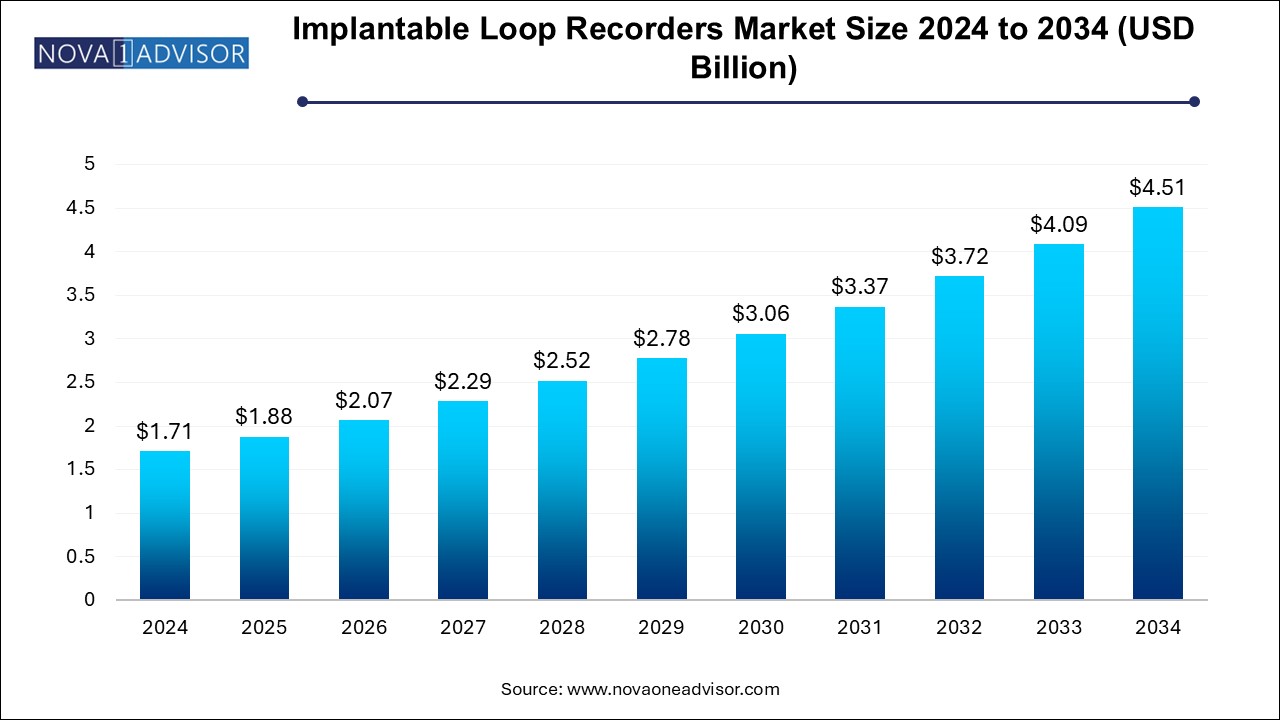

The implantable loop recorders market size was exhibited at USD 1.71 billion in 2024 and is projected to hit around USD 4.51 billion by 2034, growing at a CAGR of 10.2% during the forecast period 2025 to 2034.

