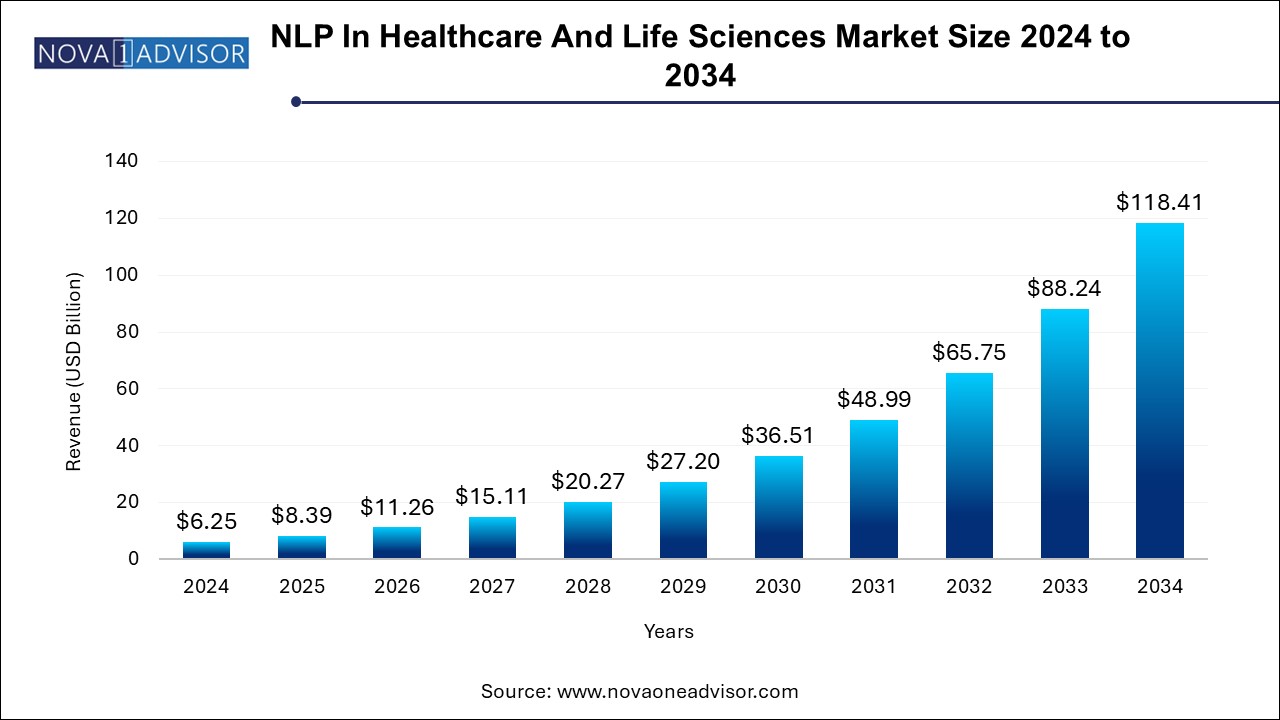

The NLP in healthcare and life sciences market size was exhibited at USD 6.25 billion in 2024 and is projected to hit around USD 118.41 billion by 2034, growing at a CAGR of 34.2% during the forecast period 2024 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 8.39 Billion |

| Market Size by 2034 | USD 118.41 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 34.2% |

| Base Year | 2024 |

| Forecast Period | 2024-2034 |

| Segments Covered | Technique, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | IBM; Microsoft; Google (Alphabet Inc.); IQVIA; Dolbey Systems, Inc.; Averbis; Press ganey; lexalytics; Clinithink; Hewlett Packard Enterprise Development LP; Apixio; Edifecs; JohnSnow Labs; Itrex Group; CloudMedx; BenevolentAI; Tempus. |

The growth of the market is attributed to the growing need for predictive analytics to improve significant health concerns, the increasing demand to enhance care delivery and patient engagement, the rising focus on enhancing clinical decision support, and the growing investment in AI integration in healthcare.

For instance, in January 2024, Accenture announced an investment in QuantHealth via Accenture Ventures, marking a strategic move into enhancing clinical trial design. QuantHealth, leveraging AI, offers a cloud-based simulation of clinical trials, enabling pharmaceutical and biotech firms to develop treatments faster and more efficiently.

Moreover, incorporating Natural Language Processing (NLP) into healthcare communication tools, such as chatbots and virtual assistants, enhances patient engagement. This integration facilitates more effective patient communication, providing timely healthcare guidance and increasing compliance with treatment protocols. Furthermore, the application of an NLP-powered chatbot presents a significant advancement for elderly healthcare applications, streamlining patient care and support. For instance, in March 2024, Quickblox, a prominent provider of AI-powered communication platforms, launched a HIPAA-compliant chatbot powered by OpenAI to enhance communication within the healthcare sector. This chatbot, named the "SmartChat Assistant," utilizes advanced AI technology to facilitate efficient communication and ensure compliance with the stringent HIPAA standards to protect patient data.

