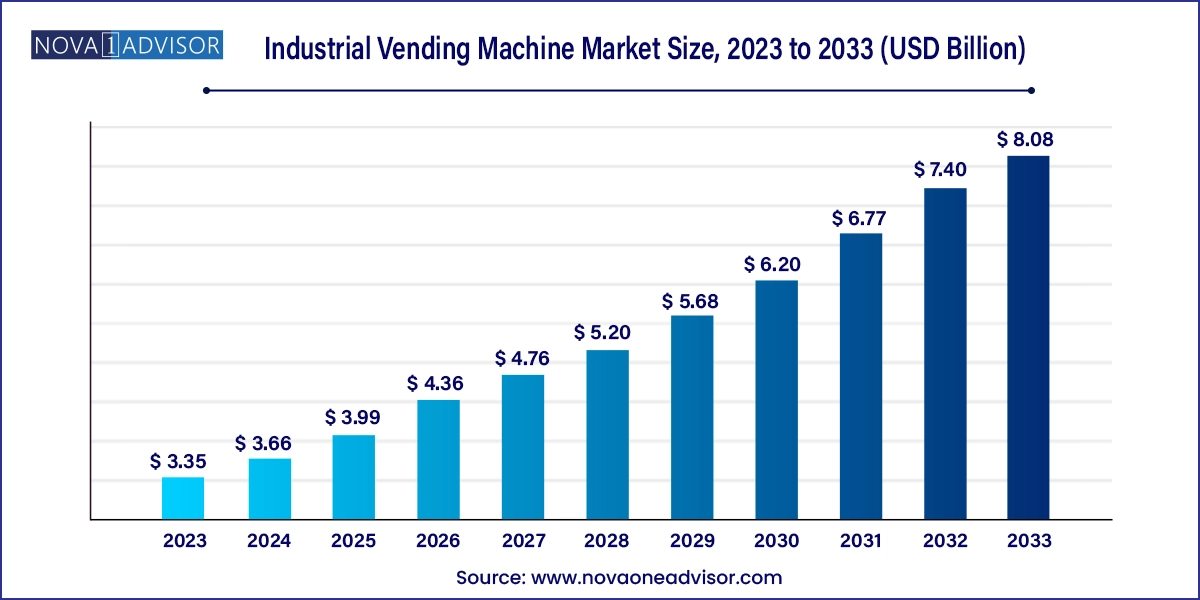

The global industrial vending machine market size was exhibited at USD 3.35 billion in 2023 and is projected to hit around USD 8.08 billion by 2033, growing at a CAGR of 9.2% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.66 Billion |

| Market Size by 2033 | USD 8.08 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.2% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Product, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Apex Industrial Technologies, LLC; AutoCrib, Inc.; Brammer; IMC Group; SecuraStock; CribMaster; Fastenal Company; Airgas Inc.; IVM, Inc. |

The increasing demand is attributed to the growing trend toward lean manufacturing practices. As businesses strive to eliminate waste and improve efficiency, industrial vending machines are essential for managing and dispensing materials as needed. By supporting just-in-time (JIT) inventory practices, these machines help companies maintain minimal stock levels while ensuring that critical items are always available. This approach reduces storage costs and minimizes the capital tied up in inventory.

Another important driver is the rising adoption of customized and flexible manufacturing processes in sectors such as aerospace, automotive, and electronics, where production lines often need to adapt to different product specifications; industrial vending machines offer a flexible solution for managing a wide range of tools and components. These machines can be easily reconfigured to accommodate different items, enabling manufacturers to quickly adapt to changing production needs without disrupting operations. This flexibility is increasingly valuable as companies look to stay competitive in a market where customization and rapid product development are key differentiators. Industrial vending machines are provisioned to record inventory usage by tracking the type, time, and user identification, bringing transparency and accountability. Additionally, these machines improve the company's output by reducing the walk-around time and facilitating employee typicity. They also avoid hoarding various items.

Industrial vending machines prevent companies from spending on constant inventory replenishments and reduce repeated purchase expenses by lowering freight and stock outage costs. Companies can ensure the availability of inventory of tools and spare parts as per requirement, which can be done by optimizing this type.

Advancements in software and data analytics are also contributing to the increasing demand. Modern industrial vending machines come equipped with sophisticated software platforms that enable remote management, detailed reporting, and seamless integration with enterprise resource planning (ERP) systems. These features allow companies to centralize control over multiple vending machines across different locations, making managing inventory on a global scale easier. Generating detailed usage reports helps businesses optimize operations, reduce costs, and enhance decision-making processes.

The versatility of industrial vending machines is another significant driver in terms of end-use applications. While traditionally used in manufacturing environments, these machines are now being adopted across a broader range of industries, including healthcare, logistics, and construction. In healthcare, industrial vending machines are increasingly being used to dispense medical supplies, pharmaceuticals, and personal protective equipment (PPE) in hospitals and clinics. This ensures that critical supplies are readily available to healthcare professionals while maintaining strict inventory controls to prevent misuse or theft.

