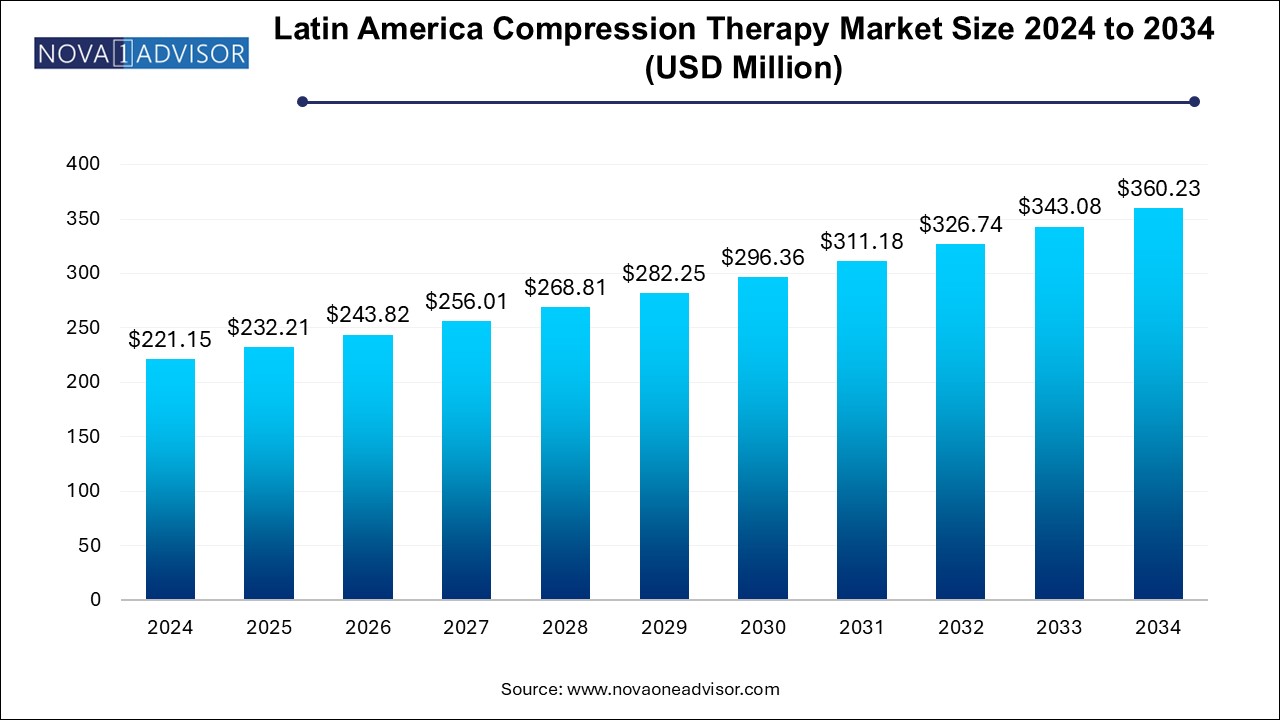

The Latin America compression therapy market size was exhibited at USD 221.15 million in 2024 and is projected to hit around USD 360.23 million by 2034, growing at a CAGR of 5.0% during the forecast period 2024 to 2034.

The Latin America compression therapy market is experiencing a pivotal period of growth and transformation, shaped by evolving healthcare needs, a rise in chronic venous and lymphatic disorders, and an increased focus on non-invasive therapeutic solutions. Compression therapy, which involves applying controlled pressure to limbs to enhance venous return and reduce swelling, is becoming increasingly essential in managing conditions such as varicose veins, lymphedema, deep vein thrombosis (DVT), and post-operative edema.

Countries across Latin America—including Brazil, Mexico, and Argentina—are witnessing a dual healthcare challenge: managing aging populations susceptible to vascular disorders and addressing the growing incidence of obesity, diabetes, and sedentary lifestyles that exacerbate such conditions. These dynamics are fueling demand for effective, affordable, and patient-friendly treatment methods—making compression therapy an indispensable solution in both acute and chronic care.

Despite relatively limited awareness in some rural areas, urban centers are experiencing a surge in demand for both static and dynamic compression therapy. Products such as compression bandages, stockings, sleeves, and intermittent pneumatic compression (IPC) devices are gaining traction, not only in hospital and clinical settings but also in home healthcare, thanks to evolving patient preferences and healthcare policy shifts favoring cost-effective outpatient solutions.

Moreover, the region's increasing participation in global healthcare innovation, including medical device distribution partnerships and regulatory improvements, is facilitating the entry of international brands and enhancing product accessibility. With continued investments in healthcare infrastructure and growing public-private healthcare collaborations, the Latin American compression therapy market is poised for sustained expansion through 2034.

