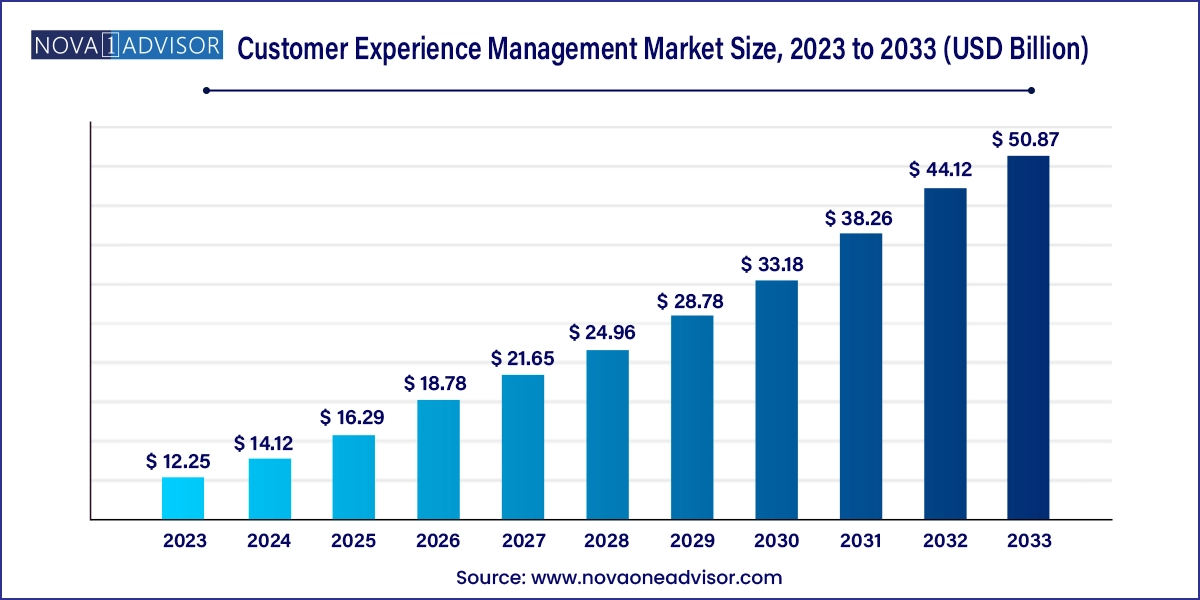

The global customer experience management market size was exhibited at USD 12.25 billion in 2023 and is projected to hit around USD 50.87 billion by 2033, growing at a CAGR of 15.3% during the forecast period 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.12 Billion |

| Market Size by 2033 | USD 50.87 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 15.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Analytical Tools, Touch Point Type, Deployment, Organization Size, End-use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

| Key Companies Profiled | Accenture Plc; Amdocs; Capgemini; CBRE; Cognizant; Delta BPO Solutions; Go4Customer; HCL Technologies Ltd.; Infosys Ltd. (Infosys BPM); International Business Machines Corp.; NCR Corp.; SODEXO; Teleperformance SE; TTEC Holdings, Inc.; Wipro |

The market growth can be attributed to the rising importance of understanding customer behavior and their preferences, which drives various brands and organizations to implement customer experience strategies, such as regularly communicating and engaging with customers, developing a long-term program, and utilizing automation, to provide the best service performance to customers in real-time. The increasing use of digital technology tools is likely to set the pace for digital transformation and digital optimization in both existing and new businesses. These developments are expected to increase the use of cloud technology and work collaboration tools, thereby supporting customer experience management (CEM) market growth.

The market is expected to witness an increasing share of work delivered through digital engagement models based on collaboration platforms and tools. The rapid proliferation of smart technologies, such as Machine Learning (ML), Artificial Intelligence (AI), and the Internet of Things (IoT), among others has declined the cost of computing and storage power. For instance, automakers are using AI and analytics to provide maintenance services with in-vehicle sensors that can tell when a customer needs any service. This development would further drive the market growth. The continued digital transformation across various industries is prompting companies to replace the existing solutions required to create, manage, and enhance the digital presence with a unified solution that can serve all purposes.

