The whole genome sequencing market size was exhibited at USD 2.24 billion in 2024 and is projected to hit around USD 16.50 billion by 2034, growing at a CAGR of 22.10% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.74 Billion |

| Market Size by 2034 | USD 16.50 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 22.10% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Product & Service, Type, Workflow, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Illumina, Inc.; Thermo Fisher Scientific, Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; BGI; QIAGEN; Agilent Technologies; ProPhase Labs, Inc. (Nebula Genomics); Psomagen; Azenta US, Inc.; (GENEWIZ) |

The WGS market is experiencing significant growth, driven by a confluence of technological advancements, decreasing costs, and a growing demand for personalized medicine. Several key factors contribute to this expansion, transforming the landscape of genomics and impacting various sectors, including healthcare, research, and agriculture.

One of the most critical drivers of the WGS market is the rapid advancement in sequencing technologies. The development of next-generation sequencing (NGS) platforms has dramatically increased the speed and efficiency of genome sequencing. These technologies allow for high throughput sequencing which aids in analysis of vast amounts of genetic data quickly and cost-effectively. Innovations such as nanopore sequencing and single-cell sequencing are also emerging, further enhancing the capabilities of genomic analysis. In May 2024,SOPHiA GENETICS partnered with Microsoft and NVIDIA to develop a scalable whole genome sequencing (WGS) analytical solution for healthcare institutions, aiming for customer availability by year-end. As these technologies continue to evolve, they make WGS more accessible to a broader range of users, from large research institutions to smaller laboratories and clinics.

The cost of sequencing a whole genome has plummeted over the past decade, making it feasible for routine clinical use. The introduction of competitive sequencing platforms has led to a significant decrease in the price per base of DNA sequenced. This decline in cost is crucial for driving adoption, as it allows healthcare providers to incorporate genomic data into standard practice. The promise of affordable WGS is particularly appealing in the context of personalized medicine, where tailored treatments based on individual genetic profiles can improve patient outcomes.

The shift towards personalized medicine is a significant factor propelling the WGS market. Healthcare providers are increasingly recognizing the value of genomics in understanding diseases at a molecular level, leading to more precise diagnoses and targeted therapies. WGS allows for the identification of genetic predispositions to various conditions, enabling proactive healthcare management. In March 2023, Godrej Memorial Hospital in Mumbai launched genome testing to identify over 150 genetic conditions. In collaboration with HaystackAnalytics, it introduced the Health Genometer Smart Plan, an AI platform that analyzes high-risk conditions through genomic tests. This test covers over 7,000 genes and addresses 48 medical conditions, including cancer and diabetes, while providing personalized health recommendations. As patients and providers seek more personalized treatment options, the demand for whole genome sequencing is expected to rise sharply.

WGS is gaining traction in various applications beyond traditional clinical diagnostics. In cancer research, for instance, it plays a pivotal role in identifying mutations that drive tumor growth, facilitating the development of targeted therapies. In infectious disease management, WGS is instrumental in tracking outbreaks and understanding pathogen evolution. Furthermore, the agricultural sector is leveraging WGS for crop improvement and livestock breeding, optimizing traits such as disease resistance and yield.

The regulatory landscape is evolving to support the integration of genomic data into clinical practice. Agencies like the FDA are establishing guidelines for the use of genomic information in drug development and patient care. This supportive environment fosters innovation and encourages investment in genomic technologies, thereby propelling the WGS market forward.

The surge in investment from both public and private sectors is another critical driver of the WGS market. Venture capital firms and government initiatives are increasingly funding genomic research and technology development. This influx of capital is enabling startups and established companies to innovate and expand their offerings, further stimulating market growth.

Based on product & service, the consumables segment dominated the market with the largest revenue share of 61.15% in 2024. As the demand for genomic research and personalized medicine surged, the need for high-quality reagents, kits, and other consumables increased significantly. These products are crucial for sample preparation, library construction, and sequencing itself, making them indispensable in both clinical and research settings. Additionally, the recurring nature of consumable purchases fosters consistent revenue streams for manufacturers. Innovations in consumables, enhancing their performance and reliability, further fueled market growth.

