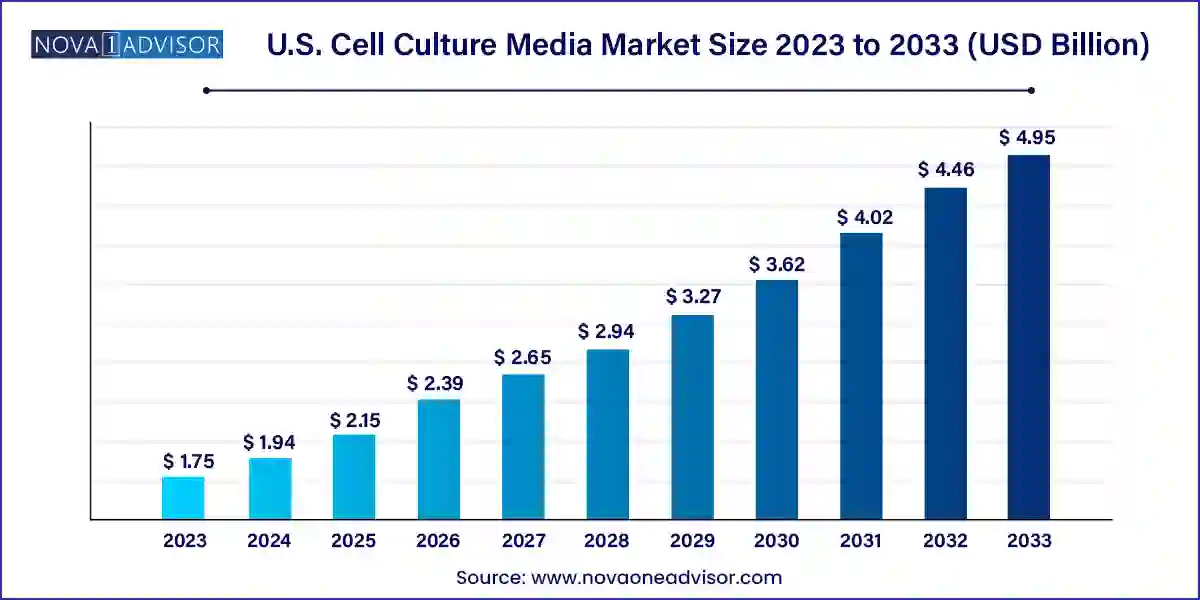

The U.S. cell culture media market size was exhibited at USD 1.75 billion in 2023 and is projected to hit around USD 4.95 billion by 2033, growing at a CAGR of 10.96% during the forecast period 2024 to 2033 owing to continuously increasing use of cell culture technology. Furthermore, increased awareness about stem cells is driving the use of gene and cell therapy.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.94 Billion |

| Market Size by 2033 | USD 4.95 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.96% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Application, Type, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope | U.S. |

| Key Companies Profiled | Sartorius AG; Danaher Corporation; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH |

The U.S. cell culture media market accounted for 31% of the global cell culture media market in 2023. One of the major factors is the presence of a well-established R&D infrastructure and favorable regulatory landscape, which is rapidly evolving to adapt to the ongoing research progress in this sector. The U.S. has three main federal agencies-the Animal and Plant Health Inspection Service (APHIS), U.S. Environmental Protection Agency (EPA), and U.S. Department of Health and Human Services’ Food and Drug Administration (FDA)-which ensure safe use of genetically modified/engineered organisms.

In addition, supportive government policies and high healthcare expenditure are likely to favor market growth in this region. Investments by government and leading companies in the market in pharmaceuticals and biotechnology industries are growing. For instance, in November 2022, FUJIFILM Holdings Corporation announced the launch of a cell culture media manufacturing facility with an investment of USD 188 million in Research Triangle Park (RTP), North Carolina.

Cell culture-based viral vaccines are used worldwide to immunize humans against infections. The cell culture is a continuous process of the development of substrates for the safe production of viral vaccines. The increased demand and strict safety rules for novel vaccines to control and eradicate viral diseases have enforced manufacturers & researchers toward cell culture-based vaccines. Usage of cell culture technology is also included in developing other vaccines that are U.S.-licensed. This comprises vaccines for smallpox, rotavirus, rubella, hepatitis chickenpox, and polio. Development of superior biological models, optimization of cell culture growth medium, and reduction in animal-derived component dependencies endure to boost the rapidly developing cell-based vaccine development.

