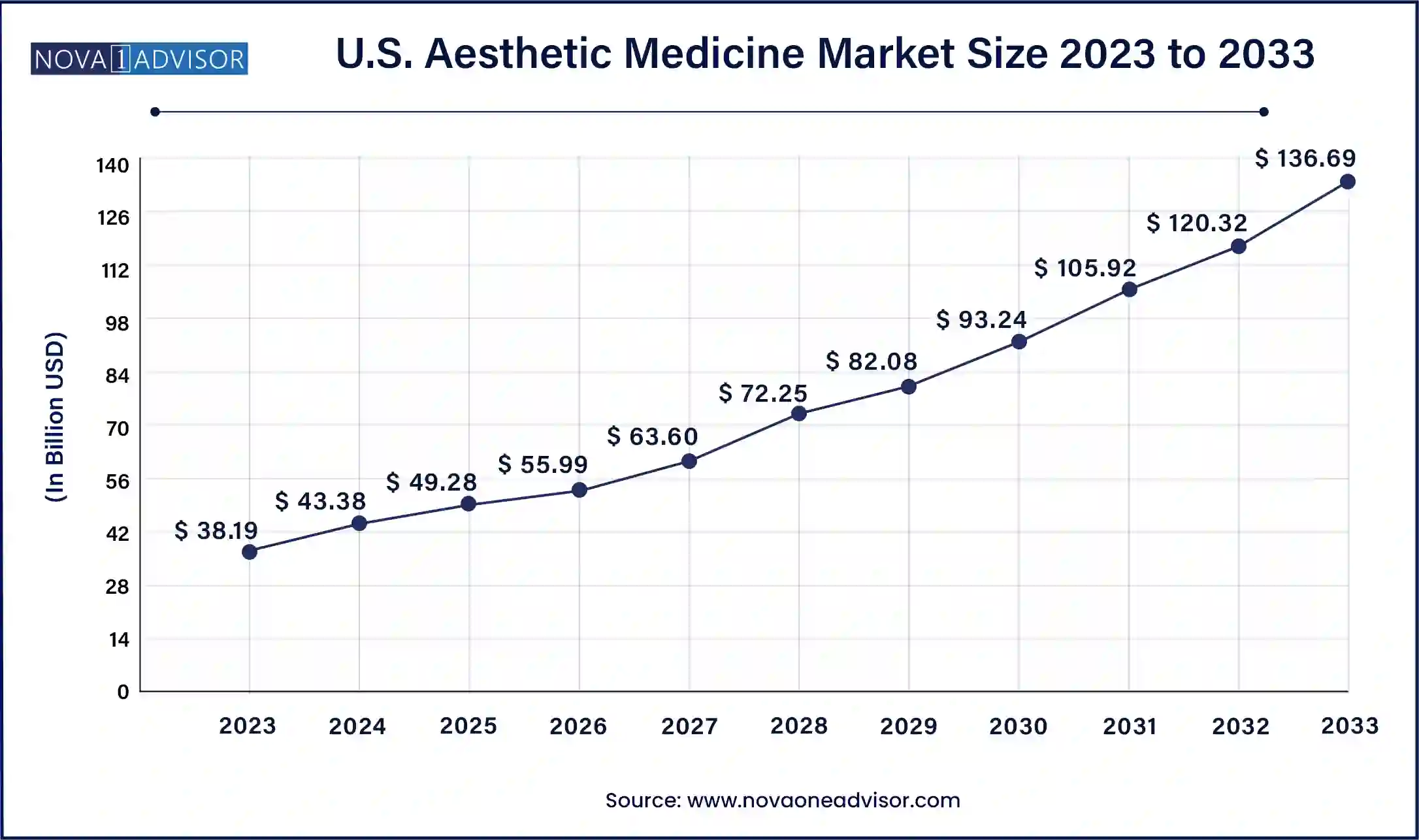

The U.S. aesthetic medicine market size was valued at USD 38.19 billion in 2023 and is anticipated to reach around USD 136.69 billion by 2033, growing at a CAGR of 13.6% from 2024 to 2033.

