The mortuary bags market size was exhibited at USD 1.59 billion in 2024 and is projected to hit around USD 2.98 billion by 2034, growing at a CAGR of 6.5% during the forecast period 2025 to 2034.

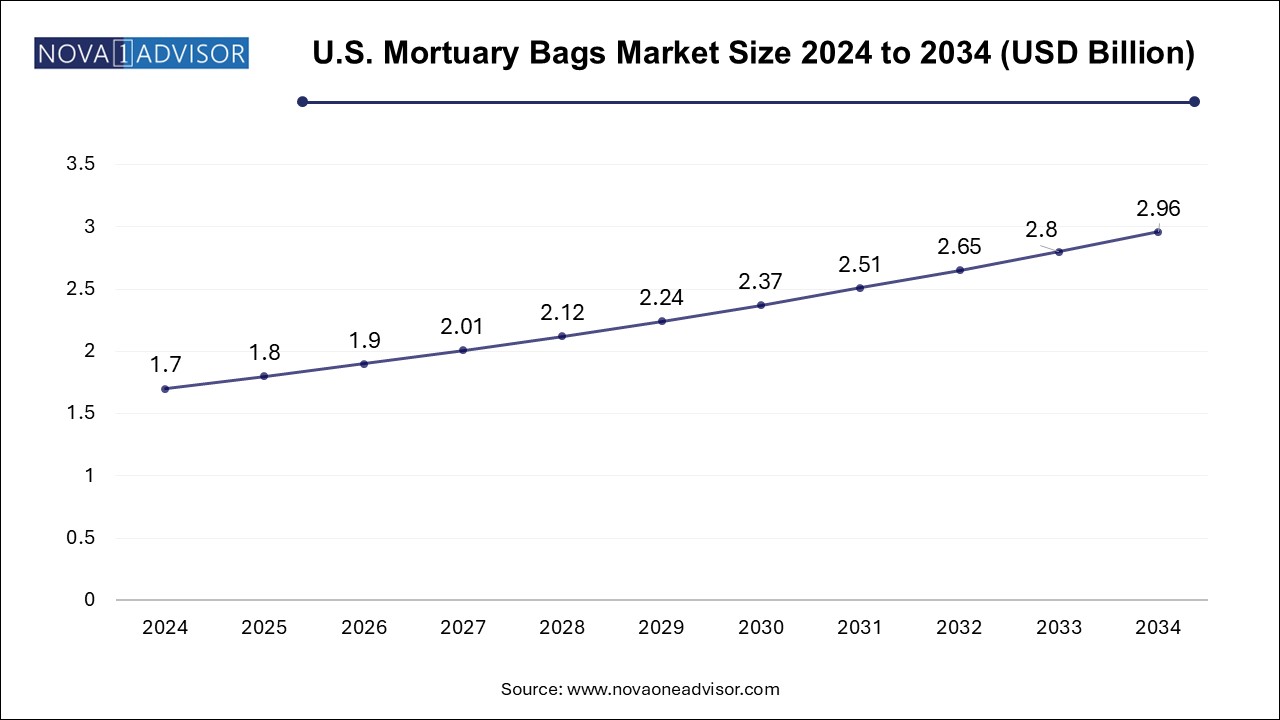

The U.S. mortuary bags market size is evaluated at USD 1.7 billion in 2024 and is projected to be worth around USD 2.96 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

The North America mortuary bags market is expected to experience steady growth driven by several key factors. One major influence is the increasing number of fatalities from road accidents and the rising prevalence of chronic diseases, which create a greater need for effective body-handling solutions in healthcare settings. In addition, product design and materials innovations enhance the functionality and appeal of mortuary bags, making them more suitable for various applications. The aging population and the associated rise in health-related deaths influence the demand for mortuary bags in North America. Hospitals and mortuary services increasingly recognize the importance of reliable and hygienic solutions for managing deceased individuals. Furthermore, the presence of key manufacturers in the region contributes to market growth as they continue to develop advanced products that meet the evolving needs of funeral homes and healthcare facilities. Overall, the North America mortuary bags industry is well-positioned for continued growth as it adapts to changing demographics and healthcare challenges.

U.S. Mortuary Bags Market Trends

The U.S. mortuary bags market is experiencing steady growth, driven by rising road accidents, health-related fatalities, and public health emergencies, particularly pandemics. The increasing prevalence of non-communicable diseases and an aging population further support the demand for mortuary bags. Polyethylene remains the preferred material due to its durability and affordability, with morgues and hospitals being the primary users. The market is expected to continue expanding as the need for efficient post-mortem management solutions grows, particularly in response to ongoing health crises and accidents.

