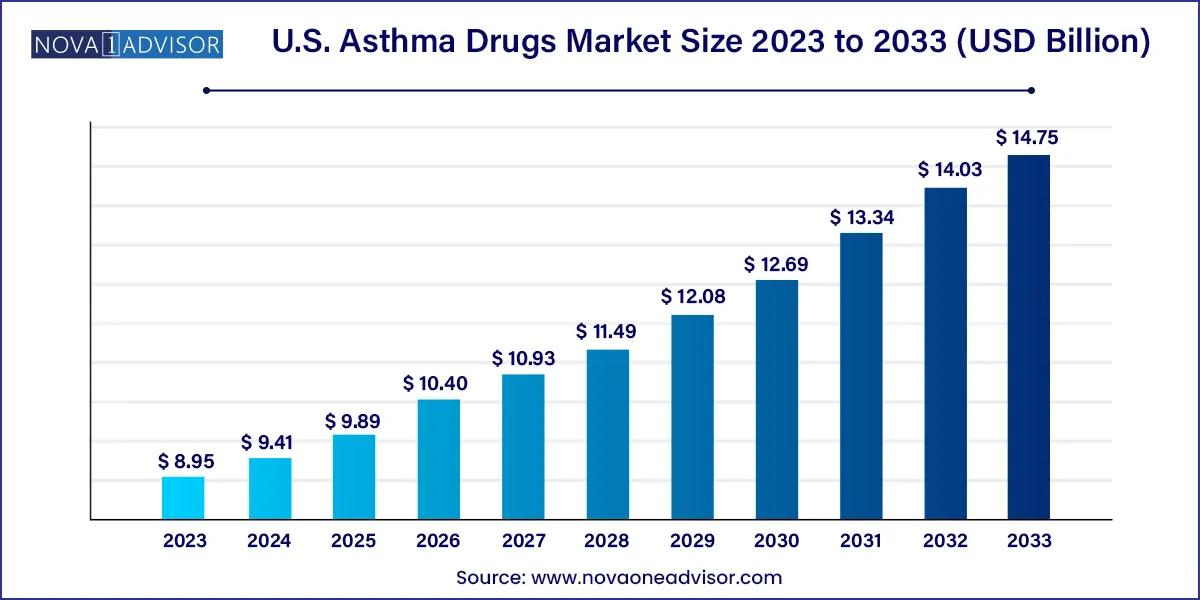

The U.S. asthma drugs market size was valued at USD 8.95 billion in 2023 and is projected to surpass around USD 14.75 billion by 2033, registering a CAGR of 5.12% over the forecast period of 2024 to 2033.

The U.S. asthma drugs market stands as a vital component of the broader respiratory therapeutics landscape, driven by a growing patient population, the increasing burden of chronic respiratory diseases, and continued pharmaceutical innovation. Asthma, a chronic inflammatory disease of the airways, affects individuals of all age groups and is characterized by recurring symptoms such as wheezing, breathlessness, chest tightness, and coughing. According to the Centers for Disease Control and Prevention (CDC), over 25 million Americans were living with asthma as of 2024—making it one of the most prevalent chronic diseases in the country.

This large and diverse patient base has spurred the development of a wide array of pharmaceutical interventions, ranging from quick-relief bronchodilators to long-term anti-inflammatory therapies and biologics targeting severe asthma. The market is defined by its dynamic product pipeline, presence of global pharmaceutical leaders, and the growing adoption of advanced delivery mechanisms such as digital inhalers.

Over the past decade, significant shifts have occurred in asthma drug development, transitioning from reliance on traditional beta-agonists and corticosteroids to the inclusion of biologics, monoclonal antibodies, and targeted therapies designed for severe eosinophilic and allergic asthma subtypes. These precision-based treatments are addressing unmet needs in a population that was previously poorly controlled on standard therapies.

Furthermore, environmental factors, urbanization, climate change, and rising air pollution have contributed to an increasing incidence of asthma cases, particularly in children and the elderly. This epidemiological trend, coupled with policy efforts to improve asthma management and medication access, is fueling market growth. The presence of robust R&D pipelines, continuous clinical trials, and increasing awareness of asthma control in the U.S. healthcare ecosystem supports an optimistic outlook for the asthma drug market in the coming years.

Surge in Biologics for Severe Asthma: Monoclonal antibodies targeting IL-4, IL-5, and IgE pathways are gaining traction as first-line treatments for severe asthma phenotypes.

Digital Inhaler Technology: Smart inhalers that track usage patterns and adherence are being integrated into asthma management plans.

