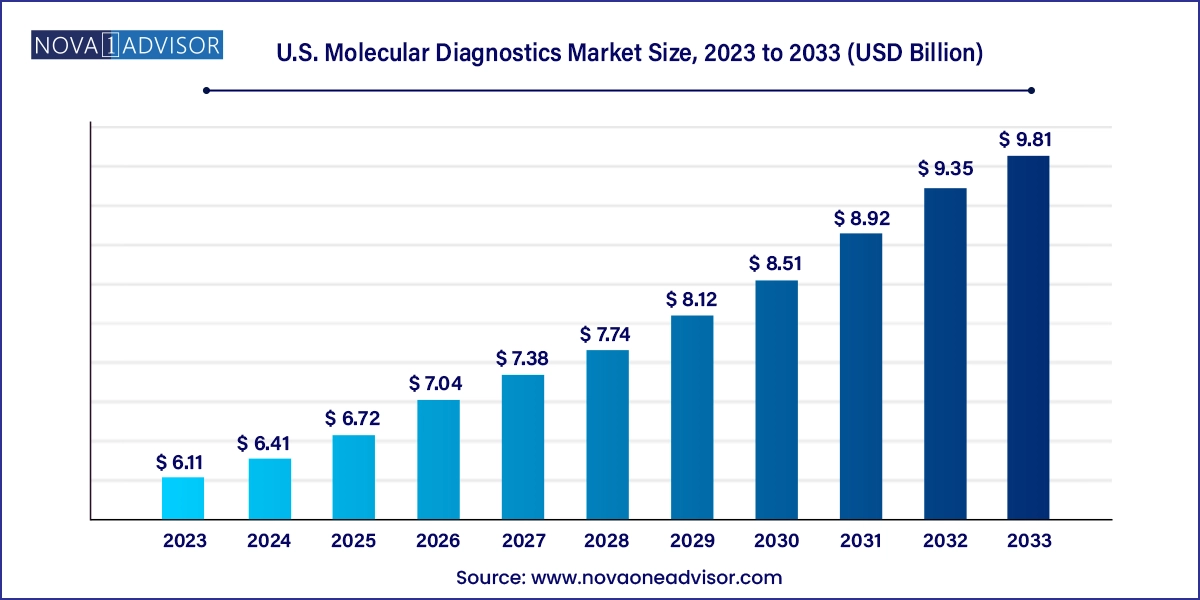

The U.S. molecular diagnostics market size was exhibited at USD 6.11 billion in 2023 and is projected to hit around USD 9.81 billion by 2033, growing at a CAGR of 8.84% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.41 Billion |

| Market Size by 2033 | USD 9.81 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.84% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Disease, End-use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S. |

| Key Companies Profiled | Abbott; Siemens Healthcare GmbH; QIAGEN; F. Hoffmann-La Roche Ltd; Quest Diagnostics Incorporated; Danaher; Thermo Fisher Scientific, Inc.; Hologic Inc.; BD; Charles River Laboratories; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Agilent Technologies, Inc. |

The increasing prevalence of infections and technological advancements in molecular diagnostic tests drive the market. Furthermore, the presence of favorable reimbursement policies coupled with rising government support in the form of funding and initiatives for the development of diagnostics tests is anticipated to drive the U.S. molecular diagnostics growth over the forecast period.

The COVID-19 pandemic has positively impacted the market by encouraging players to develop novel and rapid diagnostic kits capable of detecting coronavirus. This has resulted in positive revenue growth for major market players operating in the infectious disease segment. For instance, Thermo Fisher Scientific reported 150% revenue growth owing to the rising demand for diagnostics offerings in April 2021. However, the rising adoption of vaccination in the region is anticipated to reduce the demand for COVID-19 testing over the forecast period.

Moreover, increasing incidences of infections in the country primarily drive the demand for cost-effective and efficient diagnostics techniques. According to a study published by the Journal of Clinical Virology in March 2023, enterovirus infection incidents increased by 21.7% compared to the previous year. Furthermore, enterovirus majorly affects the population with ages less than 5 years, of which around 41% of the infected toddlers require supplemental oxygen. In addition, according to the article published by the National Library of Medicine in May 2021, around 40 % of the U.S. population in the U.S. is affected by H. pylori infection every year.

The presence of government support in the form of approvals and funding is anticipated to fuel the market growth over the forecast period. For instance, in May 2023, Abbot received approval for its Alinity m STI Assay from the U.S. FDA. The test is capable of differentiating and detecting STIs. In addition, in 2020, ASPR’s Biomedical Advanced Research and Development Authority and NIH’s National Institute of Allergy and Infectious Diseases organized the Antimicrobial Resistance Diagnostic Challenge in which Visby Medical’s rapid PCR test won USD 19 million in federal funding.

High prices associated with molecular tests are one of the major factors impeding the market for U.S. molecular diagnostics. Furthermore, the scarcity of comparable tests is another reason for price hikes. The significant variations in prices for different applications of each molecular diagnostic product further compound this problem. However, the presence of favorable reimbursement policies in the country is anticipated to fuel the market demand. For instance, in January 2023, the U.S. Department of Health and Human Services announced that individuals with group health plans or covered by private health insurance who purchase at-home COVID-19 tests will get benefits of cost coverage from the insurance or plan.

The respiratory disease segment dominated the market with a share of 41.79% in 2023. The growth is attributed to the increasing prevalence of respiratory infections such as HPIVs, MDR-TB, and group A streptococcal, among others, coupled with the increasing awareness regarding the availability of diagnostics tests for diagnosing and treatment of infections. According to a study conducted by the CDC, there has been a significant increase in the number of parainfluenza infections till December 2023. This is further contributing to the growing number of hospitalizations caused by HPIVs.

The healthcare-associated infections segment is anticipated to witness the fastest growth from 2024 to 2033. The growth is attributed to the increasing incidences of HAI and technological advancements in diagnostic techniques are driving the growth. According to a study published by the National Library of Medicine in December 2023, around 4% of the total hospitalizations are affected by HAI in the U.S. every year. Furthermore, rising government support in the form of initiatives to reduce the incidence of infections during hospitalizations is anticipated to fuel the growth over the forecast period. For instance, in 2023, the Centers for Medicare & Medicaid Services introduced the Hospital-Acquired Condition (HAC) Reduction Program to encourage hospitals to reduce incidences of infection during hospitalization and improve overall patient safety.

The hospital core laboratory held the largest share of 39.43% of the market for U.S. molecular diagnostics in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is attributed to the increasing prevalence of infections, such as MRSA, Staphylococcus aureus (SA), and enterovirus. According to a study published by NCBI in May 2023, the prevalence of SA carriage was found to be 30.2% among individuals aged between 18 years and 64 years, 20.7% among children, and 16.7% among people aged more than 65 years.

Reference labs are also expected to register a considerable CAGR during the forecast period. Increasing government support through initiatives and reimbursement policies is anticipated to drive market growth over the forecast period. For instance, in March 2023, the U.S. government launched the AHRQ Safety Program for MRSA Prevention. The program is anticipated to boost the demand for molecular diagnostic techniques by creating awareness regarding multidrug-resistant organisms and MRSA transmission.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. molecular diagnostics market

Disease

End-use