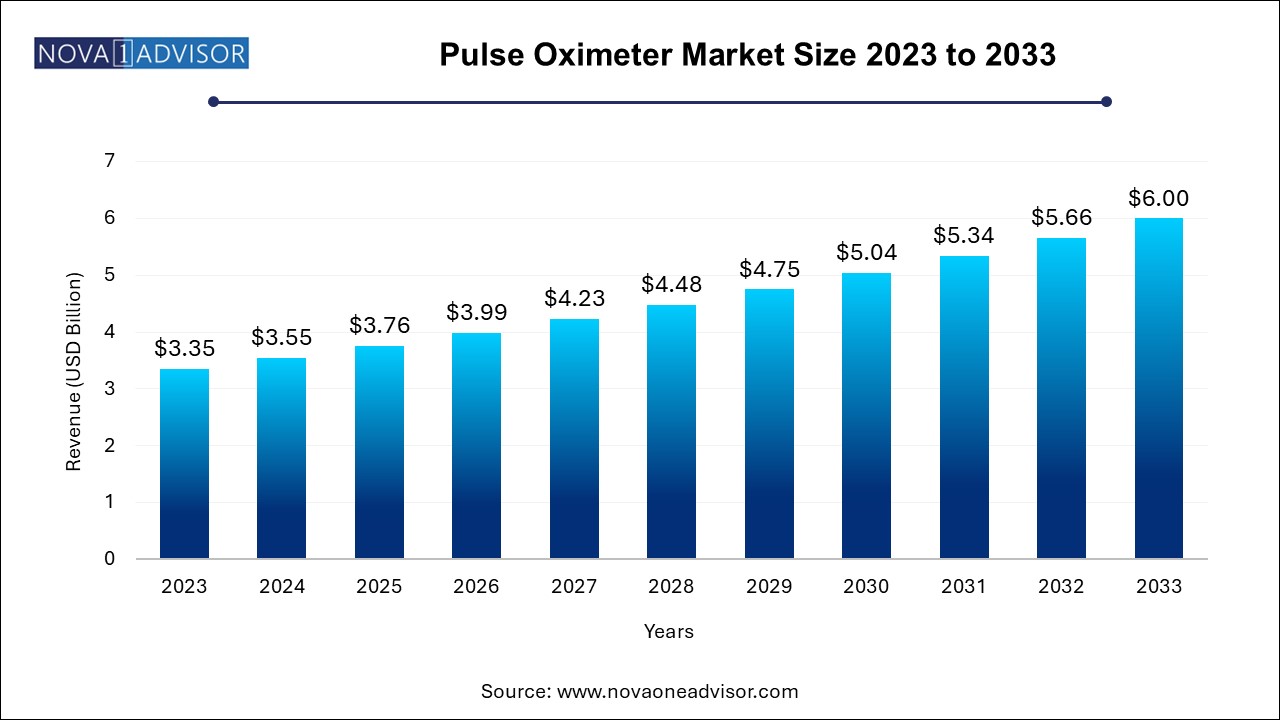

The global pulse oximeter market size was exhibited at USD 3.35 billion in 2023 and is projected to hit around USD 6.0 billion by 2033, growing at a CAGR of 6.0% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.55 Billion |

| Market Size by 2033 | USD 6.00 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.0% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Type, Age Group, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Medtronic; Masimo; Koninklijke Philips N.V.; GE HealthCare; Nonin; NIHON KOHDEN CORPORATION; ICU Medical, Inc.; OSI Systems, Inc.; CONTEC MEDICAL SYSTEMS CO., LTD; Drägerwerk AG & Co. KGaA |

The rising incidence of respiratory and cardiovascular diseases worldwide is expected to drive the demand for continuous monitoring devices, including pulse oximeters. According to World Health Federation 2023 insights, cardiovascular diseases impact over 500 million individuals globally, leading to 20.5 million fatalities in a year, which represents nearly one-third of all deaths worldwide. Moreover, factors such as technological advancements, strategic partnerships among key players, and the rising adoption of home healthcare & remote patient monitoring are driving the pulse oximeters market growth.

