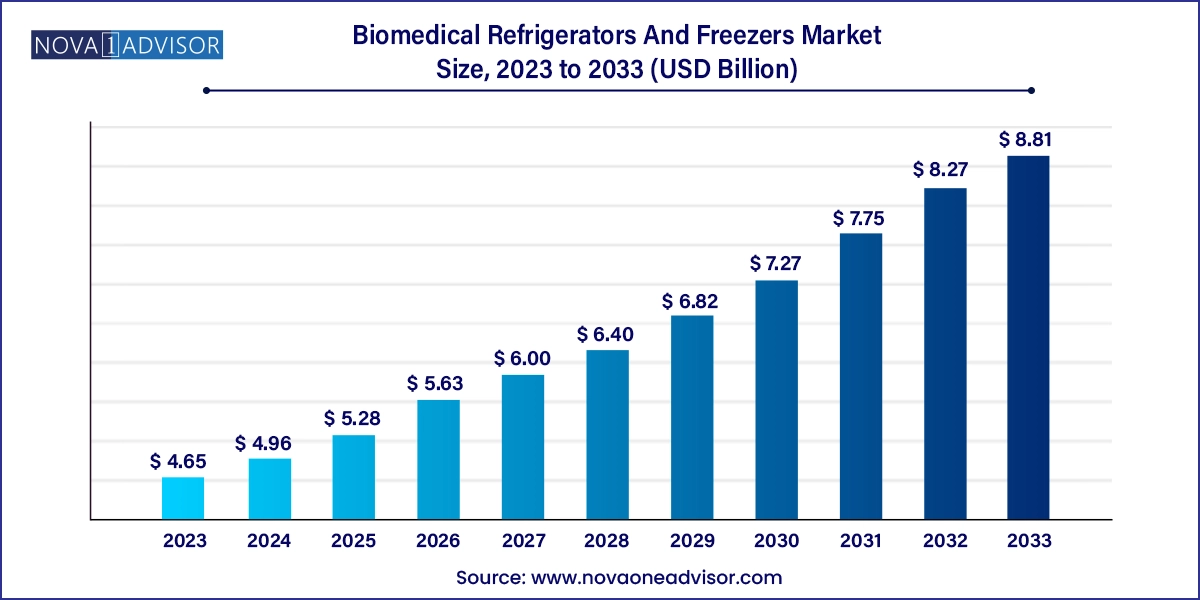

The biomedical refrigerators and freezers market size was exhibited at USD 4.65 billion in 2023 and is projected to hit around USD 8.81 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.96 Billion |

| Market Size by 2033 | USD 8.81 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 6.6% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, End Use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa and Kuwait. |

| Key Companies Profiled | Panasonic Healthcare Corporation, Haier Biomedical, Eppendorf AG, Power Scientific, Inc., Aegis Scientific, Inc., Haier Biomedical, Follett LLC, Helmer Scientific, Thermo Fisher Scientific, Azbil Corporation |

The rising geriatric population worldwide and the prevalence of chronic diseases such as cardiovascular disease, diabetes, and cancer are major drivers contributing to the market’s growth. In addition, these medical facilities are used to avoid product degradation, provide thermal insulation and store biological, which has increased their usage, leading to the market’s growth.

The advancement of science and technology has increased the R&D activities in the medical goods industry, which has helped promote medication discovery and creation. In addition, the growing demand for biopharmaceuticals and organ transplantation has boosted the biomedical refrigerators and freezers market to grow positively in the forecast period. For instance- in January 2024, according to a report published in the Organ Procurement & Transplantation Network, a total of 46,632 organ transplants were performed in the year 2023.

The increasing prevalence of chronic disease worldwide has a major impact on how the biomedical refrigerators and freezers market has been growing. According to World Health Organization (WHO) data, about 17 million people die from chronic disease before the age of 70. Cardiovascular disease accounts for most chronic disease deaths, followed by 9.3 million deaths by cancer, 4.1 million by chronic respiratory diseases, and about 2 million by diabetes and kidney diseases caused by diabetes. These biomedical refrigerators and freezers are essential for storing vaccines, blood, and blood components used in the treatment of various chronic illnesses such as cancer, cardiac diseases, and infectious diseases. This has led to their high usage rate, driving the market to grow in the forecast period.

Ongoing improvements in biopharmaceuticals, personalized medicine, and gene treatments are expected to increase the demand for precise and specialized storage conditions provided by biomedical refrigerators and freezers. Advances in life science and pharmaceutical research increases the demand for ultra-low temperature freezers which require dependable, accurate, and secure preservation equipment. This is expected to drive market growth and support the development of new treatments for chronic diseases. For instance- in February 2023, Panasonic Healthcare Corporation launched the PHCbi Brand VIP ECO SMART Ultra-Low Temperature Freezer without compromising preservation capability and helps in minimizing power consumption.

Various government initiatives and support from government to provide technical and financial assistance in the improvement of healthcare infrastructure, treatment of several chronic diseases and procurement of biomedical refrigerators and freezers is a positive trend witnessed in the market. For instance, in 2019, the World Health Assembly extended the WHO Global Action Plan for the control and prevention of NCDs in 2013 to 2020 and further extending it to 2030, thereby contributing towards the achievement SDG goal 3.4.

