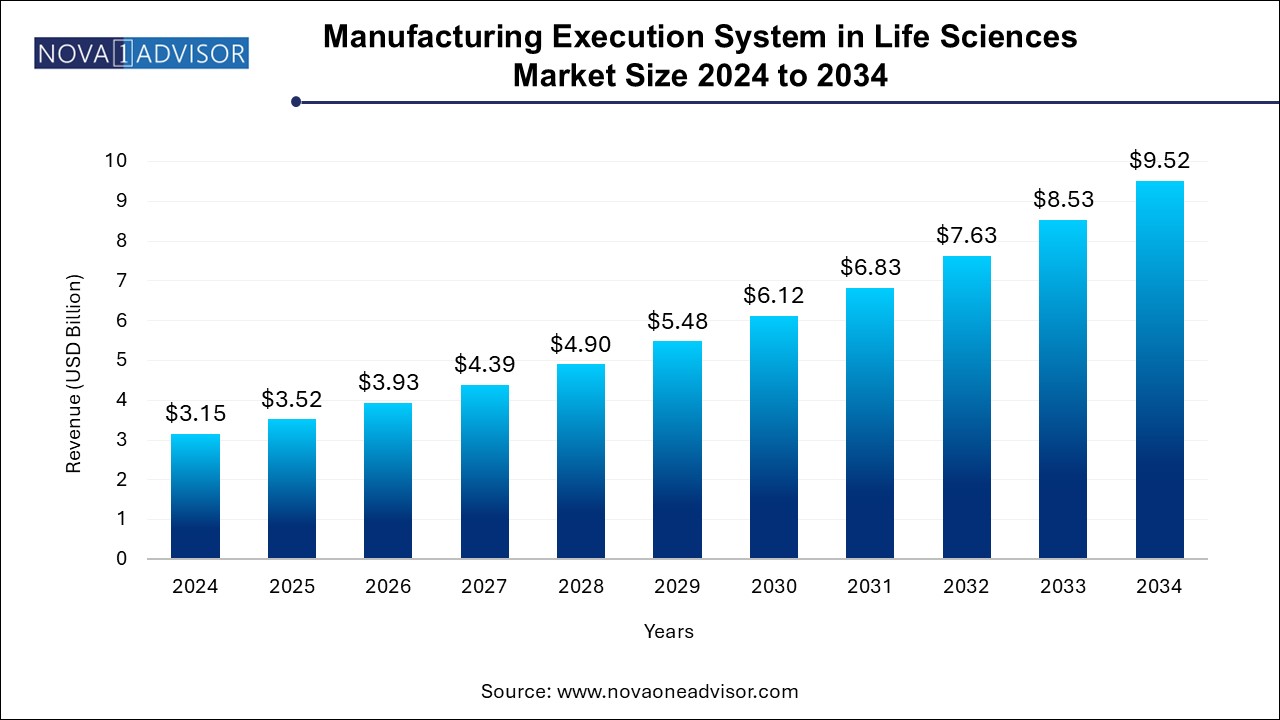

The manufacturing execution system in life sciences market size was exhibited at USD 3.15 billion in 2024 and is projected to hit around USD 9.52 billion by 2034, growing at a CAGR of 11.7% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 3.52 Billion |

| Market Size by 2034 | USD 9.52 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 11.7% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Solution Type, Deployment Type, End-user, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | ABB; Körber AG; MasterControl Solutions, Inc.; AVEVA Group Ltd.; Cognizant; Rockwell, Automation; Nagarro; Siemens AG; Emerson Electric Co. |

The increasing regulatory compliance, demand for real-time data and analytics, growing biopharmaceutical sector, technological advances, and globalization of the life sciences industry are some of the factors driving the demand for manufacturing execution systems in life sciences industry. The pharmaceutical industry is increasingly adopting digitization, driving the demand for Pharma 4.0 and manufacturing execution systems (MES) in the life sciences market. Pharma 4.0 enhances connectivity, productivity, compliance, and information management to address challenges effectively.

