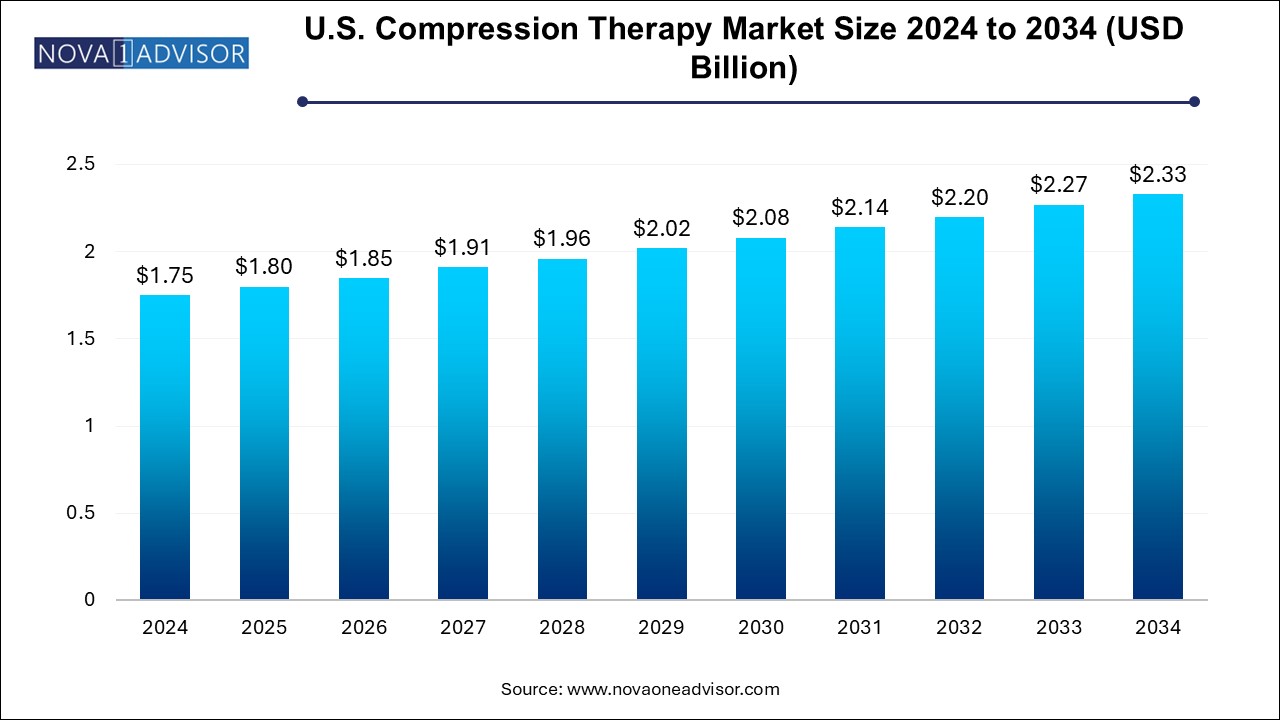

The U.S. compression therapy market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 2.33 billion by 2034, growing at a CAGR of 2.91% during the forecast period 2024 to 2034.

Compression therapy, a cornerstone in the management of venous and lymphatic disorders, has long been a trusted clinical method in the United States. Its efficacy in treating chronic venous insufficiency, lymphedema, deep vein thrombosis (DVT), and post-surgical recovery has secured its place as an essential therapeutic option. In a healthcare landscape that continues to prioritize cost-effectiveness, patient outcomes, and at-home care solutions, compression therapy aligns well with current and future care paradigms.

The U.S. compression therapy market is undergoing a significant transformation fueled by several interrelated factors: an aging population prone to chronic circulatory conditions, a rise in lifestyle diseases such as obesity and diabetes, and growing awareness among healthcare providers and patients about early intervention in venous disorders. Additionally, innovations in textile technology, wearable devices, and pneumatic pump systems have modernized traditional therapy, offering increased comfort and therapeutic value.

Compression therapy is delivered in both static and dynamic formats, encompassing garments such as compression stockings, bandages, and more advanced devices like pneumatic compression pumps. Beyond clinical settings, there’s been a growing shift toward home healthcare and self-managed care, making the market ripe for technological advancements and user-friendly product designs. With increasing attention from insurers and healthcare policy stakeholders, the U.S. market stands poised for both growth and innovation through the forecast period.

