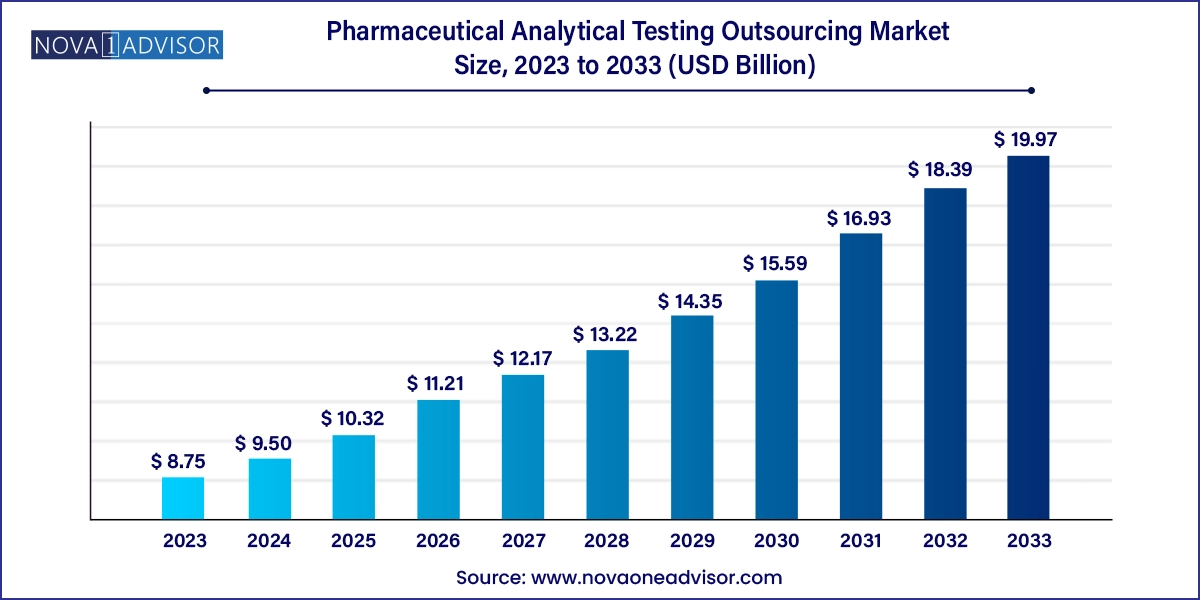

The global pharmaceutical analytical testing outsourcing market size was exhibited at USD 8.75 billion in 2023 and is projected to hit around USD 19.97 billion by 2033, growing at a CAGR of 8.6% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.50 Billion |

| Market Size by 2033 | USD 19.97 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Services, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | SGS SA, Labcorp, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group plc, PPD Inc (Thermo fisher Scietific, Inc.), Wuxi AppTec, Boston Analytical, Charles River Laboratories, Pharmaceutical Services, Inc |

Growth in the market can be attributed due to increasing focus toward safety, & quality; regulation, pricing benefits of outsourcing, and rising number of end use. Besides, increasing R&D investment is one of the critical sustainability strategies adopted by market players. As, not all companies have an infrastructure for analytical testing. Therefore, outsourcing these operations is a suitable option, which helps to save time and cost.

Other factors, such as the changing regulations for in vivo and in vitro tests, are also expected to propel the growth of the market for pharmaceutical analytical testing outsourcing. Besides, high demand for quality generic drugs, analytical testing methods, improved the quality and transparency of the review & approval process, and encourage new drug R&D in line with global development is anticipated to fuel the market growth.

In addition, innovation or new product development is directly proportional to the demand for testing services due to pricing concerns, competitive pressures, and lead-time to market, companies are opting for outsourcing of testing services. Moreover, focus on customized care and technological advancements, which has resulted in rapid development of new products. Likewise, development of biosimilar, combination products, and other innovative medicines has fueled the demand for pharmaceutical analytical testing services.

On the basis of services segment, the market is classified into bioanalytical testing, method development & validation, stability testing, and others. Bioanalytical testing includes clinical and non-clinical. Similarly, method development & validation is segregated into extractable & leachable, technical consulting, impurity method, and others. Likewise, stability testing includes drug substance, stability indicating method validation, photostability testing, accelerated stability testing, and others. Other service segments held the largest share of over 40.0% in 2023. The segment includes environmental monitoring, raw material testing, batch release, microbial testing, and physical characterization of the materials. Changing regulations for in vivo and in vitro tests and innovative approaches to reduce the complexity of the tests are contributing to the segment’s growth.

The bioanalytical testing services segment is expected to witness the fastest growth over the forecast period. The entry of new participants into the market and an increasing number of clinical trial registrations have contributed to the segment’s growth. A lot of small-scale industries are not equipped with top-end analytical tools and opt for outsourcing these studies to industry experts having years of experience in performing, documenting, and adapting to the challenges presented during analysis. This is also anticipated to drive segment growth.

On the basis of end use segment, the market is segregated into pharmaceutical companies, biopharmaceutical companies, contract research organizations. The pharmaceutical companies segment dominated the global pharmaceutical analytical testing outsourcing market and accounted for a revenue share of over 47.2% in 2023. There are a significant number of small-sized pharmaceutical companies globally that lack in-house analytical testing capabilities. This has encouraged small-sized pharmaceutical companies to collaborate with CROs to assist them with analytical testing services. Outsourcing analytical testing services also saves time for the pharmaceutical company, thus helping them focus on their core competence. This further supports the growth of the segment market.

The biopharmaceutical companies’ segment is estimated to show growth at a lucrative rate in the market over the forecast period. Growth in the segment can be attributed to demand for testing in biopharmaceutical companies to improve productivity, characterize biologics and biosimilars, and provide real-time product quality control. Biopharmaceutical analytical testing requires specialized staff to run the assays and prepare regulatory filings. This reason has significantly contributed to the demand for outsourcing biopharmaceutical analytical services to an expert team and thus is expected to have a positive impact on the segment market.

North America dominated the global pharmaceutical analytical testing outsourcing market in 2023, holding a revenue share of 53.17%. This growth can be attributed to various factors such as highly reliable, high-end, and complex pharmaceuticals. Moreover, original equipment manufacturers are increasingly shifting toward electronics manufacturing service providers to efficiently manage the high volume of electronic components in current pharmaceuticals. In addition, increasing number of pharmaceutical industries within U.S. & Canada, and presence of number of major market players this region is expected to contribute significantly to the market growth.

Asia Pacific is expected to show growth at a lucrative rate in the market over the forecast period owing to growing investments and market players expanding its presence in the Asia Pacific region. Such expansions across Asia Pacific regional countries are likely to have a positive impact on the Asia Pacific market. For instance, pharma outsourcing trends in India is attributed to low costs, availability of industry experts, and presence of WHO-cGMP compliant facilities.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pharmaceutical analytical testing outsourcing market

Services

End Use

Regional