The services segment is expected to witness the fastest CAGR of 25.11% during the forecast period. As WGS becomes more integral to personalized medicine and research, there’s a heightened need for specialized services such as data analysis, interpretation, and bioinformatics. These services help healthcare providers and researchers navigate complex genomic data, ensuring accurate results and actionable insights. Additionally, advancements in sequencing technology have increased the volume of data generated, necessitating expert support for data management. The growing trend of outsourcing sequencing and analytical services to specialized providers also contributed to this growth, allowing institutions to focus on core research activities.

Based on type, the large whole genome sequencing held the largest market share in 2024 due to its extensive application in diverse fields such as cancer genomics, population studies, and complex trait research. Large WGS allows for comprehensive analyses of genetic variations, enabling researchers to uncover critical insights into disease mechanisms and evolutionary biology. Advances in sequencing technologies have significantly reduced costs and improved throughput, making large-scale projects more feasible and attractive.

The small whole genome sequencing segment is projected to experience the fastest CAGR of 24.77% during the forecast period. The technique allows for efficient sequencing of smaller genomes, such as those found in certain bacteria and viruses, which are crucial for understanding infectious diseases and antibiotic resistance. As researchers seek to understand specific genetic variations without the complexity of larger genomes, the demand for focused analyses is rising. The growth of microbiome studies and precision agriculture further enhances the relevance of small WGS, positioning it as a key segment in the evolving genomics market.

Based on workflow, the sequencing segment held the largest market share of 52.07% in 2024. This segment dominated the market due to its integral role in streamlining the entire sequencing process, from sample preparation to data analysis. Comprehensive workflows ensure high efficiency and accuracy, making them essential for both research and clinical applications. As sequencing technology evolves, the demand for standardized, user-friendly workflows has increased, facilitating broader adoption across various institutions. In October 2023, Twist Bioscience Corporation launched Twist Full Length Unique Dual Index Adapters to facilitate PCR-free WGS and large-scale multiplexing, leveraging its silicon platform for high-quality synthetic DNA. Moreover, advancements in automation and bioinformatics tools enhance throughput and data management, making workflows more reliable and accessible. These factors are expected to drive the segment.

The data analysis segment is projected to witness the fastest CAGR of 23.78% during the forecast period. Data analysis segment is fueled by the exponential increase in genomic data generated by advanced sequencing technologies. As whole genome sequencing becomes more widespread, the need for sophisticated data analysis tools to interpret complex genomic information is critical. The integration of artificial intelligence and machine learning into data analysis enhances predictive accuracy and speeds up interpretation, further driving demand.

The human whole genome sequencing segment dominated the market with the largest revenue share of 63.09% in 2024. By providing comprehensive insights into an individual's genetic makeup, human WGS enables tailored healthcare solutions, facilitating precise diagnoses and targeted treatments. The increasing prevalence of genetic disorders, coupled with a growing emphasis on preventive medicine, drives demand for human genomic data. Furthermore, significant investments in research initiatives and biobanks have expanded the availability of human genomic resources, enhancing the segment’s relevance. Advances in sequencing technology have also reduced costs, making human WGS more accessible to healthcare providers and researchers. This convergence of factors solidified the human WGS segment as a leader in the genomics market.

The microbial whole genome sequencing market segment is projected to witness the fastest CAGR of 23.55% from 2024 to 2033. The segment is fueled by the increasing need for comprehensive understanding and management of microbial communities, particularly in healthcare and agriculture. The rise of antibiotic resistance and infectious diseases has heightened demand for precise genomic insights into pathogens, facilitating targeted treatments and outbreak tracking. The growing interest in microbiome research further fuels this segment, as understanding microbial interactions can lead to innovations in personalized medicine and sustainable agriculture practices.