The U.S. aesthetic medicine market represents one of the most dynamic sectors within the broader healthcare and cosmetic industries. With rising consumer awareness, increased disposable income, cultural emphasis on appearance, and technological advancements, the industry has evolved from a niche segment catering to affluent demographics into a mainstream health and wellness domain. Aesthetic medicine encompasses a wide spectrum of procedures both invasive and non-invasive aimed at enhancing physical appearance, reversing signs of aging, and improving self-esteem and mental well-being.

The U.S. remains the global hub for aesthetic innovation and adoption, with a significantly high per capita expenditure on cosmetic procedures. According to data from the American Society of Plastic Surgeons (ASPS), millions of aesthetic procedures are performed annually in the country, with noninvasive treatments like Botox and dermal fillers seeing particularly strong demand. An aging but aesthetically conscious population, the rise of social media, and increasing accessibility through dermatology clinics and medspas are crucial forces pushing the market forward.

Moreover, with celebrity endorsements and social media influencers advocating for aesthetic procedures as part of personal grooming, there has been a paradigm shift in societal attitudes. Treatments are no longer limited to celebrities or older adults; they now appeal to younger demographics seeking preventative or enhancement-focused procedures.

Rise in Preventive Aesthetic Procedures Among Millennials and Gen Z: Younger consumers (ages 20-39) are increasingly opting for procedures like Botox and fillers to prevent signs of aging before they appear.

Growth of Minimally Invasive and Noninvasive Treatments: There is a strong shift toward noninvasive solutions due to quicker recovery times, lower risks, and cost-effectiveness, leading to significant market traction in laser therapies, injectables, and chemical peels.

Medical Tourism Within the U.S.: Individuals are traveling between states and cities known for aesthetic excellence, like Miami, Los Angeles, and New York, to access top-tier surgeons and clinics.

Teledermatology and Virtual Consultations: Especially post-COVID, virtual consults have allowed broader access to aesthetic consultations, boosting patient engagement and clinic reach.

Men Entering the Aesthetic Market: The male demographic, previously less engaged, is now increasingly pursuing aesthetic enhancements, particularly jawline contouring, hair restoration, and body sculpting.

Adoption of AI and Robotics in Aesthetic Devices: The use of AI in diagnostic imaging, treatment planning, and robotic-assisted procedures has improved precision and personalized care.

Celebrity and Influencer Endorsements: The promotion of aesthetic treatments by high-profile individuals continues to normalize these services, shaping consumer perceptions.

Integration of Aesthetic Services in Dermatology and Primary Care: More healthcare providers are expanding their service offerings to include cosmetic enhancements.

U.S. Aesthetic Medicine Market Report Scope

| Report Attribute | Details |

| Market Size in 2024 | USD 43.38 Billion |

| Market Size by 2033 | USD 136.69 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 13.6% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Procedure, age, metropolitan cities |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | The Cosmetic Clinic; Therapie Clinic; SKINovative; Shea Aesthetic Clinic; Rejuv Medical; AnewSkin Medspa; R+H Medicine; Manhattan Aesthetics; SkinLab Clinic |