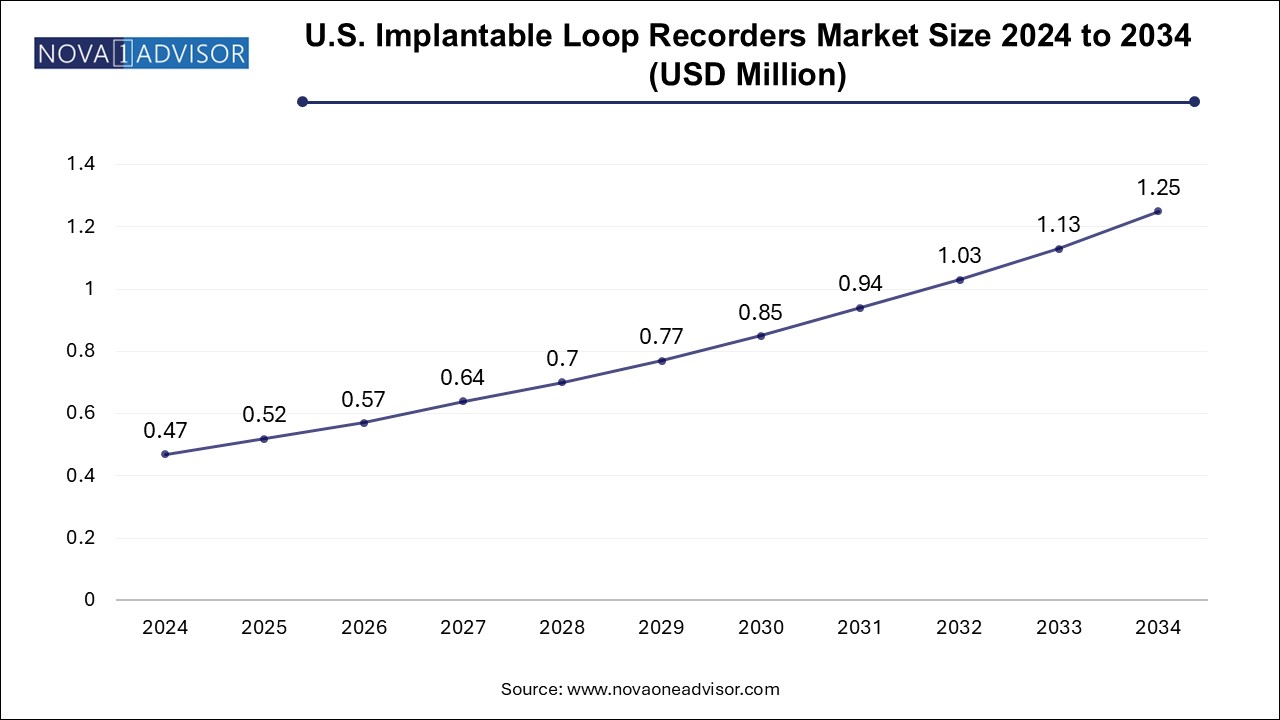

The U.S. implantable loop recorders market size is evaluated at USD 0.470 million in 2024 and is projected to be worth around USD 1.25 million by 2034, growing at a CAGR of 9.29% from 2025 to 2034.

Implantable loop recorders market in North America dominated with a revenue share of 36.8% in 2024 supported by a high prevalence of atrial fibrillation, strong reimbursement infrastructure, and advanced healthcare systems. The American Heart Association (AHA) reports that over 6 million people in the U.S. are affected by AF, a number expected to double by 2050. This growing patient population fuels consistent demand for long-term rhythm monitoring.

Moreover, the presence of major manufacturers, such as Medtronic and Abbott, along with a well-established network of electrophysiology centers, drives technological adoption. U.S. healthcare providers have embraced remote monitoring systems, with ILRs frequently integrated into telehealth platforms. Medicare and private insurers offer favorable reimbursement for ILR implantation and monitoring services, further supporting market growth.

Asia Pacific is the fastest-growing region in the ILRs market, driven by rising cardiovascular disease prevalence, expanding healthcare access, and increased government investment in digital health. Countries like China, India, Japan, and South Korea are witnessing rising AF diagnoses and a growing emphasis on stroke prevention.

Japan, with one of the highest elderly populations globally, is leading in ILR adoption among Asian countries. Meanwhile, China and India are scaling up cardiac infrastructure, with ILRs being introduced in tier-1 city hospitals and cardiac institutes. Government health insurance schemes are beginning to incorporate cardiac rhythm monitoring tools, including ILRs, in their coverage.

Collaborations between Western device manufacturers and local distributors are facilitating product entry and physician training in the region. As healthcare digitization expands, Asia Pacific is expected to emerge as a vital contributor to global ILR adoption.

The implantable loop recorders (ILRs) market is a critical segment of the cardiac monitoring devices industry, addressing a growing need for long-term and continuous heart rhythm surveillance. ILRs are small subcutaneous devices implanted under the skin to continuously monitor the electrical activity of the heart for extended periods—typically up to three years. These devices are indispensable for detecting intermittent arrhythmias, atrial fibrillation (AF), and unexplained syncope, conditions that are often difficult to diagnose using conventional short-duration ECG or Holter monitoring.