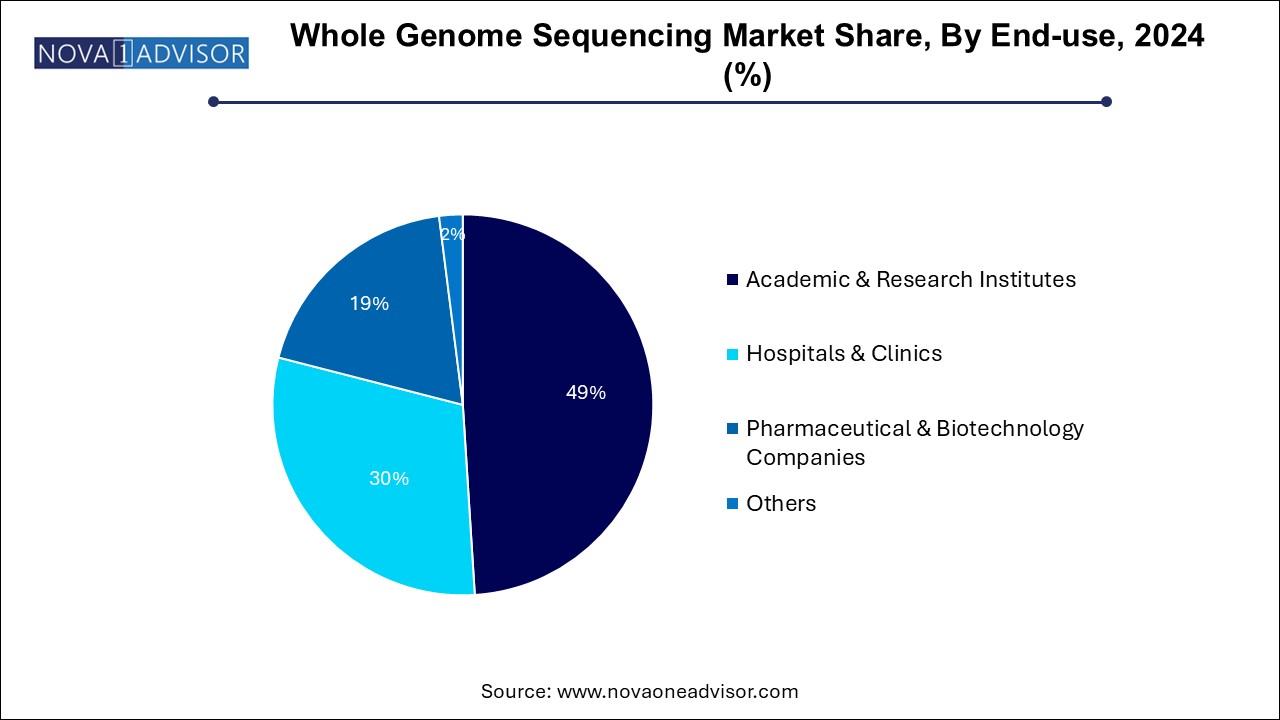

The academic & research institutes segment held the largest market share of 49.0% in 2024. These institutions are at the forefront of research initiatives, exploring complex biological questions that require comprehensive genomic analysis. Significant funding from governmental and private sources supports large-scale genomic projects, enabling these institutes to leverage cutting-edge sequencing technologies. Their collaborative nature fosters partnerships with biotech companies and healthcare providers, amplifying the application of genomic data across various fields. Moreover, academic institutions contribute to the development of new methodologies and analytical tools, further solidifying their position in the market.

The hospitals & clinics segment is projected to witness the fastest CAGR of 24.64% during the forecast period. As personalized medicine gains traction, healthcare providers are recognizing the value of whole genome sequencing in diagnosing genetic disorders, guiding treatment decisions, and tailoring therapies to individual patients. The rising prevalence of chronic diseases and genetic conditions drives demand for comprehensive genomic analysis to improve patient outcomes. Increasingly supportive regulatory frameworks further facilitate the adoption of genomic testing in hospitals and clinics.