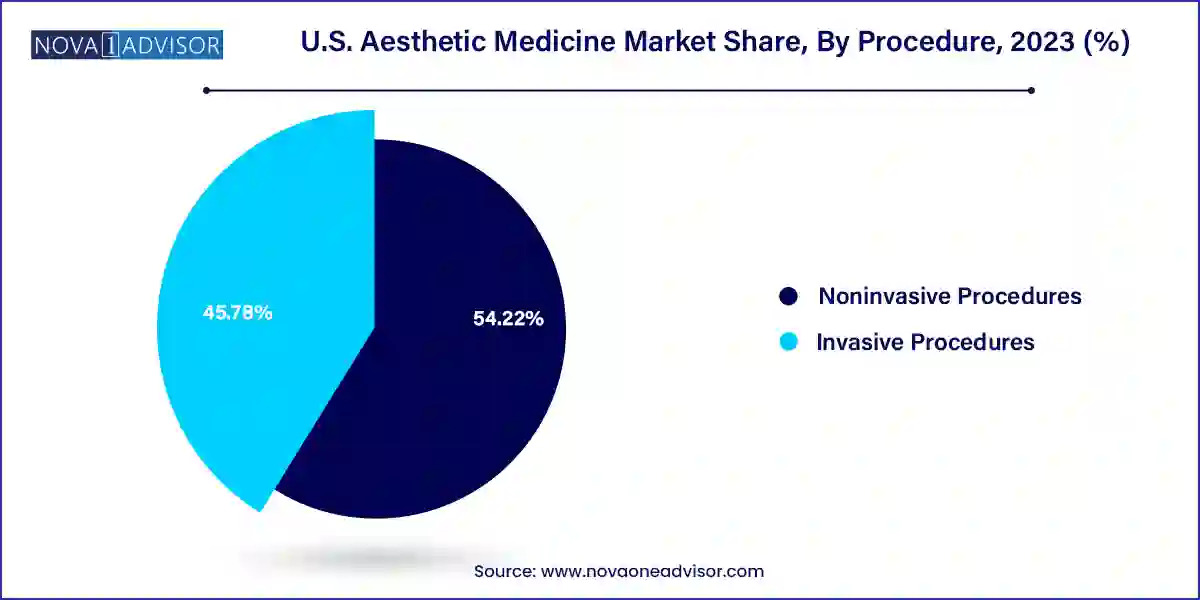

Noninvasive procedures dominated the U.S. aesthetic medicine market owing to their safety profile, affordability, and increasing patient preference for minimal downtime. Botox injections and soft tissue fillers are especially prominent. These injectables not only address wrinkles and fine lines but are increasingly used for facial contouring and lip enhancement. In 2023 alone, over 7 million Botox procedures were performed in the U.S., making it the top nonsurgical aesthetic treatment. Moreover, soft tissue fillers have expanded in use from simple volume enhancement to cheek contouring and even nose reshaping (liquid rhinoplasty). Laser hair removal and chemical peels are also seeing strong adoption among younger demographics seeking long-term grooming solutions.

Invasive procedures, although less frequent than noninvasive, represent the largest revenue-generating category per treatment. Breast augmentation and liposuction lead the surgical side, driven by long-lasting outcomes. Nose reshaping (rhinoplasty) is particularly common among individuals in their 20s and 30s, often for both aesthetic and functional improvements. Tummy tucks and eyelid surgeries are preferred among the 40+ demographic, primarily for rejuvenation and post-pregnancy body restoration. Though invasive, advancements in surgical techniques, such as the use of VASER technology in liposuction, are enhancing safety and patient satisfaction, contributing to the steady rise in demand.

