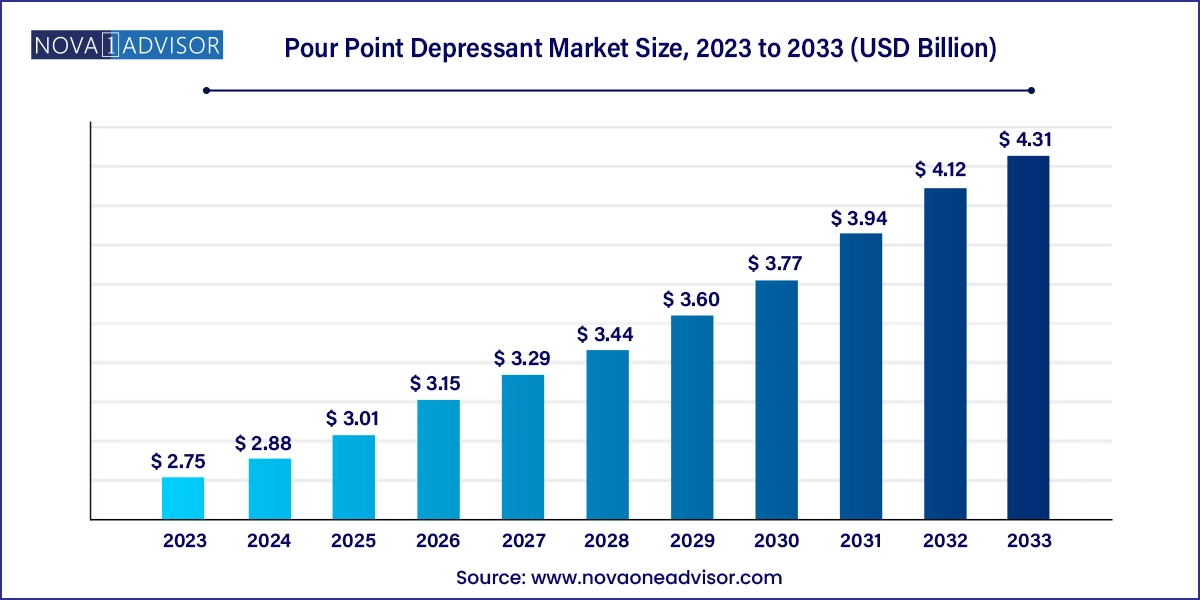

The pour point depressant market size was exhibited at USD 2.75 billion in 2023 and is projected to hit around USD 4.31 billion by 2033, growing at a CAGR of 4.6% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.88 Billion |

| Market Size by 2033 | USD 4.31 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia and South Africa |

| Key Companies Profiled | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

This is attributed to increasing industrialization around the globe, rising awareness about vehicle maintenance, increasing scope of aerospace industry and wide-scale adoption of pour point depressants in the making of lubricants for the oil & gas industry. Pour point depressants are chemical compounds added to various hydrocarbon-based fluids to modify their flow characteristics at low temperatures. Their primary function is to reduce the pour point temperature of a fluid, which is especially important in regions with cold climates. They can be manufactured in different chemical structures such as polymers, copolymers, and organic compounds with polar functional groups, dependent upon the application and characteristics of base fluid.

Oil and gas industry is a prominent end-use market for pour point depressants on a global scale. They play an important role in optimizing the flow properties of crude oil and petroleum products, especially in tundra and other cold regions of the world. The hydrocarbons have an inherent characteristic to freeze and solidify at lower temperatures and it raises the need for additives. The difficulty in maintaining the flow of petroleum products such as petrol, diesel, and aviation fuel causes operational disruptions, reduced product quality and increased maintenance cost. Hence the growth of oil & gas industry is a major driver for pour oil depressants market.

The substantial rise in the sales of vehicles all over the globe is also a major driver for the pour point depressant industry. The rapid increase in population as well as rising trend of urbanization has played a huge part in the growth of automobiles industry. According to the International Organization of Motor Vehicle Manufacturers, in 2022, the total number of cars sold touched the number of 61.6 million, an increase of 6% over the sales in 2021, this in turn accelerates the need for lubricant additives and pour point depressants.

