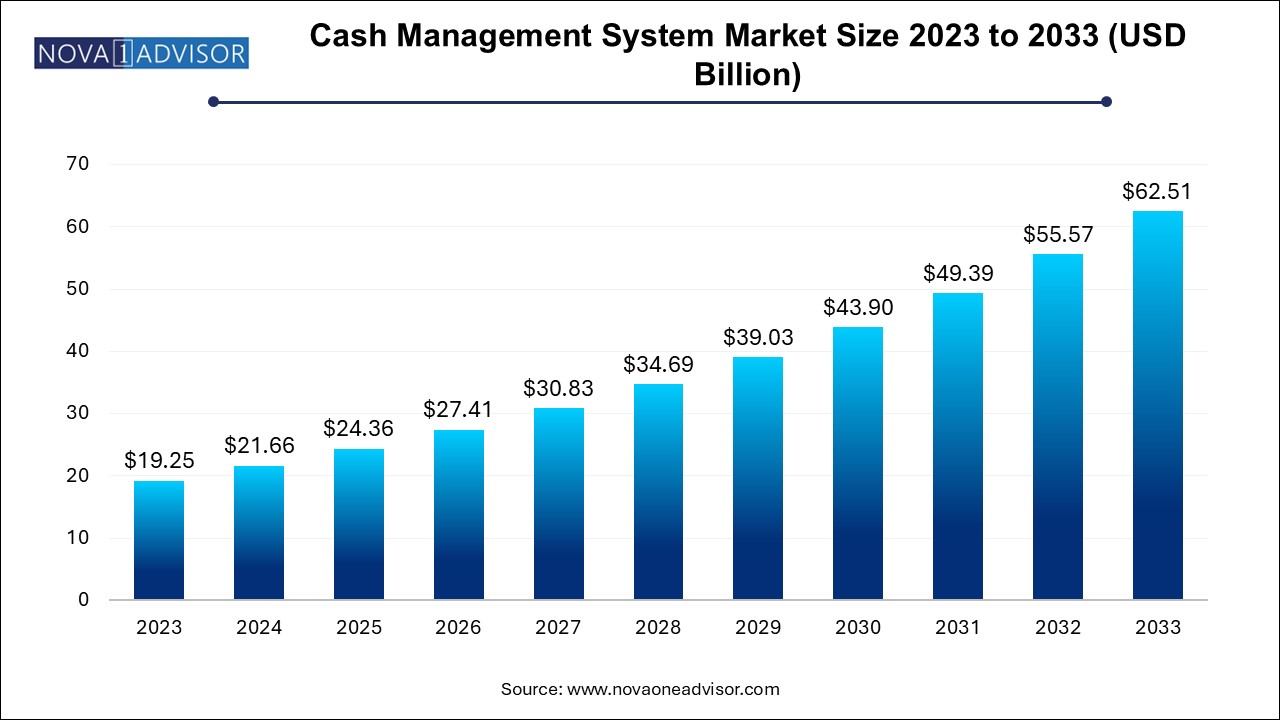

The global cash management system market size was exhibited at USD 19.25 billion in 2023 and is projected to hit around USD 62.51 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2024 to 2033.

The growth can be attributed to the rise in the e-commerce sector and the increased adoption of automated applications in the banking sector. An increasing need for automated cloud-based solutions in banking is expected to further create lucrative growth opportunities for the market. The cloud-based cash management system can be easily integrated into existing enterprise resource planning (ERP) systems that help banks manage money flow and payments through a network. This allows banks to scale money management systems to address the corporate customers’ requirements by providing real-time access to transactions.

The increasing need for centralized cash management solutions in banking transaction processes is anticipated to propel the market growth. These solutions allow businesses to overview information about cash and financial transactions. Numerous businesses are focusing on driving financial efficiency and managing transaction risk. As a result, businesses are widely adopting a centralized cash management system.

Growing adoption of smart safe cash management solutions across various end-uses is anticipated to fuel market growth. Smart safe solutions help businesses overcome cash handling and storage issues. These technologically advanced safes allow businesses to monitor cash at every step of the money handling process. These safes provide clear visibility into the money flow at all times.

The integration of machine learning (ML) and artificial intelligence (AI) techniques in the financial sector is expected to create growth opportunities for the market over the forecast period. AI and ML platforms are helping businesses in providing the most accurate money flow forecasts. The AI and ML integrated solutions are widely adopted by enterprises as these solutions seamlessly integrate with accounting systems, enterprise resource planning (ERP) systems, and bank management systems. The ML and AI algorithms process datasets, including vendor invoices, customer invoices, and bank statement inflows/outflows for accurate and comprehensive money flow forecasts.