Rise in At-home and Ambulatory Care: Patients are increasingly managing chronic conditions like lymphedema and varicose veins from home using wearable compression devices.

Integration of Smart Compression Devices: Emerging wearable tech solutions integrate pressure sensors, mobile apps, and AI for personalized therapy.

Focus on Aesthetic and Comfort Improvements: Enhanced fabric materials and seamless designs are being introduced to increase patient compliance.

Growth of Dynamic Pneumatic Therapy: Intermittent pneumatic compression devices are being used more frequently for post-operative recovery and in high-risk DVT patients.

Increased Awareness and Preventive Use: Preventive applications, especially among athletes, frequent travelers, and postpartum women, are gaining traction.

Shifts in Reimbursement Policies: Adjustments in Medicare and private insurer policies are shaping the adoption of high-cost compression technologies.

Sustainability in Compression Wear: Eco-friendly, reusable compression garments are making their way into the market, driven by conscious consumer demand.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.80 Billion |

| Market Size by 2034 | USD 2.33 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 2.91% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Technology, End use, Distribution Channel |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Cardinal Health; 3M; SIGVARIS GROUP; Essity ; Julius Zorn, Inc.; HARTMANN USA, Inc; Bauerfeind USA Inc.; medi USA; BIOCOMPRESSION SYSTEMS; Gottfried Medical, Inc. |

One of the most significant drivers propelling the U.S. compression therapy market is the country’s growing geriatric population, which is particularly vulnerable to vascular conditions such as chronic venous insufficiency, deep vein thrombosis, and lymphedema. According to the U.S. Census Bureau, more than 77 million Americans are expected to be aged 65 or older by 2034, making up over 20% of the total population. Age-related decline in vascular elasticity, combined with a higher risk of immobility and surgeries, makes this demographic highly susceptible to venous disorders.

Compression therapy offers a non-invasive, cost-effective way to manage these conditions without relying heavily on pharmacological or surgical interventions. As healthcare systems aim to reduce hospital readmissions and promote preventive care, compression therapy is gaining favor among physicians and patients alike. Hospitals and home care settings increasingly prescribe compression garments and devices as part of postoperative and chronic care regimens, contributing to expanding market demand.

Despite its clinical benefits, compression therapy faces a significant hurdle in the form of poor patient compliance. Many users report discomfort, heat buildup, or difficulty in donning and doffing compression garments—factors that lead to therapy discontinuation. These challenges are particularly acute in the elderly population, where physical limitations may hinder proper usage of stockings or bandages.

Moreover, dynamic compression devices, while effective, can be bulky, noisy, and require user education. Patients without adequate training may fail to use them correctly, diminishing therapeutic outcomes. Inadequate reimbursement coverage for certain devices also disincentivizes continued use. Manufacturers face the dual challenge of maintaining medical-grade compression efficacy while improving comfort, usability, and aesthetics to enhance adherence and long-term outcomes.

The most promising opportunity in the U.S. compression therapy market lies in technological advancement, particularly in dynamic compression systems and smart textiles. Companies are investing in pneumatic pumps that adjust compression levels in real time based on patient needs, while integrating digital features such as remote monitoring, app-controlled settings, and data analytics.

Smart compression garments with embedded sensors are emerging, capable of monitoring limb circumference, temperature, and patient activity. These features enable dynamic, personalized therapy while offering valuable data to physicians and caregivers. Moreover, 3D knitting technology and seamless designs are improving patient comfort, making the garments suitable for long-term wear and cosmetic appeal. This fusion of medical-grade efficacy with user-friendly design is opening new revenue streams and making compression therapy more accessible across care settings.

Static compression therapy dominated the U.S. compression therapy market, due to its broad application in both clinical and non-clinical environments. Products like compression stockings and bandages are widely used to manage varicose veins, lymphedema, and post-surgical swelling. Their non-invasive nature and relative affordability make them a preferred first-line treatment for both acute and chronic conditions. Compression stockings, in particular, are the most prescribed due to ease of use and established reimbursement models. Additionally, static compression garments have become increasingly popular in non-medical scenarios, such as among airline travelers, athletes, and pregnant women, contributing to rising consumer-based demand.

