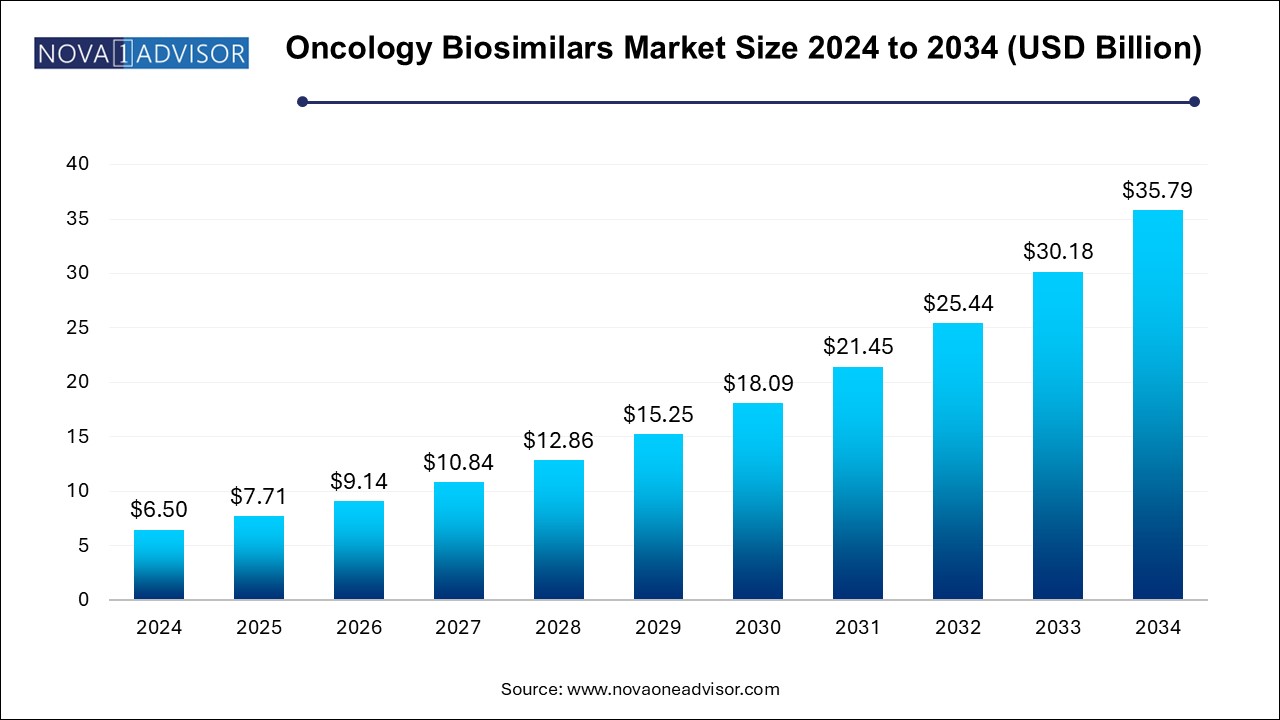

The oncology biosimilars market size was exhibited at USD 6.50 billion in 2024 and is projected to hit around USD 35.79 billion by 2034, growing at a CAGR of 18.6% during the forecast period 2024 to 2034.

A biosimilar is a biological product that closely mimics and is identical to a previously approved reference product. These are less expensive than branded or certified items. Several oncology biologics have already lost their patents, and others are about to expire. Biosimilars are predicted to gain popularity as more products lose their patents. Leading generic companies including Allergan Plc., Teva Pharmaceutical Industries Ltd., Mylan N.V., and Sandoz (a Novartis International AG division) are likely to benefit from these patent expirations and position themselves as market leaders in oncology biosimilars.

