revenue generation in other disease-type segments from 2019 to 2020. In addition, German researchers have developed an innovative therapy option based on CRP, further highlighting its importance in medical advancements.

The hospitals segment held the largest revenue share of 28.01% in 2023. Growth in the hospital segment is attributable to the increasing adoption of CRP testing in hospitals, particularly in developing regions worldwide. The rising prevalence of conditions such as COVID-19, CVDs, and cancer-related infections has resulted in a higher number of hospital visits, leading to an increased demand for CRP testing kits. This trend provides significant growth opportunities for the market.

The clinics segment is projected to register a significant growth rate, primarily due to the rapid adoption of point-of-care CRP testing in primary care settings. The increased availability and cost-effectiveness of CRP testing, along with its ability to provide rapid and accurate results, are driving its adoption in clinics. Furthermore, governments' investment and financial support to encourage the adoption of point-of-care CRP testing in primary care settings, aimed at improving diagnosis and treatment, are expected to contribute to the revenue growth of this segment throughout the forecast period.

North America dominated the market with a share of 39.42% in 2023 due to the increasing prevalence of cardiovascular diseases, a steady stream of product launches, the presence of established market players, technological advancements, and a well-developed healthcare infrastructure. Moreover, in October 2020, Nova Biomedical introduced the Allegro CRP test for its Allegro capillary blood analysis device, which is specifically designed for point-of-care testing in primary care settings. The introduction of this test enables clinicians to perform 11 essential tests using the Allegro analyzer and its StatStrip companion meter. This comprehensive offering empowers clinicians to make informed decisions and adjustments in primary care settings.

The tests aid clinicians in making critical therapeutic decisions and modifications. The growing number of product launches for CRP testing in the United States is anticipated to drive the adoption of these tests, resulting in market growth within the country. The Asia Pacific region is anticipated to witness substantial growth during the forecast period, primarily driven by factors such as the continuously growing population and a rising geriatric population, particularly in countries like Japan and China. In addition, the robust adoption of CRP testing in hospitals, coupled with the increasing prevalence of cardiovascular diseases and malaria, is expected to drive market growth for CRP testing in the region in the coming years.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global C-reactive protein testing market

Assay Type

Detection Range

Disease Area

End-use

Regional

Chapter 1. C-reactive Protein Testing Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Information Analysis

1.2.2. Market Formulation & Data Visualization

1.2.3. Data Validation & Publishing

1.3. Research Assumptions

1.4. Information Procurement

1.4.1. Primary Research

1.5. Information or Data Analysis

1.6. Market Formulation & Validation

1.7. Market Model

1.8. Global Market: CAGR Calculation

1.9. Objective

1.9.1. Objective - 1

1.9.2. Objective - 2

Chapter 2. C-reactive Protein Testing Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. C-reactive Protein Testing Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing R&D in the field of C-reactive protein testing

3.2.1.2. Rising incidence of chronic disorders

3.2.2. Market Restraint Analysis

3.2.2.1. Availability of alternative disease testing methods

3.2.3. Market Opportunity Analysis

3.2.3.1. Technological advancements pertaining to conventional CRP tests

3.2.3.2. Growing adoption of point-of-care tests

3.2.4. Market Threat Analysis

3.2.4.1. Threat analysis on conventional CRP tests

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. Assay Type Business Analysis

