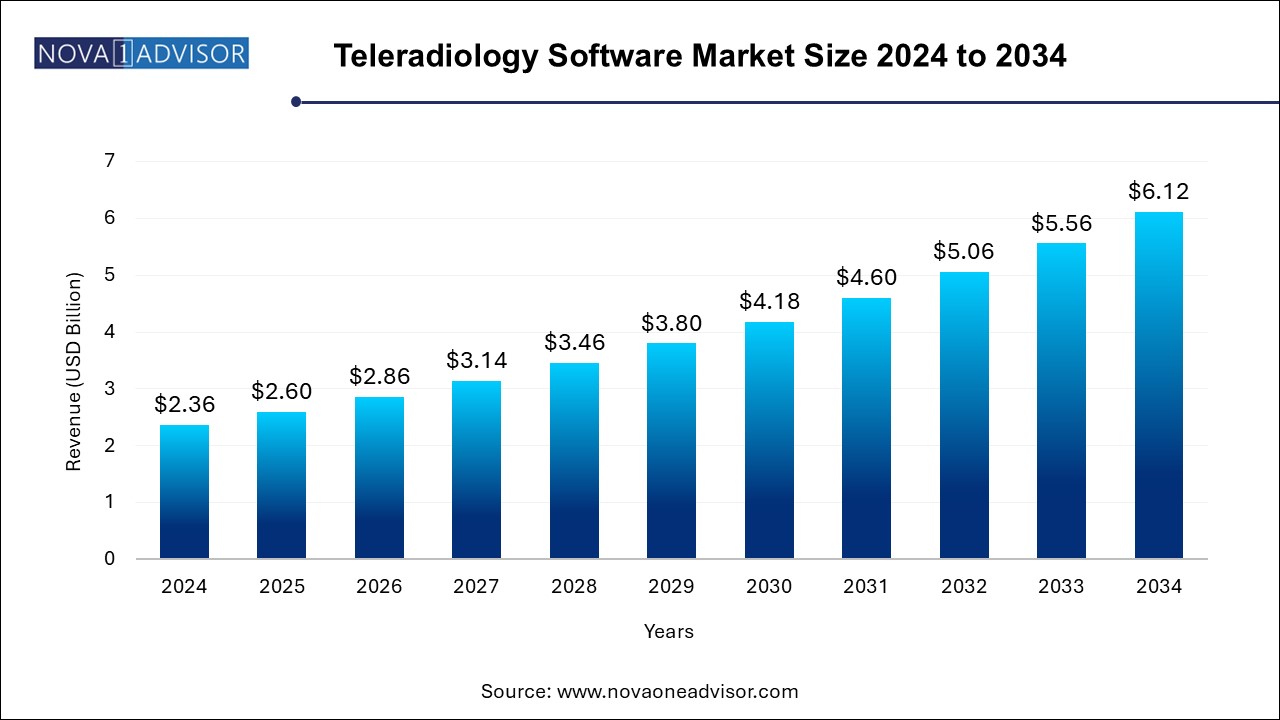

The teleradiology software market size was exhibited at USD 2.36 billion in 2024 and is projected to hit around USD 6.12 billion by 2034, growing at a CAGR of 10% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.60 Billion |

| Market Size by 2034 | USD 6.12 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 10.0% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Software Type, Mode of Delivery, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Carestream Health; Telerad Tech; GE Healthcare; Comarch SA; Perfect Imaging Solution's, LLC; Radical Imaging LLC; OpenRad; RamSoft, Inc.; Koninklijke Philips N.V.; Pediatrix Medical Group |

The rising prevalence of chronic diseases, such as cardiovascular diseases, cancer, liver disorders, spinal cord injury, and others, paired with the growing geriatric population, are key drivers of demand for teleradiology software. As the demand for imaging diagnostics increases, radiology centers and hospitals are adopting teleradiology solutions.

Cloud-based solutions have witnessed significant adoption by healthcare providers. According to the 2024 Future of Healthcare report by HIMSS, patients’ willingness to use digital health tools (DTHs) is expected to increase. According to the report, nearly 3-quarters of U.S. healthcare payers believed big tech innovation is the major and important driver of digital transformation. Numerous advantages of cloud-based teleradiology software, such as high accessibility to patient data despite large volumes, are expected to drive the adoption of cloud-based software solutions, fueling the overall market growth.

The rising adoption of digital healthcare infrastructure across all geographies and the rapid increase in radiology image data sets are among the few vital factors driving the demand for healthcare information networks to store, ingest, manage, access, and interpret clinical data of various patients individually. The rise in the number of medical images produced annually is propelling the need for a structured reporting system for radiology images to integrate it with individual Electronic Health Records (EHR) solutions, which has further surged the demand and adoption of Radiology Information System (RIS) by diagnostic centers and other healthcare institutes.

Moroever, non-profit organizations and governments across all regions are promoting and investing in teleradiology services, which is expected to drive the market. For instance, Teleradiology Solutions, a non-profit trust that focuses on imparting teleradiology support to hospitals located in rural/under-served/semirural parts of Asia, has collaborated with the National Board of Medical Examiners through its e-learning portal “Radguru.” This portal's mission is to stimulate radiology's growth through interactive e-learning. This collaboration will allow about 800 PG students to receive interactive training in radiology from international faculty. Similarly, growth in joint ventures between governments and private companies, such as the Singapore government and Teleradiology Solutions and Tripura government and Teleradiology Solutions, is anticipated to create growth opportunities in the forthcoming years.