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team also includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

| Report Coverage | Details |

| Market Size in 2025 | USD 7.71 Billion |

| Market Size by 2034 | USD 35.79 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 18.6% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Key Companies Profiled | Pfizer Inc. (U.S.), GlaxoSmithKline plc (U.K.), Novartis AG (Switzerland), Mylan N.V. (U.S.), Teva Pharmaceutical Industries Ltd.(Israel), Sanofi (France), F. Hoffmann-La Roche Ltd. (Switzerland), Zydus Cadila (India), Lupin (India), Amneal Pharmaceuticals LLC. (U.S.), Cipla Inc. (U.S.), Aurobindo Pharma (India), Glenmark Pharmaceuticals Limited (India), Eli Lilly and Company (U.S.), Sun Pharmaceutical Industries Ltd. (India), Allergan (Ireland), Bristol-Myers Squibb Company (U.S.), Takeda Pharmaceutical Company Limited (Japan), BIOCAD (Russia), Apotex Inc. (Canada), Endo International plc (Ireland) |

Market Definition

A biosimilar is a generic counterpart of a well-known biologic medicine. Medications made from living substances such as cells, tissues, or proteins are known as biologic drugs. A biosimilar is a medication that is based on a biologic drug that has already been studied, produced, clinically tested for safety and effectiveness, and authorized by the US Food and Drug Administration (FDA). Since the biosimilar is based on the approved drug, the biologic medications are commonly referred to as reference drugs. The functions of biosimilar are same as the reference drugs and it is dependent to FDA approval.

Rise in the prevalence of cancer

The surging prevalence of cancer is a major factor driving the oncology biosimilars market's growth rate during the forecast period of 2022-2029. Cancer is a lifestyle disease caused by abnormal cell proliferation that can lead to the formation of a tumor. Biological medications, often known as biologics, are used in the majority of effective cancer treatments nowadays, including targeted therapies and immunotherapies. These medications are derived from living creatures such as bacteria, animal or plant cells, yeast and they require complicated manufacturing techniques and a long development time. The development of biosimilars of branded cancer biologics is gaining popularity as a way to reduce treatment costs.

Growing number of government initiatives

The rising initiatives by government is expected to expand the oncology biosimilars market. Additionally, Biosimilars are being promoted by governments in a number of nations as a cost-cutting solution. The United States Food and Drug Administration (USFDA), for instance, has created educational materials for physicians and patients on biosimilars.

Furthermore, sedentary lifestyle of people and surging geriatric population will result in the expansion of oncology biosimilars market. Along with this, rising healthcare expenditure and increasing demand for biosimilar drugs due to their cost-effectiveness will enhance the growth rate of the market.

Increase in the number of research and development activities

The rising number of research and development activities for new indications and patent expiry of biologics is estimated to create new opportunities for the oncology biosimilars market growth in coming years. The players are investing in these research activities in order to test different formulas and increase revenue. The competitors also engage in strategic alliances, which aid in significantly affecting the oncology biosimilars market's growth rate.

Moreover, rising investment for the development of advanced technologies and increase in the number of emerging markets will further provide beneficial opportunities for the oncology biosimilars market growth during the forecast period.

Restraints/Challenges

On the other hand, high cost associated with the drug development and distribution will obstruct the growth rate of market. The lack of healthcare infrastructure in developing economies and dearth of skilled professionals will challenge the oncology biosimilars market. Additionally, regulatory as well as clinical barriers and resistance from biologics manufacturers will act as restrain and further impede the growth rate of market during the forecast period of 2022-2029.

This oncology biosimilars market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the oncology biosimilars market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Patient Epidemiology Analysis

Oncology biosimilars market also provides you with detailed market analysis for patient analysis, prognosis and cures. Prevalence, incidence, mortality, adherence rates are some of the data variables that are available in the report. Direct or indirect impact analyses of epidemiology to market growth are analysed to create a more robust and cohort multivariate statistical model for forecasting the market in the growth period.

The COVID-19 outbreak and subsequent lockdown in numerous countries around the world had a huge impact on the financial status of enterprises in all sectors. The private healthcare sector is one of the areas where the pandemic had a significant impact. The coronavirus pandemic had a significant influence on medicine development, production, and supply, as well as on the businesses of different healthcare corporations around the world. The outbreak has resulted in the shutdown of industrial establishments, with the exception of those that manufacture critical commodities, and disruptions in product supply chains. As a result, the COVID-19 outbreak had impacted the economy in by causing supply chain channel disruptions, and having a financial impact on firms and financial markets. Due to supply chain concerns, the pandemic also harmed generic manufacturers, who supply the majority of market volume. This is predicted to slow down output. However, in the short run, this could raise drug prices. In addition, the innovative medicine producers are likely to cover the supply gap, resulting in a lesser overall market impact

The oncology biosimilars market is analysed and market size insights and trends are provided by country, indication, drug class, route of administration, end-users and distribution channel as referenced above.