Furthermore, market players are developing solutions to analyze population health using NLP. To analyze patterns and trends, NLP leverages predictive analytics by examining extensive datasets, such as electronic health records and social determinants. This enables healthcare providers to predict potential health challenges, optimize resource allocation, and initiate preventive measures. NLP technology analyzes subtleties in the language of medical records to derive critical insights, aiding in informed decision-making and forward-thinking healthcare management. For instance, in February 2024, Persistent Systems collaborated with Microsoft and introduced a Generative AI-powered Population Health Management (PHM) solution. This solution, which supports value-based care models, utilizes Social Determinants of Health (SDoH) to assess patients' non-clinical needs and improve predictions regarding care costs associated with clinical conditions. The objective is to ensure timely and appropriate quality patient care, simultaneously enhancing efficiency and cost-effectiveness for healthcare providers and organizations.

Artificial Intelligence (AI) and Machine Learning (ML) technologies were increasingly utilized for precise diagnostic processes, mostly in identifying COVID-19-positive individuals through tailored patient data. A study published by NCBI in 2020 demonstrated that AI-enhanced algorithms successfully identified 68% of COVID-19-positive cases within a sample of 25 patients, initially misdiagnosed as negative by medical practitioners. The deployment of AI and ML in healthcare aims to improve patient outcomes, minimize equipment downtime, and reduce medical costs, contributing to market expansion. The onset of the pandemic has significantly boosted the integration of AI-driven technologies in patient and medication management, diagnostics, system interoperability, claims handling, workflow enhancement, and cybersecurity measures

The smart assistance segment held the largest share of 18.71% in 2024. The increasing demand for enhanced patient care and medication adherence fuels the demand for smart assistance in the healthcare sector. Thus, market players are integrating AI-powered capabilities into their solutions to provide enhanced patient experience. For instance, in May 2024, SameSky Health Inc. introduced new AI capabilities to its CultureGuide platform to enhance its natural language processing and machine learning functionalities. This update seeks to improve the personalization of experiences for health plan members by expanding the platform's capabilities.

The classification and categorization segment is expected to grow at the fastest CAGR of 39.0% over the forecast period. Healthcare providers utilize text classification to detect patients at risk from medical records by searching specific keywords or phrases. It also helps providers obtain real-time analysis of insights extracted from unstructured medical texts. The increasing investment by key market players in technological advancements is anticipated to fuel market growth over the forecast period.

