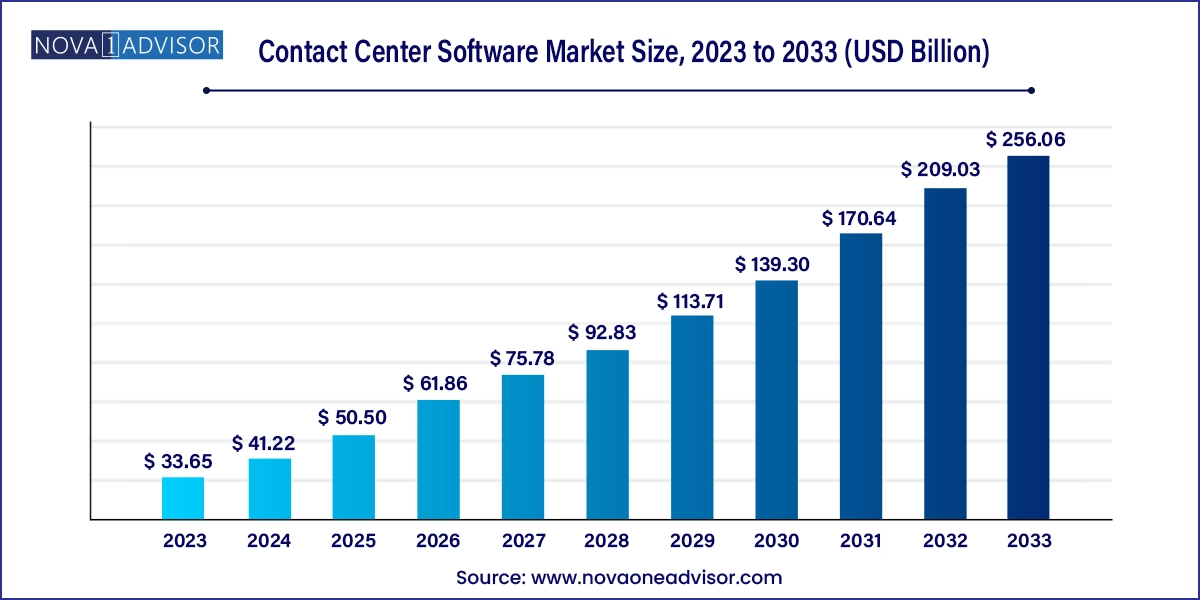

The global contact center software market size was exhibited at USD 33.65 billion in 2023 and is projected to hit around USD 256.06 billion by 2033, growing at a CAGR of 22.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 41.22 Billion |

| Market Size by 2033 | USD 256.06 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 22.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Solution, Service, Deployment, Enterprise Size, End use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | 8X8, Inc.; ALE International; Altivon; Amazon Web Services, Inc.; Ameyo; Amtelco; Aspect Software; Avaya Inc.; Avoxi; Cisco Systems, Inc.; Enghouse Interactive Inc.; Exotel Techcom Pvt. Ltd.; Five9, Inc.; Genesys; Microsoft Corporation; NEC Corporation; SAP SE; Spok, Inc.; Talkdesk, Inc.; Twilio Inc.; UiPath; Unify Inc.; VCC Live |

The increasing demand for enhanced customer experience is expected to significantly drive the market growth. Businesses understand the importance of providing exceptional customer service and invest in contact center software to streamline customer interactions, improve response times, and personalize the customer experience. Moreover, the rise of omnichannel communication is driving the adoption of contact center software.

Customers now expect to interact with businesses through various channels such as voice, email, chat, social media, and more. Contact center software enables businesses to manage and integrate these channels, providing a seamless and consistent experience across all touchpoints. Furthermore, the increasing focus on data analytics and AI-powered technologies drives the demand for advanced contact center software. Businesses are leveraging AI-powered features such as chatbots, speech analytics, and predictive analytics to automate processes, gain valuable insights from customer interactions, and improve operational efficiency.

The need for cost optimization and operational efficiency is a major driving factor. Contact center software helps businesses streamline their operations, reduce manual tasks, and improve agent productivity. With features like call routing, workforce management, and real-time reporting, businesses can optimize their resources and improve overall efficiency. In addition, the globalization of businesses is also driving the adoption of contact center software.

