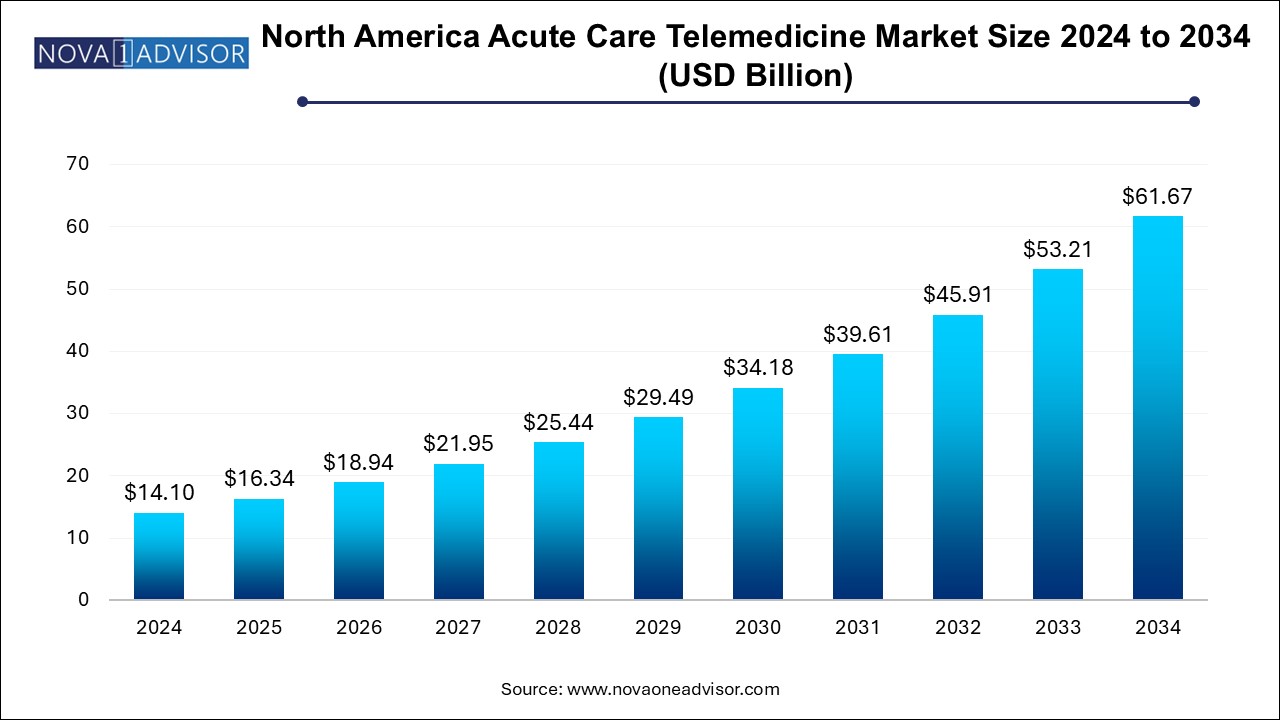

The North America acute care telemedicine market size was exhibited at USD 14.1 billion in 2024 and is projected to hit around USD 61.67 billion by 2034, growing at a CAGR of 15.9% during the forecast period 2025 to 2034.

| Report Coverage | Details |

| Market Size in 2025 | USD 16.34 Billion |

| Market Size by 2034 | USD 61.67 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 15.9% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Delivery, Application, End Use, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America |

| Key Companies Profiled | Teladoc Health, Inc.; AMD Global Telemedicine; Eagle Telemedicine; AMN Healthcare Services Inc.; Access TeleCare, LLC; Enghouse Video (Vidyo, Inc.); RelyMD; Doctor On Demand (Included Health, Inc.); GE HealthCare; Advanced Telemed Services |

Factors such as the growing adoption of telemedicine solutions by healthcare providers, rising consumer demand and patient acceptance, delivery of enhanced quality of care, and the shortage of specialty physicians and healthcare staff contribute to market growth. For instance, according to the Association of American Medical Colleges (AAMC), the U.S. is expected to witness a shortage of up to 86,000 physicians by 2036.

The increasing demand for remote healthcare services is revolutionizing North America's acute care telemedicine market. With the rising prevalence of chronic conditions and the urgency of delivering specialized care during emergencies, telemedicine platforms have become essential for acute care management. These platforms enable real-time consultations, remote diagnostics, and continuous patient monitoring, reducing emergency room overcrowding and improving response times. Advanced technologies, including AI and IoT, enhance care by enabling predictive analytics and seamless integration with hospital systems, addressing critical care needs while expanding access to underserved populations.