Increasing cyberattacks and data theft are, however, hindering the market growth. In May 2023, the World Economic Forum stated that the worldwide losses that occurred due to cyberattacks reached USD 1 trillion. Cyber-attackers are targeting card processing, e-banking, ATM management, and interbank transfer processes for data theft. This, as a result, is obstructing market growth and creating challenges for securing financial transactions data.

| Report Coverage | Details |

| Market Size in 2024 | USD 21.66 Billion |

| Market Size by 2033 | USD 62.51 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 12.5% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Component, Operation Type, Deployment, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Sopra Banking Software SA; Intacct Corporation; NTT Data Corporation; National Cash Management Systems (NCMS); Giesecke & Devrient GmbH; Oracle Corporation. |

The introduction of AI (artificial intelligence) has been fuelling the market’s growth. The process of cash management and cash forecasting has been revolutionized by the implementation of AI technologies such as machine learning, robotic process automation (RPA), and deep learning. The process of cash management thus resulted in greater efficiencies, enhanced productivity, and higher profitability. The technology benefits by eliminating the need for manually performing the tasks like reporting payables, receivables, and others enhances the effectiveness of such tasks, along with increases the efficiency by reducing time demand.

The majority of transactions that occurred in the retail sector are cash transactions. Retail stores are required to accept, process, and store cash payments along with the required amount for change. The need for working capital increases due to the cash kept at stores, also handling cash leads to waste of human resources. In addition, this sector is highly prone to experience internal cash shrinkage or stealing. According to Global Retail Theft Barometer, over $41 Billion of shrinkage was done by internal employees. This necessitates the requirement for an effective money management system thus providing lucrative growth opportunities to the market.

However, the software incompatibility during expansion has resulted in a major drawback for vendors providing cash management systems. This is ascribed to the interoperability problems faced by the systems when organizations collaborate or get acquired by another company. In addition, setting up a cash management system requires specific infrastructure which can be compatible with new services and software. Furthermore, incorporating new technologies into existing business needs high initial investments. Collectively these factors are observed to hamper the market growth.

Based on the component, the market has been segmented into solution and service. The solution segment is expected to dominate the market over the forecast period owing to the increasing need for fund transfer process automation and streamlining of money management processes. The cash management solutions enable businesses to simplify complex money transfer processes and reduce manual workload. Numerous vendors are focusing on offering configurable automation algorithms as per the business needs. For instance, Cashbook is focused on offering configurable automation algorithms to business ERP systems, thereby helping businesses improve their outcomes.

The service segment is expected to register the highest CAGR over the forecast period. Various businesses are adopting cash management services to efficiently process their payables and receivables. These services help businesses optimize money flow position and further help drive effective management of the business operations. Moreover, these services allow businesses to predict money flow and manage liquidity.

Based on the operation type, the market has been segmented into balance and transaction reporting, cash flow forecasting, corporate liquidity management, payables, receivables, and others. The balance and transaction reporting segment dominated the market in 2023, owing to the increased adoption of balance and transaction reporting module by business treasurers to accurately monitor all receivables and payables in real-time. An increasing need to gain visibility into money transfer activities across multiple accounts, currencies, and geographies is further anticipated to drive the segment growth over the forecast period. Moreover, these modules allow businesses to maintain control over money flow and liquidity.

The cash flow forecasting segment is anticipated to register the highest growth over the forecast period. The money flow forecasting tools are widely used by corporates and banks to identify future money needs. Various factors, such as highly competitive industry and economic uncertainty, are propelling organizations to deliver more value to their customers. The need for an effective money demand measurement is rapidly growing, which is expected to fuel the segment growth during the forecast period.

Based on deployment, the market has been segmented into cloud and on-premise. The on-premise deployment segment is anticipated to continue its dominance over the forecast period. This deployment method allows businesses to have control over their business data and offers a sense of proprietorship compared to cloud deployment. Moreover, the on-premise deployment process permits large-scale customization of services and products whilst offering infrastructure flexibility.

The cloud deployment segment is anticipated to register the highest growth over the next eight years. The cloud deployment mode is preferred by a wide range of businesses owing to the advancements in technology and numerous benefits it offers, such as easy upgradation and low operational cost. The advantage of this deployment method is that businesses that are using cloud services need not upgrade those services constantly. Moreover, this deployment enables the ability to manage, monitor, and control large and complex systems.

Based on the enterprise size, the market has been segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprise segment dominated the market in 2023, owing to the increased adoption of cash management systems in larger banks to precisely manage payments and basic account transactions. These systems include services like image lockbox and automated clearing house (ACH) receipt. Moreover, the systems also offer payables automation services, which, in turn, is expected to fuel the demand in large enterprises.