Lastly, the globalization of supply chains has heightened the need for efficient resource management across multiple locations. For multinational companies operating in diverse geographical regions, industrial vending machines provide a standardized solution for managing inventory across different facilities. This uniformity ensures consistency in operations, simplifies logistics, and enhances overall supply chain visibility. By enabling centralized control and monitoring of inventory levels across various sites, these machines help companies optimize their global supply chains, reduce lead times, and respond more effectively to market demands.

The coil vending machine held the largest market revenue share of 37.8% in 2023. The demand is rising primarily due to its versatility and efficiency in managing a wide range of small-to-medium-sized items, such as tools, safety gear, and personal protective equipment (PPE). These machines are particularly valued in industries where space optimization and quick access to inventory are critical. The coil design allows for precise control over inventory, minimizing wastage and reducing downtime by ensuring that essential items are always available. Additionally, the ease of customization in coil vending machines to accommodate various product sizes enhances their functionality across different industrial applications, driving increased adoption in manufacturing, healthcare, and logistics sectors.

The carousel vending machines segment is projected to grow at the fastest CAGR of 10.3% over the forecast period. Carousel vending machines offer better inventory management by optimizing storage space and allowing for high-density product placement, which is crucial in industrial environments where space and efficiency are essential. Moreover, these machines enable easy access to items through their rotating shelves, reducing retrieval time and increasing operational efficiency. As industries continue to seek automation and streamlined processes, carousel vending machines are becoming increasingly attractive for managing tools, components, and supplies in manufacturing and maintenance settings, driving their growing demand in the market.

The PPE segment held the largest market revenue share in 2023. The increasing demand is due to heightened safety regulations and the growing emphasis on workplace safety across various industries. Companies are increasingly adopting PPE vending machines to ensure their employees have easy and immediate access to essential safety gear, such as gloves, masks, and helmets. These machines help maintain compliance with safety standards by automating inventory management, reducing waste, and ensuring that PPE is available on demand. Additionally, the convenience of tracking and managing PPE usage through these vending machines helps organizations optimize costs and minimize downtime, further driving the demand in this segment.

The MRO tools segment is projected to grow at the fastest CAGR over the forecast period. The growing emphasis on reducing downtime and enhancing operational efficiency across various industries drives segment growth. Industrial operations rely heavily on the availability of MRO tools to ensure the smooth functioning of machinery and equipment. By integrating these tools into vending machines, companies can provide easy and immediate access to essential items, minimizing delays caused by equipment failure or maintenance needs. Additionally, automated tracking and inventory management for vending machines helps reduce wastage and ensure that tools are available, further driving their adoption in the MRO tools segment.

The manufacturing segment held the largest market revenue share in 2023. Manufacturing environments often require various tools, parts, and personal protective equipment (PPE) to be readily available to workers to minimize downtime. Industrial vending machines provide a convenient and automated way to manage these supplies, ensuring they are available on-demand while reducing wastage and inventory costs. Additionally, the integration of advanced technologies like IoT in these vending machines allows for real-time tracking and inventory monitoring, further enhancing productivity and reducing the risk of stockouts.

The aerospace segment is projected to grow significantly over the forecast period. Aerospace manufacturing involves complex assemblies and highly specialized tools, components, and materials. Industrial vending machines enable aerospace companies to streamline inventory management, ensuring that critical tools and parts are readily available while minimizing downtime. Additionally, these machines support traceability and compliance with regulatory standards by keeping accurate tool usage and maintenance records. As the aerospace industry continues to grow, driven by advancements in aviation technology and increasing global travel, the need for efficient inventory solutions like industrial vending machines will likely expand, fueling demand in this segment.

North America held the largest market revenue share of 34.9% in 2023. The region's strong focus on improving operational efficiency across various industries, such as manufacturing, aerospace, and automotive, drives market growth. Companies are increasingly adopting industrial vending machines to reduce inventory management costs, minimize downtime, and ensure the availability of critical supplies such as personal protective equipment (PPE) and maintenance, repair, and operations (MRO) tools. Additionally, the rising emphasis on workplace safety and compliance with regulations has pushed organizations to invest in automated systems that provide controlled access to essential items, thereby reducing waste and unauthorized usage. The region's well-established infrastructure and technological advancements also facilitate the integration of these machines into existing systems, further fueling their adoption.

U.S. Industrial Vending Machine Market Trends

The U.S. held the largest market revenue share regionally in 2023. The ongoing labor shortage in the U.S. manufacturing sector has led companies to seek out automation solutions to maintain productivity. Industrial vending machines help mitigate the impact of workforce shortages by reducing the need for manual inventory management and allowing workers to access necessary supplies quickly and efficiently. Additionally, the push towards sustainability and waste reduction in the U.S. has encouraged industries to adopt vending machines that minimize overconsumption and ensure that materials are used efficiently, further driving their popularity.