Expansion of Home Healthcare Services: There is increasing adoption of compression therapy devices for home use, particularly among elderly and post-operative patients.

Localization of Product Manufacturing: Regional players and global manufacturers are establishing local production and assembly facilities to reduce costs and improve availability.

Integration of Smart Technology: Although still nascent in Latin America, smart compression devices with Bluetooth capabilities and monitoring apps are beginning to enter private healthcare markets.

Growing Preventive Applications: Compression garments are being marketed to athletes and individuals with sedentary lifestyles as a preventive measure against venous disorders.

Educational Campaigns and Awareness Drives: Non-governmental organizations and medical societies are promoting awareness around chronic venous disease and lymphedema management using compression therapy.

Expansion of Insurance Coverage: Some countries in Latin America are beginning to include compression therapy in national healthcare reimbursement schemes, enhancing access.

Retail Channel Digitization: Online pharmacies and e-commerce platforms are increasingly distributing compression therapy products, especially in urban regions.

| Report Coverage | Details |

| Market Size in 2025 | USD 232.21 Million |

| Market Size by 2034 | USD 360.23 Million |

| Growth Rate From 2024 to 2034 | CAGR of 5.0% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Technology, End-use, Distribution Channel, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | Brazil, Argentina, Mexico |

| Key Companies Profiled | Bio Compression Systems, Inc., Cardinal Health, 3M, Juzo, PAUL HARTMANN AG, medi GmbH & Co. KG, SIGVARIS GROUP, BSN Medical GmbH (Essity Health & Medical), Arjo (GETINGE GROUP), Spectrum Healthcare, Smith+Nephew, Tactile Systems Technology Inc., Zimmer Biomet, DJO, LLC, Lympha Press USA, Medline |

One of the primary growth drivers for the Latin American compression therapy market is the rising burden of chronic venous disorders, fueled by an aging population and lifestyle-related diseases such as diabetes and obesity. According to the International Diabetes Federation, Latin America is witnessing one of the fastest-growing rates of diabetes globally, with Brazil and Mexico among the top ten countries for diabetes prevalence. Diabetes significantly increases the risk of peripheral vascular diseases and complications such as venous ulcers and lymphedema.

Compression therapy offers a reliable, non-invasive approach to managing these complications. The therapy improves blood circulation, reduces edema, and prevents ulcer formation—critical for diabetic patients who face slower wound healing and higher infection risks. Healthcare providers are increasingly incorporating compression garments and IPC devices into their chronic disease management protocols. As countries modernize their public health strategies and emphasize preventive care, compression therapy is being positioned as both a therapeutic and prophylactic measure, enhancing its adoption across healthcare systems.

Despite the market’s potential, one of its core challenges remains the limited awareness and access to compression therapy in rural and underdeveloped regions. In countries like Argentina and Peru, a significant portion of the population resides in rural areas where healthcare services are under-resourced and often do not include specialist vascular care. Consequently, diagnoses of venous and lymphatic conditions are either delayed or entirely missed, impeding timely therapy.

Moreover, the cost of compression garments or dynamic therapy systems remains out of reach for lower-income populations, especially in the absence of insurance coverage or government reimbursement schemes. The lack of trained professionals to guide proper product usage also affects compliance and outcomes. These challenges underscore the need for broader health literacy initiatives, training for primary care professionals, and public-private partnerships to enhance product distribution and affordability in underserved regions.

A promising opportunity in the Latin American compression therapy market lies in the expansion of government-led public health initiatives and the region's growing appeal in global medical tourism. Countries like Brazil and Mexico are making strides in incorporating vascular care into their universal healthcare systems, with growing investments in wound care clinics, rehabilitation centers, and chronic care management programs. These platforms are natural avenues for increased compression therapy utilization.

Simultaneously, the region is emerging as a hub for affordable, high-quality healthcare services. Brazil and Mexico, in particular, attract patients from North America and Europe seeking cost-effective surgical and post-surgical care. Compression therapy plays a crucial role in recovery protocols for cosmetic surgery, orthopedic procedures, and cardiovascular interventions. International clinics are stocking advanced compression systems to cater to this segment, providing a boost to premium product lines and high-margin devices.

The static compression therapy segment accounted for 73.9% of the total revenue generated in 2024, Compression bandages and stockings are standard therapeutic tools for managing venous ulcers, varicose veins, and post-operative swelling. Compression bandages, in particular, are commonly used in wound care centers and hospitals for acute therapy, while compression stockings are preferred for long-term management and prevention. Their ease of distribution through retail and pharmacies has facilitated adoption even in semi-urban regions. Moreover, the introduction of breathable, skin-friendly materials has improved patient comfort, encouraging long-term compliance.