The SME segment is anticipated to register the highest growth over the next eight years. Numerous small and medium enterprises are turning to software solutions to control their cash flows. As liquidity management becomes more complex, various SMEs across the globe are investing in high-performance software with the view of reducing transaction risk and increasing profitability. The rapidly increasing SME sector is anticipated to create growth opportunities for the market in near future.

Based on end-use, the market has been segmented into banks, retail, non-banking financial corporations, and commercial enterprises. The bank segment is expected to dominate the market over the forecast period owing to the increased adoption of money management systems to reduce the time required for the transaction process and to help increase the high net profit of the banks. These systems also help the banks to improve the technical proficiency of their employees. Various services offered by these systems include advanced web services, account reconcilement services, and balance reporting services.

The commercial enterprise segment is expected to emerge as the fastest-growing end-use segment over the forecast period. Various commercial businesses are widely adopting money management tools to optimize their business cash flow. These tools allow businesses to access a suite of online receivable, payable, and reporting solutions to meet the needs of the business. Moreover, these tools allow easy access to e-Statements and balances and transaction information through a consolidated dashboard.

Europe region dominated the market for cash management systems in 2023. The growth can be attributed to the presence of prominent market players, such as Sopra Banking Software SA; Giesecke & Devrient GmbH; and Glory Global Solutions, Inc. The European Union is accelerating its efforts to foster work around advanced technologies such as blockchain. According to Fintech Action Plan 2023, the European Commission plans to form new Fintech Labs across the region, thereby creating growth opportunities for the regional market.

Asia Pacific is anticipated to emerge as the fastest-growing regional market over the forecast period. The growth can be attributed to the increasing demand for money management systems to maximize the automation of high volume financial transactions for large enterprises. Various factors, such as the increasing need for enterprise-level connectivity and a rise in demand for liquidity management, are anticipated to propel the growth. Moreover, large as well as small and medium enterprises in the region are deploying tailor-made money management solutions to attain significant returns on investment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cash management system market

