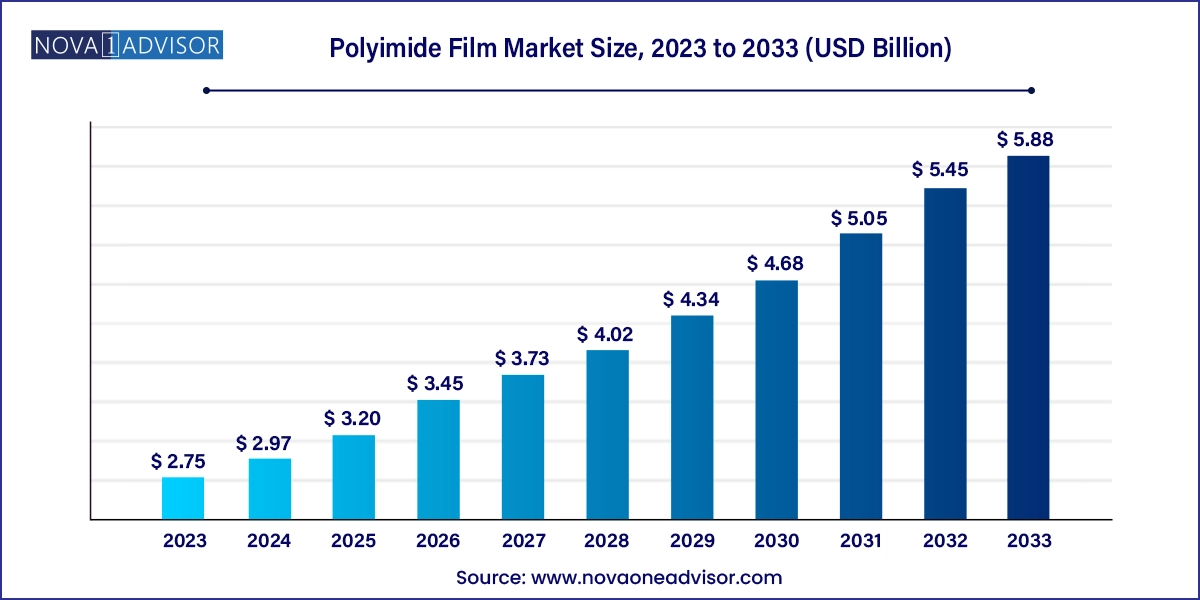

The polyimide film market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 5.88 billion by 2033, growing at a CAGR of 7.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.97 Billion |

| Market Size by 2033 | USD 5.88 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 7.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa |

| Key Companies Profiled | DuPont; Compagnie de Saint-Gobain; Kolon Industries, Inc.; KANEKA CORPORATION; Taimide Tech. Inc.; FLEXcon Company, Inc.; Arakawa Chemical Industries Ltd.; Anabond, Goodfellow; I.S.T Corporation |

The rise in demand for consumer electronics such as modern computers, LEDs, mobiles, and others is likely to drive the growth of the polyimide films industry over the forecast period. Polyimide films are widely used in aerospace on account of their high heat resistance, electrical insulation, and high strength. It is also utilized by aerospace in certain labeling applications. Primarily these films are applied in wire insulation and for electric motors which operate in harsh temperatures where heat and electricity management is a major concern.

Additionally, polyimide is extensively employed for electrical & electronic applications owing to its superior mechanical strength, thermal stability, and electrically insulating properties. In electronics, wafer carriers and guides, chip trays, test holders, electrical connectors, hard disk drive components, coil bobbins, digital copiers, wire insulators, and printer components are the prime application of polyimide.

The polyimide films industry in the U.S. is projected to witness significant growth over the coming years owing to the development of electric vehicles, consumer electronics, electrical engines, and aerospace activities. Initiatives by the government to develop the aerospace & defense sector is creating more demand in this region which is further projected to propel the industry growth in the U.S.

The U.S. enjoys several advantages in the evolving field of flexible electronics technology. It has the best and largest system of research universities across the globe, most of which are presently engaged in research and development projects with themes related to flexible electronics. Electronics development in the U.S. The U.S. defense has fostered a high-technology flexible electronics industry for military use and has set up research centers for flexible electronics. However, for flexible electronics, in which government funding appears to be an essential driver in nascent-stage industrial developments, the U.S., seems to be being outspent by European & Asian governments.