Developed by the International Society for Pharmaceutical Engineering (ISPE), this model revolutionizes manufacturing processes with more human-centric workflows, leveraging digitalization for faster therapeutic innovations and improved production processes for patient benefit. Moreover, the growing complexity of pharmaceutical and biotechnology manufacturing, along with the need for precise data management, has propelled MES demand in life sciences sector. These systems offer centralized platforms for data integration, process optimization, and quality assurance, thereby boosting overall productivity. In addition, the rise of personalized medicine and demand for innovative therapies have increased production intricacies, driving MES adoption to manage manufacturing complexities in the life sciences sector.

As the industry evolves and undergoes digital transformation, MES is set to play a crucial role in facilitating efficient, agile, and compliant manufacturing operations, driving sustained market growth. In August 2020, a survey sponsored by Appian highlighted the adoption of automation in the global life sciences and pharmaceutical industry. According to the survey, most respondents engaged in digital modernization efforts aimed at enhancing process and operational efficiency. However, automation is currently utilized in only 40% of respondents' organizations, with 75% anticipating the adoption of automation technologies in the future.

The software segment is expected to grow at a significant CAGR of 11.1% from 2024 to 2034. The growing emphasis on data integrity, traceability, and regulatory compliance in the life sciences sector propels the adoption of MES software, as these systems provide a comprehensive framework for real-time monitoring and documentation. Furthermore, rising demand for end-to-end visibility across the entire manufacturing life cycle, from research and development to production and distribution, encourages life sciences companies to invest in MES solutions that offer seamless data integration and analytics capabilities.

The services segment is expected to grow at the fastest CAGR from 2024 to 2034. With the increasing digitization of manufacturing processes, there is a growing emphasis on data security and cybersecurity. MES service providers offer expertise in implementing robust security measures, protecting sensitive data, and ensuring compliance with industry standards. Such factors are expected to drive segment growth over the coming years.

The on-premise deployment segment held the largest market share in 2024. On-premise solutions offer greater control over data security and privacy, addressing concerns related to sensitive information and intellectual property. In addition, life science companies often deal with large volumes of complex data generated during the manufacturing process, including critical parameters for quality control and batch tracking. On-premise MES solutions supply the necessary computing power and storage capacity to manage such data-intensive processes efficiently.

Furthermore, the need for seamless integration with existing enterprise resource planning (ERP) systems, laboratory information management systems (LIMS), and other legacy applications is crucial in the life science sector, owing to this, the cloud/web-based deployment segment is expected to grow at a significant CAGR from 2024 to 2034.