The Digital Transformation Initiative of the World Economic Forum expects platform-driven interactions to account for almost 2/3rd of the USD 100 trillion digitalization economy by 2025. As such, the continued integration of Artificial Intelligence (AI) and Machine Learning (ML) into CEM solutions is expected to drive industry growth. Understanding customer behavior is essential for businesses of all sizes. Given that the general public frequently spends quality time on various social networking platforms, such as Twitter, Facebook, Pinterest, LinkedIn, and Snapchat, among others, organizations have recognized that social networking platforms can provide a great opportunity to gauge changing customer behavior and the way customers interpret information about products or services. Social customer relationship management (CRM) can particularly assist businesses at this stage in positively engaging customers and increasing brand awareness.

These developments would further drive market growth. Supply chain disruptions and the implementation of new regulations would also have a significant impact on industry growth. Moreover, as more people turn to the Internet for online shopping, the B2C market is expanding rapidly. Healthcare and information technology & telecommunications are likely to see growth opportunities. As the demand for medicinal products and medicines has grown exponentially, effective and efficient change management has become increasingly important in the life sciences industry. A strong push for learning and development supported by AR/VR for remote training & demonstration for both employees & customers, as well as AR/VR-led remote troubleshooting for the energy & utility, retail, and telecom industries, would result in an improved customer experience, reduced time-to-serve, and reduced costs.

The text analytics segment accounted for a revenue share of around 39.0% in 2023. The growing need for social media analytics and demand for sorting customer interactions or Voice of the Customer (VoC) across various digital touchpoints has contributed to the overall segment growth. Furthermore, text analytics enables predictive analytics with accurate sentiment data analysis and assists users in making critical business decisions by analyzing current and historical data to predict future outcomes. As a result of these factors, the segment growth is expected to be driven by the demand for predictive analytics among organizations over the forecast period.

The speech analytics segment is expected to witness a significant growth of 18.4% from 2024 to 2033. Speech analytics helps businesses gain deeper insights into customer sentiment, needs, and pain points. By analyzing call recordings, businesses can identify recurring themes and areas for improvement. This empowers them to tailor their products, services, and support to better meet customer expectations. Speech analytics can be used to evaluate agent performance and identify areas for coaching and development. By analyzing call recordings, businesses can identify strengths and weaknesses in communication skills, product knowledge, and problem-solving abilities. This data helps ensure agents are equipped to deliver exceptional customer service.

The call centers segment accounted for the largest market share of around 31.0% in 2023 due to increased adoption of advanced contact center technologies and cloud-based & virtual contact center solutions, the emerging role of social media in contact center operations, and streamlined customer interactions to achieve high customer satisfaction. Furthermore, the growing popularity of call centers has impelled businesses to invest in technologies that aid in improving call resolution rates, customer satisfaction rates, and multi-channel performance, among others. These technologies include self-service workforce management solutions, speech technology, analytical tools, case management solutions, and email response management systems. These developments would further supplement the demand for advanced call centers.

The web services segment is expected to grow at a CAGR of 17.4% from 2024 to 2033. Web CEM enables organizations to deliver responsive, powerful, mission-critical customer experiences across omnichannel touch points that meet the needs of many enterprise information platforms, social & rich media, languages, and devices. Web CEM is a sophisticated platform that uses cutting-edge web technologies to facilitate integration with existing enterprise systems. Businesses use CEM to create a web presence that incorporates video, text, images, and documents while adhering to the principles of providing an optimized, social, and non-disruptive experience. These benefits would further drive segment growth.

The on-premises segment accounted for a market share of 49.0% in 2023. A large number of companies are shifting from manual systems to automated systems for carrying out a variety of operations. According to a customer relationship management buyer survey conducted by SelectHub, several larger enterprise groups have preferred on-premises as compared to cloud-based deployment. Due to the increasing demand for data privacy, the demand for on-premises CEM solutions has increased.

