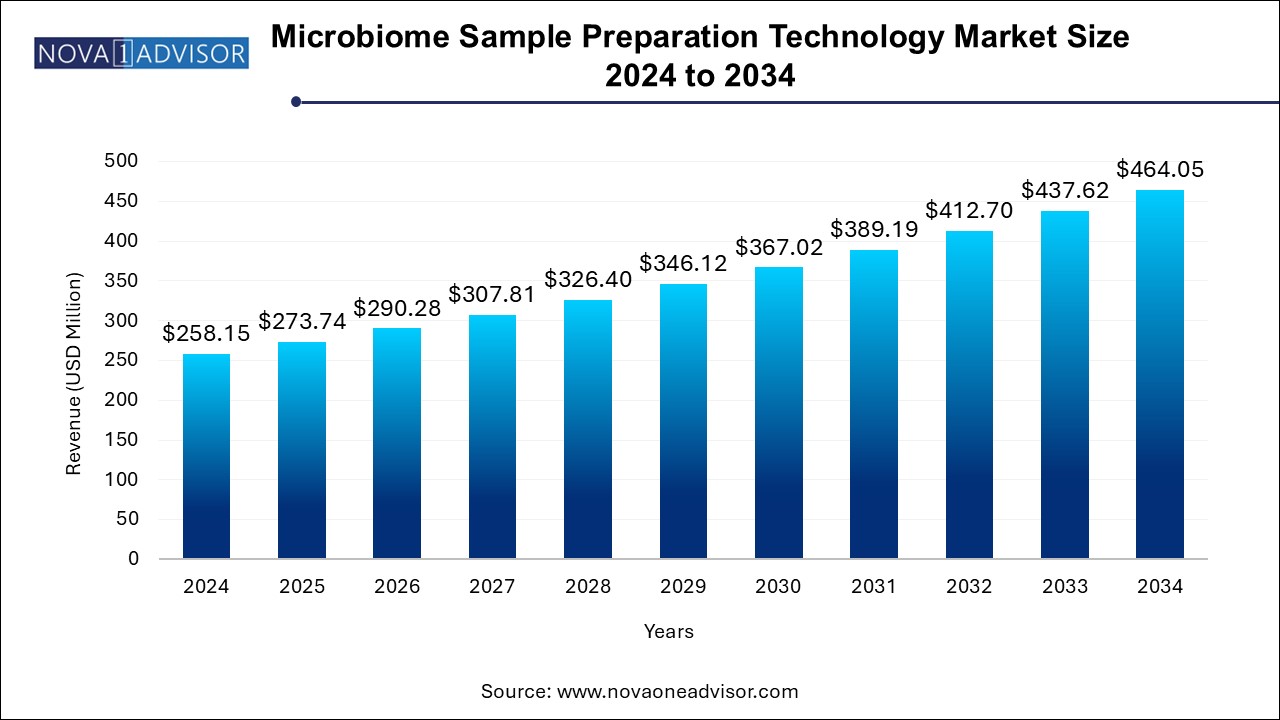

The microbiome sample preparation technology market size was exhibited at USD 258.15 million in 2024 and is projected to hit around USD 464.05 million by 2034, growing at a CAGR of 6.04% during the forecast period 2024 to 2034. Increasing demand for personalized medicine and advanced diagnostic tools in microbiome-related healthcare applications is driving the growth of the microbiome sample preparation technology market.

The microbiome sample preparation technology market is poised for substantial growth as advancements in genomics, biotechnology, and personalized medicine continue to redefine healthcare. The preparation of microbiome samples for research and diagnostic applications, such as DNA/RNA sequencing, metagenomics, and microbial community profiling, requires specialized tools and technologies. These innovations are increasingly integral to understanding human microbiota and their role in health and disease. The market encompasses a variety of products and services, including instruments, consumables, and specialized workflows, catering to a wide array of applications such as disease research, clinical diagnostics, and pharmaceutical development.

| Report Coverage | Details |

| Market Size in 2025 | USD 273.74 Million |

| Market Size by 2034 | USD 464.05 Million |

| Growth Rate From 2024 to 2034 | CAGR of 6.04% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product, Workflow, Application, Disease, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation |

Driver: Increasing demand for personalized medicine

One of the key drivers of the microbiome sample preparation technology market is the rise of personalized medicine. As healthcare continues to shift towards tailored treatments, the role of the microbiome in individual health is becoming more apparent. Personalized treatments often require precise and reproducible microbiome data to ensure optimal patient outcomes. Consequently, the demand for microbiome sample preparation technologies that can handle the complexities of microbiome samples and provide accurate, reproducible results is on the rise. Advances in DNA sequencing technologies, such as whole-genome and RNA sequencing, enable deeper insights into the microbial communities that shape human health, pushing healthcare providers to rely on advanced sample preparation tools.

Restraint: High cost of advanced sample preparation technologies

Despite the growth in demand for microbiome-related research, one significant restraint faced by the market is the high cost associated with advanced sample preparation technologies. Instruments such as high-throughput sequencing systems, along with specialized consumables like extraction kits and library preparation kits, can be prohibitively expensive for smaller laboratories and research institutions. This cost barrier limits the accessibility of these technologies, especially in developing regions. Additionally, the complexity of the workflows involved in microbiome sample preparation requires skilled professionals, further increasing operational costs. These challenges may hinder market growth, especially in cost-sensitive sectors.