The dynamic compression therapy segment is expected to grow at a CAGR of 5.5% over the forecast period. Compression pumps and sleeves, though relatively more expensive, offer superior efficacy in managing advanced lymphedema and post-thrombotic syndrome. Hospitals and specialty clinics in urban centers such as São Paulo, Mexico City, and Buenos Aires are increasingly prescribing pneumatic compression therapy as part of comprehensive vascular rehabilitation. The ongoing modernization of healthcare infrastructure and the gradual inclusion of advanced therapeutic devices in public healthcare programs are expected to drive demand. Additionally, mobile and battery-operated compression pumps are being introduced to cater to home healthcare needs, expanding the reach of dynamic solutions.

The hospitals segment dominated the Latin America compression therapy market in 2024 due to the critical role these institutions play in diagnosing and initiating treatment for venous and lymphatic disorders. Public hospitals across Brazil and Mexico routinely use compression therapy in post-surgical wards, ICU units, and dermatology departments. Compression bandages and pumps are utilized to prevent DVT in immobile patients and support recovery from orthopedic and vascular surgeries. The centralized purchasing power and bulk procurement of hospitals also drive steady demand for both static and dynamic devices.

The home healthcare segment is expected to grow at the fastest CAGR from 2024 to 2034 With more Latin Americans managing chronic conditions like diabetes, arthritis, and vascular insufficiency outside hospital settings, demand for user-friendly compression solutions has increased. Distributors and device makers are responding with educational materials, remote monitoring features, and support services to ensure proper at-home usage. Furthermore, the growing trend of home-based aesthetic procedures and cosmetic surgery recovery has created niche demand for post-surgical compression garments.

Institutional sales contributed the largest share of the total revenue in 2024 As hospitals, clinics, and long-term care facilities account for the majority of procurement in the compression therapy market. Government tenders and private hospital contracts form the backbone of this segment, especially in Brazil’s public Sistema Único de Saúde (SUS) network and Mexico's Instituto Mexicano del Seguro Social (IMSS). Institutional sales channels benefit from established supplier relationships, product standardization, and centralized training programs for healthcare workers.

The retail sales segment is expected to experience significant growth during the forecast period. Patients are purchasing compression stockings and sleeves directly from pharmacies, medical supply stores, and online marketplaces. In particular, urban middle-class consumers in Argentina and Colombia are using compression garments for fitness, pregnancy, and travel-related swelling. International brands are investing in product labeling in Spanish and Portuguese, sizing guides, and digital marketing to make compression products more accessible and appealing via retail channels.

Brazil leads the Latin American compression therapy market, driven by its robust public healthcare system (SUS), growing private health sector, and rising elderly population. The country has a significant burden of venous disorders and diabetic complications, which has created consistent demand for both acute and chronic compression therapy. Brazilian cities host specialized wound care and vascular centers where compression bandages and IPC devices are regularly used. The country also has a strong medical device import network, allowing international manufacturers to distribute advanced compression systems. In addition, Brazil’s cosmetic surgery boom has driven demand for post-operative compression garments, further expanding the market scope.

Mexico is witnessing strong growth in its compression therapy market due to expanding healthcare access, rising diabetes prevalence, and proactive government health initiatives. The IMSS and other public insurance programs are incorporating compression therapy into chronic disease management protocols. Additionally, Mexico's strategic location has made it a growing hub for medical tourism, particularly for orthopedic and vascular surgeries, where compression garments play a key recovery role. Private clinics in Mexico City and Guadalajara are increasingly stocking dynamic compression systems. Moreover, local manufacturers and distributors are partnering with international brands to expand product portfolios and improve pricing competitiveness.

Argentina’s compression therapy market is expanding gradually, anchored by urban demand and a proactive private healthcare sector. Though the public health system faces funding constraints, private insurers and clinics are making compression therapy more accessible. Buenos Aires and Córdoba serve as key urban centers where advanced vascular and lymphedema treatments are offered, often integrating both static and dynamic compression options. Patients are also turning to pharmacies and online platforms for self-purchased compression stockings. Economic fluctuations and regulatory hurdles may affect growth in rural regions, but continued investment in chronic disease prevention programs is expected to sustain long-term demand.

January 2025: SIGVARIS Group expanded its retail footprint in Latin America by launching new distribution partnerships in Brazil and Argentina, enhancing local access to medical-grade compression garments.

February 2025: 3M Health Care collaborated with public hospitals in São Paulo to provide compression bandages for diabetic foot ulcer management as part of a pilot chronic care program.

March 2025: Tactile Medical announced plans to introduce its Flexitouch Plus pneumatic compression system in Mexico through a new partnership with a regional medical distributor.

April 2025: BSN Medical (Essity AB) launched Spanish and Portuguese-language digital training modules for compression therapy compliance targeting Latin American clinicians and patients.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Latin America compression therapy market

By Technology

By End-use

By Distribution Channel

By Country