Personalized Medicine Approach: Phenotyping and genotyping of asthma patients are guiding therapy choices to improve outcomes and minimize adverse effects.

Increased Generic Competition: The expiration of patents for major branded drugs has opened the market to cost-effective generics.

Environmental Factors Driving Prevalence: Rising pollution levels and exposure to allergens are pushing incidence rates, especially in urban areas.

Telehealth in Asthma Management: Remote monitoring and consultations are improving patient access to care and medication adjustments.

Combination Therapy Innovations: Fixed-dose combination inhalers containing corticosteroids and long-acting beta agonists (LABAs) are becoming more prominent.

Regulatory Support for Pediatric Drugs: FDA incentives and pediatric exclusivity programs are encouraging more child-focused asthma drug development.

Shift Toward Once-Daily Dosing: New formulations offer improved adherence with reduced dosing frequency, particularly in maintenance therapies.

Awareness Campaigns and Public Health Initiatives: Government and non-profit organizations are promoting education and early diagnosis efforts.

| Report Attribute | Details |

| Market Size in 2024 | USD 9.41 Billion |

| Market Size by 2033 | USD 14.75 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 5.12% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Medication, By Mode of Administration, By Source, By Organization Type, and By Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | GlaxoSmithKline, Pfizer, Vectura Group, Boehringer Ingelheim, Roche, Novartis, Merck, AstraZeneca, Teva Pharmaceutical, and Others. |

The most significant driver of the U.S. asthma drugs market is the rising prevalence of asthma, compounded by a considerable portion of the population experiencing poor disease control. Despite the availability of multiple treatment options, studies show that over 50% of asthma patients in the U.S. report uncontrolled symptoms, resulting in frequent emergency visits and hospitalizations.

This gap in disease management has created a need for more effective therapies, including combination treatments, inhalation technologies with better deposition, and biologics for hard-to-treat cases. Additionally, asthma's strong presence in pediatric populations and increasing diagnoses among the elderly are pushing both acute and long-term treatment demand.

Environmental triggers, such as allergens, industrial pollutants, and tobacco smoke exposure, further exacerbate asthma symptoms and increase treatment needs. In response, healthcare providers are increasingly focusing on stepwise treatment plans, where drug prescriptions are tailored to symptom severity—driving the use of both quick-relief and maintenance medications concurrently.

One of the key restraints in the U.S. asthma drugs market is the high cost associated with advanced biologic therapies, which can limit patient access, especially among underinsured populations. Biologics such as dupilumab (Dupixent), mepolizumab (Nucala), and benralizumab (Fasenra) offer substantial benefits for patients with severe asthma, particularly those with eosinophilic or allergic phenotypes. However, these treatments can cost upwards of $30,000 per patient annually.

Even with partial insurance coverage, out-of-pocket expenses can be prohibitive, discouraging long-term use. Moreover, while these drugs reduce hospitalizations and emergency room visits in the long term, their high upfront costs are often a barrier to widespread prescribing. Payers, including Medicare and private insurers, frequently require prior authorizations or step therapy protocols, further delaying access.

These challenges create a two-tiered system in asthma care, where advanced therapies remain accessible only to those who meet strict clinical criteria or have substantial insurance coverage thus limiting the potential market reach for these innovative treatments.

An emerging opportunity in the U.S. asthma drugs market lies in the integration of digital therapeutics, smart inhalers, and connected health platforms. Non-adherence to inhaled medications is a well-documented challenge in asthma management, with studies showing up to 70% of patients fail to use inhalers correctly or consistently.

Smart inhalers address this by embedding sensors that track usage patterns, detect errors, and sync with smartphone applications for real-time feedback. These tools offer benefits not just for patients but also for physicians, who can monitor adherence and adjust treatment plans remotely. Companies such as Propeller Health and Teva have already launched FDA-cleared digital inhalers, signaling strong commercial interest.

Moreover, these connected platforms can integrate environmental data such as pollen levels and air quality indices to personalize medication usage alerts, further improving control and outcomes. As telehealth continues to gain ground, digital asthma management solutions could play a transformative role in expanding treatment adherence, especially among children and elderly patients.

Long-term control medications dominate the U.S. asthma drugs market, primarily due to their critical role in managing chronic symptoms and preventing exacerbations. This segment includes inhaled corticosteroids (ICS), leukotriene modifiers, long-acting beta agonists (LABAs), and combination drugs. Medications like fluticasone/salmeterol (Advair) and budesonide/formoterol (Symbicort) are widely prescribed for daily use. These therapies reduce inflammation and maintain bronchodilation over time, minimizing emergency interventions. With clinical guidelines emphasizing maintenance therapy for persistent asthma, long-term drugs command a substantial market share.