Implantable loop recorders provide real-time data collection, storage, and transmission capabilities, with modern devices featuring wireless connectivity and remote monitoring through cloud-based platforms. Their utility in detecting asymptomatic episodes and linking them to cardiac events has expanded their application beyond specialist centers into broader hospital systems and ambulatory care settings. Technological advancements, including miniaturization, automation, and integration with digital health ecosystems, are propelling this market into a new era of proactive and personalized cardiovascular diagnostics.

With cardiovascular diseases (CVDs) being the leading cause of mortality globally, the need for early diagnosis and continuous monitoring of arrhythmic events is more pressing than ever. The aging population, increasing incidence of atrial fibrillation, and growth in electrophysiology practices are primary contributors to market growth. Moreover, clinical guidelines in many countries now recommend ILRs for patients with unexplained syncope or cryptogenic stroke, further expanding the addressable market.

Rising Adoption of Remote Monitoring-Enabled ILRs to Reduce Hospital Visits

Increased Use of ILRs for Cryptogenic Stroke and Silent Atrial Fibrillation Detection

Miniaturization and Subcutaneous Insertion Leading to Higher Patient Compliance

Integration with Mobile Apps and Cloud Platforms for Real-Time Data Sharing

Expansion of Clinical Guidelines Supporting ILR Use in Syncope and Post-Ablation Monitoring

Surge in AI-Powered Arrhythmia Detection and Interpretation Algorithms

Growing Use of ILRs in Pediatric and High-Risk Elderly Populations

Consolidation Among Manufacturers and Increased Investment in R&D

Broader Adoption in Emerging Markets via Telehealth and Mobile Cardiac Services

Shift Toward Ambulatory and Outpatient Implantation Settings

| Report Coverage | Details |

| Market Size in 2025 | USD 1.88 Billion |

| Market Size by 2034 | USD 4.51 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 10.2% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Activation, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Medtronic, Biotronik, Abbott; Angel Medical Systems, Inc.; Boston Scientific Corporation; GE Healthcare; Koninklijke Philips N.V.; MicroPort Scientific Corporation; Nihon Kohden Corporation; Vectorious |

A key driver of the implantable loop recorders market is the global surge in atrial fibrillation (AF) and unexplained syncope cases, both of which demand long-term, continuous cardiac monitoring for accurate diagnosis. AF is the most common arrhythmia, affecting over 33 million people worldwide. Its episodic and asymptomatic nature in many cases makes it difficult to detect with conventional ECG monitoring.

ILRs offer a long-term diagnostic advantage by continuously recording heart rhythms over months or years, thereby capturing intermittent episodes that short-term devices miss. Furthermore, unexplained syncopal events—temporary loss of consciousness—pose significant diagnostic challenges and are often due to undiagnosed arrhythmias. ILRs are highly effective in determining the etiology of these episodes, influencing clinical decisions related to pacemaker implantation or lifestyle changes. As clinical adoption grows and patient outcomes improve, ILRs are becoming the standard of care for difficult-to-diagnose arrhythmias.

Despite their clinical utility, high procedural and device costs remain a restraint to the widespread adoption of implantable loop recorders. The cost of the device itself, along with the surgical procedure and follow-up care, can be substantial, particularly in healthcare systems with limited insurance coverage or reimbursement schemes. This financial burden is especially relevant in low- and middle-income countries, where public healthcare budgets are constrained.

Reimbursement policies for ILRs vary significantly across regions. While countries like the U.S., Germany, and the U.K. have adopted favorable reimbursement codes under Medicare or national health schemes, others lag in incorporating ILRs into standard healthcare packages. Moreover, private insurers may impose restrictions on eligibility criteria, making access inconsistent. To overcome this barrier, manufacturers and policymakers must work together to demonstrate cost-effectiveness and long-term savings through early intervention.

A promising opportunity lies in the integration of ILRs with artificial intelligence (AI)-driven analytics and remote patient management systems, collectively transforming these devices from passive recorders to intelligent diagnostic assistants. The use of AI algorithms to identify arrhythmia patterns, classify ECG events, and alert clinicians in real time is redefining how data from ILRs is utilized.