Component

Operation Type

Deployment

Enterprise Size

End-use

Regional

Chapter 1 Methodology and Scope

1.1 Research Methodology

1.2 Research Scope and Assumptions

1.3 List of Data Sources

Chapter 2 Executive Summary

2.1 Cash Management System Market - Industry Snapshot & Key Buying Criteria, 2021 - 2033

2.2 Global Cash Management System Market, 2021 - 2033

2.2.1 Global cash management system market, by region, 2021 - 2033

2.2.2 Global cash management system market, by component, 2021 - 2033

2.2.3 Global cash management system market, by operation type, 2021 - 2033

2.2.4 Global cash management system market, by deployment, 2021 - 2033

2.2.5 Global cash management system market, by enterprise size, 2021 - 2033

2.2.6 Global cash management system market, by end-use, 2021 - 2033

Chapter 3 Cash Management System Industry Outlook

3.1 Market Segmentation and Scope

3.2 Market Size and Growth Prospects

3.3 Cash Management System Market - Value Chain Analysis

3.3.1 Vendor landscape

3.4 Cash Management System Market Dynamics

3.4.1 Market driver analysis

3.4.1.1 Increasing need to predict cash flows accurately and help businesses to prevent and mitigate fraudulent activity

3.4.1.2 Growing demand for automation and optimization of working capital

3.4.2 Market restraint analysis

3.4.2.1 High initial investment for a cash management system

3.5 Penetration and Growth Prospect Mapping

3.6 Cash Management System Market - Porter’s Five Forces Analysis

3.7 Cash Management System Market - Company Market Share Analysis, 2024

3.8 Cash Management System Market - PESTEL Analysis

Chapter 4 Cash Management System Component Outlook

4.1 Cash Management System Market Share By Component, 2024

4.2 Solution

4.2.1 Cash management solution market, 2021 - 2033

4.3 Service

4.3.1 Cash management service market, 2021 - 2033

Chapter 5 Cash Management System Operation Type Outlook

5.1 Cash Management System Market Share By Operation Type, 2024

5.2 Balance & Transaction Reporting

5.2.1 Cash management system market for balance & transaction reporting, 2021 - 2033

5.3 Cash Flow Forecasting

5.3.1 Cash management system market for cash flow forecasting, 2021 - 2033

5.4 Corporate Liquidity Management

5.4.1 Cash management system market for corporate liquidity management, 2021 - 2033

5.5 Payables

5.5.1 Cash management system market for payables, 2021 - 2033

5.6 Receivables

5.6.1 Cash management system market for receivables, 2021 - 2033

5.7 Others

5.7.1 Cash management system market for other operation types, 2021 - 2033

Chapter 6 Cash Management System Deployment Outlook

6.1 Cash Management System Market Share By Deployment, 2024

6.2 Cloud

6.2.1 Cloud cash management system market, 2021 - 2033

6.3 On-premise

6.3.1 On-premise cash management system market, 2021 - 2033

Chapter 7 Cash Management System Enterprise Size Outlook

7.1 Cash Management System Market Share By Enterprise Size, 2024

7.2 Large Enterprises

7.2.1 Cash management system market for large enterprises, 2021 - 2033

7.3 Small & Medium Enterprises

7.3.1 Cash management system market for small & medium enterprises, 2021 - 2033

Chapter 8 Cash Management System End-Use Outlook

8.1 Cash Management System Market Share By End Use, 2024

8.2 Banks

8.2.1 Cash management system market in banks, 2021 - 2033

8.3 Retail

8.3.1 Cash management system market in retail, 2021 - 2033

8.4 Non-Banking Financial Corporations

8.4.1 Cash management system market in non-banking financial corporations, 2021 - 2033

8.5 Commercial Enterprises

8.5.1 Cash management system market in commercial enterprises, 2021 - 2033

Chapter 9 Cash Management System Regional Outlook

9.1 Cash Management System Market Share by Region, 2024

9.2 North America

9.2.1 North America cash management system market, 2021 - 2033

9.2.2 North America cash management system market, by component, 2021 - 2033

9.2.3 North America cash management system market, by operation type, 2021 - 2033

9.2.4 North America cash management system market, by deployment, 2021 - 2033

9.2.5 North America cash management system market, by enterprise size, 2021 - 2033

9.2.6 North America cash management system market, by end use, 2021 - 2033

9.2.7 U.S.

9.2.7.1 U.S. cash management system market, 2021 - 2033

9.2.7.2 U.S. cash management system market, by component, 2021 - 2033

9.2.7.3 U.S. cash management system market, by operation type, 2021 - 2033

9.2.7.4 U.S. cash management system market, by deployment, 2021 - 2033

9.2.7.5 U.S. cash management system market, by enterprise size, 2021 - 2033

9.2.7.6 U.S. cash management system market, by end use, 2021 - 2033

9.2.8 Canada

9.2.8.1 Canada cash management system market, 2021 - 2033

9.2.8.2 Canada cash management system market, by component, 2021 - 2033

9.2.8.3 Canada cash management system market, by operation type, 2021 - 2033

9.2.8.4 Canada cash management system market, by deployment, 2021 - 2033

9.2.8.5 Canada cash management system market, by enterprise size, 2021 - 2033

9.2.8.6 Canada cash management system market, by end use, 2021 - 2033

9.3 Europe

9.3.1 Europe cash management system market, 2021 - 2033

9.3.2 Europe cash management system market, by component, 2021 - 2033

9.3.3 Europe cash management system market, by operation type, 2021 - 2033

9.3.4 Europe cash management system market, by deployment, 2021 - 2033

9.3.5 Europe cash management system market, by enterprise size, 2021 - 2033

9.3.6 Europe cash management system market, by end use, 2021 - 2033

9.3.7 Germany