Asia Pacific Mortuary Bags Market Trends

Asia Pacific mortuary bags market dominated the global market with a share of 40.5% in 2024 and is expected to be the fastest-growing region over the forecast period, driven by increasing mortality rates, rising chronic diseases, and the growing number of road accidents in the region. The demand surged further during public health emergencies such as the COVID-19 pandemic, underscoring the need for efficient post-mortem management solutions. Polyethylene remains the material of choice due to its durability and cost-effectiveness, with hospitals and morgues serving as the primary end-users. The market is expected to witness sustained growth, supported by advancements in healthcare infrastructure and increasing awareness within the mortuary bags industry.

China mortuary bags market is expected to experience the fastest growth over the forecast period. This growth is driven by several factors, such as increasing fatalities due to road accidents, health-related issues, and an aging population. The demand for reliable and hygienic solutions for handling deceased individuals is rising, prompting manufacturers to focus on developing high-quality mortuary bags that meet these needs. In addition, there is a growing trend toward eco-friendly options, with companies exploring sustainable materials to address environmental concerns. Cultural practices and regulatory frameworks in China also play a crucial role in shaping the mortuary bags market. The need for specific types of mortuary bags, such as those made from durable materials such as vinyl and polyethylene, is increasing due to their effectiveness in ensuring safe transportation and containment of bodies. The China mortuary bags industry is well-positioned for continued expansion, effectively responding to the growing needs of funeral services and healthcare providers.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.69 Billion |

| Market Size by 2034 | USD 2.98 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 6.5% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Raw Material, Size, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Flexmort; Isofroid; CEABIS (Vezzani Group); Mopec; Peerless Plastics; Classic Plastics Corporation; Auden Funeral Supplies Limited; SmartChoice Funeral Supplies; Eastman Chemical Company; Evonik Industries AG |

The polyethylene segment dominated the market and held the largest revenue share of around 35.4% in 2024, and it is anticipated to witness significant growth over the forecast period. Polyethylene is a lightweight, durable, cheap, and widely produced plastic worldwide. Thus, it is majorly used in manufacturing mortuary bags, which are used to wrap and carry the bodies of patients suffering from non-communicable diseases.

The polyvinyl chloride (PVC) segment is anticipated to witness the fastest growth over the forecast period. PVC is economical and the third most widely produced synthetic plastic. It is used in manufacturing mortuary bags, as it effectively prevents the leakage of body fluids from the bag. These bags are also used in wrapping dead bodies suffering from communicable diseases.

The adult bags segment dominated the market and held the largest revenue share of 46.5% in 2024, owing to the rising prevalence of cardiovascular diseases and the increasing incidence of epidemics and pandemics. For instance, the COVID-19 pandemic has impacted adults more than the young population. Moreover, a growing number of adults suffering from various kinds of heart diseases and disorders is also anticipated to boost market growth over the forecast period.

The child/infant bags segment is expected to experience significant growth, with a CAGR of 6.7% over the forecast period. This growth is primarily driven by the rising number of neonatal and pediatric fatalities, particularly in regions with high rates of preterm births, infections, and congenital conditions. Healthcare systems are continually improving, leading to more infants being born prematurely or with health complications. This progress has increased the need for specialized, smaller-sized mortuary bags. Moreover, heightened awareness of proper handling, safety protocols in neonatal care, and infection control practices fuel the demand for high-quality child/infant mortuary bags.

The morgue segment dominated the mortuary bags market and held the largest revenue share of 44.0% in 2024. Morgues are storage rooms for human corpses awaiting identification or removal for burial or autopsies. These rooms comprise refrigerators to delay the decomposition of dead bodies kept for autopsies or study purposes. In the morgue, human corpses are wrapped in mortuary bags and stored in refrigerators. Moreover, deaths from road accidents and criminal activities have increased in recent years, and the bodies are transferred to the morgue for further investigations.This trend has significantly heightened the demand for mortuary bags.

The hospital segment of the mortuary bags market is expected to see significant growth during the forecast period due to the rising prevalence of non-communicable diseases and increasing mortality rates. Factors such as cardiovascular diseases, respiratory disorders, and other health-related issues are leading to a higher number of deaths in healthcare settings. In addition, the overall increase in road accidents and fatalities contributes to the demand for mortuary bags in hospitals, as these facilities require reliable solutions for handling deceased patients. This growing need for effective and hygienic mortuary solutions will likely drive market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the mortuary bags market

By Raw Material

By Size

By End Use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Mortuary Bags Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Mortuary Bags Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape.

