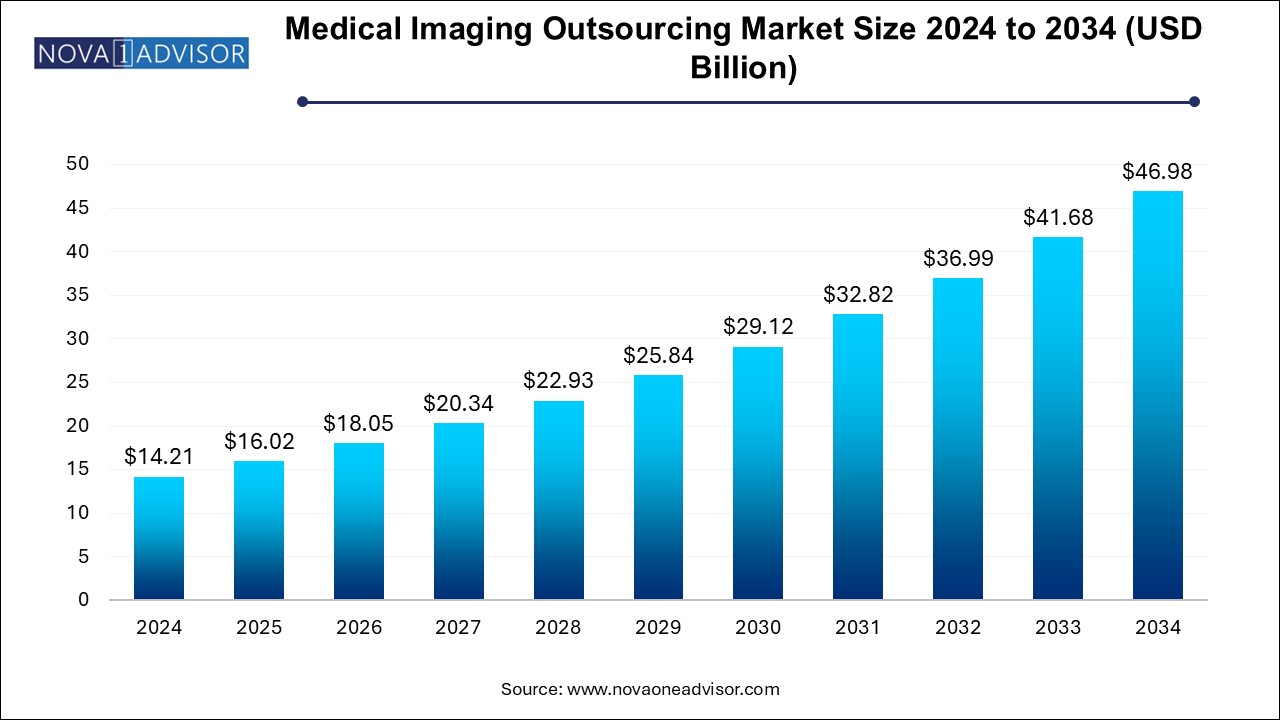

The medical imaging outsourcing market size was exhibited at USD 14.21 billion in 2024 and is projected to hit around USD 46.98 billion by 2034, growing at a CAGR of 12.7% during the forecast period 2025 to 2034.

The increasing use of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing medical imaging. Outsourcing companies are incorporating these technologies to improve image analysis, minimize errors, and speed up diagnoses. AI and ML algorithms help to identify patterns and abnormalities, enhancing diagnostic accuracy quickly. In addition, the growth of telemedicine has led to a higher demand for remote image processing, archiving, and consulting services. Outsourcing companies are expanding their offerings to meet this demand, providing solutions that support telehealth practices. These advancements are reshaping the medical imaging outsourcing industry.