9.3.7.1 Germany cash management system market, 2021 - 2033

9.3.7.2 Germany cash management system market, by component, 2021 - 2033

9.3.7.3 Germany cash management system market, by operation type, 2021 - 2033

9.3.7.4 Germany cash management system market, by deployment, 2021 - 2033

9.3.7.5 Germany cash management system market, by enterprise size, 2021 - 2033

9.3.7.6 Germany cash management system market, by end use, 2021 - 2033

9.3.8 U.K.

9.3.8.1 U.K. cash management system market, 2021 - 2033

9.3.8.2 U.K. cash management system market, by component, 2021 - 2033

9.3.8.3 U.K. cash management system market, by operation type, 2021 - 2033

9.3.8.4 U.K. cash management system market, by deployment, 2021 - 2033

9.3.8.5 U.K. cash management system market, by enterprise size, 2021 - 2033

9.3.8.6 U.K. cash management system market, by end use, 2021 - 2033

9.4 Asia Pacific

9.4.1 Asia Pacific cash management system market, 2021 - 2033

9.4.2 Asia Pacific cash management system market, by component, 2021 - 2033

9.4.3 Asia Pacific cash management system market, by operation type, 2021 - 2033

9.4.4 Asia Pacific cash management system market, by deployment, 2021 - 2033

9.4.5 Asia Pacific cash management system market, by enterprise size, 2021 - 2033

9.4.6 Asia Pacific cash management system market, by end use, 2021 - 2033

9.4.7 China

9.4.7.1 China cash management system market, 2021 - 2033

9.4.7.2 China cash management system market, by component, 2021 - 2033

9.4.7.3 China cash management system market, by operation type, 2021 - 2033

9.4.7.4 China cash management system market, by deployment, 2021 - 2033

9.4.7.5 China cash management system market, by enterprise size, 2021 - 2033

9.4.7.6 China cash management system market, by end use, 2021 - 2033

9.4.8 India

9.4.8.1 India cash management system market, 2021 - 2033

9.4.8.2 India cash management system market, by component, 2021 - 2033

9.4.8.3 India cash management system market, by operation type, 2021 - 2033

9.4.8.4 India cash management system market, by deployment, 2021 - 2033

9.4.8.5 India cash management system market, by enterprise size, 2021 - 2033

9.4.8.6 India cash management system market, by end use, 2021 - 2033

9.4.9 Japan

9.4.9.1 Japan cash management system market, 2021 - 2033

9.4.9.2 Japan cash management system market, by component, 2021 - 2033

9.4.9.3 Japan cash management system market, by operation type, 2021 - 2033

9.4.9.4 Japan cash management system market, by deployment, 2021 - 2033

9.4.9.5 Japan cash management system market, by enterprise size, 2021 - 2033

9.4.9.6 Japan cash management system market, by end use, 2021 - 2033

9.5 Latin America

9.5.1 Latin America cash management system market, 2021 - 2033

9.5.2 Latin America cash management system market, by component, 2021 - 2033

9.5.3 Latin America cash management system market, by operation type, 2021 - 2033

9.5.4 Latin America cash management system market, by deployment, 2021 - 2033

9.5.5 Latin America cash management system market, by enterprise size, 2021 - 2033

9.5.6 Latin America cash management system market, by end use, 2021 - 2033

9.5.7 Brazil

9.5.7.1 Brazil cash management system market, 2021 - 2033

9.5.7.2 Brazil cash management system market, by component, 2021 - 2033

9.5.7.3 Brazil cash management system market, by operation type, 2021 - 2033

9.5.7.4 Brazil cash management system market, by deployment, 2021 - 2033

9.5.7.5 Brazil cash management system market, by enterprise size, 2021 - 2033

9.5.7.6 Brazil cash management system market, by end use, 2021 - 2033

9.6 MEA

9.6.1 MEA cash management system market, 2021 - 2033

9.6.2 MEA cash management system market, by component, 2021 - 2033

9.6.3 MEA cash management system market, by operation type, 2021 - 2033

9.6.4 MEA cash management system market, by deployment, 2021 - 2033

9.6.5 MEA cash management system market, by enterprise size, 2021 - 2033

9.6.6 MEA cash management system market, by end use, 2021 - 2033

Chapter 10 Competitive Landscape

10.1 ALVARA Cash Management Group AG

10.1.1 Company overview

10.1.2 Financial performance

10.1.3 Product benchmarking

10.1.4 Strategic initiatives

10.2 Ardent Leisure Management Limited

10.2.1 Company overview

10.2.2 Financial performance

10.2.3 Product benchmarking

10.2.4 Strategic initiatives

10.3 Aurionpro Solutions Limited

10.3.1 Company overview

10.3.2 Financial performance

10.3.3 Product benchmarking

10.3.4 Strategic initiatives

10.4 Giesecke & Devrient GmbH

10.4.1 Company overview

10.4.2 Financial performance

10.4.3 Product benchmarking

10.4.4 Strategic initiatives

10.5 Glory Global Solutions, Inc.

10.5.1 Company overview

10.5.2 Financial performance

10.5.3 Product benchmarking

10.5.4 Strategic initiatives

10.6 Intacct Corporation

10.6.1 Company overview

10.6.2 Financial performance

10.6.3 Product benchmarking

10.6.4 Strategic initiatives

10.7 National Cash Management Systems (NCMS)

10.7.1 Company overview

10.7.1 Financial performance

10.7.2 Product benchmarking

10.7.3 Strategic initiatives

10.8 NTT Data Corporation

10.8.1 Company overview

10.8.2 Financial performance

10.8.3 Product benchmarking

10.8.4 Strategic initiatives

10.9 Oracle Corporation

10.9.1 Company overview

10.9.2 Financial performance

10.9.3 Product benchmarking

10.9.4 Strategic initiatives

10.10 Sopra Banking Software SA

10.10.1 Company overview

10.10.2 Financial performance

10.10.3 Product benchmarking

10.10.4 Strategic initiatives

10.11 List of Prominent Market Players