Conversely, quick-relief medications are the fastest-growing segment, driven by increased diagnosis rates and heightened awareness of early intervention. Short-acting beta agonists (SABAs) like albuterol remain first-line rescue therapies for acute symptoms. With the widespread availability of metered-dose inhalers and the rise in self-managed asthma action plans, usage of quick-relief drugs is growing across pediatric and adult populations. Additionally, increased environmental pollution and allergens contribute to a higher frequency of asthma attacks, expanding the use of rescue inhalers in both urban and rural settings.

Inhalers dominate the mode of administration, and for good reason—these devices deliver medication directly to the lungs, offering rapid relief and efficient absorption with fewer systemic side effects. Inhaled therapies, including metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and soft mist inhalers, are the gold standard in both rescue and maintenance asthma treatment. Their portability and ease of use make them particularly popular among children, adolescents, and working adults.

Injections are the fastest-growing segment, largely due to the increasing use of biologics in treating severe asthma cases. Injectable monoclonal antibodies such as omalizumab (Xolair), reslizumab (Cinqair), and dupilumab (Dupixent) are administered subcutaneously or intravenously and offer targeted immunomodulation. Their adoption is rising in specialized asthma clinics and hospitals, especially for patients who fail to respond to conventional inhaled therapies. With more injectable biologics under development and anticipated FDA approvals, this mode of administration is expected to grow significantly in the next decade.

Private organizations dominate the asthma drug landscape in the U.S., due to their superior resources for research and development, advanced marketing capabilities, and established distribution networks. Major pharmaceutical companies like GlaxoSmithKline, AstraZeneca, and Novartis lead the market, particularly in the branded and biologic drug categories. Their ability to run multi-center clinical trials and gain rapid regulatory approval gives them a significant market advantage.

Public organizations are gaining prominence, especially through academic collaborations and government-funded research initiatives. Institutions like the National Institute of Allergy and Infectious Diseases (NIAID) are actively supporting asthma drug research, particularly in pediatric and minority populations. This is fostering innovation in underexplored areas such as environmental asthma and pediatric asthma management.

Adults are the primary consumers of asthma medications, making them the dominant application segment. While asthma onset often occurs in childhood, a significant number of patients carry the disease into adulthood or are diagnosed later in life. Adult patients typically use a combination of quick-relief and long-term medications and may require biologics or additional treatments due to comorbidities such as COPD, obesity, or cardiovascular disease.

Pediatric asthma drug usage is the fastest-growing segment, driven by rising diagnosis rates, school-based asthma screening programs, and expanded insurance coverage for children under government health plans. Pediatric asthma management is becoming a public health priority, with drug manufacturers increasingly developing child-friendly formulations, including flavored liquids and spacer-compatible inhalers. Moreover, clinical trials are being tailored specifically for pediatric populations, encouraging targeted therapy options for young patients.

The U.S. stands as the world’s most mature and innovative asthma drug market, supported by high disease prevalence, advanced healthcare infrastructure, and strong pharmaceutical R&D capabilities. Federal agencies such as the CDC and FDA actively participate in asthma surveillance, therapeutic regulation, and public awareness initiatives, ensuring that both branded and generic drugs meet stringent quality standards.

States like California, Texas, and New York see high asthma incidence, with urbanization, poor air quality, and healthcare disparities exacerbating the disease burden. These states are also focal points for asthma research trials, biologic therapy adoption, and digital inhaler implementation.

With widespread access to healthcare facilities, insurance coverage under ACA provisions, and a focus on value-based care, the U.S. market continues to support the adoption of innovative treatments while encouraging cost-effective alternatives through generics and telemedicine platforms.

March 2025: AstraZeneca received expanded FDA approval for Fasenra (benralizumab) to be used in pediatric patients aged 6–11 years with severe eosinophilic asthma.

February 2025: Propeller Health launched a new AI-powered asthma inhaler tracking system that integrates environmental triggers and real-time symptom monitoring.

January 2025: Teva Pharmaceuticals announced the commercial launch of a generic version of Advair Diskus, expanding low-cost access to combination maintenance therapy.

December 2024: GSK reported Phase III trial success for a once-daily triple combination inhaler designed for both asthma and COPD patients.

November 2024: Regeneron and Sanofi revealed real-world evidence data showing significant reduction in hospitalizations among patients on Dupixent, further validating its use in moderate-to-severe asthma.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Asthma Drugs market.

By Medication

By Mode of Administration

By Source

By Organization Type

By Application