Rapid industrialization has also significantly driven the demand for pour point depressants (PPDs) in end-user industries across the globe. Pour point depressants serve as crucial agents in mitigating the adverse effects of low temperatures on these industrial processes. Industries such as aviation, marine, and energy production rely on PPDs to ensure the smooth operation of their machinery and transportation networks, even in extreme cold weather conditions.

Oil & gas segment accounted for the largest revenue share of around 45.70% in 2023. The oil & gas industry has experienced significant growth in recent years due to increasing demand for energy in developing countries. Fast-paced industrialization, rise in the number of automobiles and rapid urbanization have been major factors leading to the expansion of oil & gas extraction activities. According to the International Energy Agency, the demand for oil products is set to increase by 6% between 2022 and 2028 to reach 105.7 million barrels per day in the year 2028. This is bound to increase the consumption of pour point depressants applied in the industry.

Aerospace industry is another significant end-user of pour point depressants as they play a crucial role in addressing the challenges faced by aircraft in low-temperature environments such as high-altitude flight and space exploration. Pour point depressants maintain the functionality and fluidity in aircraft components, preventing the risk of oil gelling and excess viscosity in cold conditions.

Marine industry, including maritime transport, offshore activities and shipping is a significant end-user of pour point depressants. They are primarily used as engine lubricants for ships and other vessels. The hydraulic systems used on offshore platforms and ships rely on efficient lubrication in hydraulic systems to work in harsh environments, which necessitates the usage of additives in their machine operations.

The ethylene co vinyl acetate segment accounted for the largest revenue share in 2023. This is attributed to their widespread utilization in biomedical engineering and drug delivery applications. The growth in the drug delivery industry in recent years is due to advancements in technology and increased research and development. Additionally, the increasing prevalence of chronic diseases and the aging population have aided the growth of the drug delivery industry.

Styrene esters are derived after styrene is made to go through an esterification process. They provide flexibility and adhesion along with working as pour point depressants in the automotive and aerospace industries. The increasing demand in the automotive industry due to the adoption of electric vehicles has led to the growth in the consumption of styrene esters in the construction of engines and other parts in automotive.

Poly alkyl methacrylates are widely used in the automotive and healthcare industries due to their characteristic properties such as excellent thermal stability and resistance to a wide range of chemicals. The growing trend of using bio-based and environmentally friendly alternatives has also acted as a major driver for the consumption of the product in the polymer industry.

Asia Pacific region accounted for the largest revenue share of around 32.50% in 2023. This is attributed to rapid industrialization in the region driving up the demand for lubricants. The region is home to developing economies such as China, India, and Bangladesh with growing automotive sectors that act as major consumers for pour point depressants in the operation of engines. The liberal trade policies enacted by economic blocs such as the Association of Southeast Asian Nations (ASEAN) and individual countries such as China have contributed to the wide-scale industrial development in the region.

North America holds a significant position in the market due to its well-developed oil & gas and aerospace industry. The U.S. has the world’s largest aerospace industry and stood at a total value of USD 391 billion in 2021, according to the Aerospace Industries Association (AIA). It acts as a major consumer of pour point depressants for both civilian uses in airliners as well as in military aircraft. The other major end-user of pour point depressants in North America is the oil & gas industry, especially in the regions of Northern Canada and Alaska which experience extremely cold temperatures for the majority part of the year.

Europe contains a large-scale automobile industry which consumes pour point depressants in large quantity in the manufacturing of engines. The region contains major automobile manufacturing corporations such as Mercedez-Benz, Volkswagen, Renault SA and others which use lubricants to increase the performance of their product offerings. European authorities levy stringent regulations such as Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) to ensure safety and environmental impact within prescribed limits.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the pour point depressant market

Products

End-use

Regional

Chapter 1 Methodology and Scope

1.1 Market Segmentation & Scope

1.2 Market Definitions

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal Database

1.4 Information analysis

1.5 Market formulation & data visualization

1.6 Data validation & publishing

1.6.1 Research scope and assumptions

1.6.2 List of Data Sources

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Pour Point Depressant: Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Global Pour Point Depressant Market Outlook

