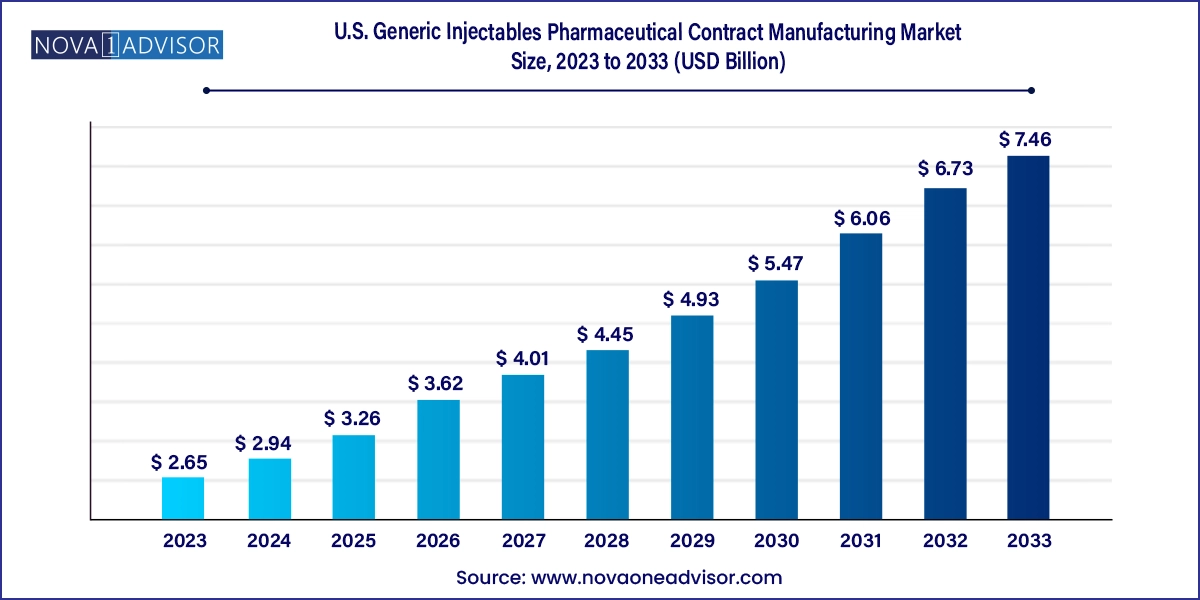

The U.S. generic injectables pharmaceutical contract manufacturing market size was exhibited at USD 2.65 billion in 2023 and is projected to hit around USD 7.46 billion by 2033, growing at a CAGR of 10.9% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.94 Billion |

| Market Size by 2033 | USD 7.46 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 10.9% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Molecule Type, Application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Hikma Pharmaceuticals plc; Pfizer Inc.; Fresenius Kabi; Sandoz AG; Jubilant Pharma Limited; Baxter; PCI Pharma Services; Gland Pharma Limited (USA); Dr. Reddy’s Laboratories Ltd.; Grand River Aseptic Manufacturing |

The rising frequency of injectable medications losing patent protection is one of the primary factors supporting the growth of the generic injectables pharmaceutical contract manufacturing space. For instance, in March 2023, Takeda Pharmaceutical Company Limited's blockbuster medication Velcade (bortezomib) saw its patent exclusivity in the U.S. expire, leading to the introduction of generic alternatives in the same year.

Furthermore, the manufacturing and supply of injectables are specialized and capital-intensive. Injectables require dedicated manufacturing lines, which can cost around USD 30-35 million. Owing to the aforementioned factors, the contract manufacturing of generic injectables is gaining traction, thus augmenting the growth of the U.S. market for generic injectables pharmaceutical contract manufacturing.

The COVID-19 pandemic significantly impacted the pharmaceutical industry, including the sector of generic injectables. It disrupted global supply chains, leading to a shortage of pharmaceutical ingredients and raw materials. This affected the manufacturing process of generic injectables, leading to potential supply shortages, excluding the injectables for COVID-19 treatment. Regulatory bodies in the U.S. prioritized the review of medical products and drugs pertaining to COVID-19 treatment, potentially delaying the approval of new generic injectables. Furthermore, economic uncertainties led to cost and pricing pressures in the pharmaceutical sector, thus affecting the pricing of generic injectables.

Geopolitical wars, crises, and conflicts profoundly and multifacetedly have impacted the generic injectables industry. However, the U.S. generic injectables pharmaceutical contract manufacturing sector managed to recover and achieve substantial sales growth in 2023 and 2023, largely driven by the expiration of patents for several blockbuster drugs during this period. In July 2023, the patent for Sanofi's highly successful medication Mozobil expired, leading to the introduction of generic versions of Plerixafor.

The large molecule segment held the dominant revenue share of 62.3% in 2023. The growing emphasis on tailored treatments and precision medicine is a major factor augmenting the growth of the large molecule generic injectable drugs segment in the U.S. Moreover, increasing product launches including biosimilars is a major factor supporting segment growth. For instance, in January 2023, Amgen announced the launch of AMJEVITA, a biosimilar to Humira, in the U.S. AMJEVITA was the first generic version of Humira approved by the U.S. FDA. Such factors are poised to support segment growth.

The small molecule segment is anticipated to register a stable CAGR of 10.5% during the forecast period. Small molecule-based injectable drugs continue to hold an essential position in the treatment of a wide range of illnesses, including cancer, blood disorders, infectious diseases, and cardiovascular ailments. The high growth of the segment is majorly due to the increasing rate of generics being launched across the U.S. and, concurrently, several contract manufacturers garnering profits by entering the manufacturing business of generic injectables. This is one of the main reasons supporting segment expansion across the forecast period.

The oncology segment held the largest revenue share of 29.9% in 2023 in the U.S. generic injectables pharmaceutical contract manufacturing market. This is due to increasing generic product launches pertaining to cancer treatment. A considerable number of contract manufacturers are focusing on the development of generic injectables for anti-cancer treatment therapy. Additionally, a substantial pipeline of generic products for anti-cancer therapies is in development, with numerous generic drugs set to be introduced to the market.

For instance, from 2007 to 2020, the U.S. Food and Drug Administration (FDA) approved 16 oncology biosimilars. It is anticipated that this number will continue to increase in the forecast period, contributing to the expansion of this segment. Furthermore, the growing prevalence of the condition further supports research and development activities pertaining to abbreviated new drug application (ANDA) of biosimilars for anti-cancer therapeutics.

On the other hand, the neurology segment is expected to register the fastest CAGR of 11.3% during the forecast period. This is mainly due to the rise in demand for biosimilars to treat several neurological conditions. Moreover, large scale contract manufacturers are focusing on the development of neurology-based biosimilars, thereby supporting the segment’s growth.

For instance, in April 2023, Teva Pharmaceuticals and MedinCell announced that the U.S. FDA had granted approval for UZEDY (risperidone) extended-release injectable suspension for treating schizophrenia in adults. Additionally, the incidence of neurological disorders such as Alzheimer's disease and Parkinson's disease has been steadily increasing over the past decade, which is further anticipated to support the growth of this segment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. generic injectables pharmaceutical contract manufacturing market

Molecule Type

Application