Technological advancements in pulse oximeters have made them more accurate and cost-effective, driving market demand. Traditional pulse oximeters use transmittance technology, where light passes through tissue. In contrast, reflectance pulse oximetry measures light reflected from tissue, allowing more flexible placement, including on the forehead and chest, which is particularly useful for patients with poor peripheral circulation.

Increased Accuracy and Cost-Effectiveness: Technological advancements in pulse oximeters have made them more accurate and cost-effective, driving market demand. Traditional pulse oximeters use transmittance technology, where light passes through tissue. In contrast, reflectance pulse oximetry measures light reflected from tissue, allowing more flexible placement, including on the forehead and chest, which is particularly useful for patients with poor peripheral circulation.

For instance, in March 2023, OxiWear, a U.S.-based health technology startup, launched a wireless, ear-mounted pulse oximeter designed to continuously monitor oxygen levels and notify users of low oxygen. Equipped with an optical sensor and Bluetooth LE technology, it transmits health metrics to a smartphone app. In addition, it provides data on SpO2 levels and heart rate and allows users to specify emergency contacts.

The increasing incidence of respiratory disorders, fueled by factors such as overconsumption of alcohol & tobacco, sedentary lifestyles, unhealthy diets, and obesity, is expected to drive demand for technologically advanced pulse oximeters. For instance, statistics from the American College of Allergy, Asthma & Immunology in June 2023, indicate that approximately 7.7% of Americans suffer from asthma. Furthermore, the following figure depicts the projected proportion of deaths attributed to leading respiratory causes, highlighting the critical need for advanced monitoring technologies in healthcare settings.

Furthermore, the COVID-19 pandemic intensified existing vulnerabilities within oxygen delivery systems. The virus caused acute respiratory failure characterized by hypoxemia, which required oxygen administration. This led to a surge in demand for pulse oximeters due to their effectiveness in measuring peripheral blood oxygen saturation. In addition, the demand for other critical medical products also increased, contributing to robust growth of certain companies in the market.

For instance, Bloomreach, a vendor in e-commerce solutions, highlighted a surge in U.S. market demand for fingertip pulse oximeters. The reporting period began with a 506% increase in sales for the week of February 17, 2020, followed by a subsequent 168% rise in the week of February 24, 2020. Although demand showed a relative plateau, a slight downturn was observed in early April 2020. Demand resurged by mid-May, leading to stock shortages at major retailers like Walgreens, CVS, and Target, including backorders and delays.

The monitors segment dominated the market and accounted for the largest share of 65.0% of the global revenue in 2023. The segment growth is driven by the critical role of monitors in continuous and accurate monitoring of blood oxygen saturation and pulse rate, essential in both clinical & home settings. In addition, the increasing prevalence of respiratory and cardiovascular diseases and the rapidly aging population propel the demand for reliable monitoring solutions. Furthermore, the increase in approvals and support initiatives by companies is contributing to the overall market growth. For instance, in June 2023, Masimo received 510(k) clearance from FDA for its Radius VSM, a wearable device designed to continuously monitor multiple vital parameters.

However, the sensors segment is expected to grow at the fastest CAGR from 2024 to 2030. Sensors offer enhanced accuracy in oxygen saturation (SpO2) measurements, which is critical for diagnosing respiratory conditions and monitoring patients in various healthcare settings. Moreover, as the market shifts toward consumer-centric technology, patient-centric monitoring outcomes are improving, impacting the pulse oximeter sensors market with the launch of better technology products. For instance, in November 2022, BioIntelliSense launched its patented, FDA-cleared pulse oximetry sensor chipset and associated processing technology.