The serum-free media segment witnessed the highest revenue share of 37.20% in 2023 owing to the expanding scope of applications and benefits offered by serum-free culture processes. It offers consistent performance, easier purification & downstream processing, higher precision in evaluation of cellular function, and better detection of cellular mediators. Features as such, makes it highly suitable for producing biopharmaceutical-grade products. Moreover, lack of undefined serum components, media definition can be enhanced, enabling regulatory compliance fulfillment for cell and gene therapy manufacturing. Such factors are also expected to boost further demand for serum-free media over the forecast period.

The stem cell culture media segment is projected to register a considerable CAGR from 2024 to 2033. Increasing demand for stem cell therapies and growing research studies on stem cell applications in regenerative medicine have driven the demand for stem cell culture products. Stem cell culture media offers specialized formulations required for differentiation, expansion, or maintenance of pluripotency in stem cells. These factors are expected to drive the market growth in the forthcoming years.

The biopharmaceutical production segment registered the highest revenue share of 43.00% in 2023. Rising demand for reproducible and better-defined media for meeting expanding production levels and reduction in contamination risk in downstream processes is contributing highly to the increasing demand for this segment. Moreover, strategic initiatives by prominent biopharmaceutical companies are also driving the segment growth.

The diagnostics segment is expected to witness a considerable CAGR during the forecast period. Cell cultures can be used in metabolomics for identification of biomarkers of pathologically relevant conditions. Moreover, metabolic pathways leading to production of such biomarkers can be identified to determine underlying metabolic disorders. Single cell cultures are used for cultivating a broad spectrum of viruses for producing high-titer virus materials for antibody testing. This enhances the diagnostic virology applications of cell culture media, which is expected to boost market growth during the forecast period.

The liquid media segment witnessed the highest revenue share of 63.2% in 2023 owing to a rising number of producers of biosimilars and biologics along with growing preferences for liquid media intending to limit the growth of mycobacteria. Moreover, liquid media eliminates requirement of mixing containers, scales, and the installation of a Water for Injections (WFI) circuit required to mix the powder media.

The semi-solid and solid segment is expected to register a considerable CAGR from 2024 to 2033 as it contains solidifying agents and is usually prepared as agar plates or as slab deeps. These culture media are comparatively inexpensive and can be stored for a longer term than liquid media. In addition, advancements in technology have led to production of granulated culture media from powdered dry media, which dissolves rapidly when WFI is mixed and eliminates any clump formation. This is projected to boost the segment’s growth during the forecast period.