The cloud segment is expected to witness a significant CAGR of 18.3% from 2024 to 2033. The demand for cloud CEM solutions, owing to their ease of accessibility and integration, is increasing due to the growing implementation of AI, big data, IoT, and connected devices. Organizations are increasingly preferring cloud-based deployment of a variety of CEM solutions as they are hosted on the vendor’s server and can be remotely accessed from any location. These solutions help boost employee productivity, enhance customer engagement and retention, and offer various other business benefits.

The large enterprises segment accounted for a market share of over 60% in 2023. Large organizations have multiple operational departments, due to which they widely use CEM solutions to integrate customer data with business process management features, enabling users to coordinate with their sales, marketing, and customer support processes. Moreover, vendors offering scalable features in their solutions to meet the needs of large organizations are also expected to drive the demand for CEM solutions in this segment. Furthermore, the growing applications of big data, artificial intelligence, and its applications in large enterprises are expected to drive the adoption of customer experience management solutions.

The SME segment is expected to witness a highest CAGR from 2024 to 2033. The rising number of government initiatives through digital Small and Medium Enterprise (SME) campaigns, such as video marketing, social media, and search engine marketing, across the regions is expected to drive the growth of the segment over the forecast period. With benefits ranging from predictive lead scoring to anticipating customer needs across major functions like sales, marketing, and customer service is leading towards growth of the segment over the forecasted period.

The retail segment accounted for the largest share of around 24.0% in 2023. The retail sector invests heavily in marketing and promoting products to attract customers and increase sales. However, the retail sector faces various challenges in delivering customer services. Retail companies use structured analytics CEM solutions to maintain detailed information about their customers, such as their preferences and social media activity. They can understand customer preferences by collecting this information from different touchpoints, such as websites, smartphone applications, social media platforms, and physical stores/branches, and analyzing it. These capabilities would further supplement the demand for CEM solutions in the retail sector.

The BFSI segment is anticipated to witness a significant CAGR of 17.1% from 2024 to 2033. The segment expansion can be attributed to increased demand for CEM solutions, particularly in contact centers. This has prompted BFSI firms to invest in and implement analytical tools with multi-channel customer experience management features to effectively meet customer expectations. Furthermore, CEM solutions enable BFSI businesses to maintain quality standards while reducing internal inefficiencies. These benefits provided by analytical solutions will drive demand for CEM solutions in the BFSI sector.

The North America customer experience management marketaccounted for a share of over 43.0% in 2023 and is expected to grow at a CAGR of 14.6% from 2024 to 2033. The growing investments in digital channels and marketing by the U.S. and Canadian organizations are contributing to the regional market growth. Social media is emerging as a potential channel for enterprises to share & receive feedback & product reviews and increase brand awareness. Solutions, such as social middleware, social management, social monitoring, and social measurement, are evolving and enabling enterprises to establish customer engagements and increase their brand presence among customers. Companies, such as Salesforce.com and Adobe, are making technological advancements to create social media campaigns for developing online brand communities. This results in regional enterprises spending heavily on digital channels.

U.S. Customer Experience Management Market Trends

The customer experience management market in the U.S.is projected to grow at a CAGR of 13.6% from 2024 to 2033 as the country is home to several key vendors, including Oracle Corporation, IBM, and Adobe Systems Inc., which are controlling a major market share and are driving the growth of this domestic market.

Asia Pacific Customer Experience Management Market Trends

The Asia Pacific customer experience management market is projected to grow at a CAGR of 17.5% from 2024 to 2033. As a result of the advances in the latest technologies and continued development of AI-based tools and self-service capabilities, such as chatbots, IVR, web self-service, and online communities, are allowing enterprises to better understand the changing customer behavior, provide instant support, and initiate proactive actionable responses.

The customer experience management market in China is projected to grow at a CAGR of 17.5% from 2024 to 2033. The market in China is vast but complicated owing to a diverse culture and differences in the levels of customer maturity. Hence, vendors are developing CEM solutions, particularly for the Chinese market.