As companies expand their operations internationally, they need contact center solutions that can support multiple languages, time zones, and geographical locations. Advanced contact center software provides multi-site capabilities and language support, enabling businesses to deliver consistent customer service across borders. Moreover, regulatory compliance requirements push businesses to invest in contact center software. With increasing data privacy regulations, businesses need to ensure that customer data is handled securely and in compliance with industry standards. Contact center software with built-in security features and compliance tools helps businesses meet these requirements and avoid potential legal issues.

One of the major restraints of the contact center software market is the complexity and integration challenges associated with implementing new software solutions. Integrating contact center software with existing systems and infrastructure can be a complex process that requires careful planning and coordination. Legacy systems and outdated infrastructure may not be compatible with modern contact center software, resulting in integration difficulties and potential disruptions in operations. To overcome this restraint, businesses can take several steps. First, thoroughly assessing the existing systems and infrastructure is crucial to identify gaps or compatibility issues. This assessment can help businesses plan for upgrades or modifications to ensure seamless integration.

The interactive voice responses (IVR) segment dominated the market in 2023 and accounted for a revenue share of more than 21.0%. IVR systems provide an efficient and automated way to handle customer interactions by allowing callers to navigate through menu options using voice or keypad inputs. This enables self-service capabilities, reducing the need for live agent assistance for routine inquiries and simple tasks. The convenience and time-saving benefits of IVR systems have made them widely adopted by businesses across various industries.

The customer collaboration segment is expected to register the fastest growth over the forecast period. Customer collaboration solutions allow businesses to interact with both existing and potential customers in a better way. These solutions help businesses quickly tracking, receiving, and resolving customer support issues while simultaneously gathering and utilizing customer feedback to improve the products and service offerings. The strong emphasis on enhancing collaboration by using images and videos to communicate effectively with the clients is expected to drive the growth of the segment over the forecast period.

The integration and deployment segment dominated the market in 2023 and accounted for a revenue share of more than 41.0%. The increasing adoption of cloud-based contact center software solutions is expected to drive the adoption of integration & deployment services over the forecast period. Businesses across the globe are investing aggressively in integrating multiple applications and tools, such as customer relationship management (CRM), into their business processes, thereby driving the growth of the integration & deployment segment. The rising need for rapid deployment of cloud-based solutions and business agility also bodes well for the growth of the integration & deployment segment over the forecast period.

The managed services segment is expected to register the fastest growth over the forecast period. Managed services allow businesses to focus on their core products and services while handing over the company’s IT-related tasks to managed service providers. Managed services help businesses in keeping their applications running for end users leveraging configuration management, provisioning, standard change management, and patch management tools. Managed services also include an array of value-added services to help businesses achieve the most from contact center solutions in terms of performance and reliability while keeping operational costs under control. The growing adoption of cloud solutions bodes well for the growth of the managed services segment.

The on-premise segment dominated the contact center software market in 2023 and accounted for a global revenue share of over 57.0%. On-premise deployment envisages deploying all the hardware and software required to operate and maintain a contact center at the customer’s property. On-premise solutions provide integrability, reliability, customizability, and also scalability to some extent. However, they can be very difficult and expensive to deploy at times. The customizability benefits of on-premise solutions can be realized only when businesses invest heavily in professional services.

The hosted segment is anticipated to register the fastest growth over the forecast period. Businesses across the globe are preferring cloud-based contact center solutions over on-premise solutions owing to the ability of cloud-based contact center solutions to scale services. Cloud solutions are designed to connect contact center agents to effectively centralized contact center applications while offering a secure intranet for employees to collaborate and communicate with each other. Cloud-based solutions are also capable of offering in-depth information about the agents and customers, which executives would not be able to track using on-premise solutions. According to a study by RingCentral, Inc., shifting to cloud-based solutions can help in improving customer call answer rates by around 5% while reducing the average speed of answer (ASA) by as much as 50%.

The large enterprise segment dominated the contact center software market in 2023 and reported for a global revenue share of over 57.0%. Large enterprises have their customers spread across the globe. Hence, large enterprises are more likely to invest in the latest, advanced technologies to run their business effectively and ensure business continuity. Moreover, large enterprises typically prefer solutions and services that can potentially help in augmenting profitability. The integration of AI with contact center operations is also driving the adoption of contact center software by large enterprises.