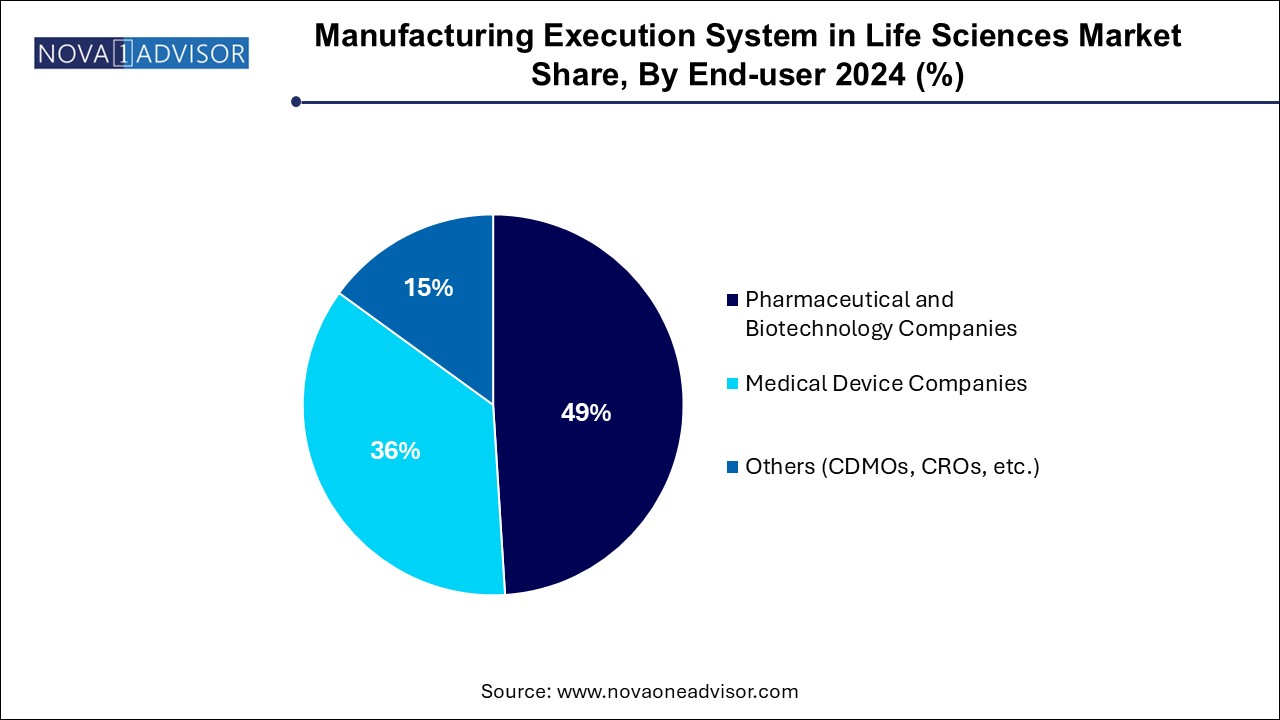

Based on end-users, the pharmaceutical & biotechnology companies segment held the largest revenue share of 49.0% in 2024. The pharmaceutical industry is highly competitive and complex. To maintain a competitive edge, companies must scale operations, enhance processes, minimize errors, reduce lead times, and prioritize quality and compliance. MES solutions enable companies to manage production lines with precision, ensuring competitiveness. Biotechnology companies also benefit from MES by effectively managing the complex processes involved in producing biologics and personalized medicines.

The medical device companies segment is expected to grow at the fastest CAGR of 12.7% from 2024 to 2034. Medical device production presents distinct challenges that companies must navigate to maintain competitiveness. Achieving this requires a delicate balance between cost reduction and regulatory compliance, alongside consistent production of high-quality products. MES solutions play a crucial role in ensuring quality, automating processes, and enforcing control over the five M's of manufacturing: Man, Measure, Machine, Method, and Material.

The North America manufacturing execution system in life sciences market dominated the market and held the largest market share of 31.0% in 2024. This region, comprising major economies like the U.S. and Canada, is highly technologically advanced, driving the digitization of manufacturing processes in the pharmaceutical industry. Key players, such as Apprentice FS, Inc.; Atachi Systems; POMS Corporation; Emerson Electric Co; and Rockwell Automation, play a crucial role in simplifying healthcare manufacturing processes, further bolstering the market growth in North America.

U.S. MES in Life Sciences Market Trends

The manufacturing execution system in life sciences market in the U.S. is expected to grow significantly over the forecast period owing to the presence of key players and extensive adoption of software solutions in life science manufacturing. Moreover, the adoption of integrated laboratory automation solutions presents additional growth opportunities for MES providers. For example, Automata announced its intention to expand its services in the U.S. in February 2024.

Europe MES in Life Sciences Market Trends

Europe is the second-largest regional market witnessing increased adoption of advanced digital technologies and strategic partnerships facilitating MES implementation. Siemens' collaboration with BioNTech SE in June 2021 in converting a facility into a COVID-19 vaccine production site exemplifies this trend, accelerating project timelines significantly. Similarly, in December 2018, Körber AG's partnership with SPC Consultants aims to expand MES services in France, Belgium, and Switzerland, contributing to market growth.

MES in life sciences market in the UK benefits from increased healthcare spending and the integration of advanced technology solutions, such as cloud technologies and automated production processes.

Asia Pacific MES in Life Sciences Market Trends

Asia Pacific shows promising growth prospects, driven by the increasing number of pharmaceutical companies and presence of key market players. Asian pharma manufacturers face challenges in maintaining product quality and compliance with legal requirements, leading to increased adoption of MES solutions to digitize production processes and enhance efficiency.

China MES in life sciences market is expected to grow at a significant CAGR from 2024 to 2034. This can be attributed to the increasing demand for quality drugs and the need to increase pharmaceutical production in the country owing to the growing population.

MES in life sciences market in India is primarily driven by various factors, such as the rising adoption of AI and cloud technologies in healthcare for improved patient outcomes. In addition, advancements in healthcare infrastructure and digitalization efforts to support the integration of software technologies to assist the production process is anticipated to impel market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the manufacturing execution system in life sciences market

Solution Type

Deployment

End-user

Regional