The tabletop/bed side pulse oximeter segment dominated the market, with the largest share of 58.2% in 2023. The adoption of tabletop/bedside pulse oximeters is driven by its wide application in various healthcare environments including hospitals, clinics, emergency departments, surgical theaters, intensive care units, and post anesthesia care units. Moreover, increasing awareness regarding the efficiency and reliability of bedside pulse oximeters in detecting SpO2 levels is contributing to the market growth. For instance, in February 2021, Medtronic published the results of a study designed to determine the effectiveness and dependability of Nellcor Bedside SpO2 Patient Monitoring System when evaluated against electrocardiography monitoring in cesarean deliveries involving 60 full-term infants. The findings indicated that the Nellcor device successfully established stable signals in all 60 cases. For the subgroup, it was noted that the Nellcor pulse oximeter achieved stability significantly faster, averaging 15 seconds.

The portable pulse oximeter segment is expected to grow at the fastest CAGR over the forecast period. The adoption of portable pulse oximeters is increasing due to their convenience and critical role in monitoring oxygen levels and respiratory health. Leading companies such as Medtronic, Masimo, and Koninklijke Philips N.V. have advanced models, including fingertip, handheld, and wearable types. These devices are increasingly utilized in hospitals, home care, and long-term care facilities due to their accuracy, ease of use, and real-time data tracking capabilities, which enhance patient management and outcomes, especially amid rising prevalence of respiratory conditions and growing health awareness.

The adult segment dominated the market, with the largest share of 62.6% in 2023. Market players are investing in developing wearable pulse oximeters capable of detecting deviations in SpO2 levels. For instance, a study published by Cosinuss GmbH in November 2023, demonstrated that c-med alpha, a portable in-ear pulse oximeter, accurately assessed blood oxygen saturation and pulse rate in healthy adults experiencing normobaric hypoxia at rest, conforming to the ISO 80601-2-61 standards for medical devices. Growing awareness among physicians and patients regarding the benefits of pulse oximeters in managing postoperative complications is fueling market growth.

The pediatric segment is expected to grow significantly over the forecast period. The rising demand is compelling market players to invest in technologically advancing pulse oximeters. This has led to increased approvals, which are expected to fuel market growth over the forecast period. For instance, in November 2023, the FDA granted De Novo clearance to the Dream Sock, an over-the-counter medical device designed for infant monitoring by Owlet. This device uses pulse oximetry technology to provide real-time health metrics, such as pulse rate & oxygen saturation levels, and includes a notification system that alerts caregivers through visual & auditory alarms when an infant's measurements deviate from established norms.

The hospitals segment dominated the market, with the largest share of 42.8% in 2023. Due to the wide application of pulse oximeters in clinical settings, prominent players in the market are investing in the development of technologically advanced pulse oximeters capable of integrating with the healthcare facility’s existing system and providing continuous patient monitoring.

For instance, in November 2021, Masimo introduced its Dual SET Pulse Oximetry technology for the Root platform, enhancing its utility as a comprehensive patient monitoring and connectivity solution. This innovation represents notable progress in the application of Masimo SET technology for Critical Congenital Heart Disease (CCHD) screening, marked by gaining CE approval and its introduction in Europe accompanied by the Masimo SET MOC-9 module and the integration of the Eve CCHD Newborn Screening Application into Root. This synergy facilitates automated newborn screenings through Dual SET Oximetry, which conducts concurrent pre- & post-ductal oxygen saturation (SpO2) measurements, employing the intuitive Eve application tailored to meet specific CCHD screening protocols of hospitals.

The home care segment is expected to grow at the fastest CAGR over the forecast period. The adoption of pulse oximeters for home care has surged in recent years, driven by the increasing awareness regarding the benefits associated with their use in chronic respiratory and cardiovascular conditions. Companies manufacture these devices to offer a convenient, noninvasive way to monitor oxygen saturation & heart rate, enabling timely intervention and better disease management. For instance, in January 2023, Royal Philips and Masimo extended their collaboration to enhance patient monitoring features for home telehealth by integrating Masimo’s W1 health tracking watch. This integration with Philips’s patient monitoring ecosystem elevates telehealth and telemonitoring capabilities.