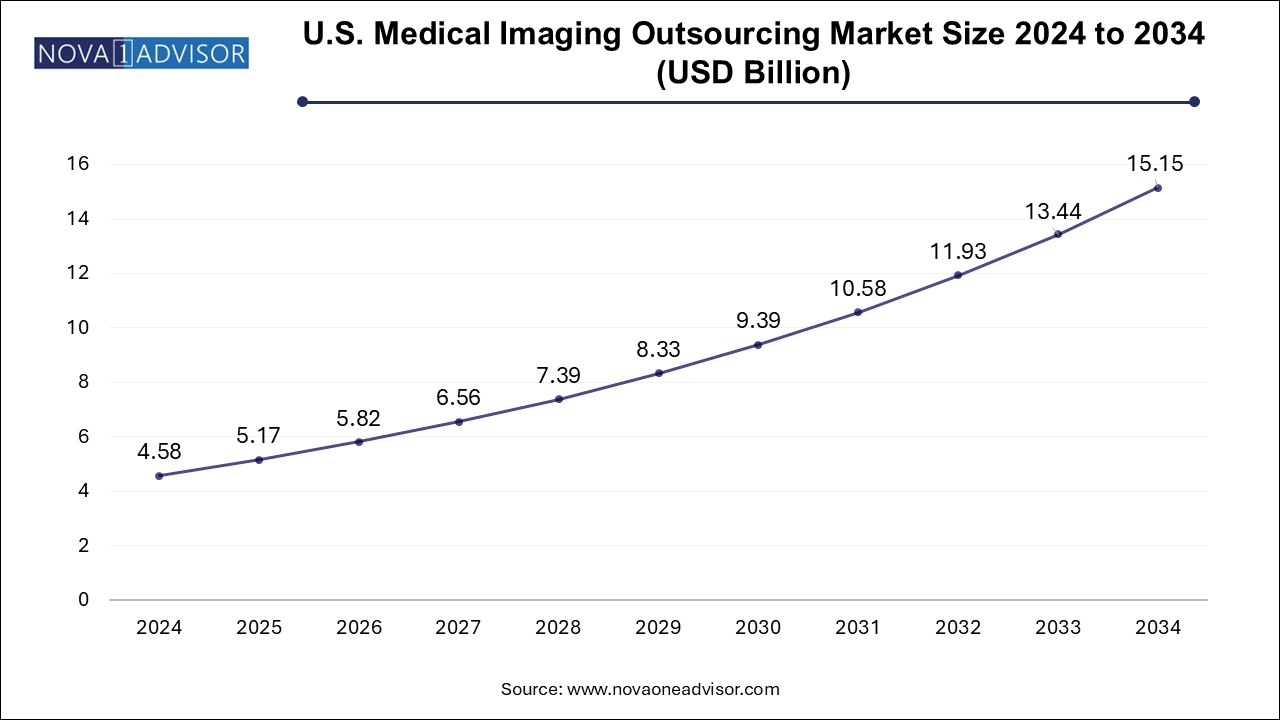

The U.S. medical imaging outsourcing market size is evaluated at USD 4.58 billion in 2024 and is projected to be worth around USD 15.15 billion by 2034, growing at a CAGR of 11.48% from 2025 to 2034.

North America medical imaging outsourcing market held the highest revenue share of 42.3% in 2024, driven by high healthcare expenditure and an advanced medical infrastructure that supports extensive diagnostic services. The region's strong emphasis on technological innovation in medical imaging has led to increased outsourcing of these services as healthcare providers seek cost-effective solutions while maintaining high-quality standards.

U.S. Medical Imaging Outsourcing Market Trends

The U.S. medical imaging outsourcing market dominated North America with a significant revenue share in 2024 due to its robust healthcare system characterized by high demand for diagnostic services. The increasing prevalence of chronic diseases necessitates efficient imaging solutions that outsourcing can provide. Moreover, integrating digital technologies in imaging processes enhances service delivery efficiency, further propelling growth in the U.S. market.

Europe Medical Imaging Outsourcing Market Trends

Europe medical imaging outsourcing market held a substantial market share in 2024, driven by an aging population that requires more frequent diagnostic testing. The region's focus on improving healthcare accessibility through outsourcing allows providers to leverage specialized expertise while managing operational costs effectively. In addition, technological advancements continue to enhance service quality within this Europe medical imaging outsourcing market.

Asia Pacific Medical Imaging Outsourcing Market Trends

Asia Pacific medical imaging outsourcing market is expected to register the highest CAGR of 13.8% over the forecast period, which can be attributed to rapid economic growth and increasing healthcare investments in countries such as India and China. The rising prevalence of chronic diseases, coupled with a growing population, drives demand for efficient diagnostic services that outsourcing can effectively fulfill.