Plasma freezers dominated the market and accounted for a market share of 28.2% in 2023. The rising prevalence of chronic diseases has increased research activity and demand for storing biological samples, including blood and plasma products. This has driven the growth of the plasma freezers segment. Manufacturers of plasma freezers have introduced innovations that reduce energy usage, avoid crystallization, and ensure even temperature distribution. These advancements have made plasma freezers more efficient and reliable, further boosting their adoption.

The laboratory /pharmacy/medical refrigerators segment is expected to grow at the fastest CAGR over the forecast period. It can be attributed to the efforts to prevent high wastage of laboratory chemicals, vaccines, and other biological products owing to improper storage conditions, and this has been a major factor impacting the profitability and operational efficiency of laboratories and pharmacies. In addition, the growing GLP practices and government scrutiny in the implementation of quality management are also contributing factors to the segment’s growth.

Blood banks accounted for the largest market revenue share of 38.2% in 2023. It can be attributed to the increasing number of blood banks in developed and developing countries. The surging demand for blood transfusions, awareness for blood donation, and the requirement for a blood cold chain for blood storage during the transportation of blood samples and donor sessions to the laboratory have contributed to boosting the market’s growth. For instance, according to a report by the American Cancer Society, there were about 1.9 million people diagnosed with cancer in 2023. This would surge the need for blood during their chemotherapy treatment; thereby, the requirement for biomedical refrigerators and freezers would increase and help the market to grow positively.

Pharmacies segment is expected to grow at a significant rate of 6.6% CAGR during the forecast period. The need to prevent medication spoilage, the growing prevalence of chronic diseases, the expansion of the biopharmaceutical industry, improved patient safety, and government support to grow at a faster rate in the coming years.

North America biomedical refrigerator and freezers market dominated the market in 2023. It is attributed to the high prevalence of chronic diseases and the rising geriatric population, leading to a significant number of blood transfusion procedures and the consumption of various pharmaceutical products. The improved healthcare sector and the funding/investment done by governments help in improving patient care and reducing the wastage of pharmaceutical and biological components. All these factors have contributed to the growth of the market positively.

U.S. Biomedical Refrigerators And Freezers Market Trends

The U.S. biomedical refrigerators and freezers market dominated the global market with a share of 40.8% in 2023 owing to factors such as improved healthcare facilities and expenditure and the increasing geriatric population leading to various chronic diseases. In addition, the increasing number of blood transfusions has also affected the market’s growth. For instance, in 2021, there were an estimated 10,764,000 blood transfusions in the U.S. In addition, in 2023, according to the American Heart Association, an estimated 928,741 deaths occurred in 2020 in the U.S. due to cardiovascular diseases.

In addition, in 2020, around 41% of people in the U.S. died of coronary heart disease, and 17.3%, 12.9%, 9.2%, and 2.6% died of stroke, high blood pressure, heart failure, and diseases of the arteries, respectively. In 2023, CDC awarded about USD 114 million to all 50 states, thereby increasing the healthcare spending for heart-related disorders. Heart Truth is a national education program launched by the U.S. government and is still in progress to create awareness among people to live a heart-healthy lifestyle. All these factors have created awareness among people for better healthcare facilities such as biomedical refrigerators and freezers for not compromising on preservation capability. Thereby boosting market growth.

Europe Biomedical Refrigerators and Freezers Market Trends

Europe biomedical refrigerators and freezers market was identified as a lucrative region in 2023. The growth can be attributed to the new technological advancements in this region. In addition, the growing geriatric population and prevalence of heart and circulatory diseases have impacted the market’s growth. In addition, the growing number of organ transplants has also boosted the market growth. For instance, in October 2023, according to the European Directorate for the Quality of Medicines & Healthcare, there was an increase of 6% in organ transplants in 2023 over 2021. In 2022, approximately 40,000 organ transplants were performed in over 1000 transplantation centers in the Council of Europe member states. Moreover, according to the Eurostat report of 2024, circulatory diseases resulted in about 32.7% of deaths in the European Union (EU) in 2020. It demands better treatment options, and with the help of advancements in science and technology and storage facilities, the market is expected to drive market.

Asia Pacific Biomedical Refrigerators and Freezers Market Trends

Asia Pacific biomedical refrigerators and freezers market is anticipated to witness significant growth in biomedical refrigerators and freezers market. The rising burden of chronic diseases is leading to increased demand for improved healthcare facilities. In addition, increased awareness among healthcare providers and patients about the benefits of advanced storage procedures, such as biomedical refrigerators and freezers are fueling the market growth in Asia-Pacific. In addition, about 3.9 million deaths occur in the WHO South-East Asia Region every year due to cardiovascular diseases. Thus, awareness about the importance of better healthcare facilities has boosted this market to grow positively.

MEA Biomedical Refrigerators And Freezers Market Trends

MEA biomedical refrigerators and freezers market is anticipated to witness significant growth over the forecast period due to the growing public awareness. Demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, may also contribute to the growing demand for biomedical refrigerators and freezers, thereby increasing the market growth in this region. For instance, in 2023, according to American College of Cardiology, an estimated one-third of all deaths in MEA occur due to cardiovascular diseases.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the biomedical refrigerators and freezers market

Product

End Use

Regional