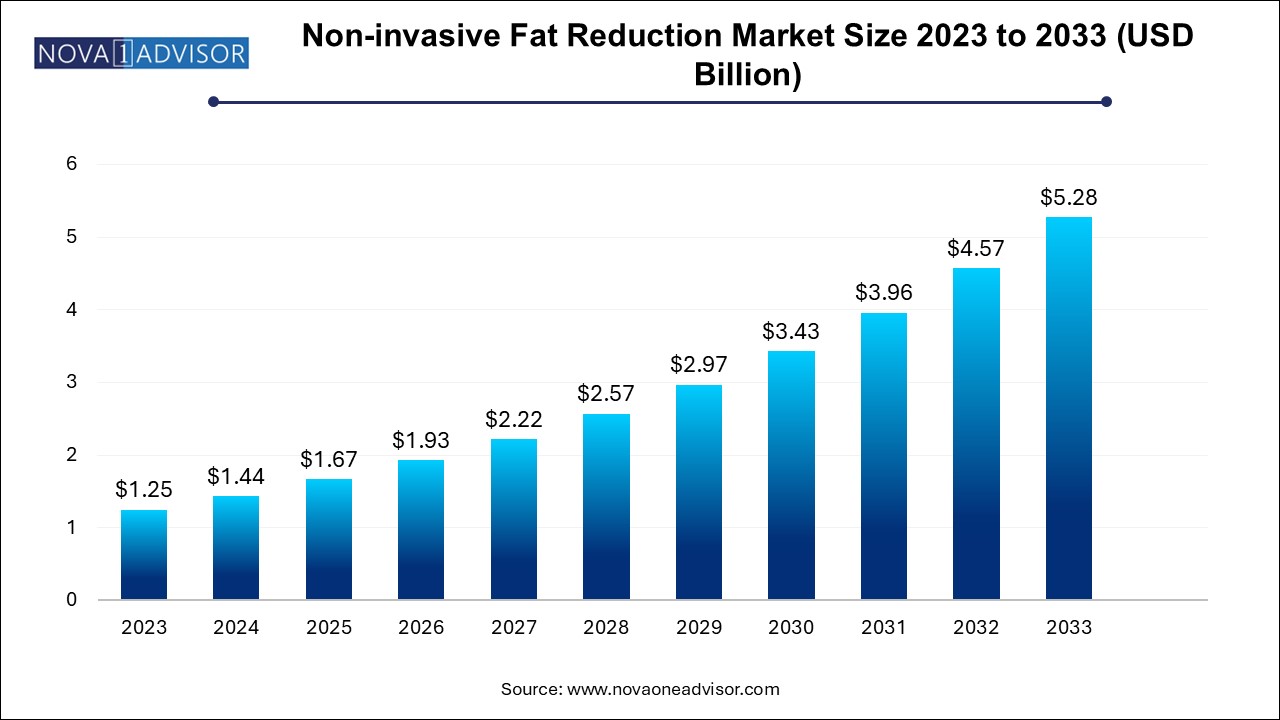

The global non-invasive fat reduction market size was exhibited at USD 1.25 billion in 2023 and is projected to hit around USD 5.28 billion by 2033, growing at a CAGR of 15.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.44 Billion |

| Market Size by 2033 | USD 5.28 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Cynosure; Fosun Pharmaceuticals Co. Ltd.; Cutera Inc.; Zeltiq Aesthetics; Candela Corp.; BTL Industries; Venus Concept; Lynton Lasers Ltd.; AbbVie Inc.; Hologic, Inc. |

Non-invasive fat reduction is a procedure carried out to remove excess fat from certain parts of the body by using methods, such as laser, lipolysis, cryolipolysis, and radiofrequency. Non-invasive devices used in these procedures are FDA-approved as their safety & efficiency have been tested and have shown significant results. In March 2023, the FDA approved the EON Smarter Body Contouring device manufactured by Dominion Aesthetics Technologies, Inc. for the treatment of back and thighs. The device is designed with state-of-the-art technology, which offers maximum flexibility and can be used for the treatment of all patients.

These procedures are to be carried out by professional practitioners who are technically sound to execute these treatments. Some of the famous brands for non-invasive fat reduction procedures are CoolSculpting, Kybella, Vanquish, and Sculpsure. The COVID-19 pandemic had a negative impact on the growth of this market. Since the lockdown guidelines instructed the delay of several elective procedures, the demand for non-invasive fat reduction devices was also reduced. Most of the clinics were on the verge of shutting down as a result of a lesser number of procedures and disruption in production and supply chain. However, with the easing of lockdown restrictions, a surge in aesthetic surgeries was observed in the following years.

