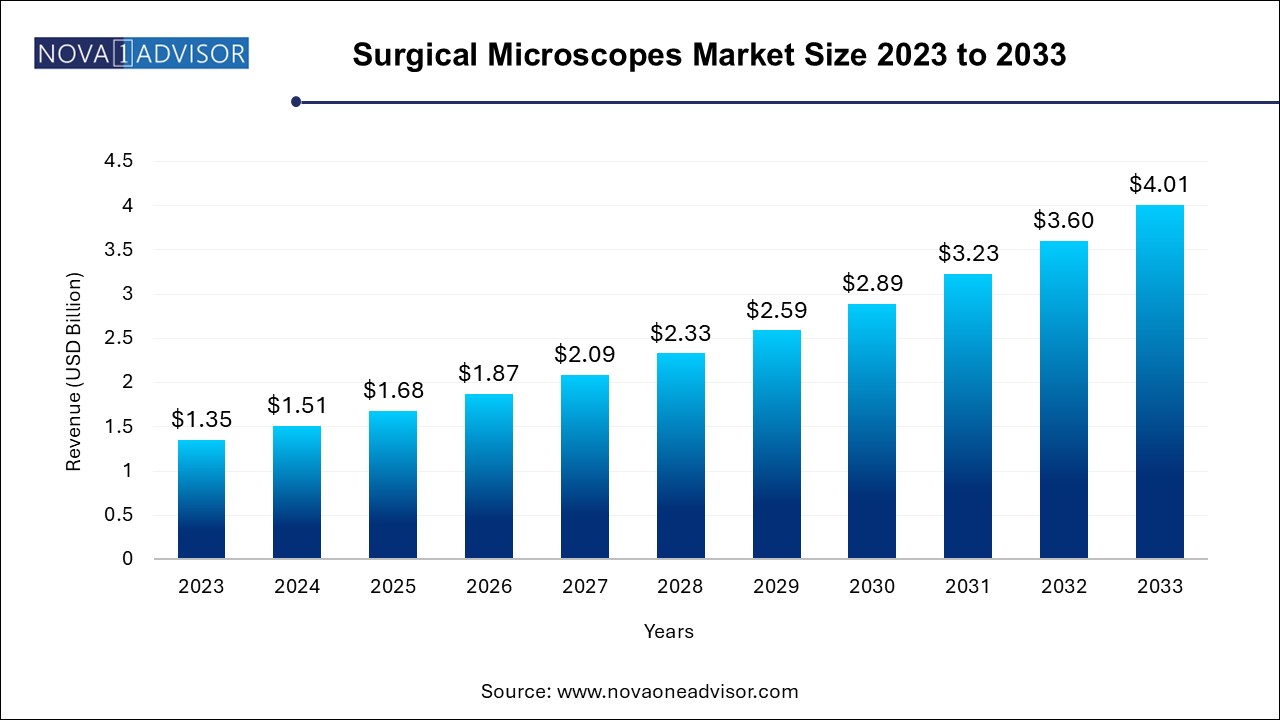

The surgical microscopes market size was exhibited at USD 1.35 billion in 2023 and is projected to hit around USD 4.01 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.51 Billion |

| Market Size by 2033 | USD 4.01 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 11.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Type, Application, End use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled | Carl Zeiss Meditec AG; Olympus Corporation; Leica Microsystems; Alcon, Inc.; Takagi Seiko Co., Ltd.; TOPCON CORPORATION; Seiler Instrument, Inc.; haag-streit.com; ARI Medical Technology Co., Ltd.; Synaptive Medical; Chammed Co, Ltd. |

An increasing number of surgical procedures, demand for more precision, and emerging technologies, such as wide-angle illumination, red reflex illumination, and Augmented Reality (AR) microscopy are expected to boost the market growth. Surgical microscopes have become an essential tool for minimally invasive procedures in several fields, including neurosurgery, ophthalmic surgery, dental surgery, otorhinolaryngology, and cosmetic surgery.

Technological advancements have enabled companies to design integrated surgical systems to streamline the workflow of surgical practices in hospitals and outpatient surgical centers. For example, digitalization of surgical microscopes has transformed its quality and effectiveness. Moreover, companies provide customized microscopes for medical specialties such as ophthalmology, ENT, dental, and neurosurgery.

Technological advancements in the product have significantly improved vision, stability and sizing, positioning, and recording capabilities and helped integrate image-guided microscope systems for better outcomes. They offer 3d visualization, optimum lighting, and magnification of deep surgical fields through small approaches. Apart from clinical benefits, surgeons physically benefit from these microscopes as they allow them to adjust their posture while performing long and complicated procedures. These advantages, coupled with the rapid adoption of microsurgery, are fueling the market growth.

Moreover, surgical microscopes have revolutionized the field of minimally invasive surgeries as they allow surgeons to perform surgeries with maximum precision on actual pathology by magnifying the surrounding anatomical structures, resulting in improved patient outcome with shorter duration of procedures and rapid recovery. In addition, limitations of open surgeries have been significantly eliminated by integrating the workflow in operating rooms.