4.1. C-reactive Protein (CRP) Testing Market: Assay Type Movement Analysis

4.2. Immunoturbidimetric Assay

4.2.1. Immunoturbidimetric Assay Market, 2021 - 2033 (USD Million)

4.3. ELISA

4.3.1. ELISA Market, 2021 - 2033 (USD Million)

4.3.2. Clinical ELISA

4.3.2.1. Clinical ELISA Market, 2021 - 2033 (USD Million)

4.3.3. Nonclinical ELISA

4.3.3.1. Nonclinical ELISA Market, 2021 - 2033 (USD Million)

4.4. Chemiluminescence Immunoassay

4.4.1. Chemiluminescence Immunoassay Market, 2021 - 2033 (USD Million)

4.5. Others

4.5.1. Others Market, 2021 - 2033 (USD Million)

Chapter 5. Detection Range Business Analysis

5.1. C-reactive Protein (CRP) Testing Market: Detection Range Movement Analysis

5.2. High Sensitivity C-reactive Protein (hs-CRP)

5.2.1. High Sensitivity C-reactive Protein (hs-CRP) Market, 2021 - 2033 (USD Million)

5.3. Conventional CRP

5.3.1. Conventional CRP Market, 2021 - 2033 (USD Million)

5.4. Cardiac CRP (cCRP)

5.4.1. Cardiac CRP (CCRP) Market, 2021 - 2033 (USD Million)

Chapter 6. Disease Area Business Analysis

6.1. C-reactive Protein (CRP) Testing Market: Disease Area Movement Analysis

6.2. Cardiovascular Diseases

6.2.1. Cardiovascular Diseases Market, 2021 - 2033 (USD Million)

6.3. Cancer

6.3.1. Cancer Market, 2021 - 2033 (USD Million)

6.4. Rheumatoid Arthritis

6.4.1. Rheumatoid Arthritis Market, 2021 - 2033 (USD Million)

6.5. Inflammatory Bowel Disease

6.5.1. Inflammatory Bowel Disease Market, 2021 - 2033 (USD Million)

6.6. Endometriosis

6.6.1. Endometriosis Market, 2021 - 2033 (USD Million)

6.7. Lupus

6.7.1. Lupus Market, 2021 - 2033 (USD Million)

6.8. Others

6.8.1. Others Market, 2021 - 2033 (USD Million)

Chapter 7. End-use Business Analysis

7.1. C-reactive Protein (CRP) Testing Market: End-use Movement Analysis

7.2. Clinics

7.2.1. Clinics Market, 2021 - 2033 (USD Million)

7.2.2. Clinics, by entity

7.2.2.1. Physician offices

7.2.2.1.1. Physician Offices Market, 2021 - 2033 (USD Million)

7.2.2.2. Small clinics

7.2.2.2.1. Small Clinics Market, 2021 - 2033 (USD Million)

7.2.2.3. Others

7.2.2.3.1. Others Market, 2021 - 2033 (USD Million)

7.2.3. Clinics, by setting

7.2.3.1. Urban setting

7.2.3.1.1. Urban Setting Market, 2021 - 2033 (USD Million)

7.2.3.2. Rural settings

7.2.3.2.1. Rural Settings Market, 2021 - 2033 (USD Million)

7.3. Hospitals

7.3.1. Hospitals Market, 2021 - 2033 (USD Million)

7.3.2. Urban setting

7.3.2.1. Urban Setting Market, 2021 - 2033 (USD Million)

7.3.3. Rural settings

7.3.3.1. Rural Settings Market, 2021 - 2033 (USD Million)

7.4. Laboratories

7.4.1. Laboratories Market, 2021 - 2033 (USD Million)

7.4.2. Urban setting

7.4.2.1. Urban Setting Market, 2021 - 2033 (USD Million)

7.4.3. Rural settings

7.4.3.1. Rural Settings Market, 2021 - 2033 (USD Million)

7.5. Assisted Living Healthcare Facilities

7.5.1. Assisted Living Healthcare Facilities Market, 2021 - 2033 (USD Million)

7.5.2. Urban setting

7.5.2.1. Urban Setting Market, 2021 - 2033 (USD Million)

7.5.3. Rural settings

7.5.3.1. Rural Settings Market, 2021 - 2033 (USD Million)

7.6. Home

7.6.1. Home Market, 2021 - 2033 (USD Million)

7.7. Others

7.7.1. Others Market, 2021 - 2033 (USD Million)

Chapter 8. Regional Business Analysis

8.1. C-reactive Protein (CRP) Testing Market Share By Region, 2024 & 2033

8.2. North America

8.2.1. SWOT Analysis

8.2.2. North America C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.2.3. U.S.

8.2.3.1. Key Country Dynamics

8.2.3.2. Target Disease Prevalence

8.2.3.3. Competitive Scenario

8.2.3.4. Regulatory Framework

8.2.3.5. U.S. C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.2.4. Canada