The countries covered in the oncology biosimilars market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the oncology biosimilars market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and rising healthcare expenditure will further propel the market’s growth rate in this region. Additionally, surging prevalence of cancer will further propel the market’s growth rate in this region.

Asia-Pacific is expected to grow during the forecast period of 2022-2029 due to large number of generic manufacturer in this region. Also, development of healthcare infrastructure and rising geriatric population will further propel the market’s growth rate in this region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

By indication, breast cancer segment dominated the market in 2024. The rising incidents and deaths from breast cancer are developing the need for effective biosimilars in oncology therapies. Several factors lead to the development of breast cancer such as age, genetics, lifestyle habits, reproductive history, use of oral contraceptives, exposure to radiation and psychological conditions. Improved diagnostic imaging techniques for detection, advancements in biosimilar based therapies, availability of better treatment options, rising government support, studying of demographic trends and heightened awareness among women are the factors expanding the market. Biosimilars can be used for treating early and metastatic breast cancer while reducing the cost of medications and increasing the access to treatments. Currently, there are multiple approved biosimilars by the U.S. FDA available in the market which can used for treating breast cancers and their side effects also.

Lung cancer segment is anticipated to grow rapidly over the forecast period. The rising prevalence of non-small cell lung cancer (NSCLC) is propelling the market growth. Lung cancer can be caused due to various factors such as smoking, passive smoking, radon, family history, radiation therapy, age, HIV infection and other diseases. The ongoing researches for studying safety, potency and long-term side effects of biosimilars, alternatives for original biologics and clinical trials demanding effective treatment options for lung cancer is driving the market growth. Moreover, the accelerated approvals by regulatory agencies is increasing the acceptance and adoption of the biosimilars in the market. For instance, in Dec 2024, Merus, a clinical-stage oncology company has entered in an agreement with Partner Therapeutics by licensing the right to commercialize zenocutuzumab, branded as Bizengri drug for the targeted treatment of NRG1 fusion-positive (NRG1+) NSCLC and NRG1 fusion-positive pancreatic adenocarcinoma in patients who have had disease progression during or after prior systemic therapy. Also, the FDA has granted an accelerated approval for Bizengri.

By drug class, the granulocyte colony-stimulating factor (G-CSF) segment dominated the market in 2024. They are used for preventing neutropenia (low white blood cell [WBCs] count) in cancer patients taking chemotherapy by stimulating the bone marrow to produce more WBCs proving as a safe, efficient and cost-effective alternative. Furthermore, the integration of AI can be applied for analysing patient data to predict who will benefit most from G-CSF biosimilars prophylaxis and provide personalized treatment plans by monitoring potential side effects which will ultimately improve patient care. The rising expirations of G-CSF biologics, increased regulatory approvals, driving competition among market players to expand their biosimilars portfolio are embracing the adoption of oncology biosimilars thereby expanding the market. For instance, in Oct 2024, Meithal pharmaceuticals, a biopharmaceutical company expanded its biosimilars portfolio by signing a licensing agreement with its parent company, Hong Kong King-Friend Industry Co., for the marketing and distribution of two oncology biosimilars pegfilgrastim and filgrastim in the U.S. These medications are bone marrow stimulants which work by binding to G-CSF receptors supporting WBCs production in patients undergoing chemotherapy.

Monoclonal antibody (mAb) biosimilars segment is anticipated to grow rapidly during the forecast period. The biosimilars are effective in targeting tumors and slowing progression thereby boosting the immune responses. Additionally, the development of chimeric antigen receptors T (CAR-T) cells which are engineered by utilizing a part of monoclonal antibody called as single-chain variable fragment (scFv) within their CAR for specifically targeting cancer cells by using antibody-like recognition ability from a mAb. Furthermore, the advancements in R&D of new mAb with increased availability and affordability and the rise in regulatory approvals is expanding the market growth of this segment. For instance, in June 2024, Biocon Biologics Ltd., a biosimilars company announced its regulatory approval from European Medicines Agency (EMA) for manufacturing biosimilar Bevacizumab which is applied for targeted cancer treatment of various types. The biosimilar will be manufactured in Bengaluru at the company’s new multi-product mAbs drug substance facility.