Several key market players have into strategic mergers & acquisitions, joint ventures, and new product development to expand their market presence in the global market. In the past few years, the joint venture is an integral part of the polyimide films industry that allows market players to strengthen their market position globally. For instance, in January 2023, according to DuPont, electronics & industrial sector, the expansion project at the Ohio manufacturing facility of the company Interconnect Solutions has been completed. With the USD 250 million investment, DuPont will be better able to meet the growing demand for Pyralux flexible circuit and Kapton polyimide film materials used in defense, specialty industrial, consumer electronics, and automotive applications.

Automotive dominated the global polyimide film industry and accounted for more than 33.0% of the total market share, in terms of revenue, in 2023. The growing automotive production along with the increasing percentage of electric vehicles continues to propel the demand. Common automotive applications of polyimide films are EGR valve bushings, thrust washers, seat sensor applications, and traction applications. The harsh temperature condition present in the powertrain applications requires materials that can withstand high thermal, mechanical, and electrical loads.

The growing lightweight trends in the automotive industry are pushing manufacturers to include lighter materials in their offerings. Next-generation compact cars (NGCC) which are compact and equipped with powerful engines are developing the demand for products with excellent electromechanical resistance. Polyimide films are projected to witness a higher market share in the automotive segment over the forecast period owing to their excellent properties which are capable of fulfilling the challenging automotive requirements.

Furthermore, these films are heavily used in various other applications including electronics, aerospace, and labeling. Growing flexible electronics create more requirements, which are projected to foster the product growth potential over the coming years. The films provide excellent strength at a relatively lesser dimension. The strong electromechanical properties of the film make it one of the most suitable candidates for the advanced plastics family.

Flexible printed circuits (FPC) dominated the application segment in the global polyimide films market and accounted for more than 66% of the total market share, in terms of revenue, in 2023. Growth in the electronics sector along with growing electrification trends in the automotive sector continues to augment the FPC demand which further attracts polyimide makers to expand their product portfolio for the application segment. Flexible printed circuits are used as connectors in numerous applications where production constraints, space savings, and flexibility restrict the serviceability of the rigid circuit board. These factors are likely to propel the demand for FPC in the polyimide films market.

Additionally, Specialty Fabricated Products (SFP) are an emerging application segment of polyimide films that are projected to gain a higher market share at a healthy growth rate. The growth in demand is primarily attributed to the growing consumer electronics technology which expands the new application scope for the SFPs. SFPs made by polyimide these films have a unique capability to operate at low and high operating temperatures which makes them suitable for numerous niche applications.

Currently, various industries are using SFPs in applications such as speaker coils, barcode labels, diaphragms, gaskets, and spiral-wrapped tuning. Other major application of specialty fabricated products includes nuclear linear accelerator insulation, space blankets, sensors, transportation belts, and aircraft shim stocks. SFPs made by polyimide films maintain electrical and mechanical integrity at a wide temperature range of -270°C to 400°C.

North America dominated the polyimide film market in 2023 and accounted for more than 33.0% of the overall market revenue share.North America led by U.S., Mexico, and Canada accounted for the dominant market share globally. The market is projected to witness strong growth over the coming years owing to the developed electronics, automotive, and aerospace industries. The presence of top manufacturers in the automotive industry such as Ford, Chrysler, Cadillac, Tesla, and others. In this region and proper infrastructure coupled with high disposable income is expected to drive this market.

Mexico is another lucrative market in North America for automotive and auto components. In the last few years, the country has become a major region for investment through all categories of manufacturers, but mainly from automotive suppliers and automakers. Apart from low wages, the country offers informative workforce training and development programs along with other lucrative development incentives.

Europe accounted for a revenue share of more than 24.0% in 2023 owing to the development of electric vehicles, the presence of an established printing & labeling market, and the presence of numerous major market players. Development in technological services has enabled companies and consumers to track the product. Low data tariff cost is acting as a driver for the tracking technology. Polyimide films ensure a reliable and durable way to track the product by making the labeling at the optimal level. Growth in these sectors is contributing to the development of polyimide films in Europe. Development in printed electronics is a major factor in the rising demand for the product segment in this region.

However, recovering the economic situation in the United Kingdom has fostered the development of several employment opportunities. This, in turn, has driven the perception that a higher degree of energy is required to cater to the growing industrialization. These factors are thus promoting polyimide film market growth owing to its capability of enabling product operation at optimum efficiency with lower energy consumption.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the polyimide film market

Application

End-use

Regional