8.2.4.1. Key Country Dynamics

8.2.4.2. Target Disease Prevalence

8.2.4.3. Competitive Scenario

8.2.4.4. Regulatory Framework

8.2.4.5. Canada C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.3. North America

8.3.1. SWOT Analysis

8.3.2. North America C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.3.3. U.S.

8.3.3.1. Key Country Dynamics

8.3.3.2. Competitive Scenario

8.3.3.3. Regulatory Framework

8.3.3.4. U.S. C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.3.4. Canada

8.3.4.1. Key Country Dynamics

8.3.4.2. Competitive Scenario

8.3.4.3. Regulatory Framework

8.3.4.4. Canada C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4. Europe

8.4.1. SWOT Analysis

8.4.2. Europe C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.3. UK

8.4.3.1. Key Country Dynamics

8.4.3.2. Competitive Scenario

8.4.3.3. Regulatory Framework

8.4.3.4. UK C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.4. Germany

8.4.4.1. Key Country Dynamics

8.4.4.2. Competitive Scenario

8.4.4.3. Regulatory Framework

8.4.4.4. Germany C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.5. France

8.4.5.1. Key Country Dynamics

8.4.5.2. Competitive Scenario

8.4.5.3. Regulatory Framework

8.4.5.4. France C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.6. Italy

8.4.6.1. Key Country Dynamics

8.4.6.2. Competitive Scenario

8.4.6.3. Regulatory Framework

8.4.6.4. Italy C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.7. Spain

8.4.7.1. Key Country Dynamics

8.4.7.2. Competitive Scenario

8.4.7.3. Regulatory Framework

8.4.7.4. Spain C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.8. Sweden

8.4.8.1. Key Country Dynamics

8.4.8.2. Competitive Scenario

8.4.8.3. Regulatory Framework

8.4.8.4. Sweden C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.9. Norway

8.4.9.1. Key Country Dynamics

8.4.9.2. Competitive Scenario

8.4.9.3. Regulatory Framework

8.4.9.4. Norway C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.4.10. Denmark

8.4.10.1. Key Country Dynamics

8.4.10.2. Competitive Scenario

8.4.10.3. Regulatory Framework

8.4.10.4. Denmark C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5. Asia Pacific

8.5.1. SWOT Analysis

8.5.2. Asia Pacific C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5.3. China

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. China C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5.4. India

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. India C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5.5. Japan

8.5.5.1. Key Country Dynamics

8.5.5.2. Competitive Scenario

8.5.5.3. Regulatory Framework

8.5.5.4. Japan C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5.6. Thailand

8.5.6.1. Key Country Dynamics

8.5.6.2. Competitive Scenario

8.5.6.3. Regulatory Framework

8.5.6.4. Thailand C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5.7. South Korea

8.5.7.1. Key Country Dynamics

8.5.7.2. Competitive Scenario

8.5.7.3. Regulatory Framework

8.5.7.4. South Korea C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.5.8. Australia

8.5.8.1. Key Country Dynamics

8.5.8.2. Competitive Scenario

8.5.8.3. Regulatory Framework

8.5.8.4. Australia C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.6. Latin America

8.6.1. SWOT Analysis

8.6.2. Latin America C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.6.3. Brazil

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Brazil C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.6.4. Mexico

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. Mexico C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.6.5. Argentina