Moreover, the surging implementation of Picture Communication and Archiving Systems (PACS) is expected to boost the demand for teleradiology software. Diagnostic centers, medium-sized hospitals, and diagnostic clinics focus on procuring specialized PACS tools due to the growing demand for CT scans. Companies developing PACS are focusing on the changing requirements of small hospitals. For instance, in August 2021, GE Healthcare launched Edison True PACS. This AI-enabled transformative system offers decision support to radiologists and helps them adapt to higher workloads and exam complexity, further improving diagnostic accuracy.

Companies offering teleradiology software are involved in new product launches, existing product upgrades, mergers and acquisitions, and regional expansion to enhance their market position. For instance, in November 2024, Comarch SA partnered with OneMark Engineering Technologies in the Philippines to expand its e-Health solutions in the APAC market. The partnership aimed to bring innovative solutions to customers in Southeast Asia, showcasing Comarch's products, including Comarch Diagnostic Point and Comarch HomeHealth 2.0. Likewise, in August 2024, RamSoft launched its rebrand and new website, emphasizing accelerated imaging and streamlined workflows. The company's new tagline, "Accelerated Imaging," reflects its commitment to speeding up radiology processes and improving patient care.

Picture Archive and Communication System (PACS) accounted for the largest market revenue share of approximately 48.0% in 2024. Factors such as medical diagnostic procedures and the growing adoption of remote patient monitoring have increased the adoption of PACS software among healthcare providers. There are several benefits of using PACS in radiology, such as data organization and image visualization; other than this, financial saving is another significant plus. According to a recent HIMSS Analytics Essentials report, the radiology PACS technology is used extensively across the healthcare industry, allowing healthcare providers to store and access electronic imaging studies effectively and cost-effectively.

Vendor Neutral Archive is expected to register the fastest CAGR of 11.9% during the forecast period. The rising need to easily share medical imaging information among healthcare providers is one of the key factors boosting the demand for VNA. Healthcare providers are utilizing VNA software owing to its advantages over PACS, such as flexibility, accessibility, interoperability, and data ownership. Some of the major features of VNA software are image object change management (IOCM), image lifecycle management (ILM), tag morphing, and hanging protocols.

Web-based held the largest revenue share of 40.0% in 2024. Remote data accessibility and a high preference for web applications are some factors propelling the segment’s growth. Moreover, the number of imaging procedures is growing as CT and MRI scans are becoming routine, and thus radiologists have to access many images at any time. This factor is likely to drive the demand for web-based teleradiology solutions.

Cloud-based is projected to grow at the fastest CAGR of 9.7% over the forecast period. The adoption of cloud-based solutions in healthcare is accelerating, driven by benefits such as scalability, flexibility, cost-effectiveness, and predictability. This trend is particularly evident in teleradiology, where radiologists can manage multimodality units without high upfront costs. As healthcare systems recognize the importance of these developments, the demand for AI-enabled, cloud-based teleradiology software is increasing, fuelling significant market growth.

North America teleradiology software market led the global teleradiology software market with a revenue share of 40.4% in 2024. Market growth in the region is driven by several key factors, including an expanding patient base, the prevalence of chronic diseases, and the presence of major market players. Favorable government initiatives, technological advancements, and high healthcare expenditure have also contributed to industry growth. The region's advanced healthcare infrastructure and regulatory support facilitate the adoption of innovative technologies and remote healthcare services.

U.S. Teleradiology Software Market Trends

The teleradiology software market in the U.S. dominated the North America teleradiology software market with a share of 79.4% in 2024. According to the American Cancer Society, cancer is the second most common cause of death in the U.S., with approximately 1.9 million new cases diagnosed annually. Market growth in the country is aided by increasing cased of cancer and cardiovascular diseases, higher usage of teleradiology, and the existence of major players.

Europe Teleradiology Software Market Trends

Europe teleradiology software market was identified as a lucrative region in 2024, driven by factors such as a shortage of radiologists and demand for specialized consultants and on-call radiology reading. Rising healthcare expenses and shrinking healthcare funding have accelerated the need for efficient teleradiology services, fostering regional market expansion. Moreover, the strong demand and widespread availability of PACS are expected to generate opportunities for teleradiology software growth.

The teleradiology software market in the UK is expected to grow rapidly in the coming years due to strict regulations and guidelines are in place to guarantee that patients are provided with safe and efficient care. Issues covered by these guidelines include data security, protection of patients’ data, equipment requirements and clinical practices. Radiologists interpreting teleradiology images in the UK must be registered with GMC and adhere to the same practice standards and continuing education requirements as other medical professionals.

Asia Pacific Teleradiology Software Market Trends

Asia Pacific teleradiology software market is anticipated to witness the fastest growth over the forecast period, registering a CAGR of 13.4%. Market growth in the region is driven by a significant unmet medical need resulting from the prevalence of chronic diseases, such as cancer and cardiac diseases. The region's shortage of radiologists, favorable government initiatives in the digital health sector, and growing adoption of advanced technology are key factors supporting market growth. The widespread presence of chronic diseases in the region creates a high demand for medical imaging solutions, underscoring the need for innovative diagnostic technologies.

The teleradiology software market in China is expected to grow rapidly in the coming years China's vast population and widespread distribution make it difficult for patients in remote areas to reach medical specialists. Teleradiology can be useful to overcome this deficiency since other specialists can remotely analyze the original image. Advancements such as in image reaching capabilities, communication and cloud technology have helped in increasing the possibility of remote communication of medical images hence boosting the teleradiology market in China.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the teleradiology software market

Software Type

Mode Of Delivery

Regional