Europe Industrial Vending Machine Market Trends

Europe market is witnessed as lucrative in this industry. The demand for industrial vending machines in Europe is being driven by the region's strong focus on advanced manufacturing technologies and the push towards Industry 4.0. European countries such as Germany, the UK, and France are at the forefront of industrial innovation, and companies in these nations are increasingly implementing industrial vending machines to enhance productivity and efficiency. These machines support lean manufacturing practices by ensuring that tools and supplies are readily available, reducing downtime, and improving workflow.

Asia Pacific Industrial Vending Machine Market Trends

Asia Pacific is projected to grow at the fastest CAGR over the forecast period. Rapid industrialization and the expansion of manufacturing activities, particularly in countries such as China, India, and Southeast Asia, drive the need for more efficient inventory management solutions. Additionally, the increasing adoption of advanced technologies and automation in industries to enhance productivity and reduce operational costs fuels the demand for industrial vending machines. Furthermore, the growing presence of multinational corporations in Asia-Pacific, seeking to optimize their supply chains and maintain consistent access to tools and materials, further bolsters the market.

The industrial vending machine market in China is projected to grow rapidly in the coming years. The increasing labor costs in China are pushing companies to seek automated solutions that reduce dependency on manual inventory management. As Chinese manufacturers continue upgrading their facilities and integrating advanced technologies, industrial vending machines are becoming essential for maintaining competitiveness and efficiency in the rapidly evolving industrial landscape.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global industrial vending machine market

Type

Product

End-use

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information Analysis.

1.3.2. Market Formulation & Data Visualization

1.3.3. Data Validation & Publishing

1.4. Research Scope & Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Industrial Vending Machine Market Snapshot, 2024 & 2033

2.2. Industrial Vending Machine Market - Segment Snapshot, 2024 & 2033

Chapter 3. Industrial Vending Machine Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.3.3. Market Opportunity Analysis

3.4. Industry Analysis Tools

3.4.1. Porter's Five Forces Analysis

3.4.2. PESTEL Analysis

3.5. COVID - 19 Impact Analysis

Chapter 4. Industrial Vending Machine Market Type Outlook

4.1. Type Movement Analysis & Market Share, 2024 & 2033 (USD Million)

4.2. Industrial Vending Machine Market Estimates & Forecast, by Type (USD Million)

4.2.1. Carousel Vending Machine

4.2.2. Coil Vending Machine

4.2.3. Cabinet Vending Machine

4.2.4. Others

Chapter 5. Industrial Vending Machine Market Product Outlook

5.1. Product Movement Analysis & Market Share, 2024 & 2033 (USD Million)

5.2. Industrial Vending Machine Market Estimates & Forecast, by Product (USD Million)

5.2.1. MRO Tools

5.2.2. PPE

5.2.3. Others

Chapter 6. Industrial Vending Machine Market End - use Outlook

6.1. End - use Movement Analysis & Market Share, 2024 & 2033 (USD Million)

6.2. Industrial Vending Machine Market Estimates & Forecast, by end - use (USD Million)

6.2.1. Manufacturing

6.2.2. Oil & Gas

6.2.3. Construction

6.2.4. Aerospace

6.2.5. Others

Chapter 7. Industrial Vending Machine Market: Regional Outlook

7.1. Industrial Vending Machine Market Share by Region, 2024 & 2033 (USD Million)

7.2. North America

7.2.1. North America Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.2.2. U.S.

7.2.2.1. U.S. Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.2.3. Canada

7.2.3.1. Canada Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3. Europe

7.3.1. Europe Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3.2. UK

7.3.2.1. UK Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3.3. Germany

7.3.3.1. Germany Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3.4. France

7.3.4.1. France Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3.5. Italy

7.3.5.1. Italy Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.3.6. Spain

7.3.6.1. Spain Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4.2. China

7.4.2.1. China Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4.3. India

7.4.3.1. India Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4.4. Japan

7.4.4.1. Japan Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4.5. Australia

7.4.5.1. Australia Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.4.6. South Korea

7.4.6.1. South Korea Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.5. Latin America

7.5.1. Latin America Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.5.2. Brazil

7.5.2.1. Brazil Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.5.3. Mexico

7.5.3.1. Mexico Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.5.4. Argentina

7.5.4.1. Argentina Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.6. Middle East & Africa

7.6.1. Middle East & Africa Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.6.2. UAE

7.6.2.1. UAE Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.6.3. Saudi Arabia

7.6.3.1. Saudi Arabia Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

7.6.4. South Africa

7.6.4.1. South Africa Industrial Vending Machine Market Estimates and Forecast, 2021 - 2033 (USD Million)

Chapter 8. Competitive Landscape

8.1. Apex Industrial Technologies, LLC

8.2. AutoCrib, Inc.

8.3. Brammer

8.4. IMC Group

8.5. SecuraStock

8.6. CribMaster

8.7. Fastenal Company

8.8. Airgas Inc.

8.9. IVM, Inc.