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Mortuary Bags Market: Raw Material Estimates & Trend Analysis

4.1. Raw Material Market Share, 2024 & 2034

4.2. Raw Material Segment Dashboard

4.3. Market Size & Forecasts and Trend Analysis, by Raw Material, 2021 to 2034 (USD Billion)

4.4. PVC

4.4.1. PVC Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

4.5. Polyethylene

4.5.1. Polyethylene Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

4.6. Nylon

4.6.1. Nylon Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

4.7. Polyester

4.7.1. Polyester Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

4.8. Others

4.8.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

Chapter 5. Mortuary Bags Market: Size Estimates & Trend Analysis

5.1. Size Market Share, 2024 & 2034

5.2. Size Segment Dashboard

5.3. Market Size & Forecasts and Trend Analysis, by Size, 2021 to 2034 (USD Billion)

5.4. Adult Bags

5.4.1. Adult Bags Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

5.5. Child/Infant Bags

5.5.1. Child/Infant Bags Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

Chapter 6. Mortuary Bags Market: End Use Estimates & Trend Analysis

6.1. End Use Market Share, 2024 & 2034

6.2. End Use Segment Dashboard

6.3. Market Size & Forecasts and Trend Analysis, by End Use, 2021 to 2034 (USD Billion)

6.4. Hospital

6.4.1. Hospital Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

6.5. Morgue

6.5.1. Morgue Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

6.6. Others

6.6.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Billion)

Chapter 7. Mortuary Bags Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2024 & 2034