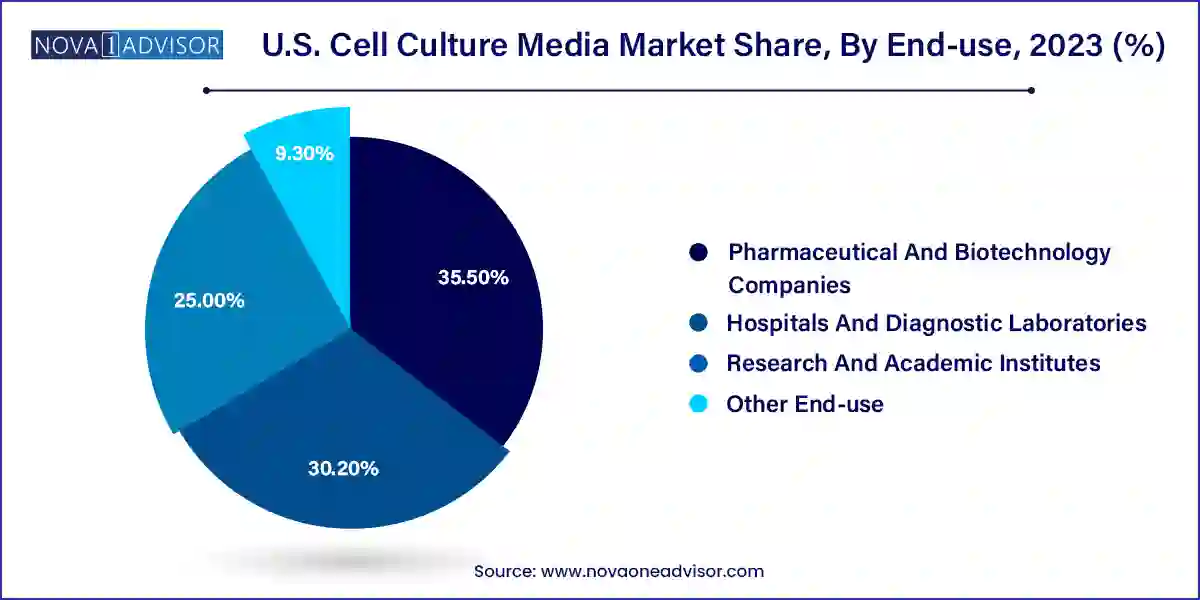

The pharmaceutical & biotechnology segment registered the highest revenue share of 35.5% in 2023 owing to introduction and advent of biosimilar or generic innovative therapeutics. Increasing number of clinical trials treatments for life-threatening diseases by pharmaceutical and biotechnology companies is further driving the demand for cell culture media. Moreover, investments by several companies are significantly increasing in R&D activities, which is further boosting the demand for cell culture media.

Hospitals & diagnostic laboratories segment is expected to register a considerable CAGR from 2024 to 2033 as they are primary care settings for diagnosis & treatment of medical conditions. A major part of a diverse population relies on such long-standing facilities for diagnosis, treatment, and management of diseases. With ongoing changes in the healthcare industry, need for hospitals with advanced facilities has increased. Rise in the number of hospitals and diagnostic laboratories is also leading to segment growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cell culture media market

Product

Application

Type

End-use

Chapter 1. U.S. Cell Culture Media Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Market Formulation & Data Visualization

1.3.2. Data Validation & Publishing

1.4. Research Assumptions

1.5. Research Methodology

1.5.1. Purchased Database

1.5.2. Internal Database

1.5.3. 1secondary Sources

1.5.4. Primary Research

1.5.5. Details Of Primary Research

1.6. Information Or Data Analysis

1.6.1. Data Analysis Models

1.7. Market Formulation & Validation

1.8. Model Details

1.8.1. Commodity Flow Analysis (Model 1)

1.8.1.1. Approach 1: Commodity Flow Approach

1.8.2. Volume Price Analysis (Model 2)

1.8.2.1. Approach 2: Volume Price Analysis

1.9. List Of Secondary Sources

1.10. Objectives

1.10.1. Objective 1:

1.10.2. Objective 2:

1.10.3. Market Estimation For Cell Culture Media Market

Chapter 2. U.S. Cell Culture Media Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. U.S. Cell Culture Media Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Ancillary Market Outlook