The Japan customer experience management market is projected to grow at a CAGR of 17.1% from 2024 to 2033. In Japan, the advanced IT infrastructure has enabled high-speed digital connectivity, which is allowing vendors to provide both on-premises and hosted CRM solutions. The high adoption of smartphones and other connected devices is also making it easier for organizations in Japan to draft innovative marketing strategies and boost sales.

The customer experience management market in India is projected to grow at a CAGR of 17.5% from 2024 to 2033. Indian businesses are increasingly recognizing the importance of customer retention for sustainable growth. CEM solutions empower companies to personalize interactions, address customer needs proactively, and ultimately retain a loyal customer base.

Europe Customer Experience Management Market Trends

The Europe customer experience management market is expected to register a CAGR of 16.2% from 2024 to 2033. In Europe, the diversity of businesses stemming from multi-currency transactions and a multi-regional user base is encouraging the adoption of CEM solutions.

The customer experience management market in the UK is likely to grow at a CAGR of 16.7% from 2024 to 2033. Factors, such as the growing emphasis on the adoption of analytical tools and customer engagement software to support sales, customer service, and marketing activities across all the industry verticals, are driving the market growth. In February 2023, Virgin Atlantic, a UK-based airline, selected Conduent, a global technology and CEM company, to provide CEM services. This includes managing rebookings, providing general customer support, and live agent support. Conduent’s human-centric approach to customer service is expected to improve customer satisfaction for Virgin Atlantic.

The Germany customer experience management market is projected to record a CAGR of 16.0% from 2024 to 2033. Increasing investments to implement digital transformation initiatives, such as Industry 4.0, coupled with the growing use of process automation tools powered by the latest technologies, such as Artificial Intelligence (Al) and Machine Learning (ML), are expected to drive the need for CEM software to automate processes, minimize variations, and improve customer experience across Germany.

The customer experience management market in France is estimated to grow at a CAGR of 17.4% from 2024 to 2033. France is experiencing a paradigm shift in the retail economy from transactional to experiential, and brands with good customer experience have managed to attain 1.5 times higher sales than their competitors. Hence, companies in France are readily investing in CEM solutions.

Middle East & Africa Customer Experience Management Market Trends

The Middle East & Africa customer experience management market is anticipated to witness a CAGR of 16.3% from 2024 to 2033. Contact centers in this region are investing aggressively in digital technologies, cloud-based solutions, and analytical tools to provide real-time customer support and enhance customer satisfaction levels. This, in turn, will support market growth

The customer experience management market in KSA is anticipated to witness a significant CAGR of 17.3% from 2024 to 2033. BPO providers are analyzing large volumes of customer data, determining patterns, predicting trends, and establishing targeted strategies that connect with individual preferences, behaviors, and expectations; thereby fostering customer satisfaction, loyalty, and representation in a competitive and dynamic market environment.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global customer experience management market

Analytical Tools

Touch Point Type

Deployment

Organization Size

End-use

Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Customer Experience Management Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Customer Experience Management Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Customer Experience Management Market: Analytical Tools Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Customer Experience Management Market: Analytical Tools Movement Analysis, USD Billion, 2024 & 2033

4.3. EFM Software

4.3.1. EFM Software Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

4.4. Speech Analytics

4.4.1. Speech Analytics Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

4.5. Text Analytics

4.5.1. Text Analytics Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

4.6. Web Analytics & Content Management

4.6.1. Web Analytics & Content Management Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

4.7. Others

4.7.1. Others Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

Chapter 5. Customer Experience Management Market: Touch Point Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Customer Experience Management Market: Touch Point Type Movement Analysis, USD Billion, 2024 & 2033

5.3. Stores/Branches

5.3.1. Stores/Branches Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

5.4. Call Centers

5.4.1. Call Centers Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

5.5. Social Media Platform

5.5.1. Social Media Platform Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

5.6. Email

5.6.1. Email Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

5.7. Mobile

5.7.1. Mobile Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

5.8. Web Services

5.8.1. Web Services Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

5.9. Others

5.9.1. Others Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

Chapter 6. Customer Experience Management Market: Deployment Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Customer Experience Management Market: Deployment Movement Analysis, USD Billion, 2024 & 2033