However, dynamic compression therapy is anticipated to be the fastest growing segment, especially driven by increased post-operative and chronic care applications. Compression pumps and sleeves are being adopted in hospitals and home care settings for patients recovering from surgery, or those with advanced venous and lymphatic disorders. These devices deliver intermittent pneumatic compression, stimulating blood flow more actively than static garments. Manufacturers are increasingly targeting this segment with innovations like portable and wearable pumps, compact control units, and user-friendly interfaces. This growth is supported by rising clinical evidence, physician recommendations, and a gradual expansion of insurance coverage for high-risk patient groups.

The hospital End Use segment dominated the market in 2024 with a share of 31.05%. As they serve as primary points of treatment for vascular conditions, trauma recovery, and post-operative care. Hospitals utilize both static and dynamic compression products across surgical, orthopedic, and vascular departments. Advanced pneumatic compression systems are particularly favored in intensive care units to prevent DVT among immobile patients. Furthermore, hospitals often serve as the initial setting for therapy prescription, after which patients continue use in outpatient or home environments. The structured care protocols and higher purchasing power of hospitals support sustained demand for both disposable and reusable compression products.

The home healthcare segment is anticipated to grow significantly over the forecast period. Driven by a cultural and systemic shift toward at-home management of chronic conditions. Patients with venous insufficiency, post-surgical swelling, or lymphedema are increasingly using compression garments and portable pneumatic pumps in their homes to avoid frequent hospital visits. The COVID-19 pandemic further accelerated the preference for home-based care. Manufacturers are responding with lightweight, noise-free, and battery-operated compression pumps designed for self-administration. Additionally, the expansion of remote patient monitoring is supporting this trend by allowing healthcare providers to oversee therapy adherence and outcomes outside clinical settings.

The institutional sales segment dominated the market share 55.0% in 2024. Supported by bulk purchasing from hospitals, nursing homes, and specialty clinics. These institutions procure compression products based on contracts, long-term partnerships with suppliers, and treatment protocols. High patient volumes and the need for immediate availability of products support consistent demand. Institutional buyers also benefit from training programs, bundled deals, and after-sales support offered by manufacturers. Given the structured and repeat-use nature of therapy in institutional settings, this channel remains vital for product circulation and revenue generation.

The retail sales distribution channel is anticipated to grow at the fastest CAGR in the market. As patients increasingly seek over-the-counter solutions and home-based therapy, retail pharmacies, online platforms, and specialty health stores are becoming important distribution points. E-commerce platforms like Amazon and dedicated medical supply websites have expanded access to compression products, offering discreet delivery and competitive pricing. Additionally, manufacturers are enhancing their digital presence and direct-to-consumer models, making it easier for patients to understand, purchase, and use compression therapy solutions without clinical gatekeeping.

The U.S. compression therapy market is strongly influenced by demographic, economic, and healthcare policy factors unique to the country. A rapidly aging population, rising obesity rates, and a high incidence of chronic venous disorders form a robust base of demand. Healthcare reforms encouraging home-based care, outpatient treatment, and preventive therapy further fuel market expansion. Major urban centers with advanced healthcare infrastructure account for the bulk of demand, while rural areas are seeing growth through telehealth and mobile healthcare services.

Policy shifts such as Medicare’s inclusion of compression products under durable medical equipment (DME) codes, as well as initiatives to reduce hospital readmissions, are driving uptake. The U.S. also hosts several key market players and research institutions, fostering innovation and product testing. Moreover, strong insurer networks and employer-sponsored healthcare plans improve access to both static and dynamic compression therapy, although reimbursement inconsistencies persist across states. With growing attention to vascular health and expanding product accessibility, the U.S. market is expected to maintain a strong growth trajectory through 2034.

January 2025: 3M Health Care introduced a new line of breathable compression bandages with antimicrobial properties aimed at diabetic foot ulcer management, enhancing comfort and compliance.

February 2025: SIGVARIS Group expanded its U.S. operations by launching an e-commerce platform tailored for direct-to-consumer sales, along with educational tools for patients managing lymphedema.

March 2025: Bio Compression Systems, Inc. announced FDA clearance for its next-generation portable pneumatic compression device featuring Bluetooth-enabled compliance monitoring.

April 2025: Juzo USA collaborated with a leading telehealth platform to offer virtual compression therapy consultations, aiming to improve adherence and patient support in home healthcare settings.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. compression therapy market

By Technology

By End Use

By Distribution Channel