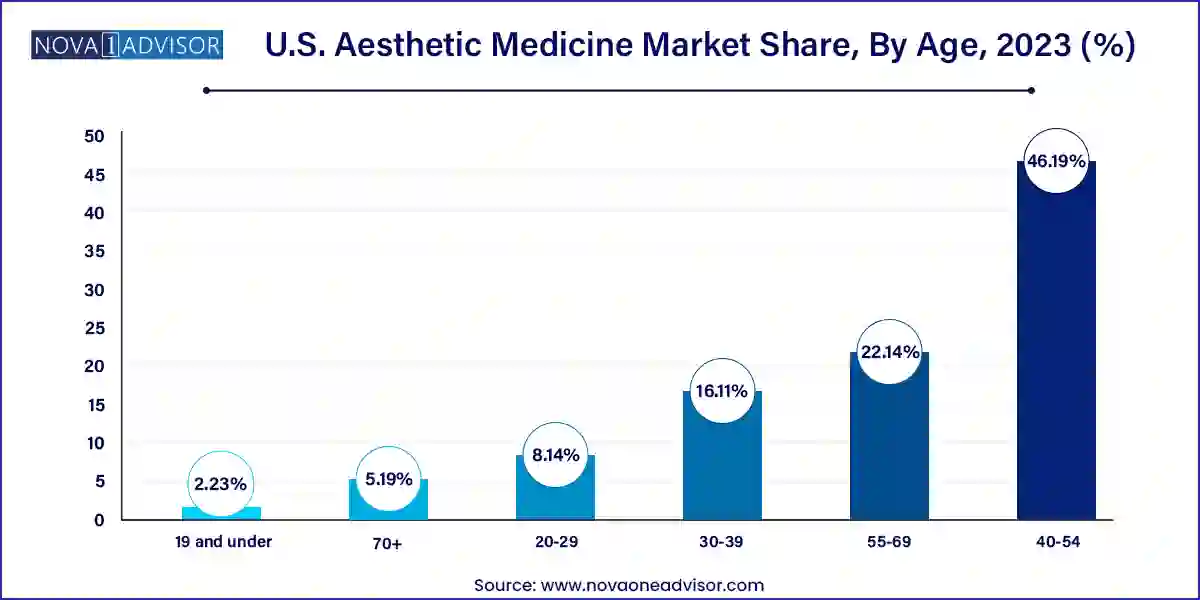

The 30-39 age group dominated the U.S. aesthetic medicine market, owing to heightened awareness about appearance and a proactive approach to aging. This demographic balances professional careers and social visibility, fueling the need for confidence-boosting enhancements. They are also more financially empowered, enabling them to spend on premium services. Aesthetic procedures such as Botox, fillers, and laser treatments are especially popular among this age bracket, who often seek subtle, natural-looking results rather than dramatic transformations. Clinics often tailor loyalty programs and combination treatment packages to retain this high-value customer segment.

The fastest-growing segment, however, is the 20-29 age group, reflecting a cultural shift where cosmetic treatments are perceived as part of routine self-care rather than corrective procedures. Gen Z and young millennials are highly influenced by social media filters, celebrity aesthetics, and peer comparison. Preventive Botox (nicknamed “Baby Botox”) and lip fillers are rising rapidly in popularity in this cohort. With relatively lower pain thresholds and income levels, these consumers prefer noninvasive and low-cost treatments, often booked through medspas or beauty clinics rather than hospitals. The accessibility of payment plans and the normalization of aesthetic services at younger ages suggest long-term growth potential in this segment.

Los Angeles leads the U.S. aesthetic medicine market in terms of both procedure volume and innovation. Known as the global capital of cosmetic enhancement, LA hosts an elite cluster of plastic surgeons and aesthetic dermatologists. Celebrity culture, combined with constant media exposure, drives high demand for cutting-edge procedures ranging from thread lifts to body contouring. Clinics in Beverly Hills, in particular, offer concierge-style services and are often early adopters of novel technologies and techniques.

New York City follows closely, especially in terms of facial aesthetic procedures. The city’s professional environment and fast-paced lifestyle contribute to demand for “lunchtime procedures” that offer quick results with minimal downtime. Manhattan-based medspas are thriving, often integrating aesthetic medicine with wellness and skincare solutions. Other rapidly growing cities include Miami known for body contouring procedures like Brazilian butt lifts and Dallas, where demand spans both surgical and nonsurgical treatments among a broad demographic.

April 2025 – AbbVie’s Allē Loyalty Program Expansion: Allergan Aesthetics (a subsidiary of AbbVie) announced the expansion of its Allē loyalty program, which now includes personalized digital consultations for Botox and Juvederm users in the U.S. This is expected to improve patient retention and drive repeat procedures.

February 2025 – Cynosure Unveils PicoSure Pro: Cynosure, a leading aesthetic device manufacturer, launched its upgraded PicoSure Pro laser system in the U.S., offering enhanced pigmentation correction and skin revitalization with minimal downtime.

January 2025 – Revance Therapeutics Secures FDA Approval for Daxxify: Revance gained FDA approval for its long-lasting botulinum toxin injection, Daxxify, offering a competitive edge against Botox with a duration of up to six months.

December 2024 – Galderma Invests in Direct-to-Consumer Campaigns: Galderma launched a high-profile campaign across major U.S. cities to promote its Restylane range of fillers, targeting younger consumers through social media and influencer partnerships.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Aesthetic Medicine market.

By Procedure

By Age

By Metropolitan Cities