Opportunity: Expanding clinical applications for microbiome-based diagnostics

An emerging opportunity in the microbiome sample preparation technology market is the expanding clinical applications for microbiome-based diagnostics. As research on the human microbiome progresses, there is growing interest in utilizing microbiome profiles for diagnosing and predicting various diseases, such as autoimmune disorders, cancer, and gastrointestinal diseases. The use of microbiome-based biomarkers for early diagnosis and treatment monitoring is gaining traction in the medical field, creating a significant market for reliable and scalable sample preparation solutions. By developing tools and technologies that facilitate accurate microbiome sample analysis, companies can tap into this burgeoning market segment and meet the increasing demand for microbiome-based diagnostics.

The consumables segment dominated the market in 2024, with a share of 86.39% and is expected to witness the fastest growth rate over the forecast period. This growth is primarily driven by the increasing demand for purification/extraction kits and DNA library preparation kits, which are essential in microbiome research. These consumables facilitate the extraction, purification, and preparation of DNA and RNA from microbiome samples, ensuring high-quality sequencing results.

The Instruments segment, on the other hand, is expected to experience steady growth due to the longer lifespan of these products, meaning they are purchased less frequently. However, innovations in automated systems, such as those capable of processing multiple samples simultaneously, are expected to contribute to a stable but sustained demand for instruments.

The Sample Extraction/Isolation segment is estimated to dominate the microbiome sample preparation market with a share of 24.09% in 2024. This segment plays a crucial role in microbiome studies, as extracting DNA efficiently from a variety of sample types is essential for generating accurate data. The extraction method varies depending on the sample composition, ensuring that DNA is obtained in high quality without contaminants.

On the other hand, the Library Preparation segment is expected to grow at the fastest rate. As DNA sequencing platforms continue to evolve, the need for advanced methods of preparing samples for sequencing is growing. This process involves several steps, such as DNA fragmentation, adapter ligation, and end repair, which are essential for accurate sequencing and reliable results.

The DNA sequencing segment is estimated to dominate the microbiome sample preparation technology market with a share of 25.65% in 2024. Sequencing technologies, such as next-generation sequencing (NGS), play a pivotal role in microbiome research, enabling the analysis of microbial communities in various health-related studies. As technology advances, sequencing is becoming more cost-effective and accessible, further driving market demand.

Sequencing technologies, such as next-generation sequencing (NGS), play a pivotal role in microbiome research, enabling the analysis of microbial communities in various health-related studies. As technology advances, sequencing is becoming more cost-effective and accessible, further driving market demand.

The diagnostic labs segment is the leading market segment in 2024, holding a 63% share. Diagnostic labs extensively use microbiome sample preparation technologies to analyze microbiomes for the detection of diseases like gastrointestinal disorders, autoimmune diseases, and cancers. The increasing reliance on microbiome analysis in diagnostics is expected to further fuel this segment's dominance.

Additionally, the pharmaceutical and biotechnology industries are expected to experience the fastest growth in the coming years, as these sectors increasingly invest in microbiome-based therapeutics and personalized medicine. The ability to effectively analyze microbiome samples is crucial for the development of targeted treatments for various conditions, thus driving demand for advanced sample preparation technologies.

Gastrointestinal disorders segment dominated the market in 2024, with a share of 53.96%. The analysis of microbiomes is essential for diagnosing and understanding various gastrointestinal issues such as irritable bowel syndrome (IBS), Crohn's disease, and C. difficile infections. The microbiome plays a significant role in gut health, and understanding microbial imbalances is vital for accurate diagnosis and treatment.

However, the autoimmune disorder segment is forecast to experience the fastest growth during the forecast period. Research into the link between autoimmune diseases and the microbiome is expanding, as studies show that microbiome imbalances can influence the development of autoimmune conditions, making this a rapidly growing area in medical research and treatment.

North America dominates the microbiome sample preparation technology market, holding the largest share due to its robust healthcare infrastructure, significant investment in research and development, and advanced healthcare systems. The U.S. is a key player in microbiome-related research, with numerous biotechnology firms, academic institutions, and healthcare providers focusing on microbiome-based diagnostics and therapies. The region's advanced capabilities in genomics, personalized medicine, and precision healthcare further solidify its leadership position in the market.

Asia-Pacific is the fastest-growing region in the microbiome sample preparation technology market. Countries such as China, India, and Japan are experiencing rapid advancements in biotechnology and genomics research. The growing healthcare demand, increased research funding, and the rising adoption of cutting-edge technologies have created favorable conditions for market expansion in this region. The increasing focus on microbiome-based health solutions in Asia-Pacific is expected to drive significant growth in the coming years.

April 2025: Thermo Fisher Scientific announced a new line of next-generation sequencing (NGS) sample preparation kits designed for microbiome research, providing faster and more efficient workflows for microbiome sequencing.

January 2025: QIAGEN launched a new automated platform for microbiome DNA extraction, which improves the consistency and throughput of microbiome research in clinical laboratories.

October 2024: Illumina Inc. introduced a new DNA/RNA extraction system aimed at enhancing sample preparation efficiency for microbiome sequencing, and streamlining workflows in research and clinical settings.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the microbiome sample preparation technology market

Product

Workflow

Application

Disease Type

End-use

Regional