In addition, with the widespread use of smartphones and the availability of advanced technology, investors are investing in developing innovative solutions for delivering high-quality healthcare and convenience to patients through mobile platforms. These platforms enable patients to monitor their fitness routines and get medical advice through mobile applications, phone calls, or WhatsApp messaging. Several apps, including Practo, AssistRx, and Wareed, have been introduced, which allow patients to book appointments, track their medical consultations and prescriptions, and store their health-related data throughout their treatment process.

Moreover, both regulatory changes and technological advancements have facilitated the rapid increase in telemedicine adoption. During the pandemic, the U.S. and Canadian governments relaxed specific regulations around telehealth, particularly reimbursement policies, enabling more widespread use. This increased patient acceptance, as many sought healthcare while staying home to mitigate the risk of virus exposure. As healthcare systems and patients became more used to virtual care, the North American market saw a substantial rise in telemedicine platforms, particularly for acute care services such as emergency consultations and post-discharge follow-up care.

By delivery, the clinician-to-clinician segment held the largest market share of 62.3% in 2024. The rise in adoption of visualized care delivery solutions, various strategies undertaken by market players, the increase in user awareness, and the introduction of technologically advanced solutions are anticipated to drive segment growth. For instance, in December 2024, VSee Health, Inc., a telehealth solutions provider, signed a teleradiology contract with the largest post-acute care hospital systems in the U.S. This collaboration is set to launch in the first quarter of 2025. It represents the latest expansion of VSee's teleradiology client base, further establishing its reputation as a provider of advanced imaging solutions.

The clinician-to-patient segment is anticipated to grow at the fastest CAGR over the forecast period. The Clinician-to-Patient model in acute care telemedicine enables real-time remote interactions between healthcare providers and patients, ensuring timely and effective care, particularly in emergency or urgent situations. Through high-definition video consultations, clinicians can assess patients visually, while audio calls offer an alternative when video is not possible. For instance, Koninklijke eICU program by Philips N.V. The eICU program transforms an organization's clinical approach by offering centralized, remote monitoring from experienced professionals, proprietary algorithms, and clinical decision support systems, facilitating proactive care delivery

By application, the teleradiology segment held a significant market share of 36.8% in 2024. Integrating artificial intelligence (AI) into teleradiology workflows has amplified its utility in acute care. AI algorithms assist in analyzing imaging data, prioritizing critical cases, and streamlining decision-making. Vendor-neutral solutions ensure seamless interoperability with hospital information systems, making teleradiology useful for acute care providers. For instance, in August 2022, STAR Teleradiology, a Florida -based radiology practice, expanded its partnership with Rad AI, a radiologist-led AI company, to use its advanced technology to generate customized radiology report impressions for their entire practice. Thus, such factors are anticipated to boost the segment growth over the forecast period.

The telepsychiatry segment is expected to grow at the fastest CAGR over the forecast period. Telepsychiatry offers access to a variety of experts, rapid availability of psychiatric interventions & assessments, access to a range of experts, and reduction in the stigma associated with mental health treatment, which can drive the market during the forecast period. In the U.S., as per the National Alliance on Mental Illness, over 20% of youth aged between 13 and 18 years suffer from mental health conditions; over 11% of the youth have a mood disorder. Similarly, over 18.1% of U.S. adults live with anxiety disorders. Therefore, the demand for telepsychiatry solutions among patients is growing.

By end use, the hospitals & clinics segment held the largest market share of 77.0% in 2024 and segment is expected to witness the fastest CAGR over the forecast period. Telemedicine helps reduce hospital congestion by enabling virtual assessments and triage. This allows medical teams to prioritize care based on severity, which helps manage patient flow, especially in times of high demand or during public health emergencies such as flu outbreaks. Moreover, hospitals and clinics are leveraging these telemedicine solutions to improve patient care and reduce operational costs by minimizing the need for in-person consultations and hospital readmissions.

The others segment is expected to witness a significant CAGR over the forecast period. The other segment comprises urgent care centers, rehabilitation facilities, and home healthcare services. Rehabilitation facilities are adopting telemedicine for post-acute care management, enabling remote monitoring of patients recovering from surgeries or severe illnesses. This ensures continuous care and facilitates the early detection of complications, improving recovery outcomes.