Moreover, the adoption of telecardiology platforms, especially in the wake of the COVID-19 pandemic, has opened new channels for long-term cardiac monitoring outside the traditional hospital setting. Patients can now be monitored from home, with alerts automatically sent to cardiologists in case of abnormal heart rhythms. This opportunity expands the reach of ILRs into rural areas, reduces hospital burden, and enables continuous care for high-risk populations. Companies that innovate around connectivity, predictive analytics, and interoperability with EMRs (electronic medical records) will be well-positioned for future growth.

Automatic implantable loop recorders hold the dominant position in the market due to their ability to autonomously detect arrhythmic events without user intervention. These devices use sophisticated algorithms to identify irregular heart rhythms such as bradycardia, tachycardia, and pauses, recording data whenever anomalies are detected. This automation increases diagnostic yield, particularly in patients with sporadic or asymptomatic conditions.

Automatic ILRs are especially valuable for elderly patients or those with limited cognitive abilities, who may not be able to manually trigger an event recorder. Additionally, automatic ILRs eliminate reliance on symptom awareness, capturing silent arrhythmias like asymptomatic atrial fibrillation—critical for preventing stroke. Their clinical utility and superior outcomes drive their widespread adoption across hospitals and cardiac centers.

Manual recorders, while less dominant, are still relevant in specific cases where patients can reliably correlate symptoms with recording initiation. These devices offer more user control and are often used in investigational settings or as adjuncts to automatic modes. However, due to the challenges of patient compliance and symptom variability, this segment is expected to grow at a slower pace than automatic recorders.

The atrial fibrillation segment held the largest market share of 41.8% in 2024. AF’s intermittent and sometimes silent nature makes it an ideal candidate for long-term monitoring using ILRs. These devices help detect asymptomatic episodes that would otherwise go unnoticed, particularly in post-ablation patients or individuals with prior strokes of unknown origin (cryptogenic stroke).

Furthermore, ILRs are frequently used in stroke risk stratification, where detecting silent AF can guide decisions around anticoagulation therapy. The importance of early AF detection to reduce the risk of stroke and heart failure has led to updated clinical guidelines supporting ILR use in AF management. Ongoing research is also investigating the role of ILRs in post-surgical cardiac monitoring, expanding this segment further.

Cardiac syncope, characterized by sudden loss of consciousness due to arrhythmic events, is the fastest-growing application segment. ILRs provide a powerful tool to correlate syncopal episodes with cardiac rhythm disturbances, allowing timely diagnosis and therapeutic intervention. Their role in guiding pacemaker placement or ruling out arrhythmic causes has made them integral in syncope workups.

The hospitals segment held the largest market share of 59.0% in 2024. as they serve as primary centers for diagnosis, implantation procedures, and follow-up care. Most ILRs are implanted in hospital electrophysiology labs or cardiac catheterization units under sterile conditions with imaging support. Post-implantation monitoring is also conducted within hospital networks using telemetry or remote monitoring hubs.

However, cardiac centers—especially specialized electrophysiology (EP) clinics—represent the fastest-growing end use segment. These centers offer dedicated arrhythmia services, advanced diagnostic capabilities, and remote monitoring solutions that cater specifically to ILR patients. The ability to provide comprehensive rhythm management, including implantation, analysis, and programming adjustments, is making cardiac centers preferred locations for long-term care.

Other end users include ambulatory surgical centers and telehealth networks, which are increasingly handling ILR follow-ups and data analysis remotely. As the market matures, decentralized care models and home-based follow-up systems are expected to grow.

March 2025: Medtronic plc announced expanded AI capabilities in its LINQ II ILR, enabling real-time arrhythmia classification and automatic EMR integration via the CareLink platform.

February 2025: Abbott Laboratories received CE Mark approval for its next-gen Confirm Rx ILR, featuring improved battery life and enhanced Bluetooth-enabled remote monitoring.

January 2025: Biotronik SE & Co. KG launched a new clinical study in Europe to assess the impact of ILRs in post-stroke AF detection, in collaboration with several academic cardiology centers.

December 2024: Boston Scientific Corporation announced the development of an ultra-miniaturized ILR prototype designed for pediatric and congenital heart patients, expected to enter trials by late 2025.

November 2024: Vectorious Medical Technologies completed a Series C funding round to accelerate commercial rollout of its hemodynamic monitoring ILR platform for heart failure management.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the implantable loop recorders market

By Activation

By Application

By End Use

By Regional