The small & medium enterprise segment is anticipated to register the fastest growth over the forecast period. The growing implementation of customer care solutions by small & medium enterprises across the globe is expected to drive the growth of the segment over the forecast period. Small & medium enterprises are adopting these solutions as part of the efforts to ease the workloads of carrying out the normal, mundane tasks while allowing contact center agents to focus on organizational development. The growing number of small- and medium-sized businesses across the globe is anticipated to create new growth opportunities for the segment over the forecast period.

The IT & telecom segment dominated the market in 2023 and reported a revenue share of more than 24.0%. The IT & telecom industry relies heavily on customer support and interaction to address technical issues, provide assistance, and deliver exceptional service. Contact center software plays a crucial role in managing and optimizing these customer interactions, ensuring seamless communication between customers and IT & telecom companies. These software solutions offer features such as call routing, automatic call distribution, and customer relationship management integration, which help IT & telecom companies efficiently manage large volumes of customer inquiries and provide timely resolutions.

The consumer goods and retail segment is anticipated to register the fastest growth over the forecast period. Customers are moving continuously toward digital channels for their shopping needs. Moreover, customers are also utilizing the latest technologies and channels, thereby prompting consumer goods & retail businesses to opt for contact center solutions for providing exceptional customer experiences. These solutions are helping retailers and businesses in striking personalized interactions with customers and building strong customer relationships. Contact center software is also helping brands and retailers in delivering automated, high-quality service while freeing agents to focus on revenue generation and brand enhancement activities with the help of AI.

North America dominated the contact center software market in 2023 and accounted for a revenue share of over 35.0%. The region has a highly developed and technologically advanced business landscape, with a large number of enterprises across various industries. These organizations have recognized the importance of delivering exceptional customer experiences and have therefore invested significantly in contact center solutions. In addition, North America is home to several major players in the contact center software industry who have a strong presence and extensive market reach.

Asia Pacific is projected to emerge as the fastest-growing regional market over the forecast period. The growth of the regional contact center software market can be attributed to the existence of a large number of Information Technology-enabled Services (ITES) and IT companies in the region. The growing adoption of contact center solutions by both large and small & medium enterprises is anticipated to drive the growth of the regional market. The favorable initiatives governments in the region have been pursuing to encourage the adoption of cloud-based systems and automation of business processes are also expected to play a decisive role in driving the growth of the regional market. The fact that several organizations across the globe remain keen on investing in Asia Pacific bodes equally well for the growth of the regional market.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global contact center software market

Solution

Service

Deployment

Enterprise Size

End Use

Regional

Chapter 1. Contact Center Software Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.4. Information Analysis

1.4.1. Market Formulation & Data Visualization

1.4.2. Data Validation & Publishing

1.5. Research Scope and Assumptions

1.6. List of Data Sources

Chapter 2. Contact Center Software Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Landscape Snapshot

Chapter 3. Contact Center Software Market: Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Impact Analysis