North America whole genome sequencing market accounted for the largest market share of 51.97% in 2024. This dominance can be attributed to substantial investments from both public and private sectors, including significant backing from venture capital and government programs. The region's well-established research ecosystem, featuring top-tier universities and research institutions, fosters rapid technological innovation.

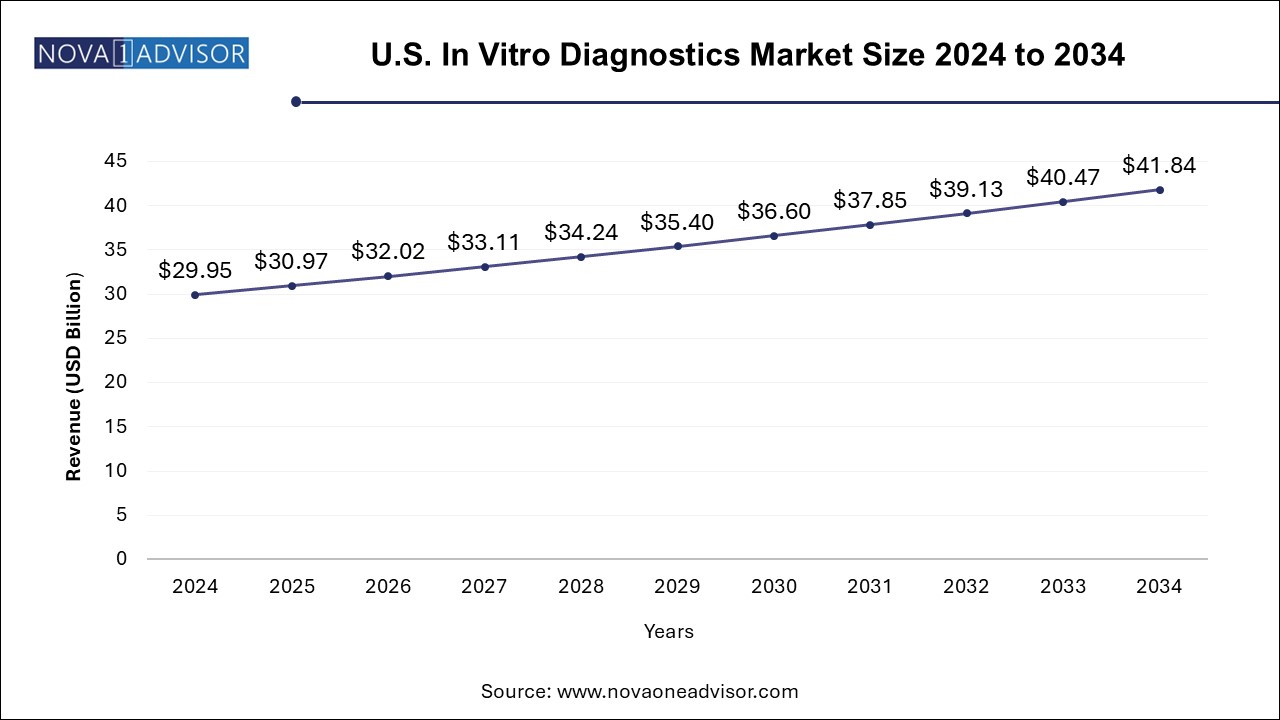

U.S. Whole Genome Sequencing Market Trends

The whole genome sequencing market in the U.S. is expected to witness significant growth in the coming years, largely due to the presence of prominent market players. Additionally, leading universities and research institutions in the country promote innovation and foster collaborative efforts in genomics. A strong regulatory framework supports biotechnological advancements while addressing safety and ethical considerations.