8.6.5.1. Key Country Dynamics

8.6.5.2. Competitive Scenario

8.6.5.3. Regulatory Framework

8.6.5.4. Argentina C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.7. MEA

8.7.1. SWOT Analysis

8.7.2. MEA C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.7.3. Saudi Arabia

8.7.3.1. Key Country Dynamics

8.7.3.2. Competitive Scenario

8.7.3.3. Regulatory Framework

8.7.3.4. Saudi Arabia C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.7.4. South Africa

8.7.4.1. Key Country Dynamics

8.7.4.2. Competitive Scenario

8.7.4.3. Regulatory Framework

8.7.4.4. South Africa C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.7.5. UAE

8.7.5.1. Key Country Dynamics

8.7.5.2. Competitive Scenario

8.7.5.3. Regulatory Framework

8.7.5.4. UAE C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

8.7.6. Kuwait

8.7.6.1. Key Country Dynamics

8.7.6.2. Competitive Scenario

8.7.6.3. Regulatory Framework

8.7.6.4. Kuwait C-reactive Protein (CRP) Testing Market, 2021 - 2033 (USD Million)

Chapter 9. Competitive Landscape

9.1. Company Categorization

9.2. Strategy Mapping

9.3. Company Market Share Analysis, 2024

9.4. Company Profiles/Listing

9.4.1. F. Hoffmann-La Roche Ltd

9.4.1.1. Overview

9.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.1.3. Product Benchmarking

9.4.1.4. Strategic Initiatives

9.4.2. Danaher

9.4.2.1. Overview

9.4.2.1.1. Beckman Coulter, Inc.

9.4.2.1.2. Radiometer

9.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.2.3. Product Benchmarking

9.4.2.4. Strategic Initiatives

9.4.3. Thermo Fisher Scientific Inc.

9.4.3.1. Overview

9.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.3.3. Product Benchmarking

9.4.3.4. Strategic Initiatives

9.4.4. Quest Diagnostics Incorporated

9.4.4.1. Overview

9.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.4.3. Product Benchmarking

9.4.4.4. Strategic Initiatives

9.4.5. Siemens

9.4.5.1. Overview

9.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.5.3. Product Benchmarking

9.4.5.4. Strategic Initiatives

9.4.6. Abbott Laboratories

9.4.6.1. Overview

9.4.6.1.1. Alere Inc.

9.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.6.3. Product Benchmarking

9.4.6.4. Strategic Initiatives

9.4.7. Laboratory Corporation of America Holdings (LabCorp)

9.4.7.1. Overview

9.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.7.3. Product Benchmarking

9.4.7.4. Strategic Initiatives

9.4.8. Merck KGaA

9.4.8.1. Overview

9.4.8.1.1. Sigma-Aldrich Co. LLC.

9.4.8.1.2. Merck Millipore

9.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.8.3. Product Benchmarking

9.4.8.4. Strategic Initiatives

9.4.9. Abaxis, Inc.

9.4.9.1. Overview

9.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.9.3. Product Benchmarking

9.4.9.4. Strategic Initiatives

9.4.10. Ortho Clinical Diagnostics

9.4.10.1. Overview

9.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.10.3. Product Benchmarking

9.4.10.4. Strategic Initiatives

9.4.11. Getein Biotech, Inc.

9.4.11.1. Overview

9.4.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.11.3. Product Benchmarking

9.4.11.4. Strategic Initiatives

9.4.12. HORIBA, Ltd.

9.4.12.1. Overview

9.4.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.12.3. Product Benchmarking

9.4.12.4. Strategic Initiatives

9.4.13. RandoxLaboratories Ltd.

9.4.13.1. Overview

9.4.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.13.3. Product Benchmarking

9.4.13.4. Strategic Initiatives

9.4.14. BODITECH MED, INC

9.4.14.1. Overview

9.4.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.14.3. Product Benchmarking

9.4.14.4. Strategic Initiatives

9.4.15. Aidian

9.4.15.1. Overview

9.4.15.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.15.3. Product Benchmarking

9.4.15.4. Strategic Initiatives

9.4.16. EurolyserDiagnostica GmbH

9.4.16.1. Overview

9.4.16.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.16.3. Product Benchmarking

9.4.16.4. Strategic Initiatives

9.4.17. Abcam plc

9.4.17.1. Overview

9.4.17.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.17.3. Product Benchmarking

9.4.17.4. Strategic Initiatives

9.4.18. Bio-Techne

9.4.18.1. Overview

9.4.18.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.18.3. Product Benchmarking

9.4.18.4. Strategic Initiatives

9.4.19. EKF Diagnostics

9.4.19.1. Overview

9.4.19.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.19.3. Product Benchmarking

9.4.19.4. Strategic Initiatives

9.4.20. SD Biosensor, INC.

9.4.20.1. Overview

9.4.20.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

9.4.20.3. Product Benchmarking

9.4.20.4. Strategic Initiatives