U.S. acute care telemedicine market dominated the market in 2024. The growing adoption of smart healthcare solutions that include various technologies, such as smart wearables, mobile apps, and eHealth services, such as telemedicine & Electronic Health Record (EHR) services, for remote access to information on severe and chronic healthcare conditions fuels the market growth in the country. For instance, according to FAIR Health’s Monthly Telehealth Regional Tracker, in January 2023, there was a 7.3% rise in national telehealth usage, with the percentage of medical claim lines increasing from 5.5% in December 2022 to 5.9% in January.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America acute care telemedicine market

By Delivery

By Application

By End Use

By Regional

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Segment scope

1.1.2. Regional scope

1.1.3. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.7. Research Assumptions

1.8. List of Secondary Sources

1.9. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Delivery outlook

2.2.2. Application outlook

2.2.3. End Use outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. North America Acute Care Telemedicine Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. North America Acute Care Telemedicine: Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTLE Analysis

Chapter 4. North America Acute Care Telemedicine Market Segment Analysis, By Delivery, 2021-2034 (USD Million)

4.1. Definition and Scope

4.2. Delivery Market Share Analysis, 2024 & 2034

4.3. Segment Dashboard

4.4. North America Acute Care Telemedicine Market, by Delivery, 2018 to 2030

4.5. Clinician-to-Clinician

4.5.1. Clinician-to-Clinician Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

4.6. Clinician-to-Patient

4.6.1. Clinician-to-Patient Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 5. North America Acute Care Telemedicine Market Segment Analysis, By Application, 2021-2034 (USD Million)

5.1. Definition and Scope

5.2. Application Market Share Analysis, 2024 & 2034

5.3. Segment Dashboard

5.4. North America Acute Care Telemedicine Market, by Application, 2018 to 2030

5.5. Teleradiology

5.5.1. Teleradiology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.6. Telepsychiatry

5.6.1. Telepsychiatry Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.7. Teleneurology

5.7.1. Teleneurology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.8. Tele-ICU

5.8.1. Tele-ICU Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.9. Telenephrology

5.9.1. Telenephrology Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

5.10. Others

5.10.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 6. North America Acute Care Telemedicine Market Segment Analysis, By End Use, 2021-2034 (USD Million)

6.1. Definition and Scope

6.2. End Use Market Share Analysis, 2024 & 2034

6.3. Segment Dashboard

6.4. North America Acute Care Telemedicine Market, by End Use, 2018 to 2030

6.5. Hospitals and Clinics

6.5.1. Hospitals and Clinics market estimates and forecasts, 2018 to 2030 (USD Million)

6.6. Others

6.6.1. Others Market Revenue Estimates and Forecasts, 2021 - 2034 (USD Million)

Chapter 7. North America Acute Care Telemedicine Market Segment Analysis, By Region, 2021- 2034 (USD Million)

7.1. Regional Market Share Analysis, 2024 & 2034

7.2. Regional Market Dashboard

7.3. Regional Market Snapshot

7.4. North America Acute Care Telemedicine Market Share by Region, 2024 & 2034:

7.5. North America

7.5.1. North America acute care telemedicine market, 2021 - 2034 (USD Million)

7.5.2. U.S.

7.5.2.1. U.S. acute care telemedicine market, 2021 - 2034 (USD Million)

7.5.3. Canada

7.5.3.1. Canada acute care telemedicine market, 2021 - 2034 (USD Million)

7.5.4. Mexico

7.5.4.1. Mexico acute care telemedicine market, 2021 - 2034 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Profiles

8.3.1. Teladoc Health, Inc.

8.3.1.1. Company overview

8.3.1.2. Financial performance

8.3.1.3. Product benchmarking

8.3.1.4. Strategic initiatives

8.3.2. AMD Global Telemedicine

8.3.2.1. Company overview

8.3.2.2. Financial performance

8.3.2.3. Product benchmarking

8.3.2.4. Strategic initiatives

8.3.3. Eagle Telemedicine

8.3.3.1. Company overview

8.3.3.2. Financial performance

8.3.3.3. Product benchmarking

8.3.3.4. Strategic initiatives

8.3.4. AMN Healthcare Services Inc.

8.3.4.1. Company overview

8.3.4.2. Financial performance

8.3.4.3. Product benchmarking

8.3.4.4. Strategic initiatives

8.3.5. Access TeleCare, LLC

8.3.5.1. Company overview

8.3.5.2. Financial performance

8.3.5.3. Product benchmarking

8.3.5.4. Strategic initiatives

8.3.6. Enghouse Video (Vidyo, Inc.)

8.3.6.1. Company overview

8.3.6.2. Financial performance

8.3.6.3. Product benchmarking

8.3.6.4. Strategic initiatives

8.3.7. RelyMD

8.3.7.1. Company overview

8.3.7.2. Financial performance

8.3.7.3. Product benchmarking

8.3.7.4. Strategic initiatives

8.3.8. Doctor On Demand (Included Health, Inc.)

8.3.8.1. Company overview

8.3.8.2. Financial performance

8.3.8.3. Product benchmarking

8.3.8.4. Strategic initiatives

8.3.9. GE HealthCare

8.3.9.1. Company overview

8.3.9.2. Financial performance

8.3.9.3. Product benchmarking

8.3.9.4. Strategic initiatives

8.3.10. Advanced Telemed Services

8.3.10.1. Company overview

8.3.10.2. Financial performance

8.3.10.3. Product benchmarking

8.3.10.4. Strategic initiatives