Majority of surgeons are adopting minimally invasive surgeries in various surgical fields worldwide. Furthermore, people in emerging economies are willing to pay for premium quality services due to increasing disposable income, which is expected to boost demand for minimally invasive surgeries, which in turn is anticipated to drive market growth during the forecast period.

Improvements in healthcare infrastructure and adoption of technologically advanced devices in developing countries have significantly improved patient outcomes. Furthermore, owing to rising disposal income, individuals are opting for expensive medical procedures such as minimally invasive surgeries that require use of surgical microscopes as they offer better resolution and magnification. The aforementioned factors are leading to increased demand for advanced medical equipment such as surgical microscopes, driving market growth.

Based on type, the on-casters segment dominated the market with a revenue share of 79.80% in 2023 and is estimated to be the fastest-growing segment during the forecast period. On-casters microscopes are floor-mounted devices that have retractable casters with single, double, or compound wheels.

Surgical microscopy on casters are used in majority of surgical fields, including dental, ophthalmology, neurosurgery, cosmetics procedures, and ENT. Caster-mounted microscopes occupy less floor space and can be easily moved in any direction as per the convenience of surgeons. This is driving the demand for these devices, thereby supporting the segment growth.

The wall-mounted surgical microscopes segment held the second-largest market share, followed by tabletop and ceiling-mounted microscopes. The wall-mounted microscopes are less frequently used owing to their limitations such as restricted flexibility and illumination & maintenance concerns.

However, such microscopes are preferred in examination or operating rooms with limited space. Moreover, the wall-mounted microscopes come with an in-built spring system, which can be tightened as per a persons’ weight. Such factors are contributing to the demand for wall-mounted microscopes. Ceiling-mounted microscopes held the least market share.

The ophthalmology segment held the largest revenue share and accounted for the largest revenue share in 2023, owing to factors such as a rising patient pool, an increase in demand for devices to fulfill the surgical requirements, and an increase in the volume of cataract surgeries. Various ophthalmic surgeries performed require surgical microscopes.

The ENT surgery segment is anticipated to exhibit an exponential CAGR during the forecast period. Some of the major surgeries include laser eye surgery; glaucoma, corneal, & eye muscle surgeries; and oculoplastic surgeries. The complex anatomy of the eye and availability of a broad range of products, such as Leica M844 F40/F20 and Leica M822 F40/F20, for treating various ophthalmic conditions are certain positive factors for the segment growth.

The neurosurgery and spine surgery segment held the second largest share during the forecast period. The overall segment held the second-largest share. Neurosurgery and spine surgery include surgeries related to the nervous system, including all the parts that are in the peripheral nerves, spinal cord, brain, and extra-cranial cerebrovascular system.

As surgical microscopes play a critical role in neurosurgeries with regard to better illumination and three-dimensional views, manufacturers are focusing on product innovation to increase treatment efficiency. For instance, at the American Association of Neurological Surgeons (AANS) Annual Scientific Meeting, in 2017, Leica Microsystem launched augmented reality imaging technologies for surgical microscopes to supplement surgical microscope views for neurological procedures.

In terms of end-use, the hospital segment dominated the global market with a market share in 2023. The market has been bifurcated into sub-segments namely, hospital and physician clinics & other settings. The hospital's segment is the largest end-use segment of operational microscopes owing to the higher number of patient admissions & surgeries performed in hospitals and greater financing capabilities.

Furthermore, hospitals have funding to purchase the most advanced surgical equipment to improve and streamline the workflow in operating rooms. For instance, in July 2019, Mater Private Hospital Brisbane installed the city’s first 3d robotic surgical microscope in the neurosurgery operating theaters.

The physician clinics and other settings segment are expected to register the fastest compound annual growth rate from 2024 to 2033. The availability of smaller operational microscopes and the rapidly growing field of dentistry are among the major factors contributing to the growth of this segment.

Over the past several years, healthcare delivery has shifted from inpatient hospital settings to various community-based and ambulatory settings. Owing to the increasing demand for shorter hospital stays and faster recovery, a higher number of patients are preferring ambulatory surgery centers.

North America dominated the global market with a market share of 39.25% in 2023. The high share is attributed to the presence of a supportive reimbursement framework for medical treatments and sophisticated healthcare facilities that are equipped with highly advanced tools and skilled neurosurgeons & cosmetic surgeons.

Moreover, the prevalence of ophthalmic and neurologic disorders in this region is substantially higher, which is facilitating the regional market growth.

Asia Pacific is anticipated to register the fastest CAGR during the forecast period. Rising cases of ophthalmic disorders, growing medical tourism, and an increasing number of surgeries performed in inpatient and outpatient settings are among the major factors driving the market in the region. In addition, favorable government policies to improve the healthcare system and rapid economic development in many countries of the region are anticipated to boost the market growth during the forecast period. India is anticipated to register the fastest CAGR during this period, owing to the increase in minimally invasive surgeries and the presence of multinational and local manufacturers in the country. The average price of operating a surgical microscope in India is estimated to be between USD 3,000-5,000.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the surgical microscopes market

Type

Application

End Use

Regional