The intravenous segment dominated the market in 2024. Most of the oncological biosimilars are administered intravenously (IV) i.e. they are directly injected into the patient’s bloodstream which the commonly used route of administration for cancer biosimilars just like their reference biologics. The IV route allows for a controlled and targeted drug while eliminating the first-pass metabolism and thereby helping achieve 100% bioavailability. These factors make them a popular option for drug delivery in chemotherapy and cancer treatments which helps in fuelling the market growth of this segment. Moreover, the accessibility and availability of IV oncology biosimilars helps in reducing treatment costs leading to increased adoption and improved life quality for patients. Some of the commonly administered intravenous oncology biosimilars include bevacizumab (for various cancers), trastuzumab (breast cancer), rituximab (lymphoma).

By end-users, the hospital segment dominated the market share in 2024. Hospitals are the primary treatment centres which provide treatments for cancers. They actively utilize oncology biosimilars for bringing safer, cost-effective and affordable treatments for patients. Furthermore, hospitals often lead the way in adopting new biosimilars and also carefully supervise clinical trials and evaluations for ensuring the safety and efficacy of their biosimilars in their patient population. Additionally, oncologists in hospitals play an important role in educating patients about biosimilars thereby promoting the market growth of this segment.

The rise in specialty clinics is experiencing the fastest growth in the market. The increasing popularity and collaborations among oncologists for implementing safe, effective treatments for cancer patients has given rise to the adoption of specialty clinics which include specialized cancer diagnosis, treatment and research facilities. These clinics are well equipped with cutting edge cancer diagnosis and treatment equipment which fuel to the market growth of this segment. Furthermore, they specialize in developing new therapies, conducting clinical trials and also provide chemotherapy to the patients which includes prescribing biosimilars for providing cost-effective treatments and increases the adoption of the patients to treatment thereby promoting the overall market growth.

Based on distribution channel, the hospital pharmacy segment dominated the market generating the most profit. Hospitals are the major centres for providing cancer therapies and treatments alongwith the administration of biosimilars for cancer patients. Hospital pharmacies can help in contributing towards the biosimilars market by including formulary management systems for identifying and selecting suitable biosimilars, using clinical decision support tools for educating providers on using biosimilars, tracking patient medication records for biosimilar substitutions, and educating the pharmacists on proper handling and effective communication strategies on biosimilars for increasing awareness among patients which will ultimately facilitate the safe and effective distribution network on oncology biosimilars within the hospital setting thereby fuelling the market growth of this segment.

The retail pharmacy distribution channel is experiencing the fastest growth in the market. The availability, accessibility and the rising demand of oncology biosimilars from retail pharmacy stores by dispensing them directly to the cancer patients is expanding the market. Furthermore, by educating the patients the benefits of switching to a biosimilar option, actively promoting their availability, communicating the price transparency, managing formularies to include biosimilars and interacting with healthcare providers for ensuring proper patient selection and switching can help in providing safer, cost-effective treatment options to patients while maintaining the standards can help in improve patient life quality. Also, by implementing patient support programs, understanding the interchangeability status of biosimilars, staying updated with latest clinical data and training the staff on the applications of biosimilars is driving the market growth of this segment.

North America dominated the oncology biosimilars market in 2024. The presence of advanced healthcare infrastructure, rising awareness among people on using biosimilars and the support from government initiatives attributes to the dominance of this region in the market. Moreover, the increasing drug approvals from the FDA for biosimilars, strategic collaborations among industries, researchers and academia as well as the investments and funding’s from various organizations to improve the life quality for the large cancer population in this region are driving the market growth.

The Asia Pacific oncology biosimilars market is expected to grow rapidly during the forecast period. The rising prevalence of cancer patients in the region and the increased adoption of the people to use biosimilars due to their cost-effectiveness is driving the market growth. Moreover, the growing patient awareness for early detection and treatment with advances in the healthcare infrastructure and researches in clinical trials are increasing the use of oncology biosimilars in this region. Further, the rising regulatory approvals are increasing the presence of companies developing and manufacturing oncology biosimilars in this region. For instance, in June 2024, Aurobindo Pharma received marketing authorisation for Trastuzumab drud in India. The drug is indicated in treatment of some types of breast cancer.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the oncology biosimilars market

Indication

Drug Class

Route of Administration

End-Users

Distribution Channel