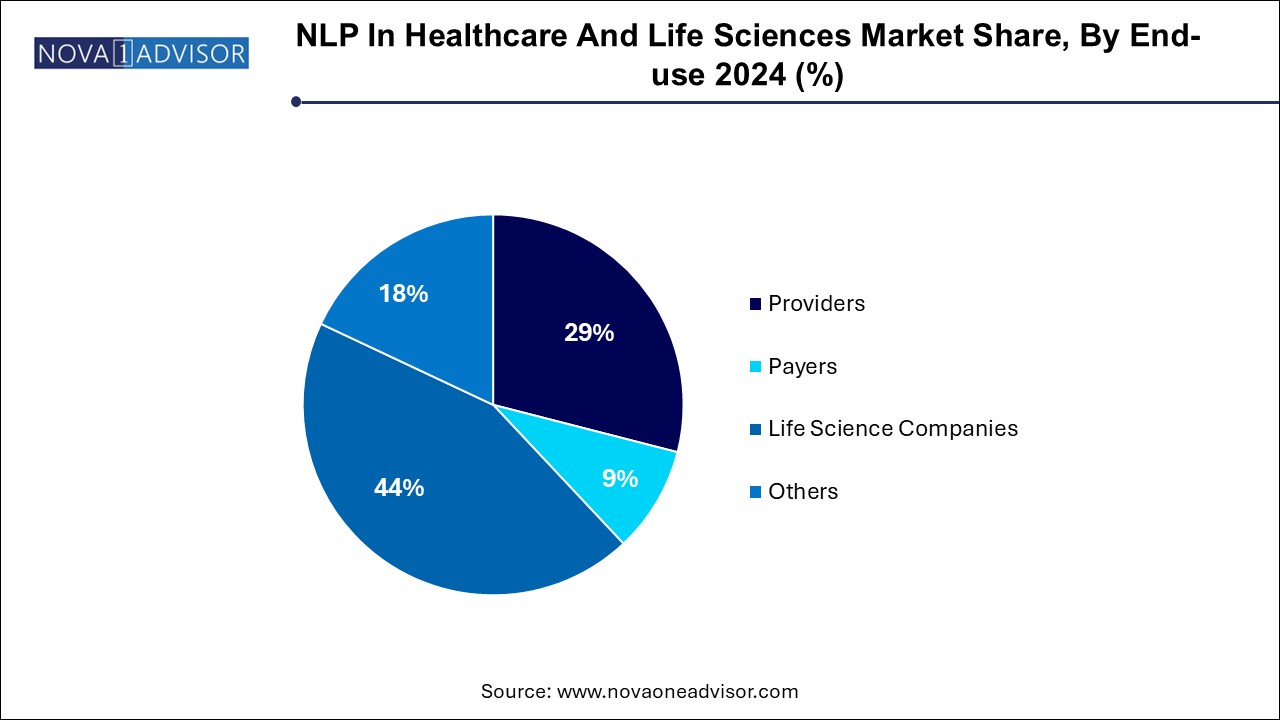

The Life Science Companies segment held a significant market share of 44.0% in 2024. Increasing awareness regarding the benefits associated with the adoption of NLP is driving market growth. Key market players are integrating NLP technology into their databases to analyze unstructured data. For instance, in May 2024, ONTOFORCE launched advanced natural language processing (NLP) features into its DISQOVER platform, a knowledge discovery tool designed for the life sciences sector. This enhancement allows users to derive meaningful insights from unstructured data, including text documents, PDFs, news articles, and images, thereby enhancing decision-making processes and enhancing research efforts.

The providers segment is anticipated to grow at the fastest CAGR of 36.3% from 2024 to 2034. NLP enhances efficiency by streamlining workflows, advancing predictive analytics, and optimizing administrative tasks. Thus, in healthcare, it enables medical professionals to save time by automatically extracting required data from medical records. Market players are launching new solutions capable of catering personalized demands of healthcare providers. For instance, in March 2024, S&P Global's subsidiary, Kensho Technologies, launched its latest NLP solution, Kensho Classify. This solution improves data usability by enhancing content discoverability and facilitating the analysis of large text volumes. It offers intelligent search capabilities, content recommendations, and more efficient research and analysis processes.

North America NLP in Healthcare and Life Sciences marketaccounted for the largest global market share of 43.60% in 2024. The market growth is attributed to the presence of sophisticated healthcare infrastructure, supportive government policies, well-established IT infrastructure, and high digital literacy. Moreover, the presence of players launching new solutions is also contributing to the growth of the region. For instance, in June 2024, Expert.ai launched its expert.ai Platform for Insurance, a technologically advanced solution utilizing natural language processing. This platform enhances underwriting and claims processes by streamlining document review cycles, efficiently extracting relevant data, and intelligently prioritizing submissions or claims based on their complexity for accelerated review or assignment to experienced adjusters.

U.S. NLP in Healthcare And Life Sciences Market Trends

The NLP in Healthcare and Life Sciences market in the U.S. is anticipated to grow at a CAGR of 32.8% over the forecast period. Key factors include the integration of NLP with EHR systems, enhanced data extraction from unstructured sources, and improved patient care through predictive analytics and personalized medicine, reflecting a shift towards data-driven healthcare solutions.

The NLP in Healthcare and Life Sciences Market in Canada is anticipated to grow at a significant rate over the forecast period. The increasing investments in AI-driven healthcare technologies and collaborations between healthcare providers and tech companies are driving this growth.

Asia Pacific NLP in Healthcare And Life Sciences Market Trends

The Asia Pacific NLP in Healthcare and Life Sciences Market is anticipated to experience the fastest CAGR of 37.0% during the forecast period. The increasing patient pool, growing acceptance of cloud computing, and rising number of government programs supporting AI are the factors primarily driving the market growth.

The NLP in the healthcare and life sciences market in Japan is expected to grow significantly over the forecast period. The market growth is attributed to government support in the form of funding aimed at AI integration into the healthcare system.

The NLP in Healthcare and Life Sciences Market in China held a significant market share in 2024 owing to the increasing application of AI in the healthcare system, which is rapidly improving disease diagnosis and treatment accuracy in country-level hospitals. Various startups are investing in AI in healthcare to make this sector more successful for patients and doctors.

The NLP market in the healthcare and life sciences market in India is anticipated to grow significantly over the forecast period. India is among the countries that have readily embraced AI in the healthcare sector, and tech giants are focusing on implementing AI in healthcare in the country.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the NLP in healthcare and life sciences market

Technique

End-use

Regional