North America dominated the pulse oximeter market with a revenue share of 39.4% in 2023. The North America pulse oximeter market is witnessing robust growth driven by several critical factors, including rising prevalence of chronic respiratory conditions, aging population, increasing adoption of remote patient monitoring technologies, and technological advancements & integration. For instance, in May 2022, Medtronic announced FDA 510(k) clearance for Nellcor OxySoft SpO2 sensor. This sensor utilizes silicone adhesive to protect fragile skin, enhance signal acquisition, and improve repositionability. It is designed to stay in place longer and reduces skin cell removal by 87%, making it suitable for patients with sensitive skin, such as newborn babies.

U.S. Pulse Oximeter Market Trends

Pulse oximeter market in the U.S. is significantly influenced by collaborations between universities and market players, which drive innovation & market growth. Universities contribute through advanced research on materials, sensors, algorithms, and clinical trials, enhancing the accuracy & reliability of pulse oximeters. For instance, in March 2024, Movano Health, in collaboration with the University of California, San Francisco (UCSF), completed another hypoxia trial, generating new blood SpO2 data. The results confirmed that the accuracy of its Evie Ring pulse oximeter surpasses the U.S. FDA guidelines, showcasing the impact of academic research on product development.

Europe Pulse Oximeter Market Trends

The pulse oximeter market in Europe is expected to be driven by the growing prevalence of chronic diseases, impact of COVID-19, and supportive government policies. Moreover, continuous innovations in pulse oximeter technology, including wearable devices and those integrated with digital health platforms, are enhancing usability & patient convenience, thereby driving the regional market. These advancements are crucial in encouraging healthcare providers and consumers to adopt newer, more sophisticated devices.

The pulse oximeter market in the UK is driven by various factors. The government's proactive stance on addressing biases in medical devices, including pulse oximeters, highlights its commitment to equitable healthcare practices and market growth. For instance, in March 2024, following recommendations from an independent review on equity in medical devices, the Department of Health and Social Care took concrete steps. Senior health experts were consulted to identify biases and propose solutions, leading to the government's acceptance of the report's conclusions. This commitment includes ensuring that pulse oximeters used within the NHS meet high standards of accuracy across different skin tones and removing racial bias from clinical study datasets.

Germany pulse oximeter market had a substantial market share in 2023. In Market players are actively investing in technological advancements in wearable pulse oximeters, which is driving significant growth in the pulse oximeter market. Healthcare professionals are increasingly relying on these devices for continuous patient monitoring, which is essential for managing chronic conditions and ensuring timely interventions.

Asia Pacific Pulse Oximeter Market Trends

Asia Pacific is anticipated to register the fastest growth in the pulse oximeter market over the forecast period. The increasing prevalence of respiratory issues has heightened the demand for pulse oximeters, which play a crucial role in monitoring blood oxygen levels-a critical aspect of respiratory care. For instance, the Asian Development Bank's report, titled Strengthening Oxygen Systems in Asia and the Pacific, emphasizes the importance of pulse oximeters in pneumonia treatment. A meta-analysis of oxygen improvement programs highlighted significant benefits, including a 48% reduction in hospital pneumonia mortality among children aged under 5 years and a 26% decrease in all-cause mortality in the same age group.

The pulse oximeter market in Japan has a significant market share in 2023. This market has been notably driven by heightened awareness and demand for these devices. With the COVID-19 pandemic primarily affecting the respiratory system and potentially causing sudden drops in blood oxygen levels, there has been a strong push among individuals and healthcare providers to secure reliable tools for early detection and symptom monitoring. This increased awareness has led to a surge in demand for pulse oximeters across Japan, prompting significant efforts to expand device manufacturing capacities.

India pulse oximeter market is expected to grow significantly during the forecast period. The growth is driven by several factors, which include increased awareness and adoption due to the COVID-19 pandemic, a shift toward domestic manufacturing, and a rising population necessitating greater healthcare services and medical devices. For instance, in June 2020, Mitocon Biomed launched Oxysat, a domestically produced pulse oximeter known for its affordability and 18-month replacement warranty. This launch came when imports from China were strained, pushing Indian manufacturers to fill the gap.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pulse oximeter market

Component

Type

Age Group

End Use

Regional