3.3.1.1. Growing demand for automating customer care services

3.3.1.2. Growing emphasis on enhancing customer experience through omnichannel solutions

3.3.1.3. Growing preference for cloud-based contact center solutions

3.3.2. Market Challenge Impact Analysis

3.3.2.1. Inability to achieve Average Speed of Answer (ASA) and low First Call Resolution (FCR)

3.4. Impact of COVID-19 Pandemic

3.5. Industry Analysis Tools

3.5.1. Porter’s Analysis

3.5.2. PESTEL Analysis

Chapter 4. Contact Center Software Market: Solution Estimates & Trend Analysis

4.1. Solution Movement Analysis & Market Share, 2024 & 2033

4.2. Contact Center Software Market Estimates & Forecast, By Solution

4.2.1. Automatic Call Distribution

4.2.2. Call Recording

4.2.3. Computer Telephony Integration

4.2.4. Customer Collaboration

4.2.5. Dialer

4.2.6. Interactive Voice Response

4.2.7. Reporting and Analytics

4.2.8. Workforce Optimization

4.2.9. Others

Chapter 5. Contact Center Software Market: Service Estimates & Trend Analysis

5.1. Service Movement Analysis & Market Share, 2024 & 2033

5.2. Contact Center Software Market Estimates & Forecast, By Service

5.2.1. Integration & Deployment

5.2.2. Support & Maintenance

5.2.3. Training & Consulting

5.2.4. Managed Services

Chapter 6. Contact Center Software Market: Deployment Estimates & Trend Analysis

6.1. Deployment Movement Analysis & Market Share, 2024 & 2033

6.2. Contact Center Software Market Estimates & Forecast, By Deployment

6.2.1. Hosted

6.2.2. On-premise

Chapter 7. Contact Center Software Market: Entertprise Size Estimates & Trend Analysis

7.1. Enterprise Size Movement Analysis & Market Share, 2024 & 2033

7.2. Contact Center Software Market Estimates & Forecast, By Enterprise Size

7.2.1. Large Enterprise

7.2.2. Small & Medium Enterprises

Chapter 8. Contact Center Software Market: End Use Estimates & Trend Analysis

8.1. End Use Movement Analysis & Market Share, 2024 & 2033

8.2. Contact Center Software Market Estimates & Forecast, By End Use

8.2.1. BFSI

8.2.2. Consumer Goods & Retail

8.2.3. Government

8.2.4. Healthcare

8.2.5. IT & Telecom

8.2.6. Travel & Hospitality

8.2.7. Others

Chapter 9. Contact Center Software Market: Regional Estimates & Trend Analysis

9.1. Contact Center Software Market: Regional Outlook

9.2. North America

9.2.1. North America contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.2.2. U.S.

9.2.2.1. U.S. contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.2.3. Canada

9.2.3.1. Canada contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.3. Europe

9.3.1. Europe contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.3.2. U.K.

9.3.2.1. U.K. contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.3.3. Germany

9.3.3.1. Germany contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.3.4. France

9.3.4.1. Germany contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.3.5. Spain

9.3.5.1. Spain contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.4. Asia Pacific

9.4.1. Asia Pacific contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.4.2. China

9.4.2.1. China contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.4.3. India

9.4.3.1. India contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.4.4. Japan

9.4.4.1. Japan contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.4.5. South Korea

9.4.5.1. South Korea contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.4.6. Australia

9.4.6.1. Australia contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.5. Latin America

9.5.1. Latin America contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.5.2. Brazil

9.5.2.1. Brazil contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.5.3. Mexico

9.5.3.1. Mexico contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.6. Middle East & Africa

9.6.1. Middle East & Africa contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.6.2. Kingdom of Saudi Arabia (KSA)

9.6.2.1. Kingdom of Saudi Arabia (KSA) contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.6.3. UAE

9.6.3.1. UAE contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

9.6.4. South Arica

9.6.4.1. South Africa contact center software market estimates & forecasts, 2021 - 2033 (USD Million)

Chapter 10. Competitive Landscape

10.1. Company Categorization

10.2. Participant’s Overview

10.2.1. 8X8, Inc.

10.2.2. ALE International

10.2.3. Altivon

10.2.4. Amazon Web Services, Inc.

10.2.5. Ameyo

10.2.6. Amtelco

10.2.7. Aspect Software

10.2.8. Avaya, Inc.

10.2.9. Avoxi

10.2.10. Cisco Systems, Inc.

10.2.11. Enghouse Interactives, Inc.

10.2.12. Exotel Techcom Pvt. Ltd.

10.2.13. Five9, Inc.

10.2.14. Genesys

10.2.15. Microsoft Corporation

10.2.16. NEC Corporation

10.2.17. SAP SE

10.2.18. Spok, Inc.

10.2.19. Talkdesk, Inc.

10.2.20. Twilio, Inc.

10.2.21. UiPath

10.2.22. Unify, Inc.

10.2.23. VCC Live

10.3. Financial Performance

10.4. Product Benchmarking

10.5. Company Market Positioning

10.6. Company Market Share Analysis, 2024

10.7. Company Heat Map Analysis

10.8. Strategy Mapping

10.8.1. Expansion

10.8.2. Collaborations

10.8.3. Mergers & Acquisitions

10.8.4. New Product Launches

10.8.5. Partnerships

10.8.6. Others