6.3. Cloud

6.3.1. Cloud Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

6.4. On-premises

6.4.1. On-premises Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

Chapter 7. Customer Experience Management Market: Organization Size Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Customer Experience Management Market: Organization Size Movement Analysis, USD Billion, 2024 & 2033

7.3. Large Enterprises

7.3.1. Large Enterprises Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

7.4. Small and Medium Enterprises

7.4.1. Small and Medium Enterprises Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

Chapter 8. Customer Experience Management Market: End-use Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Customer Experience Management Market: End-use Movement Analysis, USD Billion, 2024 & 2033

8.3. BFSI

8.3.1. BFSI Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.4. Retail

8.4.1. Retail Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.5. Healthcare

8.5.1. Healthcare Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.6. IT & Telecommunications

8.6.1. IT & Telecommunication Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.7. Manufacturing

8.7.1. Manufacturing Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.8. Government, Energy & Utilities

8.8.1. Government, Energy & Utilities Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.9. Construction, Real Estate & Property Management

8.9.1. Construction, Real Estate & Property Management Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.10. Service Business

8.10.1. Service Business Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

8.11. Others

8.11.1. Others Market Value Estimates and Forecasts, 2021 - 2033 (USD Billion)

Chapter 9. Customer Experience Management Market: Regional Estimates & Trend Analysis

9.1. Customer Experience Management Market Share by Region, 2024 & 2033 (USD Billion)

9.2. North America

9.2.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.2.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.2.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.2.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.2.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.2.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.2.7. U.S.

9.2.7.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.2.7.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.2.7.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.2.7.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.2.7.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.2.7.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.2.8. Canada

9.2.8.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.2.8.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.2.8.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.2.8.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.2.8.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.2.8.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.2.9. Mexico

9.2.9.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.2.9.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.2.9.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.2.9.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.2.9.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.2.9.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.3. Europe

9.3.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.3.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.3.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.3.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.3.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.3.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.3.7. UK

9.3.7.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.3.7.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.3.7.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.3.7.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.3.7.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.3.7.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.3.8. Germany

9.3.8.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.3.8.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.3.8.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.3.8.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.3.8.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.3.8.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.3.9. France

9.3.9.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.3.9.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.3.9.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.3.9.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.3.9.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.3.9.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.3.10. Italy

9.3.10.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.3.10.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.3.10.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.3.10.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.3.10.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.3.10.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4. Asia Pacific

9.4.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4.7. China

9.4.7.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.7.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.7.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.7.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.7.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.7.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4.8. India

9.4.8.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.8.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.8.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.8.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.8.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.8.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4.9. Japan

9.4.9.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.9.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.9.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.9.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.9.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.9.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4.10. Australia

9.4.10.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.10.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.10.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.10.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.10.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.10.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4.11. South Korea

9.4.11.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.11.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.11.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.11.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.11.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.11.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.4.12. New Zealand

9.4.12.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.4.12.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.4.12.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.4.12.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.4.12.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.4.12.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.5. Latin America

9.5.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.5.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.5.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.5.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.5.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.5.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.5.7. Brazil

9.5.7.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.5.7.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.5.7.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.5.7.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.5.7.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.5.7.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.6. Middle East & Africa

9.6.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.6.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.6.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.6.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.6.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.6.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.6.7. UAE

9.6.7.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.6.7.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.6.7.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.6.7.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.6.7.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.6.7.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.6.8. KSA

9.6.8.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.6.8.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.6.8.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.6.8.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.6.8.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.6.8.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