The China medical imaging outsourcing market dominated the Asia Pacific, with a significant revenue share in 2024 due to its vast population and rising healthcare needs. The country's ongoing improvements in healthcare infrastructure and increased investments in advanced medical technologies are enhancing service delivery capabilities. This environment encourages an expanding market for outsourced medical imaging services as providers seek efficient solutions for growing patient demands.

| Report Coverage | Details |

| Market Size in 2025 | USD 16.02 Billion |

| Market Size by 2034 | USD 46.98 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 12.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Product Type, Application, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Alliance Medical Limited; Flatworld Solutions Inc; MetaMed; North American Science Associates, LLC; Shields MRI; ProScan Imaging, LLC; RadNet Inc; TOSHIBA CORPORATION; Hitachi High-Tech Corporation; CANON MEDICAL SYSTEMS CORPORATION. |

The Magnetic Resonance Imaging (MRI) segment dominated the market with a revenue share of 30.7% in 2024, driven primarily by the increasing prevalence of chronic diseases, particularly cancer and neurological disorders. MRI is recognized for its ability to provide high-resolution images without ionizing radiation, making it a preferred choice for diagnostic imaging. In addition, advancements in MRI technology, such as the integration of AI and improved imaging techniques, have enhanced its diagnostic capabilities, further boosting its adoption in healthcare.

The Computed Tomography (CT) segment is projected to grow at the highest CAGR of 13.3% over the forecast period, fueled by its rapid imaging capabilities and cost-effectiveness. CT scans are essential for diagnosing a variety of conditions, including trauma and internal bleeding, which require immediate attention. The ongoing development of advanced CT technologies, such as dual energy and spectral CT, is expected to improve image quality and expand its applications in clinical settings, thereby driving market growth.

The diagnostic imaging segment dominated the market with the largest revenue share in 2024, driven by the growing demand for early disease detection and monitoring. Healthcare providers emphasize preventative care and diagnostic imaging, essential in identifying potential health issues early. The use of advanced imaging technologies has further enhanced diagnostic accuracy, helping to improve patient outcomes. This has increased reliance on diagnostic imaging services, driving market growth. Therefore, the medical imaging outsourcing industry benefits from this rising demand for precise and timely imaging solutions.

The teleradiology segment is projected to grow at the highest CAGR over the forecast period due to the rising demand for remote diagnostics and consultations. Teleradiology allows healthcare facilities to access specialized radiological expertise regardless of geographical location, which speeds up diagnosis and treatment decisions. This is particularly important in areas with a shortage of radiologists. The increasing adoption of telemedicine and digital health solutions further fuels this trend, improving access to quality healthcare services. Hence, the medical imaging outsourcing industry is experiencing significant growth in teleradiology.

The hospitals & clinics segment dominated the market with the largest revenue share in 2024, fueled by the increasing installation of advanced imaging equipment and a growing patient population requiring diagnostic services. Hospitals are investing significantly in upgrading their imaging facilities to provide comprehensive care and improve patient outcomes. The presence of skilled professionals and specialized departments within hospitals also contributes to their dominance in the market.

The interventional imaging centers segment is projected to grow at the highest CAGR over the forecast period, which can be attributed to the rising demand for minimally invasive procedures. These centers use imaging guidance for various interventions, such as biopsies and catheter placements, which are becoming increasingly popular due to their reduced recovery times and complications compared to traditional surgeries. This trend is likely to drive further investment in interventional imaging technologies.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the medical imaging outsourcing market

By Product Type

By Application

By End Use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Product Type

1.2.2. Application

1.2.3. End Use

1.3. Estimates and Forecast Timeline

1.4. Research Methodology

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. Internal Database

1.5.3. Secondary Sources

1.5.4. Primary Research

1.6. Information Analysis

1.6.1. Data Analysis Models

1.7. Market Formulation & Data Visualization

1.8. Model Details

1.8.1. Commodity Flow Analysis

1.9. List of Secondary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Medical Imaging Outsourcing Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraint Analysis