According to a study published in the National Library of Medicine in January 2023, in 2021, the number of cosmetic surgeries related to aesthetic, plastic, and reconstructive surgeries increased by 49.4% compared to 2020 and 29.7% compared to 2019. The sedentary lifestyle of people is expected to further propel the growth of this market as it leads to obesity and other diseases. According to an article released by the World Health Organization in October 2023, around 500 million people around the globe are likely to develop obesity, heart disease, and other chronic disorders by 2030 due to their sedentary lifestyle.

Moreover, physical inactivity, tedious & long working hours, behavioral risk factors like alcohol consumption, and smoking, as well as stress increase the risk of developing conditions like diabetes and obesity. Rapid urbanization has limited people’s time to focus on their physical health and, therefore, they have to rely on alternate options to reduce stubborn fat. Increasing acceptance and rising demand for body contouring treatments, rise in healthcare expenditure, increasing disposable income, and high cases of obesity are the key factors boosting the growth of the market. For instance, an article released by the WHO in March 2023 suggests that more than 1 billion people in the world including 650 million adults and 340 million adolescents were obese, and this number is expected to increase further over the forecast period.

According to a global survey released by the International Society of Aesthetic Plastic Surgery in January 2023, nearly 17.5 million non-surgical procedures were performed in 2021, which shows an increase of 54.4% over the last four years. Treatments for males and females were 125,311 and 605,669 respectively. The technological advancements in this field that offer quick and efficient results can be attributed to this growth. Moreover, the ease of conducting such procedures and their affordability are attracting millennials, even more, to opt for these treatments.

On the basis of technology, the global market has been further segmented into cryolipolysis, ultrasound, low-level lasers, and others. The cryolipolysis segment accounted for the largest share of 34.3% of the overall revenue in 2023 and is expected to grow at the fastest CAGR of 16.7% over the forecast period. It is a non-invasive method where cold temperatures are used to freeze and kill the fat in the targeted area, which is then drained out of the body over two to six months by the metabolic pathways.

According to a survey by American Society for Dermatologic Surgery, approximately 257, 968 cryolipolysis treatments were carried out in 2019 and cryolipolysis was the most common non-surgical aesthetic procedure in 2021. The demand for cryolopolysis technology is expected to increase further as people are choosing a minimal risk-related treatment that delivers instant and long-term results. Moreover, it is a more cost-effective method with very common complications like temporary discomfort and no downtime. A lot of campaigns have been launched by various key players to create awareness regarding the safety and benefits of these devices.

On the basis of end-use, the market is segmented into hospitals, standalone practices, multispecialty clinics, and others. The hospital segment held the largest market share of 52.3% in 2023 and is expected to grow at the fastest CAGR of 16.4% over the forecast period. This is mainly because the hospital settings are well equipped with high-end technology, fat reduction devices, professional practitioners, and the necessary infrastructure to carry out such procedures. Moreover, there is a sense of trust and reliability when the treatment is conducted in a hospital, and hospital accreditation also influences the patient’s preference for undergoing aesthetic procedures.

The segment is expected to grow further due to the increasing prevalence of obesity and other diseases. For instance, in 2020, the WHO stated that obesity has been tripling since ancient times and the desire to cut down the fat is eventually growing. This is likely to boost the demand for non-invasive fat reduction and propel market growth over the forecast period. The multispecialty clinic segment is also expected to show significant growth in the forecast period as they serve all the needs of the patients in one convenient location with procedural variations and the availability of skilled practitioners.

North America dominated the market and accounted for the largest revenue share of 38.6% in 2023. This can be attributed to the rising obese population, increasing R&D in the region, the highest per capita disposable income, rising adoption of new technology, and constant awareness campaigns. The increasing need for perfect appearance and confidence through physical characteristics in the major fields of work is driving the regional market growth. The development of convenient procedures and easy access to healthcare facilities further add to the growth of the in the country.

According to the International Society of Aesthetic Plastic Surgery, the U.S. is the country with the most nonsurgical procedures, and 3,182,815 treatments were carried out in 2020. The Asia Pacific market is expected to witness the highest CAGR of 17.4 % over the forecast period. This growth can be attributed to the availability and benefits of body contouring treatments, rising patient awareness, low cost of treatment, rising demand for aesthetics, adoption of Western culture, and marketing strategies implemented by the key players. The combination of all these factors is expected to propel market growth in the Asia Pacific region over the forecast period.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global non-invasive fat reduction market

Technology

End-use

Regional