9.6.9. South Africa

9.6.9.1. Market Size Estimates and Forecasts, 2021 - 2033 (USD Billion)

9.6.9.2. Market Size Estimates and Forecasts by Analytical Tools, 2021 - 2033 (USD Billion)

9.6.9.3. Market Size Estimates and Forecasts by Touch Point Type, 2021 - 2033 (USD Billion)

9.6.9.4. Market Size Estimates and Forecasts by Deployment, 2021 - 2033 (USD Billion)

9.6.9.5. Market Size Estimates and Forecasts by Organization Size, 2021 - 2033 (USD Billion)

9.6.9.6. Market Size Estimates and Forecasts by End-use, 2021 - 2033 (USD Billion)

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Share Analysis

10.4. Company Heat Map Analysis

10.5. Strategy Mapping

10.5.1. Expansion

10.5.2. Mergers & Acquisition

10.5.3. Partnerships & Collaborations

10.5.4. New Product Launches

10.5.5. Research And Development

10.6. Company Profiles

10.6.1. Adobe Inc.

10.6.1.1. Participant’s Overview

10.6.1.2. Financial Performance

10.6.1.3. Product Benchmarking

10.6.1.4. Recent Developments

10.6.2. Avaya Inc.

10.6.2.1. Participant’s Overview

10.6.2.2. Financial Performance

10.6.2.3. Product Benchmarking

10.6.2.4. Recent Developments

10.6.3. Clarabridge

10.6.3.1. Participant’s Overview

10.6.3.2. Financial Performance

10.6.3.3. Product Benchmarking

10.6.3.4. Recent Developments

10.6.4. Freshworks Inc.

10.6.4.1. Participant’s Overview

10.6.4.2. Financial Performance

10.6.4.3. Product Benchmarking

10.6.4.4. Recent Developments

10.6.5. Genesys

10.6.5.1. Participant’s Overview

10.6.5.2. Financial Performance

10.6.5.3. Product Benchmarking

10.6.5.4. Recent Developments

10.6.6. International Business Machines Corporation

10.6.6.1. Participant’s Overview

10.6.6.2. Financial Performance

10.6.6.3. Product Benchmarking

10.6.6.4. Recent Developments

10.6.7. Medallia Inc.

10.6.7.1. Participant’s Overview

10.6.7.2. Financial Performance

10.6.7.3. Product Benchmarking

10.6.7.4. Recent Developments

10.6.8. Miraway

10.6.8.1. Participant’s Overview

10.6.8.2. Financial Performance

10.6.8.3. Product Benchmarking

10.6.8.4. Recent Developments

10.6.9. Open Text Corporation

10.6.9.1. Participant’s Overview

10.6.9.2. Financial Performance

10.6.9.3. Product Benchmarking

10.6.9.4. Recent Developments

10.6.10. Oracle Corporation

10.6.10.1. Participant’s Overview

10.6.10.2. Financial Performance

10.6.10.3. Product Benchmarking

10.6.10.4. Recent Developments

10.6.11. Qualtrics

10.6.11.1. Participant’s Overview

10.6.11.2. Financial Performance

10.6.11.3. Product Benchmarking

10.6.11.4. Recent Developments

10.6.12. SAP SE

10.6.12.1. Participant’s Overview

10.6.12.2. Financial Performance

10.6.12.3. Product Benchmarking

10.6.12.4. Recent Developments

10.6.13. SAS Institute Inc.

10.6.13.1. Participant’s Overview

10.6.13.2. Financial Performance

10.6.13.3. Product Benchmarking

10.6.13.4. Recent Developments

10.6.14. Service Management Group (SMG)

10.6.14.1. Participant’s Overview

10.6.14.2. Financial Performance

10.6.14.3. Product Benchmarking

10.6.14.4. Recent Developments

10.6.15. Tech Mahindra Limited

10.6.15.1. Participant’s Overview

10.6.15.2. Financial Performance

10.6.15.3. Product Benchmarking

10.6.15.4. Recent Developments

10.6.16. Verint

10.6.16.1. Participant’s Overview

10.6.16.2. Financial Performance

10.6.16.3. Product Benchmarking

10.6.16.4. Recent Developments

10.6.17. Zendesk

10.6.17.1. Participant’s Overview

10.6.17.2. Financial Performance

10.6.17.3. Product Benchmarking

10.6.17.4. Recent Developments