3.3. Business Environment Analysis

3.3.1. Industry Analysis - Porter’s Five Forces Analysis

3.3.1.1. Supplier Power

3.3.1.2. Buyer Power

3.3.1.3. Substitution Threat

3.3.1.4. Threat of New Entrants

3.3.1.5. Competitive Rivalry

3.3.2. PESTLE Analysis

Chapter 4. Medical Imaging Outsourcing Market: Product Type Business Analysis

4.1. Product Type Market Share, 2024 & 2034

4.2. Product Type Segment Dashboard

4.3. Market Size & Forecasts and Trend Analysis, by Product Type, 2021 to 2034 (USD Billion)

4.4. Computed Tomography (CT)

4.4.1. Computed Tomography (CT) Market, 2021 - 2034 (USD Billion)

4.5. Magnetic Resonance Imaging (MRI)

4.5.1. Magnetic Resonance Imaging (MRI) Market, 2021 - 2034 (USD Billion)

4.6. Ultrasound

4.6.1. Ultrasound Market, 2021 - 2034 (USD Billion)

4.7. X-ray

4.7.1. X-ray Market, 2021 - 2034 (USD Billion)

4.8. Nuclear Medicine

4.8.1. Nuclear Medicine Market, 2021 - 2034 (USD Billion)

4.9. Other Modality

4.9.1. Other Modality Market, 2021 - 2034 (USD Billion)

Chapter 5. Medical Imaging Outsourcing Market: Application Business Analysis

5.1. Application Market Share, 2024 & 2034

5.2. Application Segment Dashboard

5.3. Market Size & Forecasts and Trend Analysis, by Application, 2021 to 2034 (USD Billion)

5.4. Diagnostic Imaging

5.4.1. Diagnostic Imaging Market, 2021 - 2034 (USD Billion)

5.5. Interventional Imaging

5.5.1. Interventional Imaging Market, 2021 - 2034 (USD Billion)

5.6. Teleradiology

5.6.1. Teleradiology Market, 2021 - 2034 (USD Billion)

5.7. Research and Clinical Trials

5.7.1. Research and Clinical Trials Market, 2021 - 2034 (USD Billion)

Chapter 6. Medical Imaging Outsourcing Market: End Use Business Analysis

6.1. End Use Market Share, 2024 & 2034

6.2. End Use Segment Dashboard

6.3. Market Size & Forecasts and Trend Analysis, by End Use, 2021 to 2034 (USD Billion)

6.4. Hospitals & Clinics

6.4.1. Hospitals & Clinics Market, 2021 - 2034 (USD Billion)

6.5. Interventional Imaging Centers

6.5.1. Interventional Imaging Centers Market, 2021 - 2034 (USD Billion)

6.6. Other End Use

6.6.1. Other End Use Market, 2021 - 2034 (USD Billion)

Chapter 7. Medical Imaging Outsourcing Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2024 & 2034