3.2 Industry Value Chain Analysis

3.2.1 Manufacturing/Technology Trends

3.2.2 Sales Channel Analysis

3.2.3 List of Potential End-users

3.3 Price Trend Analysis, 2021 - 2033 (USD/kg)

3.3.1 Factors influencing prices

3.4 Regulatory Framework (Standards and Compliances, Approvals, Policies)

3.5 Market Dynamics

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Market Challenge Analysis

3.5.4 Market Opportunities Analysis

3.6 Industry Analysis Tools

3.6.1 PORTERs Analysis

3.6.2 Macroeconomic Analysis - PESTLE Analysis

Chapter 4 Pour Point Depressant Market: Product Estimates & Trend Analysis

4.1 Product Movement Analysis & Market Share, 2024 & 2033

4.1.1 Poly Alkyl Methacrylates

4.1.2 Ethylene Co Vinyl Acetate

4.1.3 Styrene Esters

4.1.4 Poly Alpha Olefin

Chapter 5 Pour Point Depressant Market: End-use Estimates & Trend Analysis

5.1 End-use Movement Analysis & Market Share, 2024 & 2033

5.1.1 Oil & Gas

5.1.2 Automotive

5.1.3 Aerospace

5.1.4 Marine

5.1.5 Other End-uses

Chapter 6 Pour Point Depressant Market: Regional Estimates & Trend Analysis

6.1 Pour Point Depressant Market: Regional Outlook

6.2 North America

6.2.1 North America Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.2.2 U.S.

6.2.2.1 Key Country Dynamics

6.2.2.2 U.S. Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.2.3 Canada

6.2.3.1 Key Country Dynamics

6.2.3.2 Canada Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.2.4 Mexico

6.2.4.1 Key Country Dynamics

6.2.4.2 Mexico Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3 Europe

6.3.1 Europe Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3.2 Germany

6.3.2.1 Key Country Dynamics

6.3.2.2 Germany Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3.3 UK

6.3.3.1 Key Country Dynamics

6.3.3.2 UK Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3.3 France

6.3.3.1 Key Country Dynamics

6.3.3.2 France Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3.3 Italy

6.3.3.1 Key Country Dynamics

6.3.3.2 Spain Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.3.3 Spain

6.3.3.1 Key Country Dynamics

6.3.3.2 Spain Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.4 Asia Pacific

6.4.1 Asia Pacific Bleaching Agents Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.4.2 China

6.4.2.1 Key Country Dynamics

6.4.2.2 China Bleaching Agents Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.4.3 India

6.4.3.1 Key Country Dynamics

6.4.3.2 India Bleaching Agents Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.4.4 Japan

6.4.4.1 Key Country Dynamics

6.4.4.2 Japan Bleaching Agents Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.4.5 South Korea

6.4.5.1 Key Country Dynamics

6.4.5.2 South Korea Bleaching Agents Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.5 Central & South America

6.5.1 Central & South America Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.5.2 Brazil

6.5.2.1 Key Country Dynamics

6.5.2.2 Brazil Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.5.3 Argentina

6.5.3.1 Key country dynamics

6.5.3.2 Argentina Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.6 Middle East & Africa

6.6.1 Middle East & Africa Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.6.2 Saudi Arabia

6.6.2.1 Key country dynamics

6.6.2.2 Brazil Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

6.6.3 South Africa

6.6.3.1 Key country dynamics

6.6.3.2 South Korea Pour Point Depressant Market Estimates & Forecasts, 2021 - 2033 (Kilotons) (USD Million)

Chapter 7 Competitive Landscape

7.1 Company Categorization

7.2 Company Market Positioning Analysis 2023

7.3 Company Heat Map Analysis

7.4 Strategy Mapping

7.5 Company Listing (Business Overview, Financial Performance, Product Portfolio)

7.5.1 CLARIANT

7.5.2 Afton Chemical

7.5.3 The Lubrizol Corporation

7.5.4 Evonik Industries

7.5.5 Infineum International Limited

7.5.6 Ecolab

7.5.7 Shengyang Greatwall Lubricant Oil Co.,Ltd.

7.5.8 Puyang Jiahua Chemical Co., Ltd.

7.5.9 Sanyo Chemical Industries, Ltd.

7.5.10 Innospec