7.2. Regional Market Dashboard

7.3. Market Size & Forecasts Trend Analysis, 2021 to 2034:

7.4. North America

7.4.1. North America Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.4.2. U.S.

7.4.2.1. Key Country Dynamics

7.4.2.2. Regulatory Framework

7.4.2.3. Competitive Insights

7.4.2.4. U.S. Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.4.3. Canada

7.4.3.1. Key Country Dynamics

7.4.3.2. Regulatory Framework

7.4.3.3. Competitive Insights

7.4.3.4. Canada Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.4.4. Mexico

7.4.4.1. Key Country Dynamics

7.4.4.2. Regulatory Framework

7.4.4.3. Competitive Insights

7.4.4.4. Mexico Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5. Europe

7.5.1. Europe Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.2. UK

7.5.2.1. Key Country Dynamics

7.5.2.2. Regulatory Framework

7.5.2.3. Competitive Insights

7.5.2.4. UK Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.3. Germany

7.5.3.1. Key Country Dynamics

7.5.3.2. Regulatory Framework

7.5.3.3. Competitive Insights

7.5.3.4. Germany Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.4. France

7.5.4.1. Key Country Dynamics

7.5.4.2. Regulatory Framework

7.5.4.3. Competitive Insights

7.5.4.4. France Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.5. Italy

7.5.5.1. Key Country Dynamics

7.5.5.2. Regulatory Framework

7.5.5.3. Competitive Insights

7.5.5.4. Italy Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.6. Spain

7.5.6.1. Key Country Dynamics

7.5.6.2. Regulatory Framework

7.5.6.3. Competitive Insights

7.5.6.4. Spain Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.7. Denmark

7.5.7.1. Key Country Dynamics

7.5.7.2. Regulatory Framework

7.5.7.3. Competitive Insights

7.5.7.4. Denmark Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.8. Sweden

7.5.8.1. Key Country Dynamics

7.5.8.2. Regulatory Framework

7.5.8.3. Competitive Insights

7.5.8.4. Sweden Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.9. Norway

7.5.9.1. Key Country Dynamics

7.5.9.2. Regulatory Framework

7.5.9.3. Competitive Insights

7.5.9.4. Norway Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6. Asia Pacific

7.6.1. Asia Pacific Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.2. Japan

7.6.2.1. Key Country Dynamics

7.6.2.2. Regulatory Framework

7.6.2.3. Competitive Insights

7.6.2.4. Japan Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.3. China

7.6.3.1. Key Country Dynamics

7.6.3.2. Regulatory Framework

7.6.3.3. Competitive Insights

7.6.3.4. China Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.4. India

7.6.4.1. Key Country Dynamics

7.6.4.2. Regulatory Framework

7.6.4.3. Competitive Insights

7.6.4.4. India Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.5. Thailand

7.6.5.1. Key Country Dynamics

7.6.5.2. Regulatory Framework

7.6.5.3. Competitive Insights

7.6.5.4. Thailand Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.6. South Korea

7.6.6.1. Key Country Dynamics

7.6.6.2. Regulatory Framework

7.6.6.3. Competitive Insights

7.6.6.4. South Korea Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.7. Australia

7.6.7.1. Key Country Dynamics

7.6.7.2. Regulatory Framework

7.6.7.3. Competitive Insights

7.6.7.4. Australia Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.7. Latin America

7.7.1. Latin America Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.7.2. Brazil

7.7.2.1. Key Country Dynamics

7.7.2.2. Regulatory Framework

7.7.2.3. Competitive Insights

7.7.2.4. Brazil Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.7.3. Argentina

7.7.3.1. Key Country Dynamics

7.7.3.2. Regulatory Framework

7.7.3.3. Competitive Insights

7.7.3.4. Argentina Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8. Middle East and Africa

7.8.1. Middle East and Africa Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.2. South Africa

7.8.2.1. Key Country Dynamics

7.8.2.2. Regulatory Framework

7.8.2.3. Competitive Insights

7.8.2.4. South Africa Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.3. Saudi Arabia

7.8.3.1. Key Country Dynamics

7.8.3.2. Regulatory Framework

7.8.3.3. Competitive Insights

7.8.3.4. Saudi Arabia Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.4. UAE

7.8.4.1. Key Country Dynamics

7.8.4.2. Regulatory Framework

7.8.4.3. Competitive Insights

7.8.4.4. UAE Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.5. Kuwait

7.8.5.1. Key Country Dynamics

7.8.5.2. Regulatory Framework

7.8.5.3. Competitive Insights

7.8.5.4. Kuwait Mortuary Bags Estimates and Forecasts, 2021 - 2034 (USD Billion)

Chapter 8. Competitive Landscape

8.1. Participant Overview

8.2. Company Market Position Analysis

8.3. Company Categorization

8.4. Strategy Mapping

8.5. Company Profiles/Listing

8.5.1. Flexmort

8.5.1.1. Participant’s Overview

8.5.1.2. Financial Performance

8.5.1.3. Raw Material Benchmarking

8.5.1.4. Recent Developments/ Strategic Initiatives

8.5.2. Isofroid

8.5.2.1. Participant’s Overview

8.5.2.2. Financial Performance

8.5.2.3. Raw Material Benchmarking

8.5.2.4. Recent Developments/ Strategic Initiatives

8.5.3. CEABIS (Vezzani Group)

8.5.3.1. Participant’s Overview

8.5.3.2. Financial Performance

8.5.3.3. Raw Material Benchmarking

8.5.3.4. Recent Developments/ Strategic Initiatives

8.5.4. Mopec

8.5.4.1. Participant’s Overview

8.5.4.2. Financial Performance

8.5.4.3. Raw Material Benchmarking

8.5.4.4. Recent Developments/ Strategic Initiatives

8.5.5. Peerless Plastics

8.5.5.1. Participant’s Overview

8.5.5.2. Financial Performance

8.5.5.3. Raw Material Benchmarking

8.5.5.4. Recent Developments/ Strategic Initiatives

8.5.6. Classic Plastics Corporation

8.5.6.1. Participant’s Overview

8.5.6.2. Financial Performance

8.5.6.3. Raw Material Benchmarking

8.5.6.4. Recent Developments/ Strategic Initiatives

8.5.7. Auden Funeral Supplies Limited

8.5.7.1. Participant’s Overview

8.5.7.2. Financial Performance

8.5.7.3. Raw Material Benchmarking

8.5.7.4. Recent Developments/ Strategic Initiatives

8.5.8. SmartChoice Funeral Supplies

8.5.8.1. Participant’s Overview

8.5.8.2. Financial Performance

8.5.8.3. Raw Material Benchmarking

8.5.8.4. Recent Developments/ Strategic Initiatives

8.5.9. Eastman Chemical Company

8.5.9.1. Participant’s Overview

8.5.9.2. Financial Performance

8.5.9.3. Raw Material Benchmarking

8.5.9.4. Recent Developments/ Strategic Initiatives

8.5.10. Evonik Industries AG

8.5.10.1. Participant’s Overview

8.5.10.2. Financial Performance

8.5.10.3. Raw Material Benchmarking

8.5.10.4. Recent Developments/ Strategic Initiatives