7.2. Regional Market Dashboard

7.3. Market Size & Forecasts Trend Analysis, 2021 to 2034:

7.4. North America

7.4.1. North America Medical Imaging Outsourcing Market Estimates and Forecasts, by Country, 2021 - 2034 (USD Billion)

7.4.2. U.S.

7.4.2.1. Key Country Dynamics

7.4.2.2. Regulatory Framework

7.4.2.3. Competitive Insights

7.4.2.4. U.S. Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.4.3. Canada

7.4.3.1. Key Country Dynamics

7.4.3.2. Regulatory Framework

7.4.3.3. Competitive Insights

7.4.3.4. Canada Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.4.4. Mexico

7.4.4.1. Key Country Dynamics

7.4.4.2. Regulatory Framework

7.4.4.3. Competitive Insights

7.4.4.4. Mexico Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5. Europe

7.5.1. Europe Medical Imaging Outsourcing Market Estimates and Forecasts, by Country, 2021 - 2034 (USD Billion)

7.5.2. UK

7.5.2.1. Key Country Dynamics

7.5.2.2. Regulatory Framework

7.5.2.3. Competitive Insights

7.5.2.4. UK Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.3. Germany

7.5.3.1. Key Country Dynamics

7.5.3.2. Regulatory Framework

7.5.3.3. Competitive Insights

7.5.3.4. Germany Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.4. France

7.5.4.1. Key Country Dynamics

7.5.4.2. Regulatory Framework

7.5.4.3. Competitive Insights

7.5.4.4. France Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.5. Italy

7.5.5.1. Key Country Dynamics

7.5.5.2. Regulatory Framework

7.5.5.3. Competitive Insights

7.5.5.4. Italy Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.6. Spain

7.5.6.1. Key Country Dynamics

7.5.6.2. Regulatory Framework

7.5.6.3. Competitive Insights

7.5.6.4. Spain Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.7. Norway

7.5.7.1. Key Country Dynamics

7.5.7.2. Regulatory Framework

7.5.7.3. Competitive Insights

7.5.7.4. Norway Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.8. Denmark

7.5.8.1. Key Country Dynamics

7.5.8.2. Regulatory Framework

7.5.8.3. Competitive Insights

7.5.8.4. Denmark Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.5.9. Sweden

7.5.9.1. Key Country Dynamics

7.5.9.2. Regulatory Framework

7.5.9.3. Competitive Insights

7.5.9.4. Sweden Medical Imaging Outsourcing Market Estimates and Forecasts, by Country, 2021 - 2034 (USD Billion)

7.6. Asia Pacific

7.6.1. Asia Pacific Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.2. Japan

7.6.2.1. Key Country Dynamics

7.6.2.2. Regulatory Framework

7.6.2.3. Competitive Insights

7.6.2.4. Japan Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.3. China

7.6.3.1. Key Country Dynamics

7.6.3.2. Regulatory Framework

7.6.3.3. Competitive Insights

7.6.3.4. China Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.4. India

7.6.4.1. Key Country Dynamics

7.6.4.2. Regulatory Framework

7.6.4.3. Competitive Insights

7.6.4.4. India Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.5. South Korea

7.6.5.1. Key Country Dynamics

7.6.5.2. Regulatory Framework

7.6.5.3. Competitive Insights

7.6.5.4. South Korea Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.6. Australia

7.6.6.1. Key Country Dynamics

7.6.6.2. Regulatory Framework

7.6.6.3. Competitive Insights

7.6.6.4. Australia Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.6.7. Thailand

7.6.7.1. Key Country Dynamics

7.6.7.2. Regulatory Framework

7.6.7.3. Competitive Insights

7.6.7.4. Thailand Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.7. Latin America

7.7.1. Latin America Medical Imaging Outsourcing Market Estimates and Forecasts, by Country, 2021 - 2034 (USD Billion)

7.7.2. Brazil

7.7.2.1. Key Country Dynamics

7.7.2.2. Regulatory Framework

7.7.2.3. Competitive Insights

7.7.2.4. Brazil Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.7.3. Argentina

7.7.3.1. Key Country Dynamics

7.7.3.2. Regulatory Framework

7.7.3.3. Competitive Insights

7.7.3.4. Argentina Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8. MEA

7.8.1. MEA Medical Imaging Outsourcing Market Estimates and Forecasts, by Country, 2021 - 2034 (USD Billion)

7.8.2. South Africa

7.8.2.1. Key Country Dynamics

7.8.2.2. Regulatory Framework

7.8.2.3. Competitive Insights

7.8.2.4. South Africa Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.3. Saudi Arabia

7.8.3.1. Key Country Dynamics

7.8.3.2. Regulatory Framework

7.8.3.3. Competitive Insights

7.8.3.4. Saudi Arabia Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.4. UAE

7.8.4.1. Key Country Dynamics

7.8.4.2. Regulatory Framework

7.8.4.3. Competitive Insights

7.8.4.4. UAE Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

7.8.5. Kuwait

7.8.5.1. Key Country Dynamics

7.8.5.2. Regulatory Framework

7.8.5.3. Competitive Insights

7.8.5.4. Kuwait Medical Imaging Outsourcing Market Estimates and Forecasts, 2021 - 2034 (USD Billion)

Chapter 8. Competitive Landscape

8.1. Participant Overview

8.2. Company Market Position Analysis

8.3. Company Categorization

8.4. Strategy Mapping

8.5. Company Profiles/Listing

8.5.1. Alliance Medical Limited

8.5.1.1. Overview

8.5.1.2. Financial Performance

8.5.1.3. Service Benchmarking

8.5.1.4. Strategic Initiatives

8.5.2. Flatworld Solutions Inc

8.5.2.1. Overview

8.5.2.2. Financial Performance

8.5.2.3. Service Benchmarking

8.5.2.4. Strategic Initiatives

8.5.3. MetaMed

8.5.3.1. Overview

8.5.3.2. Financial Performance

8.5.3.3. Service Benchmarking

8.5.3.4. Strategic Initiatives

8.5.4. North American Science Associates, LLC

8.5.4.1. Overview

8.5.4.2. Financial Performance

8.5.4.3. Service Benchmarking

8.5.4.4. Strategic Initiatives

8.5.5. Shields MRI

8.5.5.1. Overview

8.5.5.2. Financial Performance

8.5.5.3. Service Benchmarking

8.5.5.4. Strategic Initiatives

8.5.6. ProScan Imaging, LLC

8.5.6.1. Overview

8.5.6.2. Financial Performance

8.5.6.3. Service Benchmarking

8.5.6.4. Strategic Initiatives

8.5.7. RadNet Inc.

8.5.7.1. Overview

8.5.7.2. Financial Performance

8.5.7.3. Service Benchmarking

8.5.7.4. Strategic Initiatives

8.5.8. TOSHIBA CORPORATION

8.5.8.1. Overview

8.5.8.2. Financial Performance

8.5.8.3. Service Benchmarking

8.5.8.4. Strategic Initiatives

8.5.9. Hitachi High-Tech Corporation

8.5.9.1. Overview

8.5.9.2. Financial Performance

8.5.9.3. Service Benchmarking

8.5.9.4. Strategic Initiatives

8.5.10. CANON MEDICAL SYSTEMS CORPORATION

8.5.10.1. Overview

8.5.10.2. Financial Performance

8.5.10.3. Service Benchmarking

8.5.10.4. Strategic Initiatives