3.2. Market Trends and Outlook

3.3. Market Dynamics

3.3.1. Market Driver Impact Analysis

3.3.1.1. Expansion Of Biosimilars And Biologics

3.3.1.2. Growth In Stem Cell Research

3.3.1.3. Emerging Cell Culture Technologies For Cell-Based Vaccines

3.3.2. Market Restraint Impact Analysis

3.3.2.1. Ethical Issues Concerning The Use Of Animal-Derived Products

3.3.2.2. Stringent Regulatory Guidelines

3.4. Business Environment Analysis

3.4.1. Swot Analysis; By Factor (Political & Legal, Economic And Technological)

3.4.2. Porter’s Five Forces Analysis

3.5. Recent Developments and Impact Analysis, by Key Market Participants

3.5.1. Mergers and acquisitions

3.5.2. Technological collaborations

3.5.3. Licensing and partnerships

3.6. COVID-19 Impact Analysis

Chapter 4. U.S. Product Business Analysis

4.1. Product Movement Analysis & Market Share, 2024 & 2033

4.2. Serum-free Media

4.2.1. U.S. serum-free media market estimates and forecasts, 2021 - 2033

4.2.2. CHO Media

4.2.2.1. U.S. CHO market estimates and forecasts, 2021 - 2033

4.2.3. HEK 293 Media

4.2.3.1. U.S. HEK 293 market estimates and forecasts, 2021 - 2033

4.2.4. BHK Media

4.2.4.1. U.S. BHK market estimates and forecasts, 2021 - 2033

4.2.5. Vero Medium

4.2.5.1. U.S. Vero Medium market estimates and forecasts, 2021 - 2033

4.2.6. Other serum-free media

4.2.6.1. U.S. other serum-free media market estimates and forecasts, 2021 - 2033

4.3. Classical Media

4.3.1. U.S. Classical Media market estimates and forecasts, 2021 - 2033

4.4. Stem Cell Culture Media

4.4.1. U.S. Stem Cell Culture Media Market Estimates And Forecasts, 2021 - 2033

4.5. Chemically Defined Media

4.5.1. U.S. Chemically Defined Media Market Estimates And Forecasts, 2021 - 2033

4.6. Specialty Media

4.6.1. U.S. Speciality Media Market Estimates And Forecasts, 2021 - 2033

4.7. Other Cell Culture Media

4.7.1. U.S. Other Cell Culture Media Market Estimates And Forecasts, 2021 - 2033

Chapter 5. U.S. Type Business Analysis

5.1. Type Movement Analysis & Market Share, 2024 & 2033

5.2. Liquid Media

5.2.1. U.S. Liquid Media Market Estimates And Forecasts, 2021 - 2033

5.3. Semisolid & Solid Media

5.3.1. U.S. Semi-Solid & Solid Media Market Estimates And Forecasts, 2021 - 2033

Chapter 6. U.S. Application Business Analysis

6.1. Application Movement Analysis & Market Share, 2024 & 2033

6.2. Biopharmaceutical Production

6.2.1. U.S. Biopharmaceutical Production Market Estimates And Forecasts, 2021 - 2033

6.2.2. Monoclonal Antibodies

6.2.2.1. U.S. Monoclonal Antibodies Market Estimates And Forecasts, 2021 - 2033

6.2.3. Vaccines Production

6.2.3.1. U.S. Vaccines Production Market Estimates And Forecasts, 2021 - 2033

6.2.4. Other Therapeutic Proteins

6.2.4.1. U.S. Other Therapeutic Proteins Market Estimates And Forecasts, 2021 - 2033

6.3. Diagnostics

6.3.1. U.S. Diagnostics Market Estimates And Forecasts, 2021 - 2033

6.4. Drug Screening & Development

6.4.1. U.S. Drug Screening & Development Market Estimates And Forecasts, 2021 - 2033

6.5. Tissue Engineering & Regenerative Medicine

6.5.1. U.S. Tissue Engineering & Regenerative Medicine Market Estimates And Forecasts, 2021 - 2033

6.5.2. Cell & Gene Therapy

6.5.2.1. U.S. Cell & Gene Therapy Market Estimates And Forecasts, 2021 - 2033

6.5.3. Other Tissue Engineering & Regenerative Medicine

6.5.3.1. U.S. Other Tissue Engineering & Regenerative Medicine Market Estimates And Forecasts, 2021 - 2033

6.6. Other Applications

6.6.1. U.S. Other Applications Market Estimates And Forecasts, 2021 - 2033

Chapter 7. U.S. End-Use Business Analysis

7.1. Application Movement Analysis & Market Share, 2024 & 2033

7.2. Pharmaceutical & Biotechnology Companies

7.2.1. U.S. Pharmaceutical & Biotechnology Companies Market Estimates And Forecasts, 2021 - 2033

7.3. Hospitals & Diagnostic Laboratories

7.3.1. U.S. Hospitals & Diagnostic Laboratories Market Estimates And Forecasts, 2021 - 2033

7.4. Research & Academic Institutes

7.4.1. U.S. Research & Academic Institutes Market Estimates And Forecasts, 2021 - 2033

7.5. Other End-Use

7.5.1. U.S. Other End-Use Market Estimates And Forecasts, 2021 - 2033

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Strategy Mapping

8.3. Company Market Position Analysis, 2024

8.4. Company Profiles/Listing

8.4.1. Sartorius AG

8.4.1.1. Overview

8.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. Danaher

8.4.2.1. Overview

8.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Merck KGaA

8.4.3.1. Overview

8.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Thermo Fisher Scientific, Inc.

8.4.4.1. Overview

8.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. FUJIFILM Corporation

8.4.5.1. Overview

8.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Lonza

8.4.6.1. Overview

8.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. BD

8.4.7.1. Overview

8.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. STEMCELL Technologies

8.4.8.1. Overview

8.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.8.3. Product Benchmarking

8.4.8.4. Strategic Initiatives

8.4.9. Cell Biologics, Inc.

8.4.9.1. Overview

8.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

8.4.10. PromoCell GmbH

8.4.10.1. Overview

8.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.10.3. Product Benchmarking

8.4.10.4. Strategic Initiatives