Europe Whole Genome Sequencing Market Trends

The whole genome sequencing market in Europe is experiencing significant growth. Increasing investment in personalized medicine and genomics research is driving demand for advanced sequencing technologies. The European Union's commitment to healthcare innovation, exemplified by initiatives like the European Genome-phenome Archive, supports this growth. Additionally, a rising prevalence of genetic disorders and the aging population emphasize the need for precise diagnostics which can boost the market growth.

The whole genome sequencing market in the UK held a significant share in 2024. The UK market is witnessing growth due to strong government support, like the Genomic Healthcare Strategy, and initiatives such as the 100,000 Genomes Project. Increasing investments in personalized medicine, rising genetic disorder diagnoses, and collaborations among NHS, academia, and biotech firms are also driving significant advancements in genomics.

France whole genome sequencing market is expected to grow remarkably over the forecast period. France's whole genome sequencing market is growing due to substantial government funding for genomics research and healthcare innovation. Initiatives like the National Plan for Genomic Medicine enhance access to genomic technologies. Collaborations between public research institutions and private biotech companies also drive advancements, supporting personalized medicine and disease prevention efforts.

The whole genome sequencing market in Germany is anticipated to grow significantly over the forecast period. Germany's whole genome sequencing market is growing due to its leadership in bioinformatics and healthcare technology. The integration of genomic data into the digital health strategy enhances patient care. Additionally, several initiatives such as partnerships between major pharmaceutical companies drive innovation in drug development in the country which can positively affect the market.

Asia Pacific Whole Genome Sequencing Market Trends

The whole genome sequencing market in Asia Pacific is projected to grow at the fastest CAGR of 25.42% over the forecast period. The market is surging due to rapid advancements in biotechnology and increasing government support for genomics research. Countries like China are investing heavily in genomic initiatives, such as the "China National Genomic Data Center." Similarly, Japan's focus on precision medicine and robust healthcare infrastructure, alongside a growing emphasis on research collaboration across the region, are key drivers of market growth.

The whole genome sequencing market in China is expected to grow over the forecast period. Initiatives like the "Healthy China 2030" plan prioritize genomic research for disease prevention and treatment. The establishment of the China National GeneBank promotes data sharing and innovation. Additionally, the rise of leading genomics companies, such as BGI, enhances accessibility and affordability of sequencing technologies. The increasing demand for personalized medicine and the expansion of genetic testing services in urban areas further accelerate market expansion in China.

Japan whole genome sequencing market is witnessing significant growth over the forecast period. Japan's whole genome sequencing market is expanding due to its advanced healthcare system and strong emphasis on precision medicine. Additionally, Japan's aging population drives demand for personalized healthcare solutions. Collaborations between academic institutions and biotechnology firms, alongside investments in artificial intelligence for genomic analysis, further enhance the market's growth potential, making Japan a leader in genomic innovation in the Asia-Pacific region.

MEA Whole Genome Sequencing Market Trends

The MEA whole genome sequencing market is projected to grow significantly over the forecast period. Countries like the UAE and South Africa are establishing genomic research centers to enhance local capabilities. The rising prevalence of genetic disorders and public health challenges also drive demand for genomic solutions. Furthermore, collaborations with global biotech firms and government support for research and development initiatives are promoting innovation and accessibility of technology across the region.

Saudi Arabia whole genome sequencing market is set to expand in line with Vision 2030, which prioritizes biotechnology as a key sector. Significant investments in research facilities and partnerships with international companies are strengthening local capabilities. Additionally, the country's strategic location provides access to emerging markets in the region, further enhancing its manufacturing potential.

The whole genome sequencing market in Kuwait is also anticipated to grow, driven by increased investments in biotechnology and pharmaceutical research. Kuwait's WGS market is growing due to government initiatives aimed at enhancing healthcare quality, including the National Health Strategy. The establishment of the Kuwait Genome Project focuses on genetic research tailored to the local population, addressing high rates of hereditary diseases. Such initiatives are likely to boost the market in Kuwait.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the whole genome sequencing market

Product & Service

Type

Workflow

Application

End Use

Regional